"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Conditions are still challenging for carriers, with low rates and high operating costs persisting as 2024 begins. Though holiday rate increases and recent fuel price declines provided temporary relief and indicated the market is approaching equilibrium, current conditions will likely continue through the first few months of the year. The market will be more susceptible to major demand disruptions by mid-year as the spot-contract rate gap tightens.

Below are the key takeaways from this month’s update:

What’s Happening: Market conditions remain loose despite short-term volatility.

Why It Matters: Relatively loose conditions indicate the market correction continues.

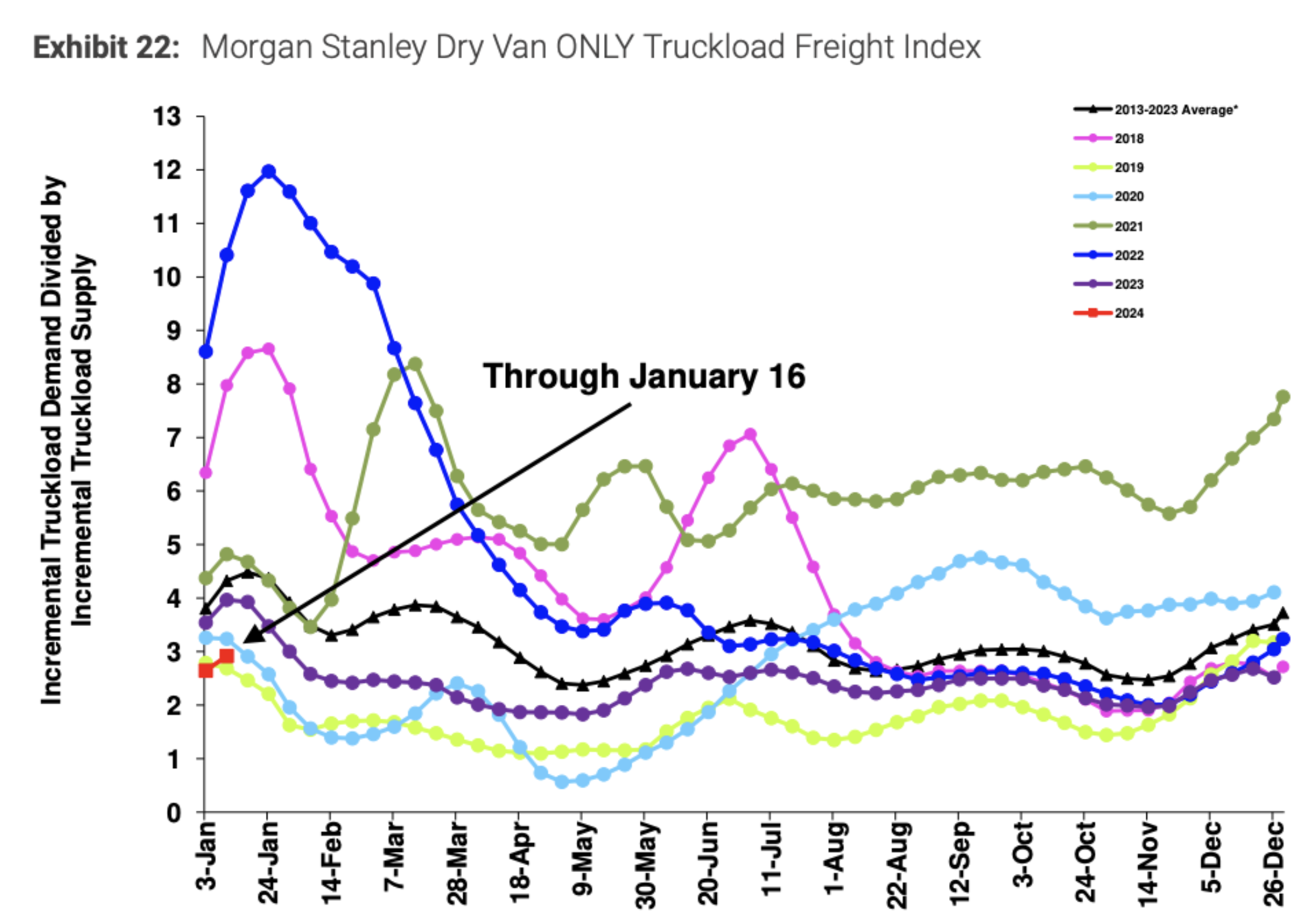

The Morgan Stanley Dry Van Freight Index is a measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

As expected, conditions tightened throughout November and December, then loosened slightly toward year-end. The first index reading of 2024 was the lowest in the past six years, further indicating that supply is still largely sufficient to support current demand.

Figures 2: Morgan Stanley Reefer and Flatbed Truckload Freight Indices

According to ACT’s Supply-Demand Index, conditions have tightened over the last four months after loosening for the previous 17. The index dropped slightly from 52.4 in October to 52.0 in November due to steady freight demand and capacity exiting the market. However, it is important to note that this is only a directional measure, and the market remains loose overall.

Figure 3: ACT For-Hire Trucking Survey

Market conditions remain relatively stable, indicating that current capacity is sufficient to meet demand. While the back half of December showed some tightness, it was less dramatic than during the pandemic years and is more indicative of traditional seasonal patterns.

Overall, December market conditions mirrored those observed in the second half of 2022, proving that this downcycle has lasted longer than normal. However, reefer market volatility increased in December compared to the end of 2022, indicating this mode is leading the charge toward market normalization.

The Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject freight they are contractually required to take, ended the year at around 5%. That was close to the high water mark in 2022 but well below the 22.45% reading at the end of 2021. The index started the year hovering above 4% and will likely remain in line with 2023 trends for the near future.

Figure 4: Outbound Tender Reject Index (SONAR)

Tender rejections on the reefer side continue to show increased volatility, with rejection rates jumping well over 10% in the second half of December. While this is far below the 38% we saw in 2021, it is still higher than the rejection rates we saw in 2022. Reefer rejection rates have started the year hovering above 8%, slightly higher than we saw in early 2023.

Figure 5: Contract Load Accepted Volume

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was up 8.2% year-over-year, or 9.1% when measuring accepted volumes after the significant tender rejection rate decline.

Accepted volumes were down 4.2% month-over-month as of early January, driven by a 6.1% decrease in accepted dry van tenders and a 2.8% decrease in accepted reefer tenders.

Figure 6: Contract Load Accepted Volume (SONAR)

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. December data showed decreases across all three modes: Dry van was down 9% month-over-month and 44.1% year-over-year, reefer was down 18.3% month-over-month and 54.6% year-over-year, and flatbed had the smallest movement, down 7.1% month-over-month and 47.9% year-over-year. These numbers continue to reflect the oversupplied market.

Figures 7 & 8: Van Load to Truck and Refer to Truck Ratio

What’s Happening: Capacity continues to exit the market, albeit at a slower pace than previous downcycles.

Why It Matters: The slow exit rate could extend the current downcycle.

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. Recent data showed relatively flat conditions despite declining load posts, indicating truck posts were also down.

Spot rates are still well below what they were at this point last year, and carriers with heavy spot market exposure continue to see significant margin compression as operating costs stay flat. Recent fuel price declines have offered some relief, but not enough to offset the rate drop observed over the past 18 months.

Capacity continues to exit the market slowly as carriers running mostly contractual freight remain profitable despite market conditions. Meanwhile, small carriers and owner-operators are mitigating their spot market exposure by joining larger fleets.

Though monthly revocations are at the lowest point since early 2022, they are still well above historical trends.

Figure 9: Net Revocations

Carrier revocations have outpaced new entrants for 14 of the last 15 months, reducing the total number of carriers. Much of the capacity that entered the market over the last few years remains underutilized, so we expect this disparity to continue for at least the near term.

Figure 10: Net Change in Carrier Population

This visual from ACT depicts the decline of the carrier population by showing the relationship between revocations and new authorities. While net revocations declined toward the end of 2023, so did the number of new carrier start-ups. Nonetheless, revocations remain historically high, and as a result, Q4 of 2023 had the largest-ever decline in carrier population. Moreover, low numbers of new entrants indicate the industry is less attractive to entrepreneurs due to limited opportunities for success.

Figure 11: DOT operating Authorities

New truck orders continue to roll in as 2024 build slots open. However, there was a 14% decline in year-over-year truck orders in 2023, with total orders falling to 234,529 from 273,588 in 2022. The decline occurred at a time when carriers were experiencing low demand and margin compression, resulting in lower profits and a lack of cash needed to order new equipment.

This trend likely points to the financial strength of larger carriers and private fleets’ ongoing investment in growth. While order levels were above the historical average, they did align with seasonal trends. More orders also represents the possibility of a much slower capacity reduction than in previous cycles. Overall, freight demand is healthy, so larger fleets are adding capacity to insource volume back from smaller for-hire fleets and owner-operators.

Figure 12: New Truck Orders

The Class 8 backlog-to-build ratio dropped from 6.0 months to 5.4 from November to December. It had declined steadily all year before rising by 10,000 units over the last four months of 2023. Backlogs will likely remain relatively flat as more 2024 build slots are opened and filled in the coming months. A key trend to watch will be the number of new truck orders placed as more build slots open.

Figure 13: New Class 8 Truck Orders: DataSource: FTR

The November ACT Driver Availability Index reading was relatively flat, dropping 0.2 points month-over-month to 55 and marking the 18th consecutive month of loosening driver conditions. We believe the influx of owner-operators joining larger fleets is the main driver of this trend, as these carriers have historically struggled with retention and are enjoying the increased driver availability. Overarching challenges such as the driver retirement rate and FMCSA drug clearance remain prevalent.

Figure 14: ACT For-Hire Trucking Index: Fleet Capacity

What’s Happening: Demand remains steady despite economic uncertainty.

Why It Matters: Steady demand continues to keep carrier wheels turning.

Demand remains down year-over-year and will likely stay flat for the first half of 2024. The overall strength of the consumer remains a focus from an economic perspective. The National Retail Federation (NRF) recently reported that imports peaked in October, which was later than the typical August peak.

Q4 2023 imports were above Q4 2022 levels, indicating that retailers may have been completing their destocking phase and were gearing up for the holidays. Downside demand risks remain, including concerns about manufacturing trends, how long strong consumer spending will continue, the potential impact of student loan payment resumption on 2024 housing and construction, and the possibility of an extended period of elevated interest rates.

If import volumes remain in line with the NRF forecast, the results will show that an 8.6% month-over-month jump in December imports drove increased freight movement into the last two weeks of 2023 and into early 2024. The total number of imports in 2023 will be around 22.4 million TEUs, down 12.4% from 2022 and over 13% from the all-time high in 2021.

Figure 15: NRF Monthly Imports

December demand trends continued to mirror patterns observed throughout 2023. DAT reports that December spot load postings were down 23.3% from November and 57.2% year-over-year. Truck postings also declined significantly, falling 14.3% from November to December and 20.2% year-over-year.

Figure 16: DAT Trendlines

What’s Happening: The Canadian market is returning to pre-holiday conditions.

Why It Matters: Capacity returning to the road will drive rates down.

What’s Happening: CFDI regulations are now being enforced for border crossings.

Why It Matters: Carriers’ failure to comply with the new regulations could cause shipment delays.

What’s Happening: As the market environment changes, LTL carriers are shifting pricing models.

Why It Matters: Shippers can expect different LTL rates based on freight characteristics.

What’s Happening: Winter weather continues to impact temp controlled rates across the North.

Why It Matters: Large storms are disrupting travel and increasing rates.

East Coast

Midwest

South Central

South West

Pacific Northwest

What’s Happening: The market is oversupplied.

Why It Matters: Rates remain relatively flat across the country.

What’s Happening: Rates experience increased volatility around the holidays.

Why It Matters: Increased volatility indicates we are well on our way towards equilibrium.

Truckstop’s Weekly National Average Spot Rates provide a detailed view of week-to-week rate movements and a real-time look into the current rate environment.

Van spot rates jumped up in the back half of December before flattening out in the first week of January, and reefer spot rates increased significantly after Christmas Day. This rate volatility is consistent with expectations. However, the increased rate movements relative to those seen in the summer peak and last year’s holiday season illustrate that the market is progressing towards equilibrium.

Figure 17: Truckstop Weekly National Spot Rate Average

National diesel prices were volatile in 2023 and declined quickly throughout Q4, falling nearly 13% to below $4.00 per gallon from September to December. In turn, per-mile fuel surcharges decreased significantly. The DAT van fuel surcharge dropped by $0.10 per mile from September to December, while reefer and flatbed surcharges declined by $0.11 per mile and $0.12 per mile, respectively, illustrating the variance between linehaul and all-in rate movements.

Figure 18: DAT Fuel Trends

Van spot rates continued to rise, increasing by $0.08 from November to December and another $0.05 in January. Contract rates also increased month-over-month for the first time since early 2022.

Although the Q4 holiday seasons likely influenced theseincreases, the gap between spot and contract is closing to levels not yet reached in the current downcycle. The December van rate spread dropped from $0.44 in November to $0.39 in December. As of mid-January, the rate spread sits at $0.35.

Figure 19: DAT Dry Van National Average RPM Spot vs. Contract

Reefer rates continue to show the most volatility, with linehaul spot rates jumping by $0.04 in December and another $0.10 in January. While we expect pullbacks in the second half of the month, the large rate increase supports the belief that the market is moving toward equilibrium.

The reefer rate spread has dropped to $0.29, the smallest during this downcycle, indicating that the market is more vulnerable to demand disruptions than during the peak demand season in summer 2023.

Figure 20: DAT Temp Control National Average RPM Spot vs. Contract

Flatbed spot rates continue to follow a similar trend as van and reefer equipment, jumping by $0.04 in December and $0.07 in mid-January. Contract rates increased by $0.05 in December but have since pulled back by $0.02. The spread between spot and contract rates remains high, at $0.64 per mile in mid-January.

Figure 21: DAT Flatbed National Average RPM Spot vs. Contract

What’s Happening: Inflation continues to cool but remains above the Fed’s target.

Why It Matters: Interest rates will likely be flat for a few more months, after which we can expect increased consumer activity.

Overall, data on economic conditions remains relatively positive. Stability in the labor market is the biggest driver of our view that we are not on the verge of going over a demand cliff in trucking. As long as labor conditions remain healthy, we believe the consumer will continue to spend and support stable truckload volumes. Drawdowns on inventories in retail and manufacturing should also support flat to positive demand growth associated with sector bottoming.

December CPI data came in at 3.4%, a small increase from the 3.1% reading in November. While this conflicted with the recent disinflation streak, the Fed is still likely begin cutting interest rates this year anyway. However, the current numbers cast doubt on when the first rate cut could occur. That said, we still expect to see two to three rate cuts this year, and large interest rate reductions would likely trigger increased housing activity and thus increase overall freight demand.

Figure 22: New York Times Inflation Data

December Bank of America card data showed consumer spending rose by 0.1% month-over-month on a seasonally adjusted basis. Total card spending in the five weeks following Thanksgiving increased by 1.3% in 2023 compared to the same time frame in 2022. The categories with the largest increases were gas (up 1% month-over-month), airlines (0.8%) and lodging (0.6%). Furniture and clothing spending were down month-over-month, with 4.3% and 2.0% declines, respectively.

Figure 23: Bank of America Card Spending

As expected, the last few weeks of 2023 were more volatile than most of the year. Reefer and van spot rates increased, though the reefer jump was more significant. The spot-contract rate gap reached levels not seen since the downcycle started, and increased rate volatility was a sign that the market continues to move toward equilibrium.

Rates remain well below pandemic levels, compressing carrier margins and driving many out of the market as net revocations outpace new entrants. However, increased profits post-pandemic are keeping other carriers afloat, resulting in a slower decline in carrier population compared to previous downcycles.

Our 2024 outlook is unchanged. We expect relatively loose conditions for the first half of 2024 as capacity supply remains sufficient to service demand. Carriers should continue to exit as the year progresses, leading to tighter conditions. In turn, the market will become more vulnerable to demand disruptions, and volatility could increase in the second half of 2024.

The Arrive Carrier Market Outlook, created by Arrive Insights™, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, ACT Research, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.