"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

January trends reversed course in February and March, with van and reefer spot rates reaching new cycle lows. Loose conditions indicate the market is trending toward equilibrium. Rates should follow typical seasonality in the coming months, and a sustained inflationary flip is unlikely to occur anytime soon.

As produce season begins and the 100 Days of Summer draw near, we expect more regional volatility than in 2023 but less than in 2021 and 2022. However, as rate movement increases this summer, the market will likely become more vulnerable to disruption.

Below are the key takeaways from this month’s update:

What’s Happening: The market remains loose despite short-lived volatility.

Why It Matters: Looseness indicates the market flip is still a ways off.

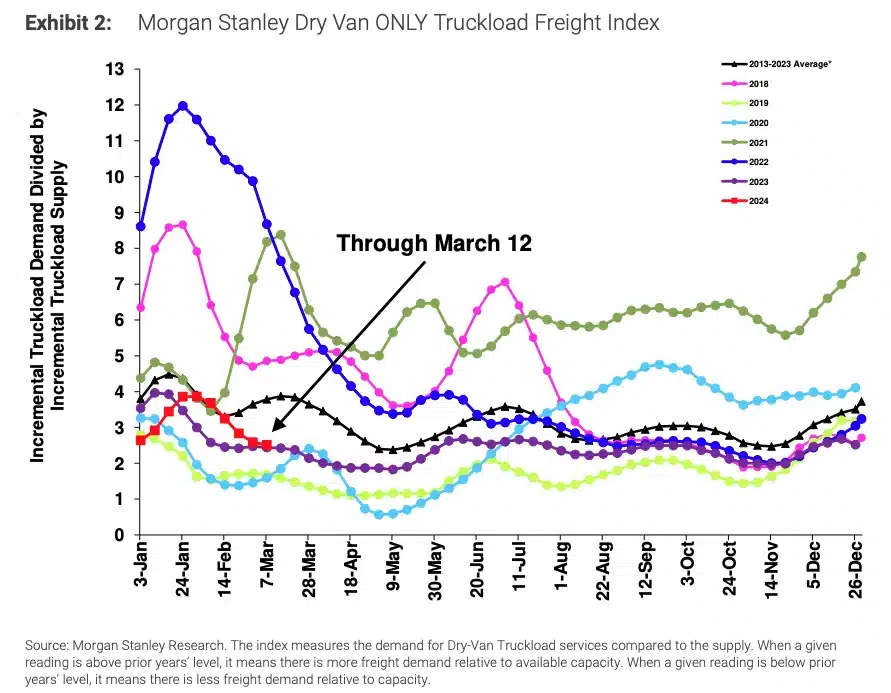

The Morgan Stanley Dry Van Freight Index is a good measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

The market was loose heading into 2024 but tightened quickly in early January, causing the index to rise above 2023 levels and land close to the 10-year average. However, the index indicates soft conditions have returned over the past six weeks, with five straight readings showing loosening and levels falling close to where they were during the same period last year.

Figures 2 & 3: Morgan Stanley Reefer and Flatbed Truckload Freight Indices

The most recent (January) ACT Supply-Demand Index reading was 50.2, down from 54.2 in December. Despite the decline, this marks six straight months of tightening conditions following 17 months of loosening, indicating the market is still down but trending toward equilibrium.

Figure 4: ACT For-Hire Trucking Survey

Market conditions returned to 2023 levels in February after some volatility in January. Loosening across markets indicates that the downcycle persists and capacity is sufficient to meet demand across all modes.

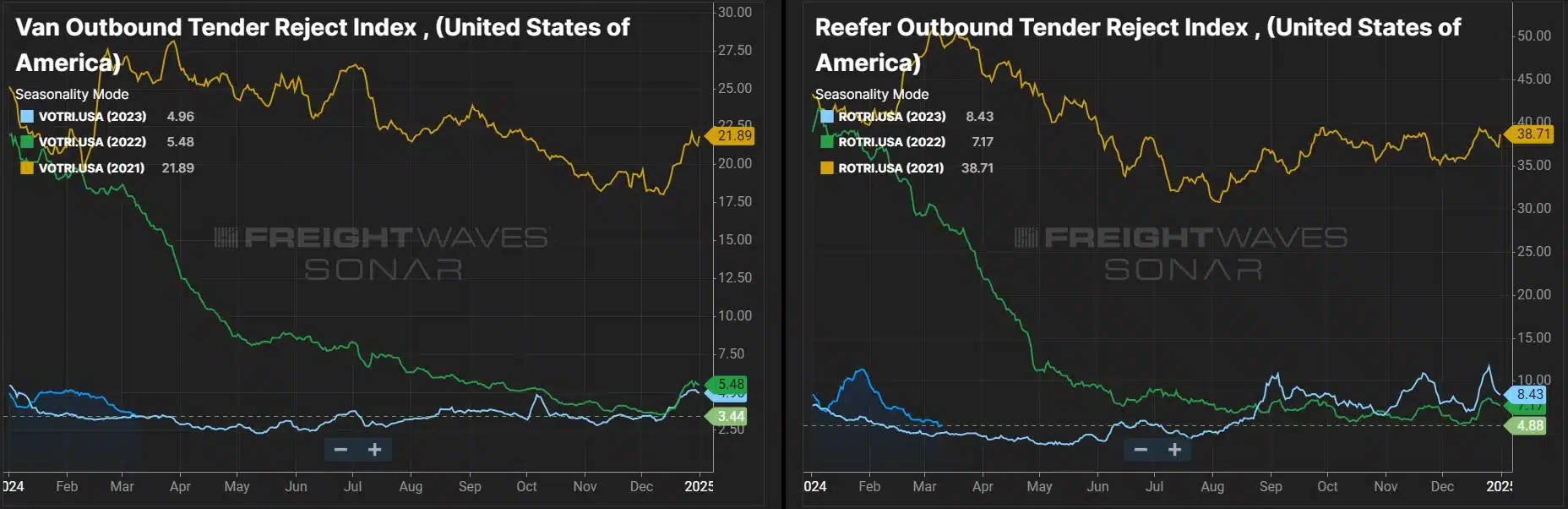

The Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject freight they are contractually required to take, hovered above 5% for most of February and remains relatively flat year-over-year despite a jump in early 2024. The tender rejection rate decline in February followed typical seasonality as shippers prepare for produce season and the 100 Days of Summer.

Figure 5: Outbound Tender Reject Index (SONAR)

Though dry van tender rejections are slightly below 4% and almost exactly in line with this time last year, they’re still well below March 2021 and 2022 levels. Reefer markets were volatile in late January, but February tender rejection rates fell back in line with 2023 levels and are trending just south of 5% to remain slightly up year-over-year.

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was up 10.1% year-over-year, or 9.7% when measuring accepted volumes. Adjusted accepted volumes were up 3% month-over-month in early March, driven by dry van tender acceptance increasing by 3% despite reefer tender acceptance declining by 1.6%.

Figure 8: Contract Load Accepted Volume (SONAR)

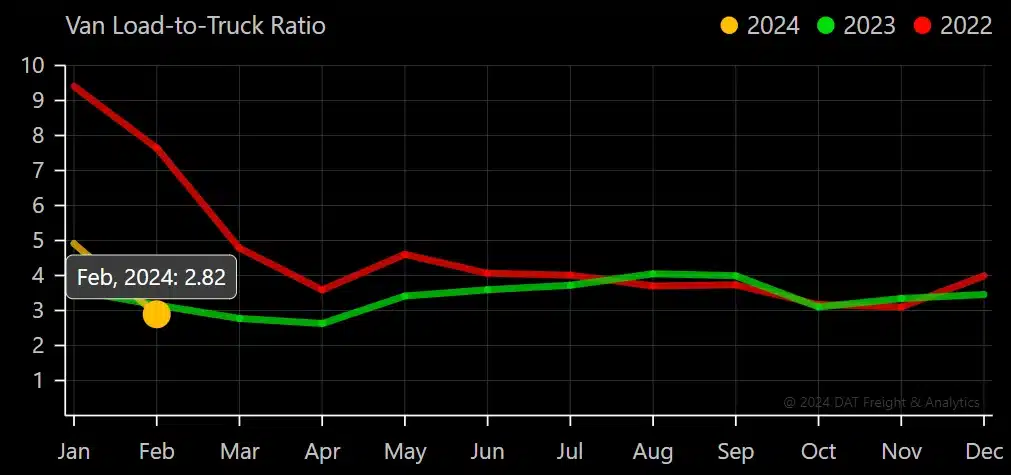

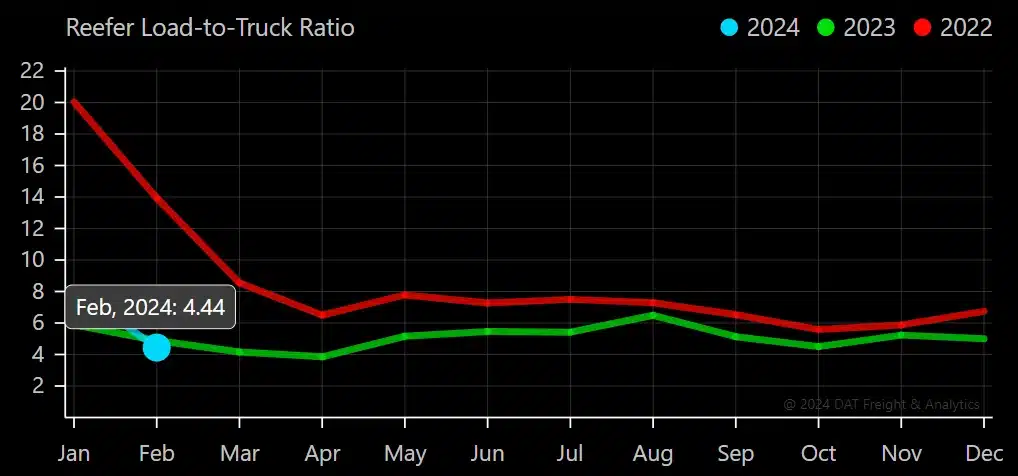

The DAT Load-to-Truck Ratio, which measures the total number of loads relative to the total number of trucks posted on their spot board, changed from previous months due to DAT data correction issues. February dry van and reefer ratios show moderate easing from January and are now similar to a year ago, indicating the market is still oversupplied.

What’s Happening: Carriers continue to exit the market, albeit slower than in previous downcycles.

Why It Matters: Slow exits indicate some carriers still have enough capital to invest in their fleets.

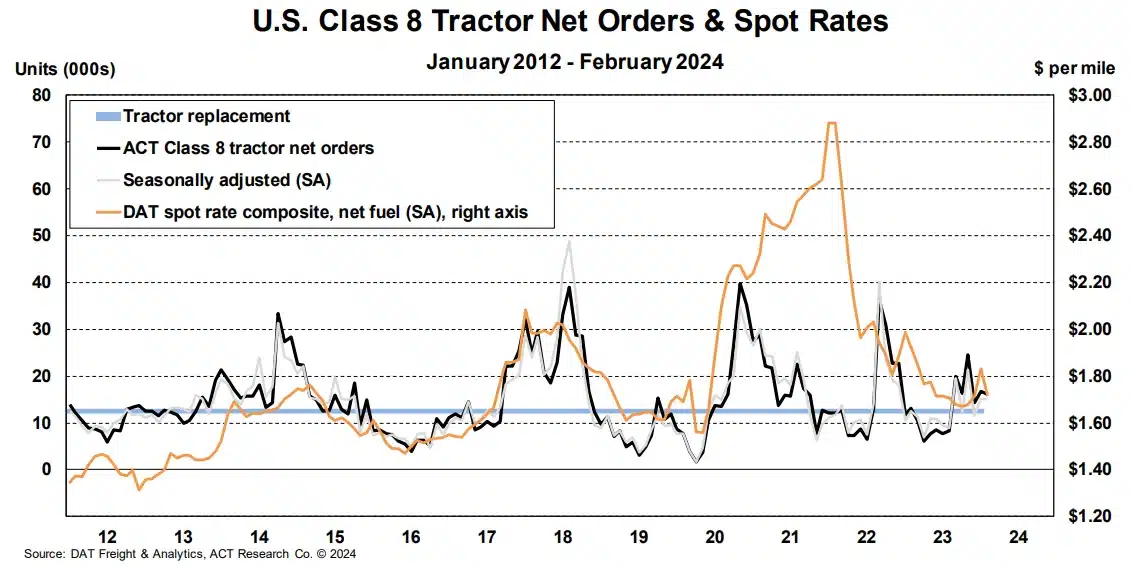

According to ACT Research, new Class 8 truck orders remain above replacement levels, with 16,000 orders in February, or 15,100 on a seasonally adjusted basis. This trend is somewhat surprising as spot rates remain low, but it could be due to private fleets preparing for 2027 emission regulations.

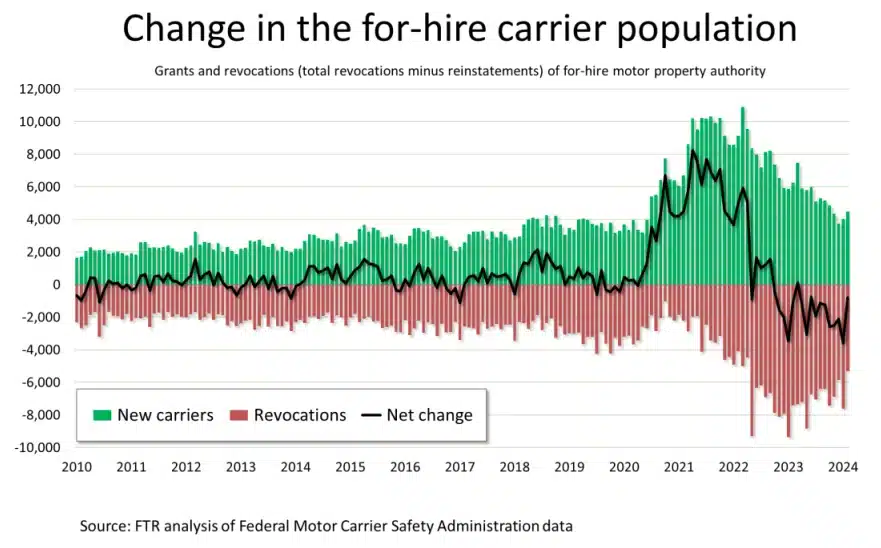

The for-hire carrier population continues to shrink. However, over the past month, revocations decreased as new entrants increased, slowing the exit rate slightly. This may have resulted from recent spot rate increases that made it possible for more carriers to stay in the market.

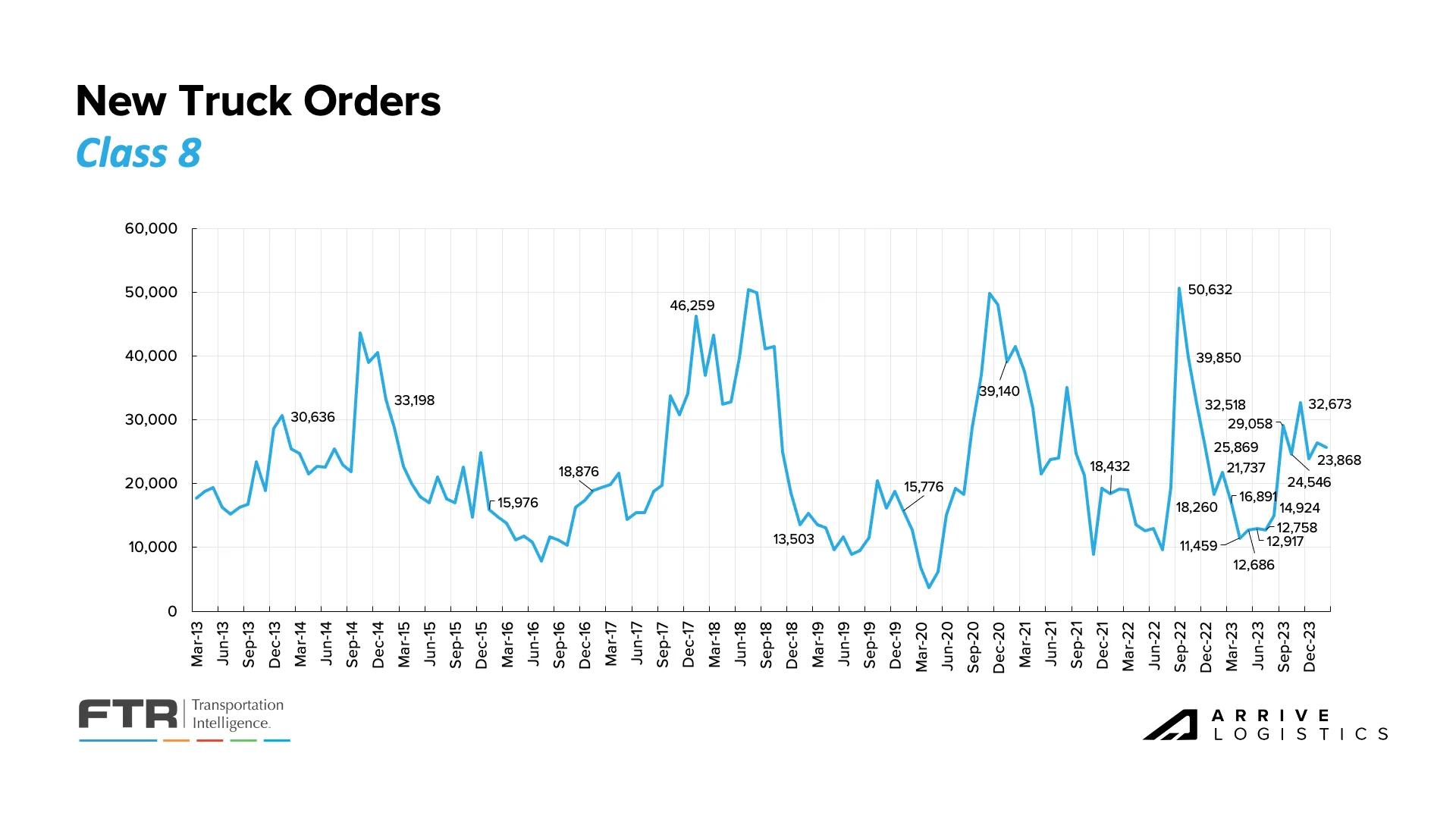

FTR reported 26,000 new orders in January — an increase of 10.3% month-over-month and more than 44% year-over-year — indicating that some carriers are trying to maintain or expand their fleets.

February order estimates are around 25,700, a 2.4% month-over-month decrease but an 18.2% year-over-year increase. This trend likely points to the financial strength of larger carriers and private fleets’ ongoing investment in growth.

While order levels were above the historical average, they did align with seasonal trends. Because freight demand is healthy overall, larger fleets are adding capacity to insource volume back from smaller for-hire fleets and owner-operators.

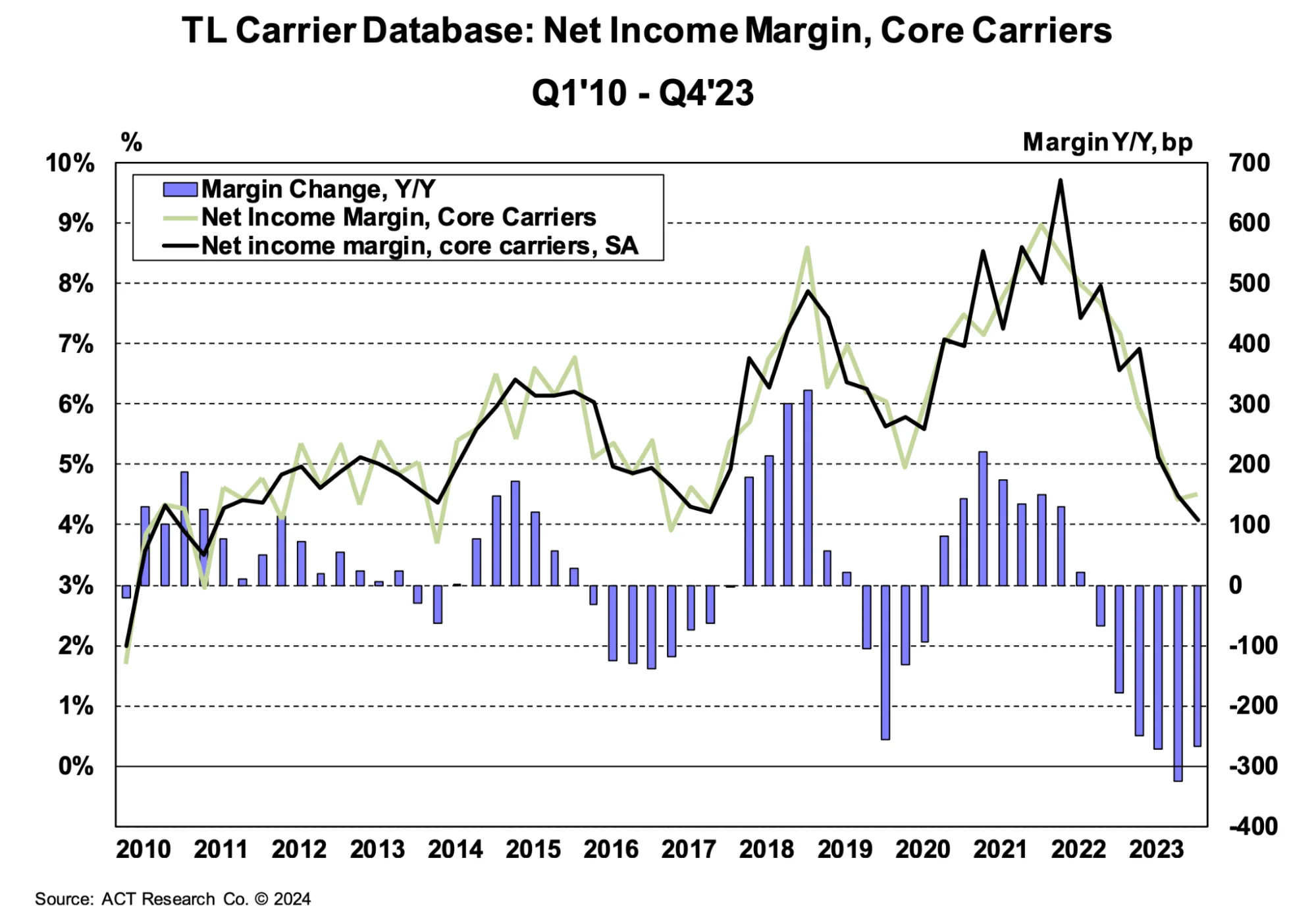

Carrier margins continue to shrink due to falling revenues and high operating expenses, with ACT’s “Core Carrier” set showing year-over-year declines for six consecutive quarters. Net margins did rise quarter-over-quarter in Q4 2023 but were still down 2.7% year-over-year. As rates become more volatile in the back half of 2024 and into 2025, the pressure on carriers should ease.

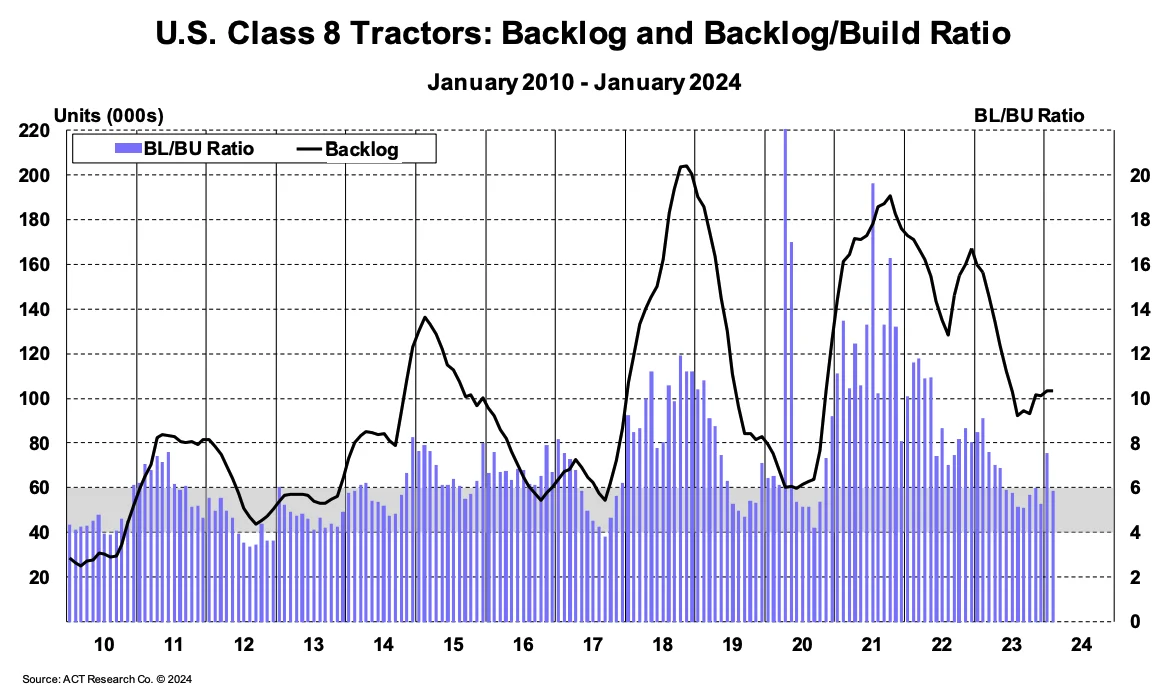

According to ACT Research, the Class 8 backlog-to-build ratio rose to 7.5 months in January, but preliminary readings for February estimate that number could fall to 5.9 months. The backlog has risen by 11,000 units over the past six months and currently sits just north of 100,000.

ACT’s Driver Availability Index increased by 4.5 points in January after dropping in December, likely due to owner-operators choosing to close rather than pay annual insurance and registration fees while rates are low. Despite loosening conditions, long-term challenges remain as retiring Baby Boomers shrink the U.S. labor force.

What’s Happening: Demand is steady, and imports are strong.

Why It Matters: Higher import volumes should drive over-the-road freight demand.

The National Retail Federation (NRF) reported increased imports in January, with nearly two million TEUs entering the U.S., leading to growth of 4.7% month-over-month and 8.6% year-over-year.

Attacks on vessels by Houthi rebels in the Red Sea are still causing significant maritime disruptions. Shippers continue to reroute shipments around the Cape of Good Hope or across the Pacific Ocean to the West Coast to avoid dangerous areas. Despite some impact on costs and transit times, the movement of global goods remains stable overall.

Figure 17: NRF Monthly Imports

Conditions calmed and followed recent trends in February as winter weather died down across the Northern U.S. February spot load postings were down 28% month-over-month. They were also down 11.9% year-over-year, but that was a significant improvement from the 36% year-over-year decline in January. Ultimately, demand today is weaker than during the pandemic but stronger than in the period preceding it.

Figure 18: DAT Trendlines

What’s Happening: Regional spring thaw restrictions are underway.

Why It Matters: Additional axle requirements could impact costs.

What’s Happening: Capacity is getting tighter as the produce season begins.

Why It Matters: Rates will likely rise as the season ramps up.

Figure 20: High Risk Areas for Theft – T21

Figure 20: High Risk Areas for Theft – T21What’s Happening: eBOLs are gaining momentum in the LTL space.

Why It Matters: Shippers may see increased efficiencies, better ETAs and fewer errors and costs.

What’s Happening: Capacity could get tight as produce season begins.

Why It Matters: Rates will likely rise as capacity tightens.

East Coast

Midwest

South Central

West

PNW

What’s Happening: Spring arriving early is causing tightness.

Why It Matters: Rates could spike soon.

What’s Happening: Rates have reached new cycle lows.

Why It Matters: Carriers will have to wait longer for any revenue increases.

Truckstop’s Weekly National Average Spot Rates provide a detailed view of week-to-week movements and a real-time look into the current environment. The index showed new cycle lows for van and reefer spot rates over the last two weeks, mirroring load-to-truck ratio and tender rejection trends during the same period; this is likely the bottom for rates as the produce season begins and summer approaches. Conversely, the flatbed market has grown stronger as construction-related seasonal demand increases.

Figure 21: Truckstop Weekly National Spot Rate Average

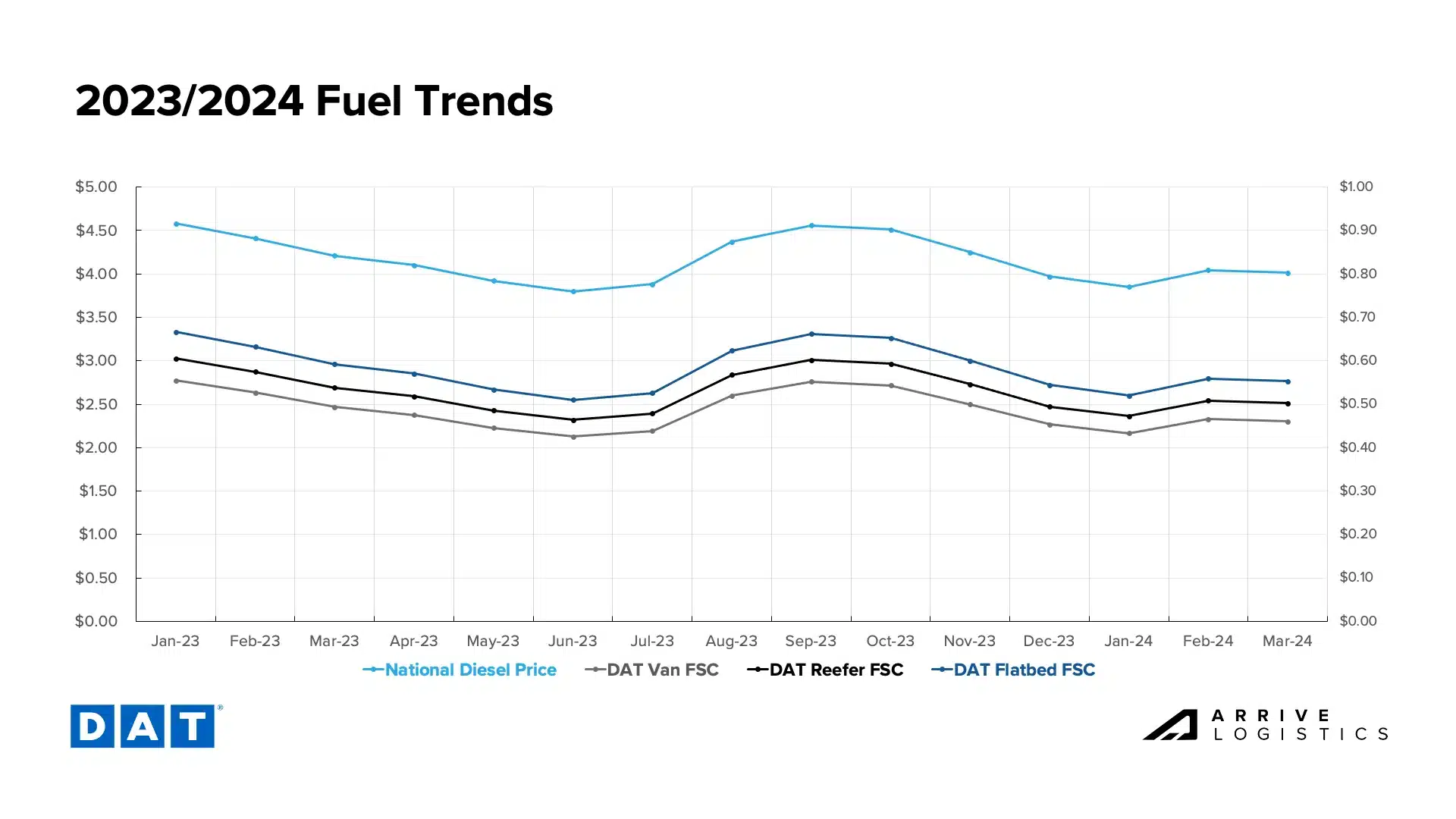

National diesel prices remain volatile, with moderate increases over the past couple of months despite some recent pullbacks. The average price through the first two weeks of March was $4.01, just a few cents below the February average. As a result, fuel surcharges across all three modes have been relatively flat but are still higher than at the end of 2023.

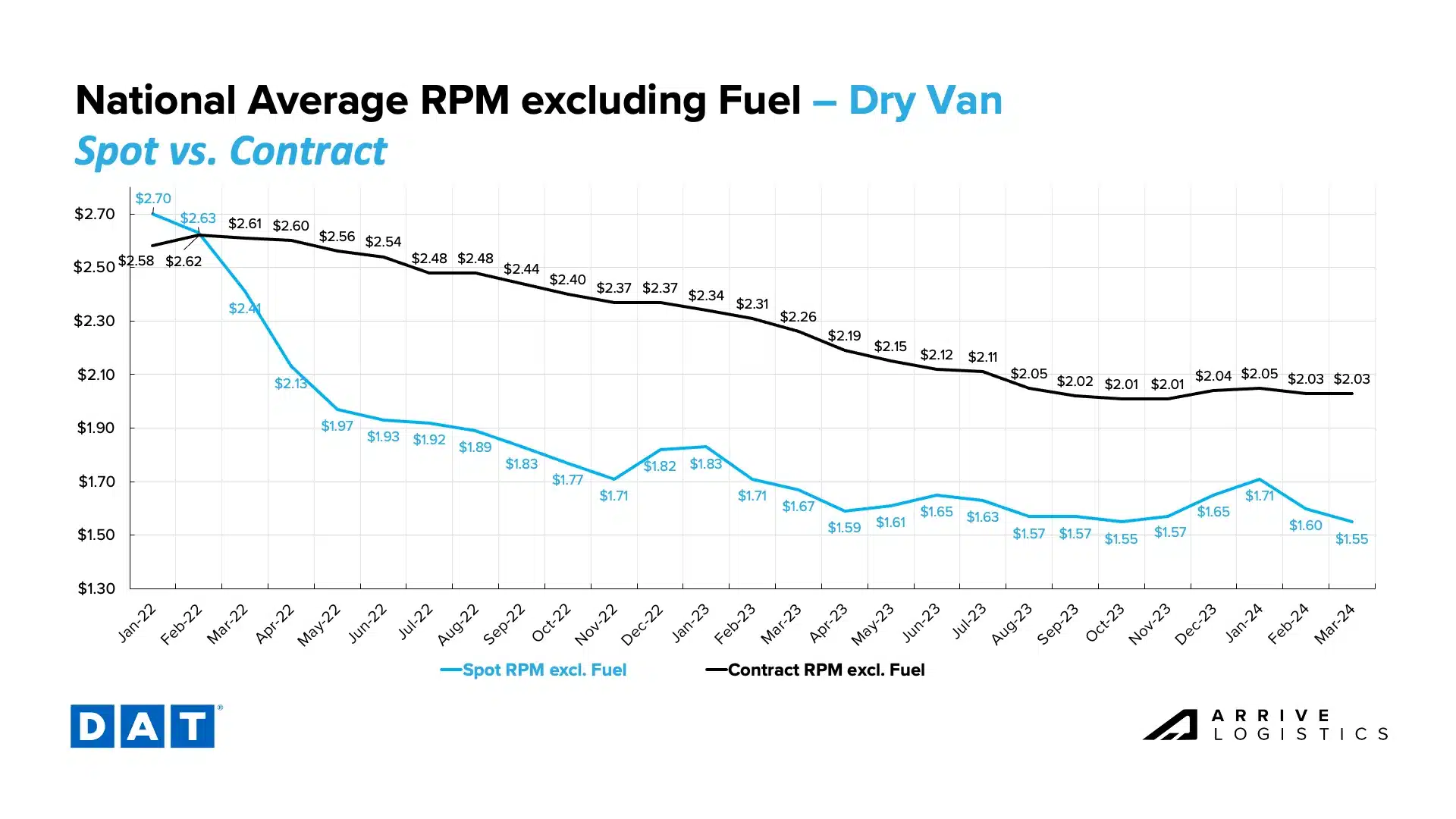

DAT shows that dry van spot rates continue to decline from January and currently sit at $1.55 per mile, which aligns with cycle lows in October 2023. Contract rates stayed flat month-over-month and currently sit at $2.03 per mile. The spot-contract spread has increased by $0.05 to $0.48 per mile. This year’s outlook for potential price increases could result in more shippers locking in rates at current cycle lows.

Reefer rates continue to follow the same trend as dry van but at a more magnified level. Linehaul spot rates sit at $1.84 per mile in March, a 12% decline from January and a 4% decline from February. Contract rates have declined by $0.02 per mile, excluding fuel, and continue to get downward pressure from lower spot rates. However, increased volatility means the reefer market recovery is still outpacing dry van.

Figure 24: DAT Temp Control National Average RPM Spot vs. Contract

Normal seasonal tightness in the flatbed market continued in early March, but rates remain down year-over-year. Unlike the dry van and reefer markets, flatbed contract rates continue to slowly tick upwards and mitigate downward pressure from spot rates. Spot rates are currently $1.93 excluding fuel, and contract rates are $2.60 excluding fuel.

Figure 25: DAT Flatbed National Average RPM Spot vs. Contract

What’s Happening: Sticky inflation persists, but the Fed will likely cut rates later this year.

Why It Matters: Lower interest rates could increase consumer spending and drive freight demand.

February CPI data came in at 3.2%, a slight increase from 3.1% in January. The inflation rate, excluding food and energy, was 3.8%. While this was slightly higher than expected, it is unlikely to deter the Fed from cutting interest rates later this year. It is still unclear when the Fed will start to cut rates, but Jerome Powell, the Chair of the Federal Reserve, announced there is almost enough evidence to begin the process. Rate cuts are likely to drive increased spending and, in turn, freight demand.

Figure 26: New York Times Inflation Data

January Bank of America card data showed spending rose 2.9% year-over-year on a non-seasonally adjusted basis. One of the key drivers was the strong recovery of service-based spending, which rebounded from a winter-impacted January. However, this was offset by weaker spending in February compared to January. Overall, consumer spending remains stable despite elevated interest rates.

Figure 27: Bank of America, Total Card Spending per Household

In February, the market returned to the loose conditions observed throughout most of 2023. Dry van and temp controlled spot rates recently reached new cycle lows, indicating the downcycle continues as capacity is still sufficient to support demand.

Demand remains steady overall, and imports continue to tick up. As produce season begins, rates and tightness will likely follow typical seasonality and be more pronounced than last year. Capacity continues to exit the market slower than in previous down cycles.

Ultimately, our 2024 outlook remains the same, with normal seasonality expected in the near term and increased rate volatility in the back half of the year.

The Arrive Carrier Market Outlook, created by Arrive Insights™, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, ACT Research, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.