"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

In early October, the East and Gulf port strikes and consecutive hurricanes caused short-lived and regionalized volatility, but conditions reverted to normal seasonal patterns later in the month. Though this holiday peak season could be more volatile than last, a sustained market shift remains unlikely until mid-2025.

"*" indicates required fields

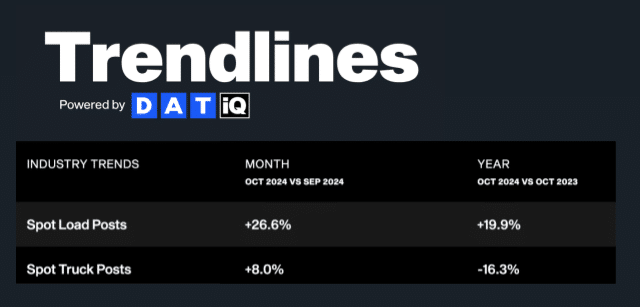

Month-over-month and year-over-year spot postings increased significantly in October.

Trucking employment declined again, indicating ongoing capacity attrition due to poor market conditions. However, overall levels remain elevated.

Dry van tender rejections remain relatively low amid strong supply, and increased carrier revenues during the holiday season will likely continue this trend.

Rates remain relatively flat and in line with seasonal expectations but may increase meaningfully as the holiday season begins, particularly for reefer equipment.

Recovery efforts from Hurricane Helene and Milton are still underway, but the freight market impact has diminished.

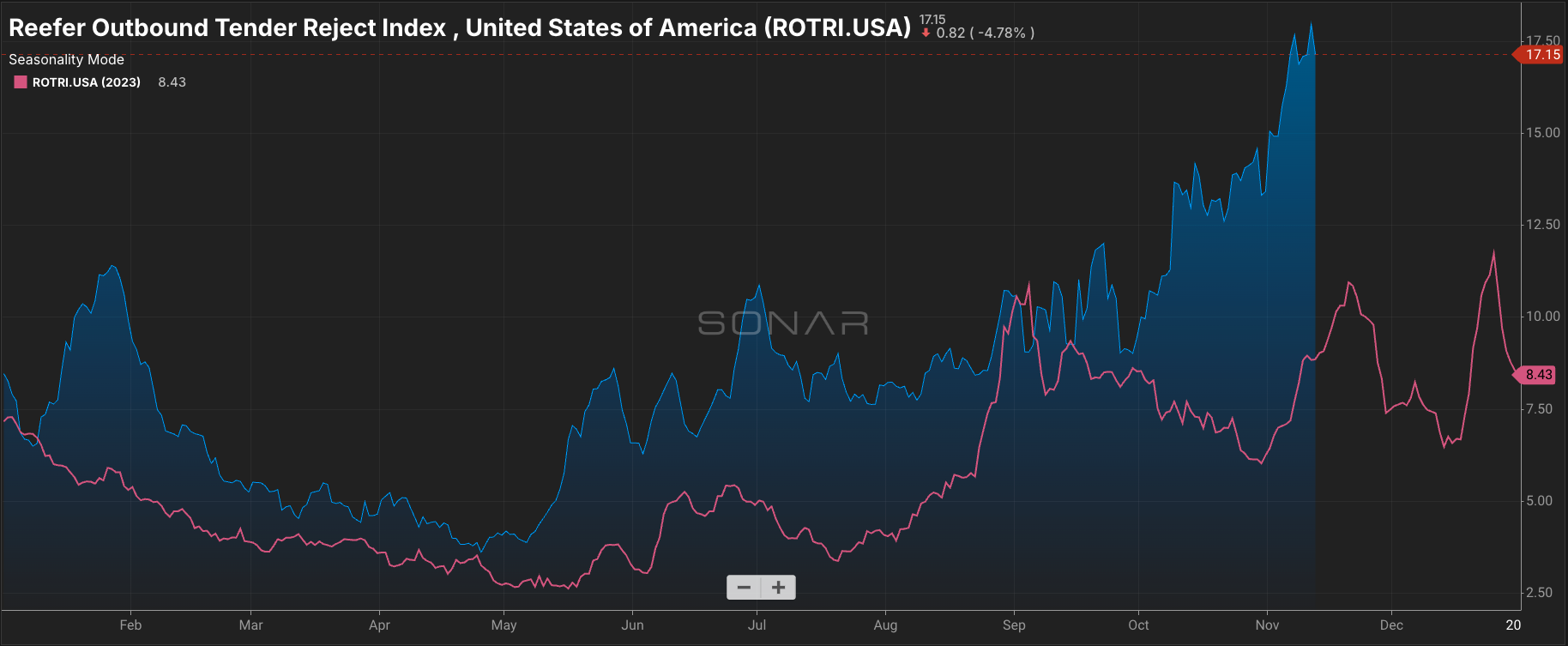

Reefer markets have not been this volatile since early 2022, as shown by large year-over-year increases in tender rejections, indicating routing guide challenges and rate volatility could intensify this winter.

Inflation remains above 2%, increasing the likelihood of additional rate cuts; this should help drive strong consumer spending heading into the holiday season.

What’s Happening: Demand is steady heading into the holidays.

Why It Matters: Tighter capacity conditions leave the market more vulnerable to disruption.

Late October and early November demand trends fell back in line with seasonal expectations after deviating in early October. Aside from minor fluctuations, demand is steady heading into the holiday peak season and should look similar to 2023 through year-end. However, tighter supply conditions mean the market is more vulnerable to disruption this year.

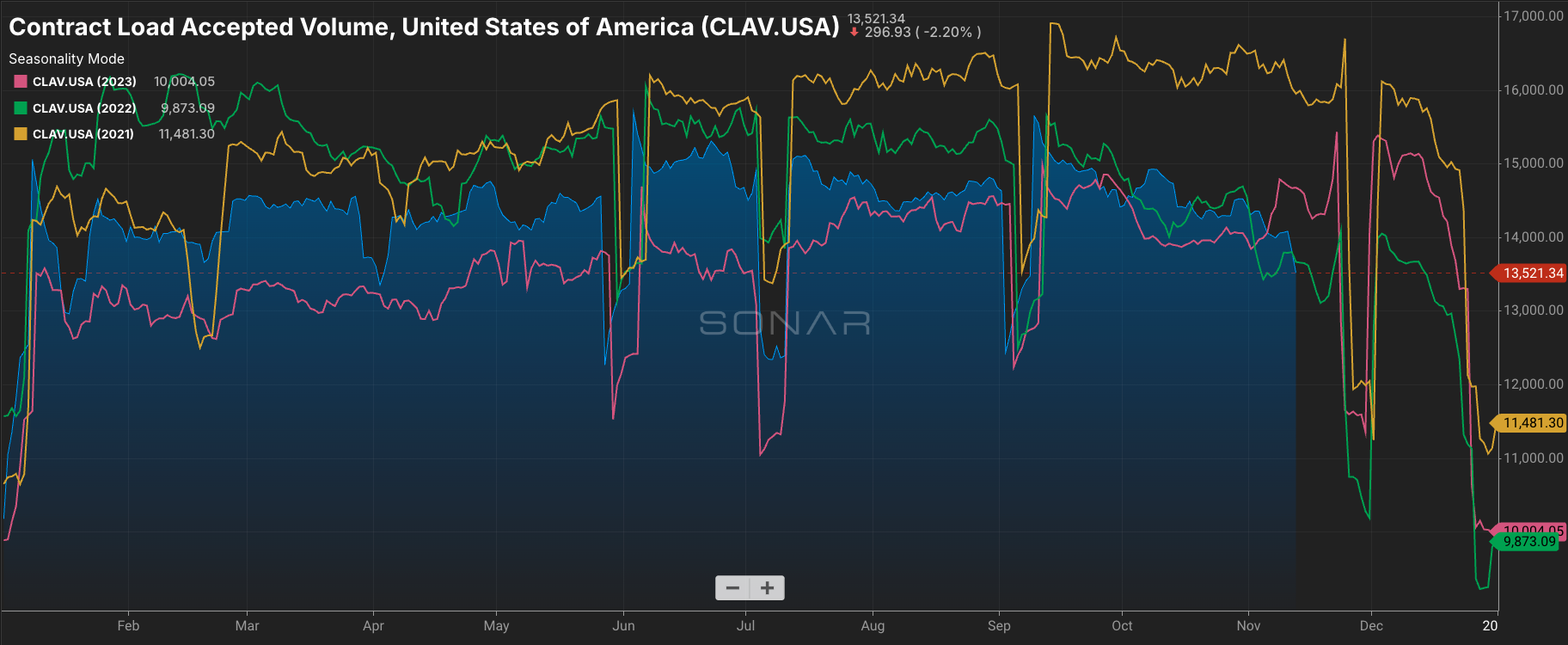

The Sonar Contract Load Accepted Volume Index (CLAV) measures accepted load tenders moving under contractual agreements. It is similar to the Outbound Tender Volume Index (OTVI) but removes all rejected tenders. The latest CLAV data shows demand followed typical seasonal trends in October and early November; the recent decline is normal as the market typically enters a brief lull ahead of Thanksgiving.

DAT reports that October spot loadings were up 26.6% from September and nearly 20% from October 2023. The year-over-year increase is notable since loadings had declined by over 40% from October 2022 to October 2023. This surge likely correlates with the disruption caused by Hurricanes Helene and Milton in late September and early October, which forced contract volume into the spot market and spurred an influx of recovery-related freight.

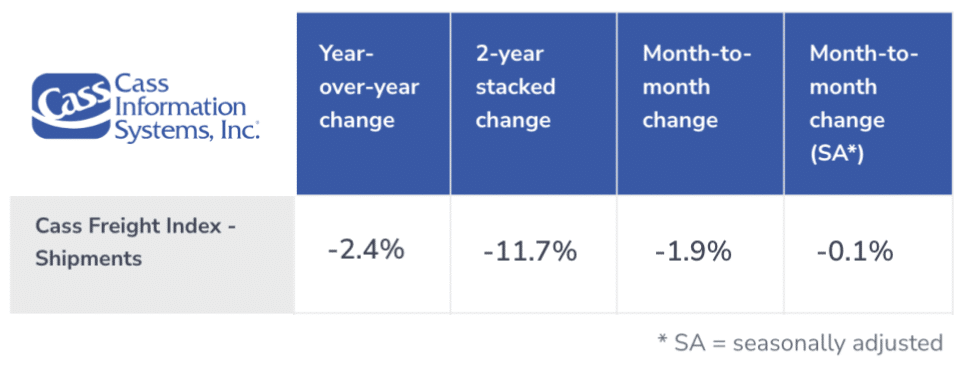

The Cass Freight Index’s shipments component is a good indicator of overall market health because it encompasses both spot and contract freight based on bill data. The October reading showed an insignificant month-over-month decline in shipments on a seasonally adjusted basis. Interestingly, the Cass data deviates from DAT spot posting data, showing relatively stable total volumes that indicate freight might be moving from the contract market to the spot market. This conclusion is also supported by the early October rise in tender rejections.

What’s Happening: Supply handled volatility well in October.

Why It Matters: It will be tested again as the holiday peak season approaches.

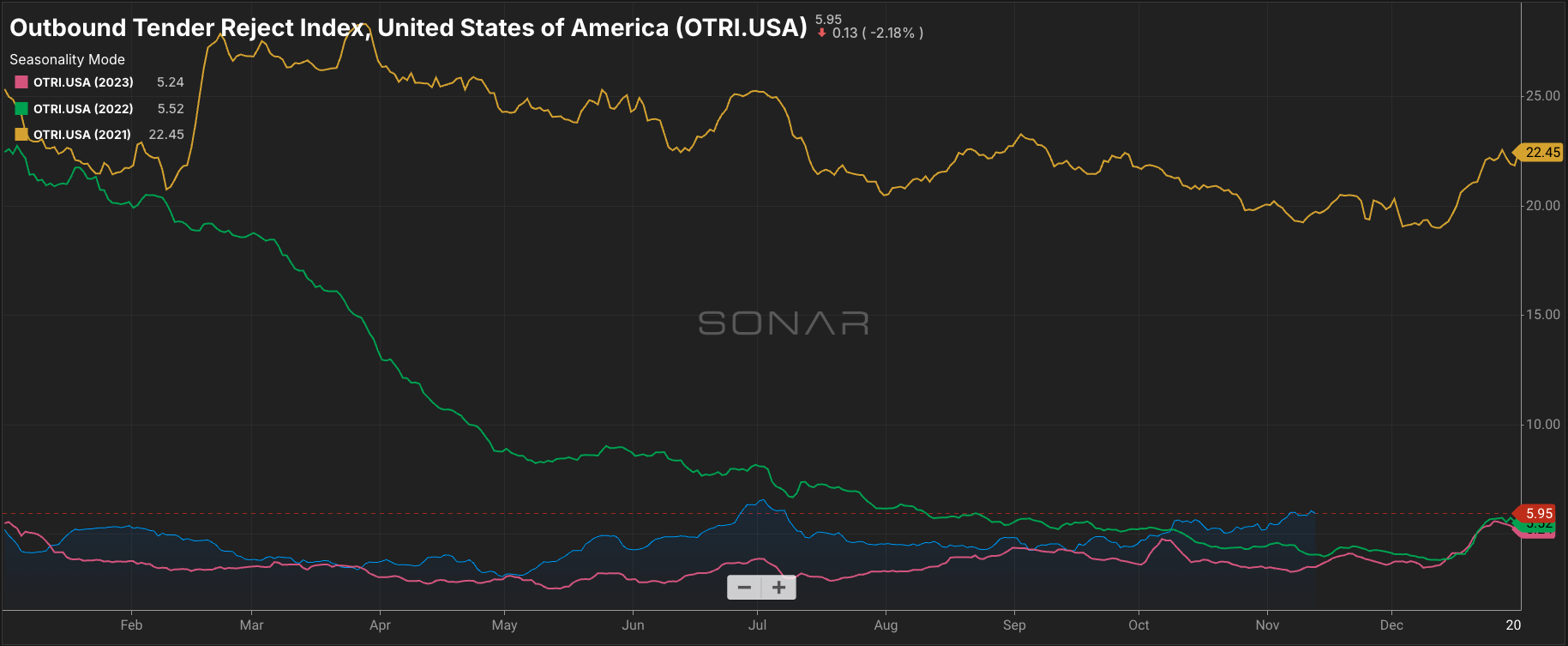

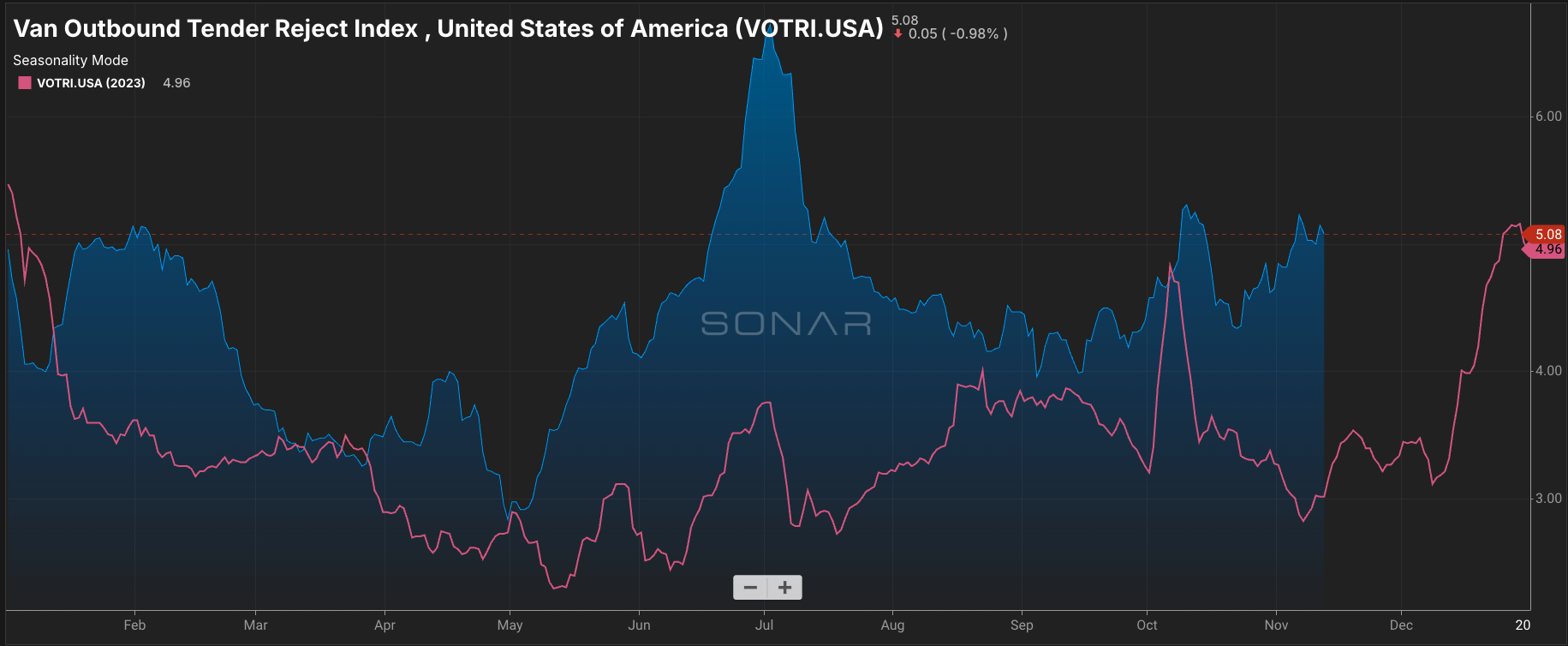

Weather-related disruptions caused unexpected delays and impacted routing guides in early October, creating tightness despite the oversupplied market. The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. It has remained over 5% since early October — the longest stretch since Q3 2022 — and is approaching the high-water mark set around the Fourth of July 2024.

Dry van tender rejections ticked up in mid-October, deviating from last year’s sharp decline. Tightness will likely increase as Thanksgiving approaches, and there is potential for more routing guide disruption this holiday season than at any other point in 2023 and 2024.

Like dry van, reefer rejections ticked up in October, deviating from 2023 trends. Then, in early November, the index surpassed 17.0, nearly twice the November 2023 reading and the highest since April 2022. If this persists, the reefer market will become increasingly vulnerable to significant disruption this holiday season, and rates will likely rise meaningfully as volume grows through year-end.

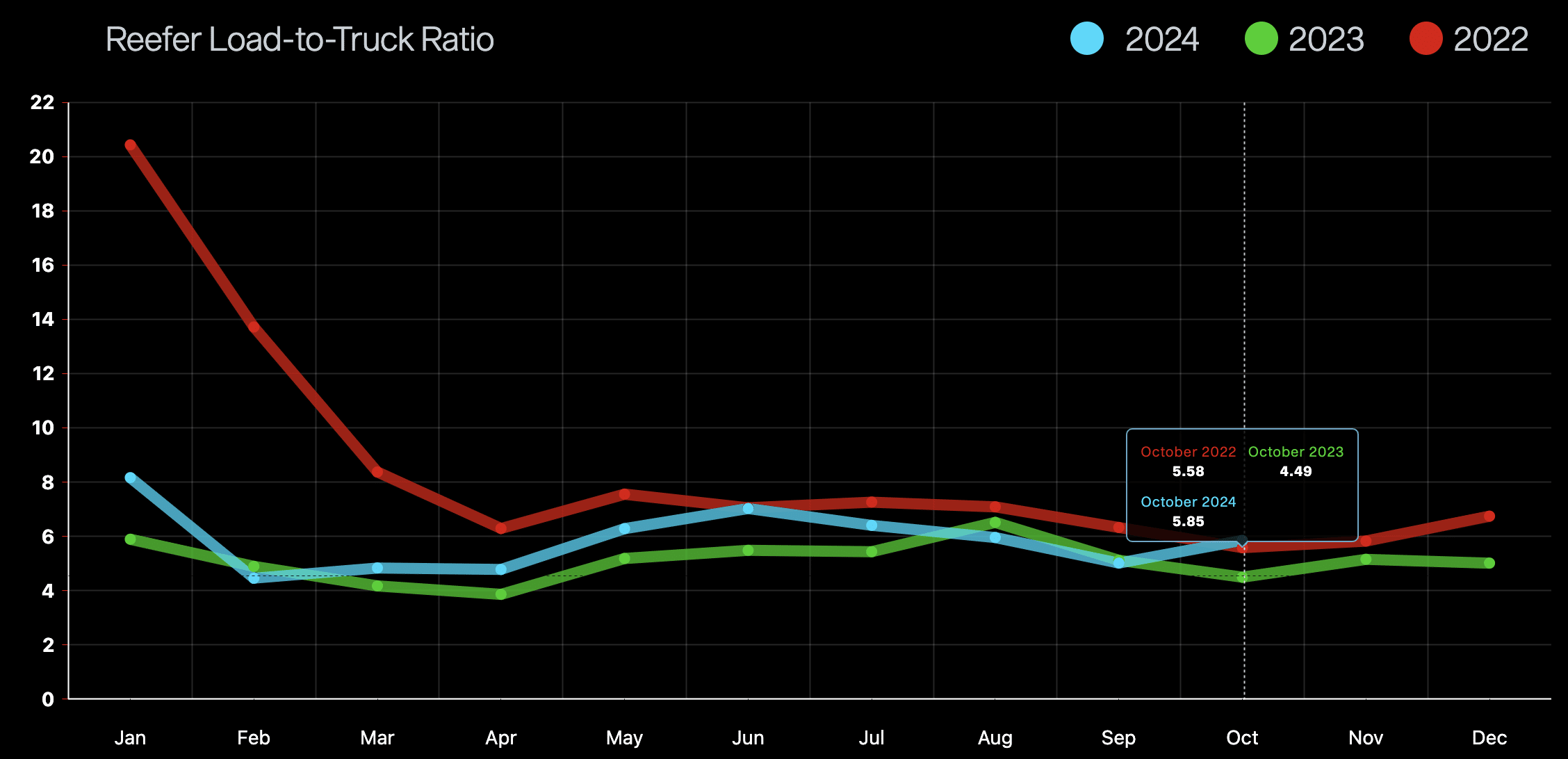

The DAT Load-to-Truck Ratio (L/T) measures the total number of loads relative to the total number of trucks posted on its spot board. The van L/T rose by 18% from September to October, reaching levels similar to October 2022 and 2023, likely due to the disruptive weather events at the beginning of the month. Reefer L/T told a similar story, ticking up over 16% to reach just above October 2022 levels. These indexes should remain elevated through year-end as demand increases and capacity tightens this holiday season.

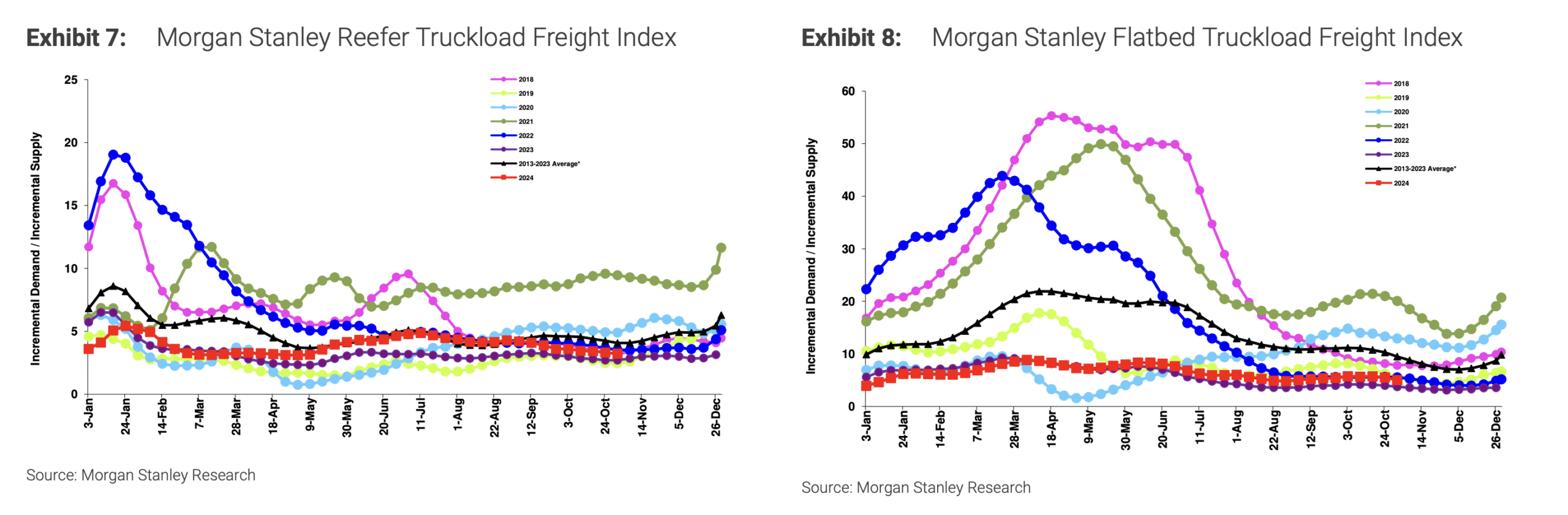

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

Despite recent routing guide disruptions and rate volatility, as of mid-November, the latest reading shows no meaningful activity or demand increases and trends returning to the 10-year average amid seasonal cooling.

Morgan Stanley Dry Van Truckload Freight Index

What’s Happening: Rates are rising as the holidays approach.

Why it Matters: Higher spot rates could disrupt shipper routing guides.

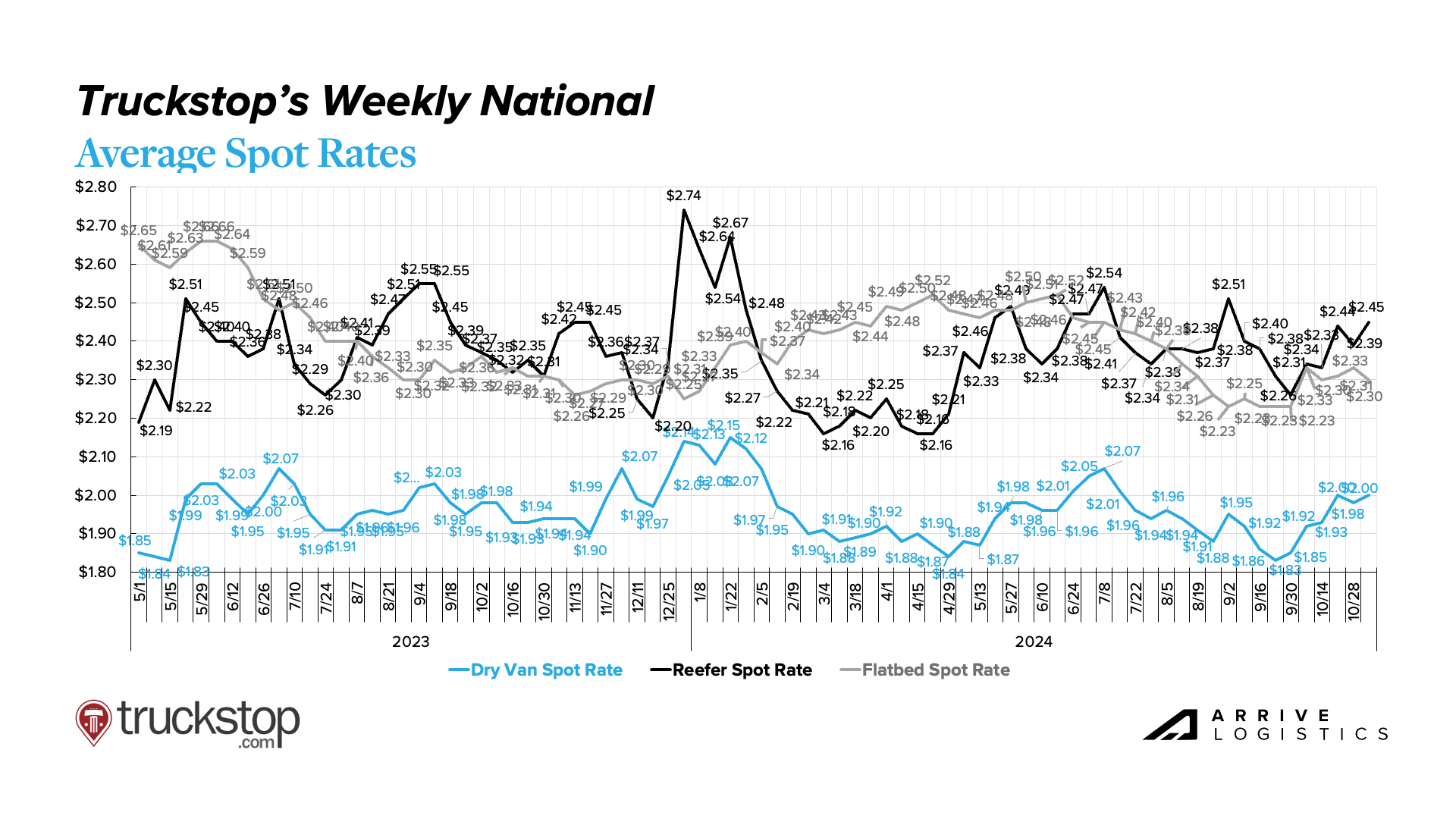

Rates across all modes increased sharply following the early October hurricanes and continue to rise as demand increases and capacity tightens ahead of the holidays. This trend is particularly pronounced in the van and reefer sectors. Truckstop’s weekly spot rate data shows dry van rates hovering around $2.00 per mile and reefer rates at $2.45 per mile. Rates for both modes have increased by $0.20 per mile over the past six weeks and will follow typical seasonality, rising again around Thanksgiving and Christmas. Flatbed rates remain down, with no major movement since early October.

According to DAT, spot rates (including fuel) increased across all three major modes in October following declines in September. Van and flatbed rates have been flat through mid-November, while reefer all-in rates have increased by $0.04 per mile. These trends are particularly notable as fuel prices have declined in the past few weeks, indicating that linehaul rates will likely rise before year-end.

DAT Monthly Rate Trends

National diesel prices rose slightly in October and fell again in early November. Low fuel prices have benefited carriers navigating higher operating costs amid low revenues. The long-term fuel cost outlook remains relatively favorable for carriers, as the incoming administration has said it will ramp up domestic oil production to bolster supply and drive down prices.

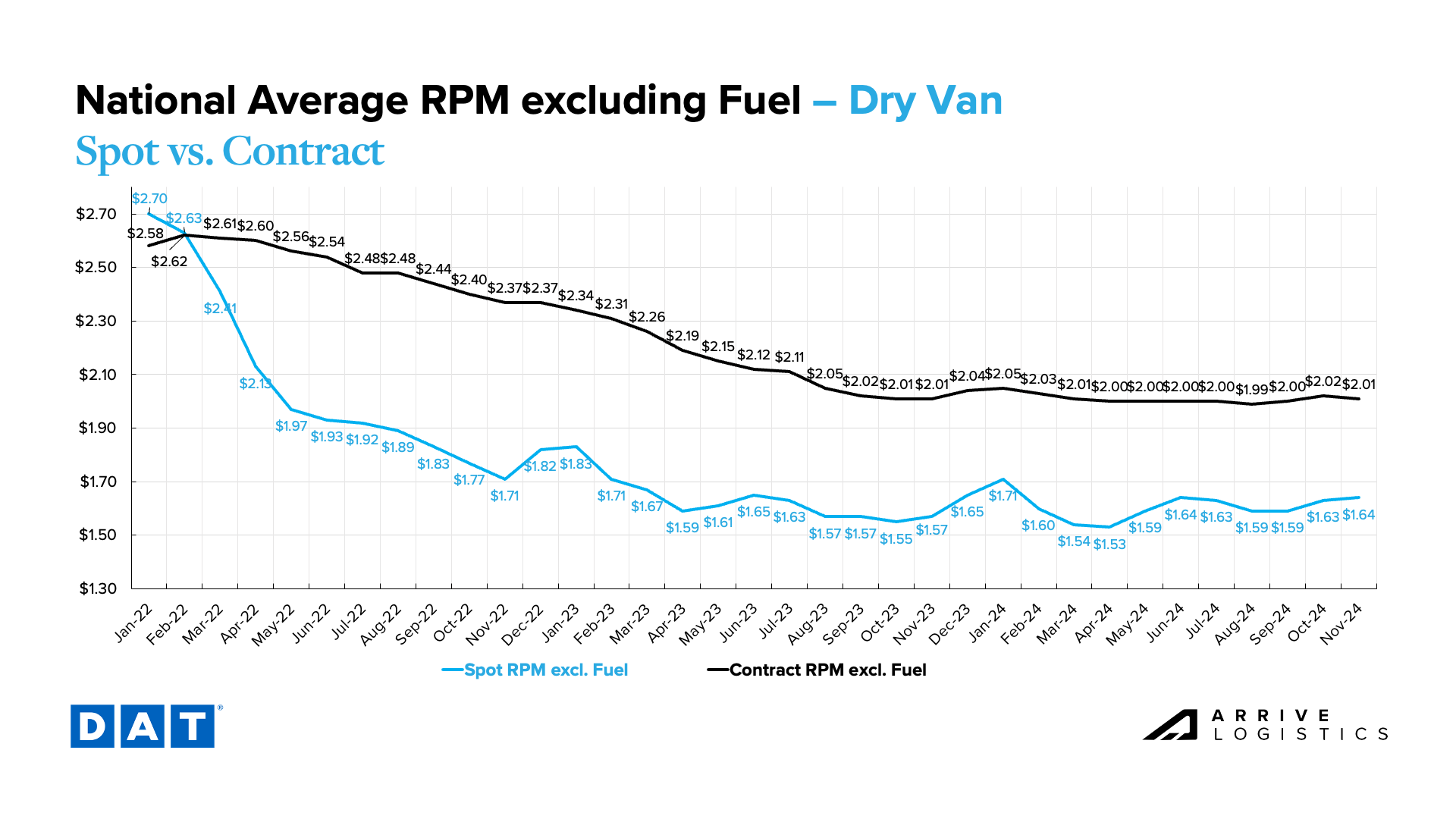

DAT dry van data shows spot and contract rates have steadied after experiencing some inflation in October due to consecutive hurricanes and port strike-related activity. The spot-contract gap remains elevated at $0.37 per mile, making sustained disruption unlikely.

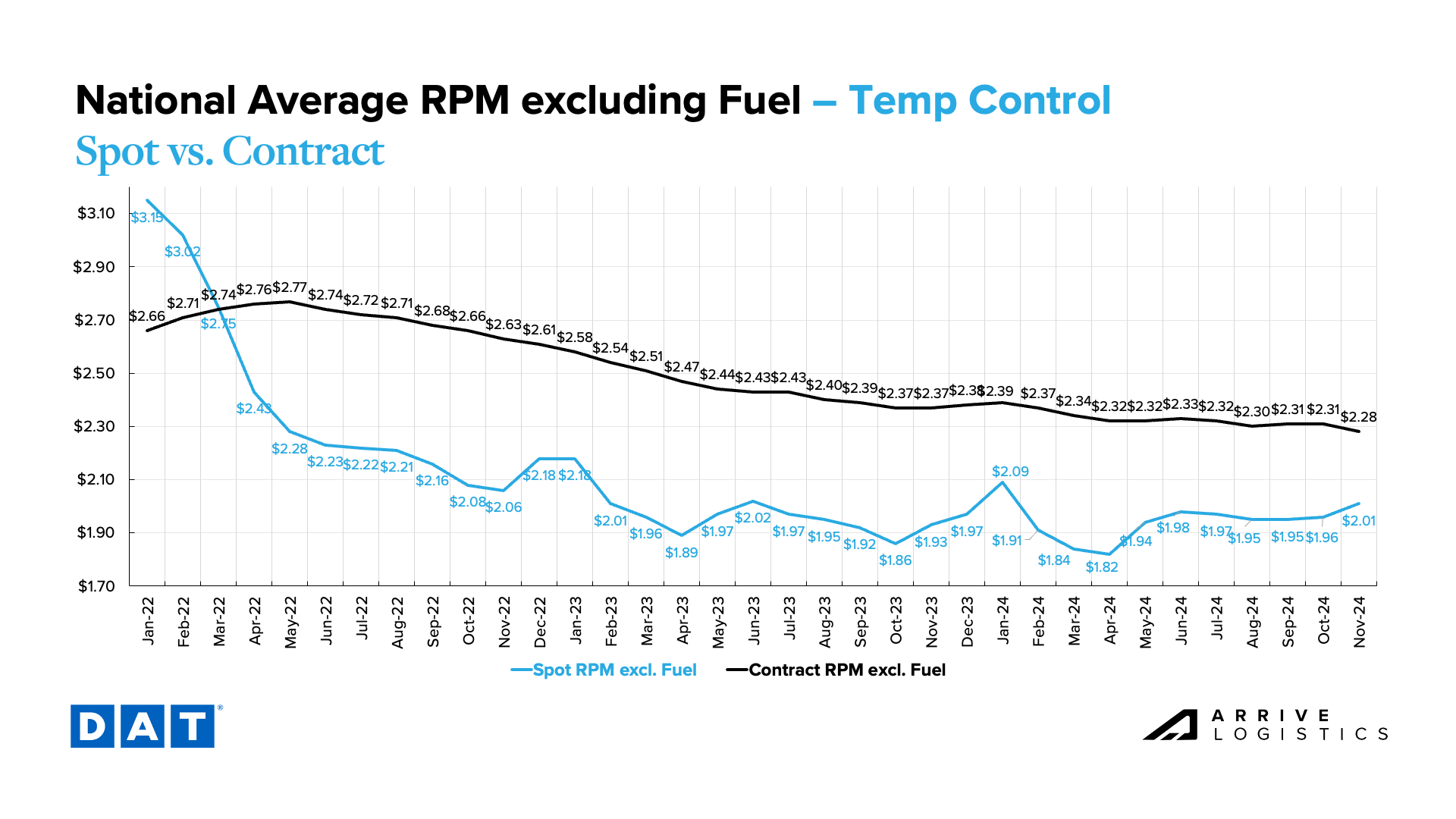

The reefer spot-contract rate gap has closed to its lowest level in this cycle at just $0.27 per mile, as spot rates surpassed $2.00 per mile, excluding fuel, for the first time since January 2024. Early November contract rates, a key catalyst for the gap closing, could normalize as the month goes on, but a tighter gap indicates increased routing guide vulnerability similar to the recent rise in rejection rates for the equipment type. Spot rates followed a similar trend in 2023, rising by $0.07 per mile from October to November. An increase is likely leading up to Thanksgiving due to higher demand for food items ahead of the holiday.

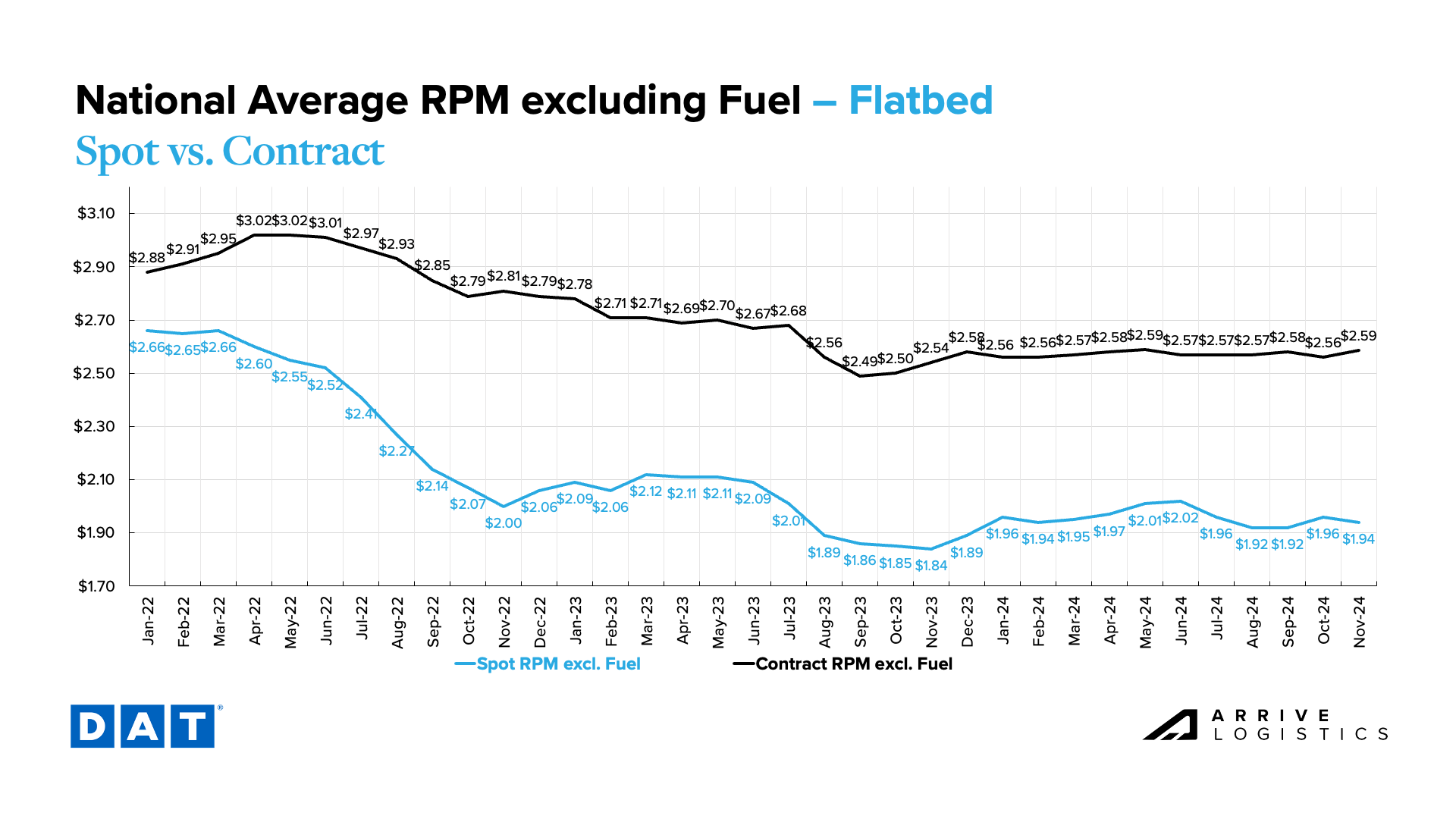

Flatbed rates rose slightly in early November but remained relatively steady. Contract rates increased by $0.03 per mile, and spot rates fell to $1.94 per mile, excluding fuel. Ultimately, the flatbed market continues to follow a different pattern than dry van and reefer. However, the spot-contract rate gap remains historically elevated, with no major disruptions likely in the near term.

What’s Happening: Canada’s Minister of Labour, Steven MacKinnon, intervened to end the Vancouver and Montreal port strikes.

Why It Matters: Goods are again flowing through Canada’s two largest ports.

What’s Happening: Spot rates are rising.

Why It Matters: This indicates the end of a market cycle.

What’s Happening: LTL carriers are expanding through acquisitions.

Why It Matters: This trend will likely continue.

What’s Happening: Seasonality is driving regional tightness.

Why It Matters: Rates are rising in these areas.

East Coast

Midwest

South

West

Pacific Northwest (PNW)

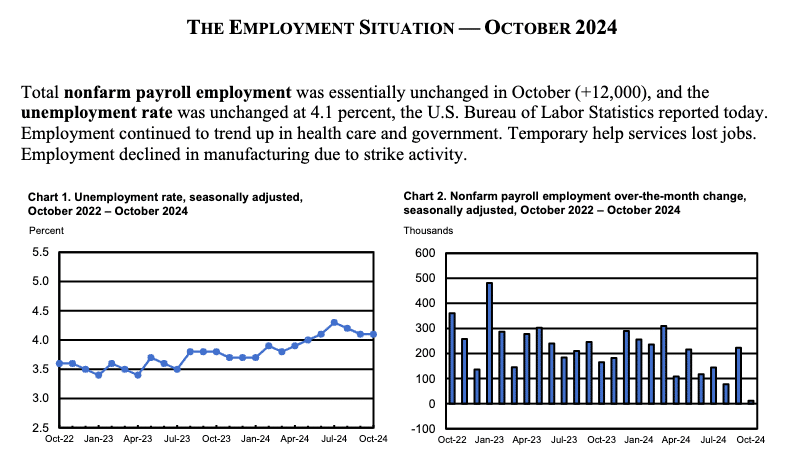

What’s Happening: Trucking jobs declined by 100 on a seasonally adjusted basis in October.

Why It Matters: A promising holiday peak season is slowing the decline.

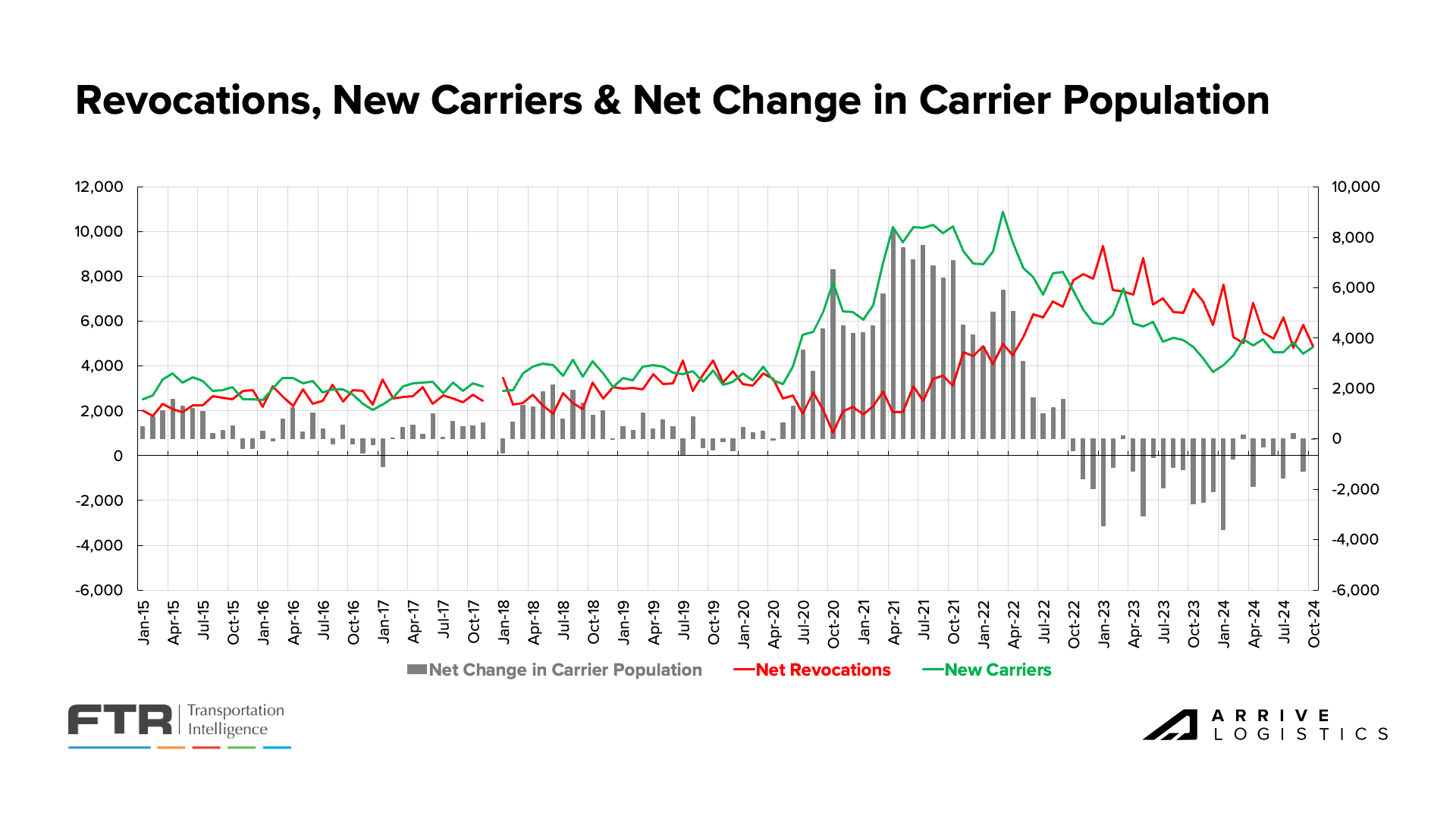

Resilient carriers continue to exit the market slower than in previous months. October revocation data shows over 4,800 carrier entrants and exits. As a result, the net change in the overall carrier population was effectively zero. Recent disruptions and holiday season rate increases, paired with recent fuel price declines, are offering many carriers a sense of stability that could keep them in the market longer.

The driver population remains relatively soft, and there is no evidence of a shortage. This is due to older drivers staying on the road longer to cover their high cost of living, plus the growing migrant population.

Initial reports said the FMCSA Clearinghouse regulations preventing drivers with a ‘prohibited’ status from getting behind the wheel could impact the driver population. However, ACT recently said that the ruling will only affect about 5,000 drivers, far fewer than initially thought.

For Hire Driver Availability Index, ACT Research

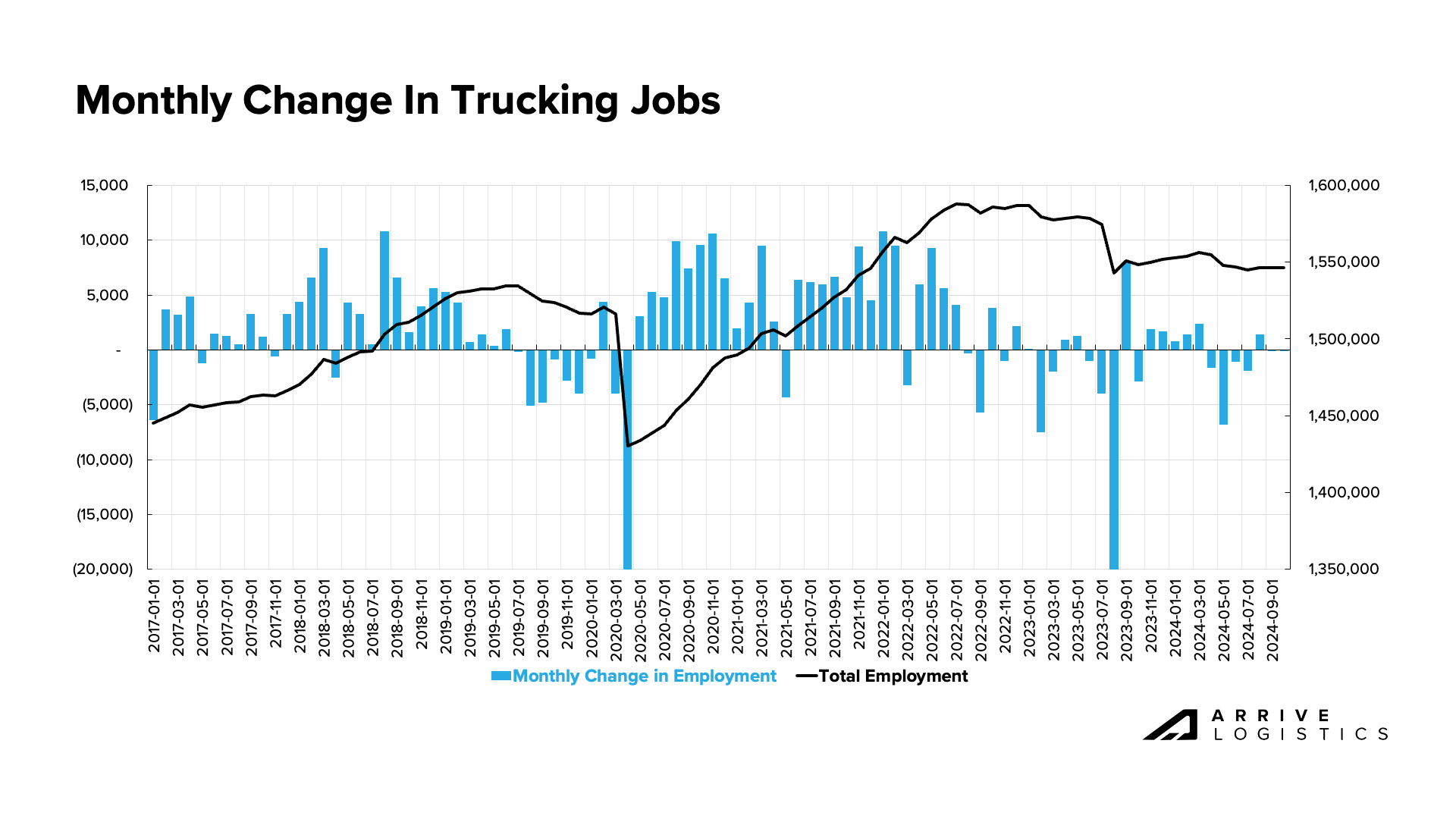

Trucking jobs declined by 100 on a seasonally adjusted basis in October, marking the second consecutive month of modest losses following a gain of 1,400 jobs in August. Some October volatility and a more promising holiday peak season than last year are helping to curb additional declines. Still, current capacity trends indicate that these rate increases will be short-lived, and a sustained recovery is still a ways off.

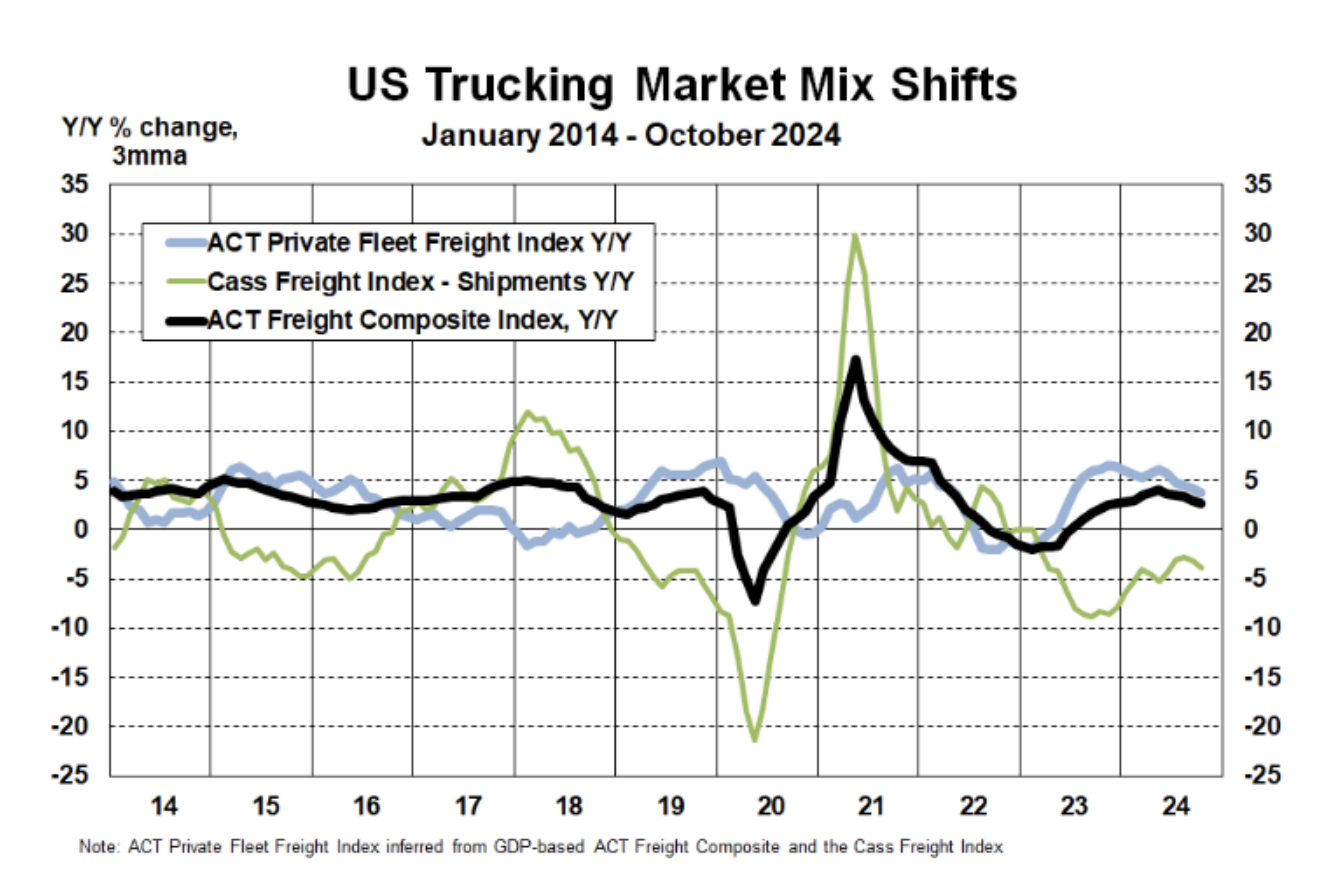

We continue to monitor the evolving role of private fleets as they increase their share of the for-hire market despite overall volume declines. With less freight available, for-hire carriers are negotiating rates aggressively to maintain volume and revenue, putting downward pressure on spot rates in turn. If this trend persists, it could extend the current rate environment deeper into 2025.

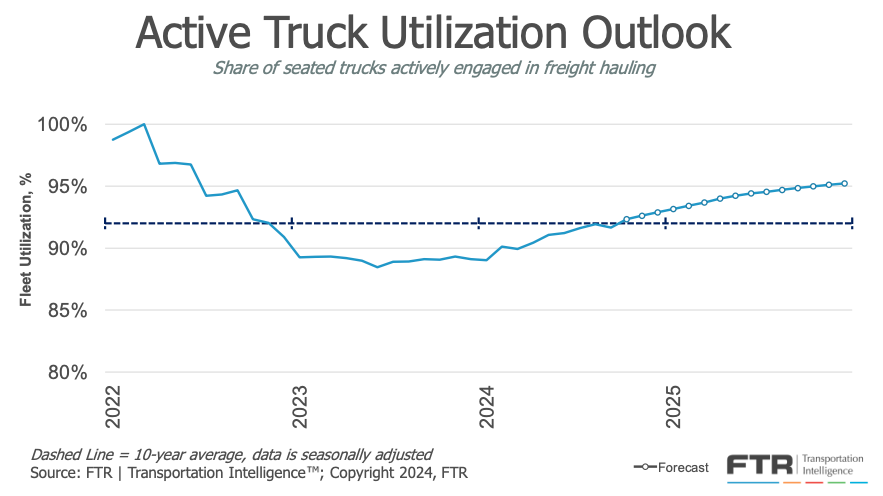

FTR’s latest truck utilization forecast remains relatively unchanged. Current utilization is nearly in line with the 10-year average of 92% and should continue to improve gradually through 2025 and into 2026. Equipment utilization improvement is a sign that fleet networks are tightening, and as that number approaches 100%, the risk of sustained disruption increases.

What’s Happening: Retailers are pulling freight forward to avoid potential disruption.

Why It Matters: While positive in the short term, this could negatively impact 2025 demand.

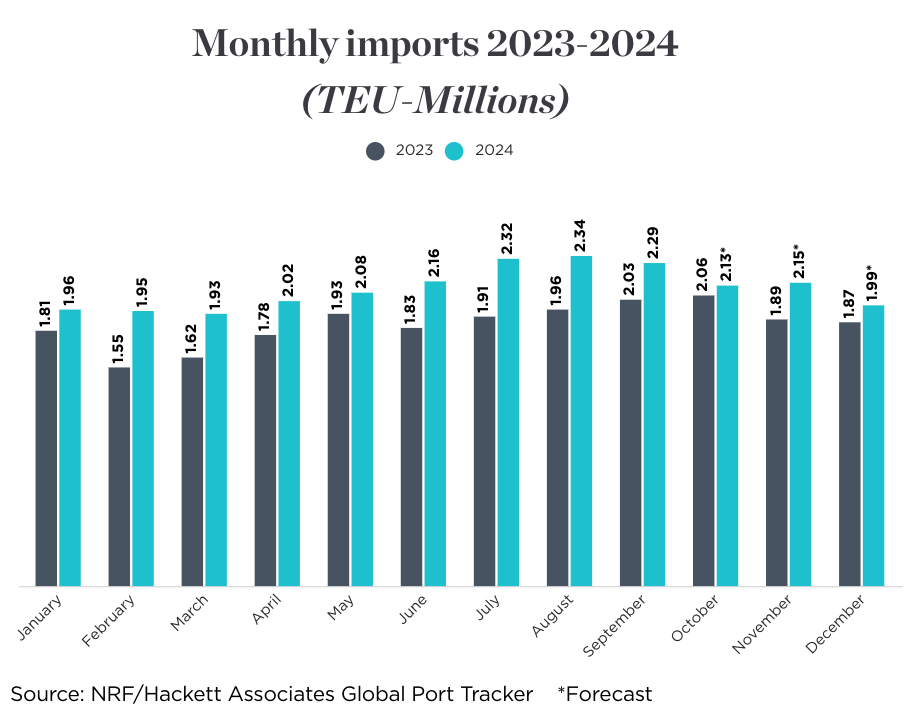

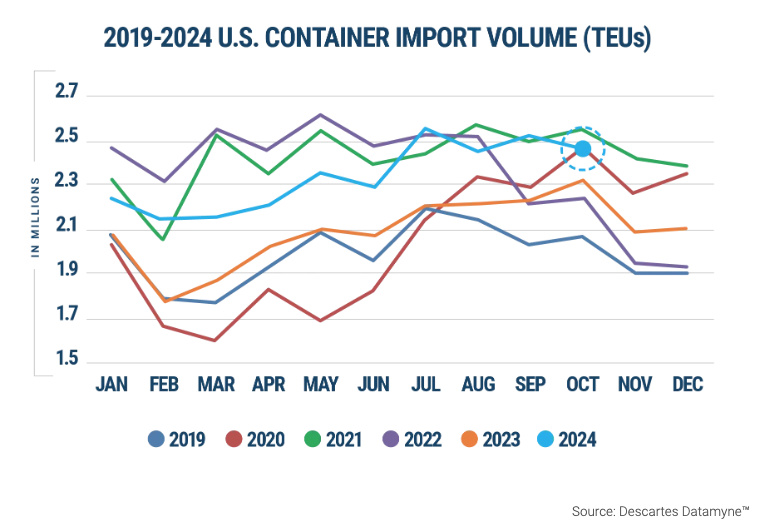

Import forecasts for the remainder of the year have improved, calling for over 2 million TEUs in November and just under 2 million in December. The revision comes as retailers proactively pull freight forward to avoid two potential disruptions: the new administration raising tariffs and port strikes resuming in mid-January. Though this volume surge should benefit the market in the near term, it could negatively impact demand in 2025.

Recent Descartes data tells a similar story as the NRF forecast, showing TEU imports declined sequentially in October but remained above 2 million. The Descartes data also shows shipment declines every November for the past five years; however, if retailers continue pulling freight forward to mitigate potential strike and tariff-related risks, imports could moderate in November and December.

Port labor negotiations have resumed, but the union has made clear its workers will strike again if no agreement is in place by mid-January. However, the incoming administration is more likely to enforce the Taft-Hartley Act, which could motivate the union to make a deal instead of striking.

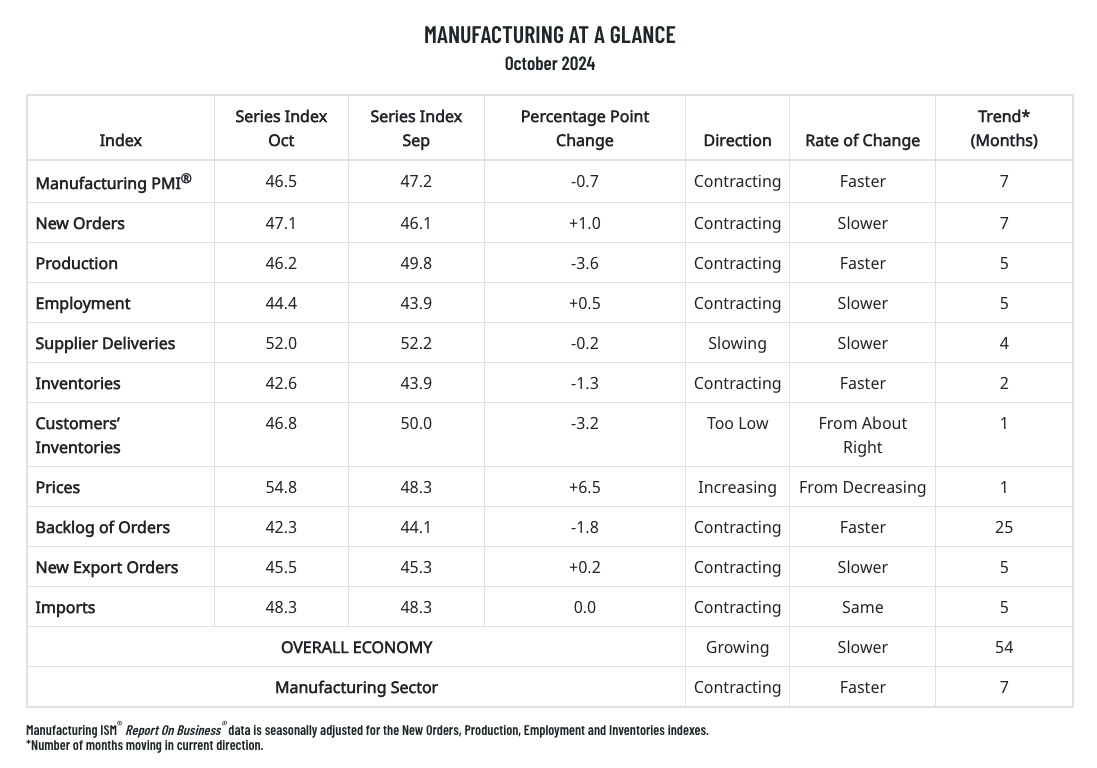

The manufacturing sector continues to contract, indexing below 50 in 23 of the past 24 months, including the last seven. The most recent reading declined by 0.7 percentage points to 46.5. However, ISM notes that a reading above 42.5 indicates economic expansion, and October was the 54th consecutive month with a reading above that threshold. As interest rates continue to decline and spending increases, manufacturing demand could grow and drive the index over 50 in 2025.

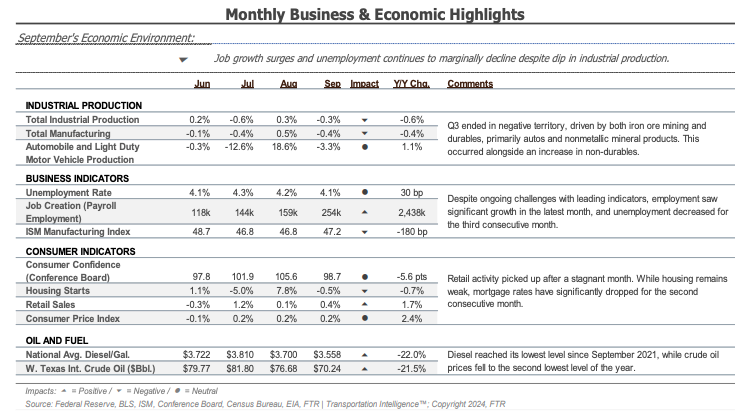

Economic trends in freight-related industries remain fluid. As industrial production and manufacturing declined, unemployment remained historically low, retail activity showed positive growth and mortgage rates fell for the second consecutive month. With interest rates dropping and the consumer market holding steady, the manufacturing and housing sectors could grow, providing a meaningful boost to overall freight demand in 2025.

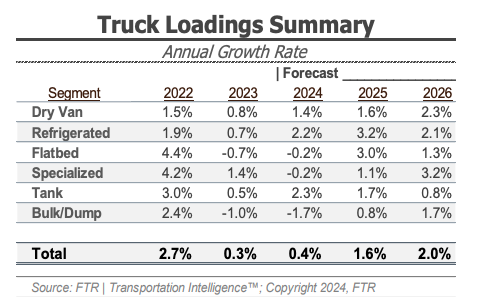

FTR made a slight downward revision to its 2024 truck loadings forecast, calling for total truckloads to grow 0.4% year-over-year, down from 0.6% last month. The dry van loadings forecast was revised downward, while the reefer and flatbed loadings forecasts both had positive revisions. The 2025 outlook remains strong, with overall truck loadings expected to grow by 1.6%.

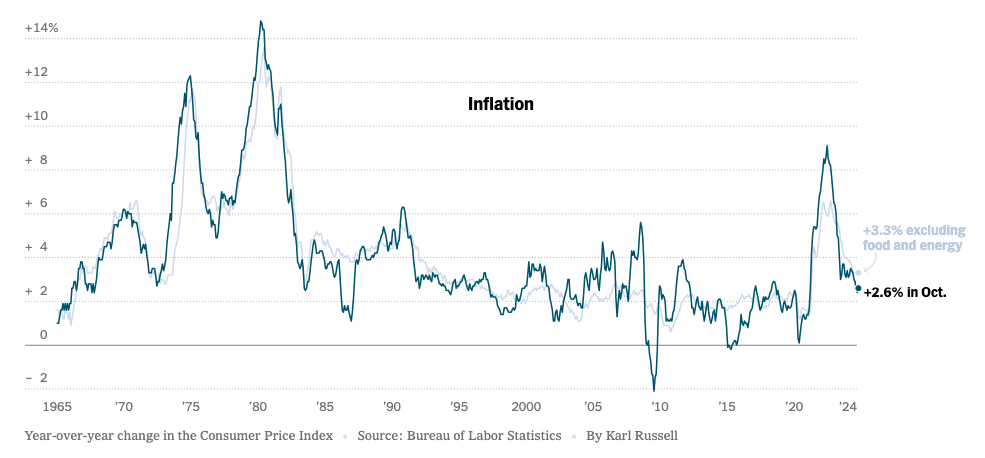

What’s Happening: Inflation rose in October.

Why It Matters: Consumer spending remained steady nonetheless.

Inflation rose from 2.4% in September to 2.6% in October, still short of the 2% target rate. Though the Fed may cut interest rates by another quarter percent during its December meeting, there would be little to no impact until mid-2025.

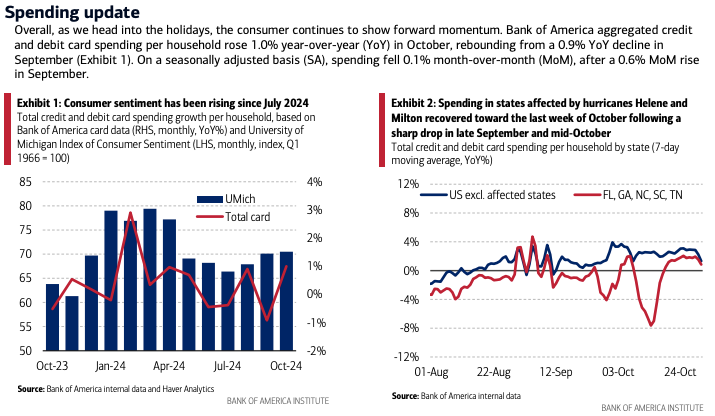

Recent Bank of America credit card data shows consumers are displaying solid momentum going into the holidays as spending rose 1.0% year-over-year in October after declining 0.9% year-over-year in September. The University of Michigan’s consumer sentiment index has been rising consistently since July, indicating positive consumer sentiment. Consumers should maintain relatively stable spending levels until interest rates fall further and wages grow.

The 4.1% unemployment rate and relatively flat total non-farm payroll employment indicate a strong labor market. This trend encourages steady consumer spending, which in turn supports stable demand.

We expect typical seasonality to remain the narrative heading into peak season. Elevated tender rejection rates and increased spot activity through recent disruptions are signs the market is more balanced than a year ago.

Demand stability seems likely, especially as shippers pull forward imports amid concerns about a second port strike and potential tariff increases. However, we believe supply is still sufficient to keep routing guides intact as we get beyond peak season. The 2024 holiday season will likely be more volatile than last year, but strong supply should support swift normalization following any fluctuations.

As the new administration’s plans become clearer, so will their impact on transportation markets. A few focus areas we’re monitoring are tariffs, immigration, labor, industry regulation and environmental policy.

A market flip is not out of the question with the right catalysts, but we are not yet ready to call for widespread disruption in the near term until there are more signs of vulnerability in the data or imminent black swan events that could shock demand or supply.

The Arrive Monthly Market Update, created by Arrive InsightsTM, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, ACT Research, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We understand market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.