"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Demand remains steady ahead of the peak holiday season, and the market is less vulnerable to disruptions due to abundant capacity. Below are other key takeaways from this month’s update:

What’s Happening: The capacity correction continues.

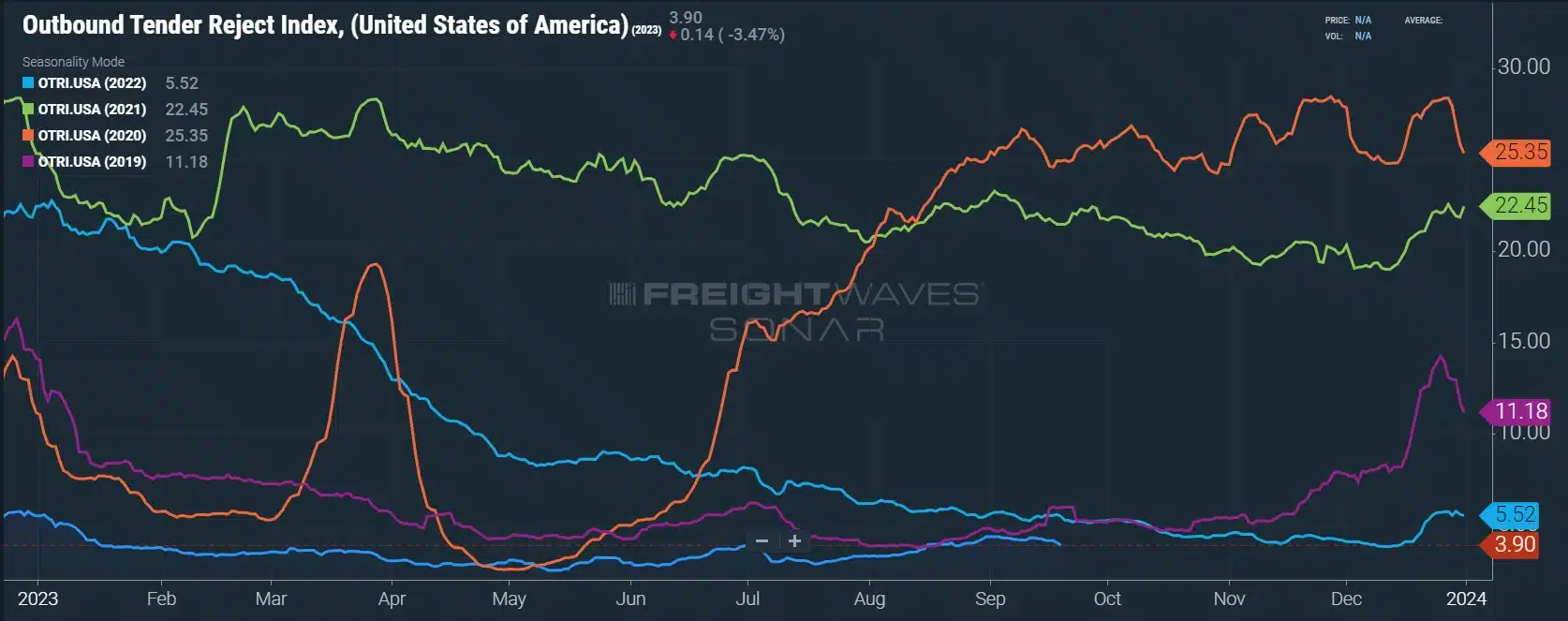

Why It Matters: Even hurricane Idalia wasn’t disruptive enough to drive a sustained capacity crunch, meaning we still have a ways to go.

The Morgan Stanley Dry Van Freight Index is a measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

As expected, conditions have tightened slightly coming into the month. While this is expected leading up to Labor Day, it was reinforced by the timing of Hurricane Idalia. All things considered, the index barely picked up from its trough, aligning with the perspective that supply is still largely sufficient to support overall demand. Historical data points to some potential tightening through the end of the third quarter before easing early in the fourth quarter.

Figure 1: Morgan Stanley Dry Van Truckload Freight Index

The ACT For-Hire Index of Supply and Demand represents the overall market sentiment. The most recent reading came in at 42.8 for the month of July, up from 41.2 in June, indicating the 17th straight month of loosening conditions. For context, during the 2015-2016 downcycle, the index showed loosening conditions for 17 out of 19 months. While the current streak is unprecedented, it is hardly surprising considering how tight the market was during and following the pandemic.

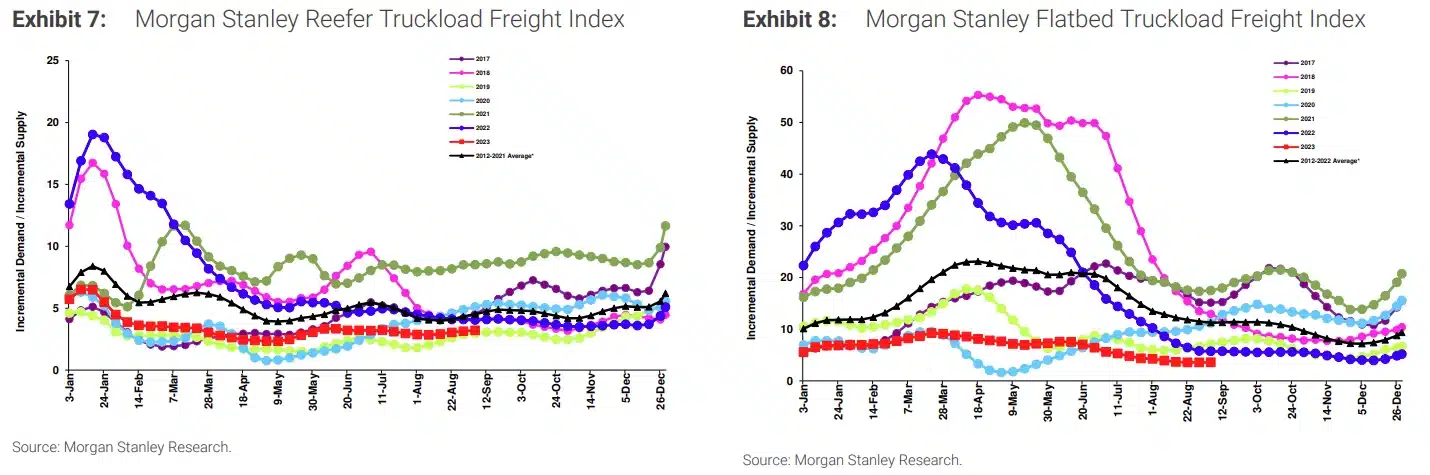

Summer peak season illustrated market tightness occurred in line with normal historical seasonality. Seasonal demand surges caused regional pockets of rate volatility. This signaled that the market is generally becoming more balanced and that rate volatility associated with seasonal demand surges and disruptive events should continue. However, the re-balancing of supply and demand seems to be further along for refrigerated equipment than van, and rate swings for reefer equipment have been and could continue to be more volatile as a result.

As expected, certain pockets and regions experienced some van spot rate volatility in August, but it had little impact on tender acceptance and service for shippers at the national level. This trend demonstrates where we stand in the capacity correction cycle — conditions remain oversupplied, and further correction is needed before the market becomes vulnerable to sustained disruption.

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The numbers fluctuated between an early-month low of 3.3% and 4.39% by month-end, indicating routing guide compliance on shippers’ contractual freight remained historically high.

What’s Happening: Market capacity was able to support temporary volatility.

Why It Matters: It is clear the correction cycle still has a ways to go.

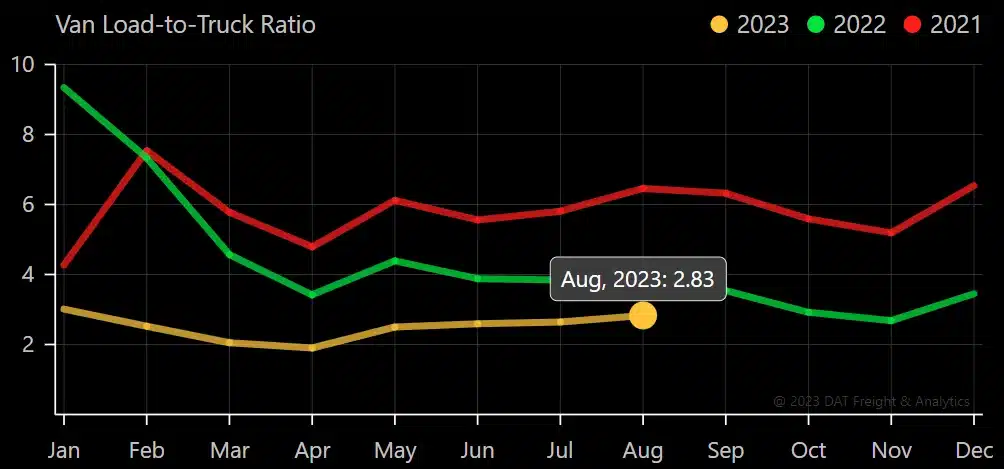

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. August data showed relatively flat conditions despite a meaningful increase in load posts, indicating truck posts were also up.

The Dry Van Load-to-Truck Ratio was up 7.2% month-over-month but remains down 20% year-over-year, whereas the Reefer Load-to-Truck Ratio was up 14.5% month-over-month but down 37.8% year-over-year.

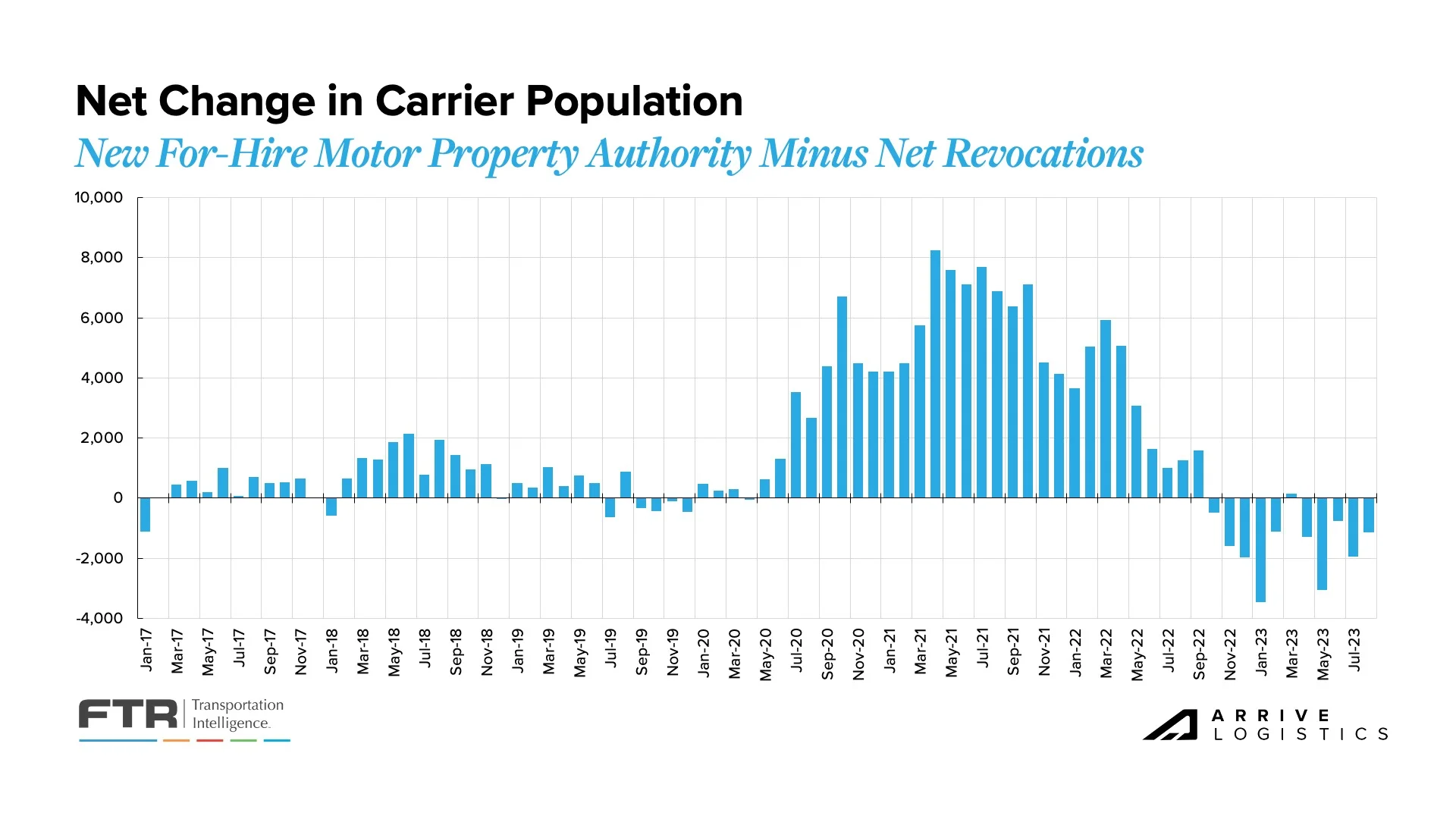

A key trend we’re still watching is revocations outpacing new carriers entering the market for 10 of the last 11 months, reducing the total number of carriers. A significant amount of capacity that entered the market over the last few years remains unutilized, so we expect this disparity to continue for at least the near term.

The Class 8 Tractor backlog continues to decline steadily, with preliminary numbers showing a drop of 7,700 units in August. Per ACT Research, the total backlog is now around 95.300 units, down from 103,000 in July. Subsequently, the backlog-to-build ratio fell to 5.8 months in August, in line with the July reading. Overall, backlogs will likely keep declining in the coming months as production levels outpace orders.

What’s Happening: Tough conditions drive more carriers out of the market.

Why It Matters: This trend will continue as capacity moves closer to equilibrium with demand.

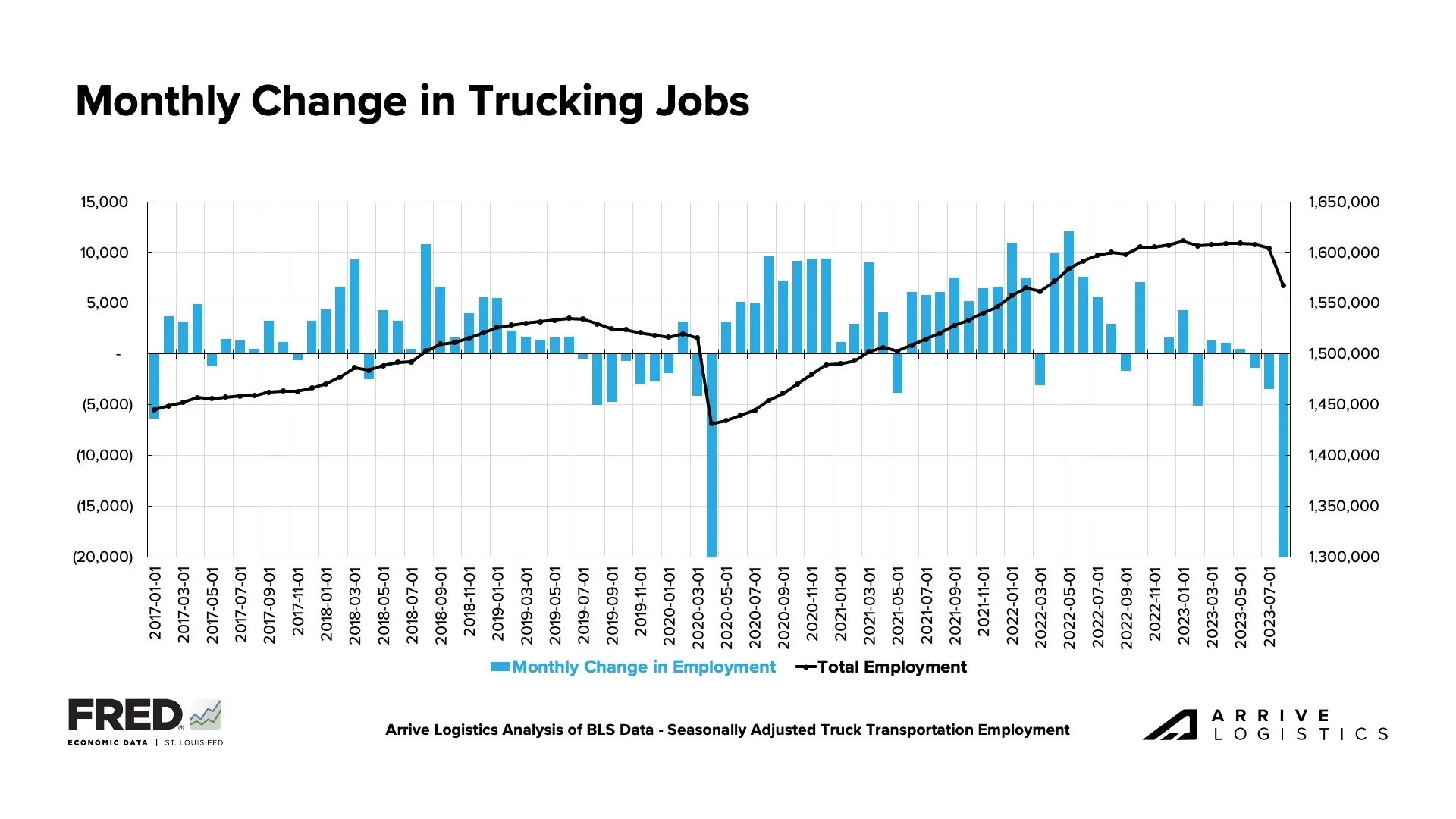

Total employment has reached the lowest level since March of 2022 after dropping by more than 41,000 jobs over the past three months. Though this is largely due to Yellow closing in August, some of those job losses may show up in September.

Given the worsening truckload rate environment, the trucking employment plateau observed in the first half of 2023 defied expectations. Carriers have focused on retaining drivers, but the longer current conditions persist, the more likely overall employment will fall further.

Conditions continue to worsen for carriers in September. Not only have spot rates fallen considerably over the past 18 months, but if the recent rise in fuel costs persists, it could cause many more operating authorities to shut down.

Carriers have largely been patient through the down cycle, but conditions are starting to take a toll as the capacity correction continues. With only a modest upside to truckload demand on the horizon, carriers are unlikely to see conditions improve meaningfully through the year’s end beyond a few seasonal periods of opportunity. Thus, carrier exits will likely increase in the coming months.

This month, high revocations again led to a negative net change in the carrier population. Strong contract service numbers indicate the correction is far from over, but this trend will inevitably lead to a capacity crunch, as it always does in the market cycle.

Increased operating expenses are the primary culprit causing carriers to close, as overall rates are still high compared to historical (pre-pandemic) levels. This trend continues to drive record-high revocations of authority, although August totals were the lowest in more than a year at just over 6,400 carriers.

Figure 11: Net Revocations: FTR Analysis of FMCSA Data

The ACT Driver Availability Index rose by a few points in July. At 59.6, it remains near record levels. However, it is important to note that this data primarily consists of medium- and large-sized fleets and is only representative of those demographics. Smaller fleets and owner-operators are feeling more heat as margins continue to compress and real wages shrink. These drivers either choose to join larger fleets or exit the industry altogether. Overall driver availability will likely start to moderate in the near to medium term once the capacity influx slows down.

What’s Happening: Rising retail volumes are a bright spot heading into Q4.

Why It Matters: While it is too early to feel any real impact, an increase in TEU imports indicates a potential rise in demand.

Recent truckload demand data is encouraging. With tonnage rising, it is easy to point to slowing destocking efforts as an ongoing and future demand driver. Volumes should also get a boost from normalizing retail ordering patterns as the inventory cycle resets.

On the flip side, there are still concerns about manufacturing trends, consumer spending, and 2024 housing and construction trends amid the pending resumption of student loan payments and the potential for an extended period of elevated interest rates.

The National Retail Federation (NRF) recently reported that import cargo volumes at the nation’s major container ports may hit the 2 million TEU mark for the second consecutive month in September and remain there in October. NRF Vice President Jonathan Gold says, “These are strong numbers, and a sign retailers are optimistic about the holiday season since they don’t import merchandise unless they think they can sell it.” This means we could see a good finish to peak season, especially if consumers show strength early on.

If consistent import volumes continue through Q4, year-over-year declines of 11.4% in August could flip to 12% increases in year-over-year import growth by December. This gives some context to how the inventory cycle’s reset could impact demand and just how large a step back retailers took a year ago to correct their overstocked inventories.

Figure 13: NRF Monthly Imports

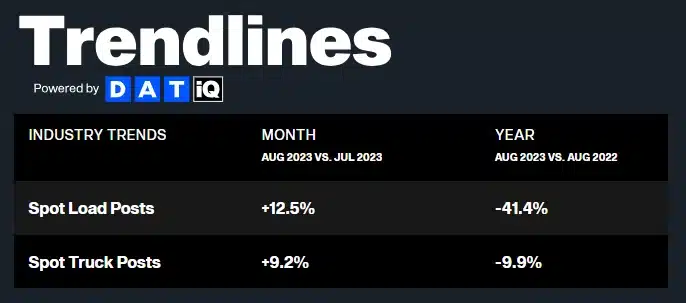

DAT reports exclusively on spot trends and noted that August spot load posts were up 12.5% compared to July after falling in each of the previous two months. The annual comps still showed a year-over-year decline, but spot load posts improved from -54% in June and -50.3% in July to -41.4% in August.

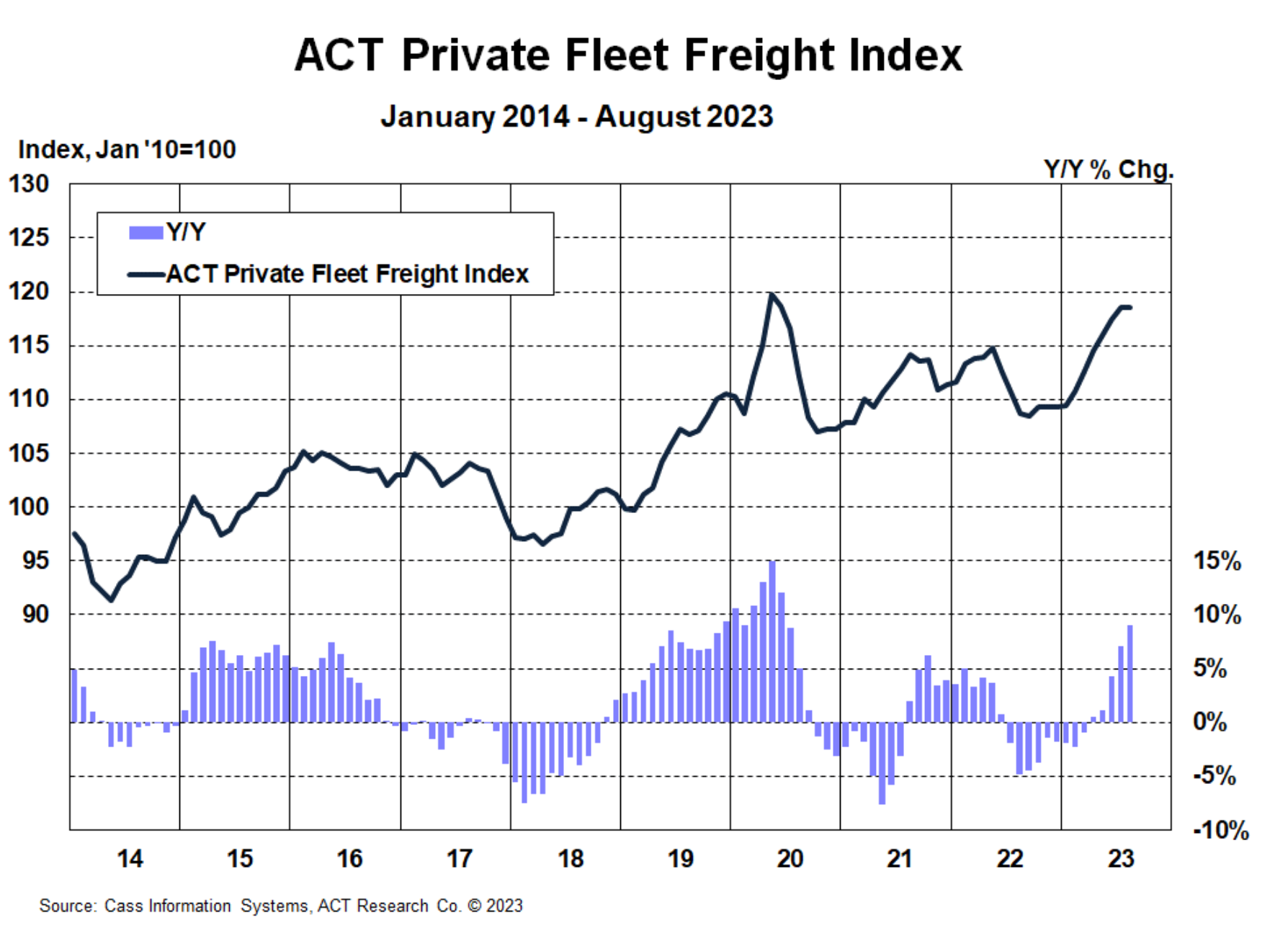

What’s Happening: Private fleets are growing.

Why It Matters: Private fleets absorbing for-hire freight could extend the current downcycle.

An interesting trend we are monitoring is the continued growth of private fleets. Shippers with private fleets are not flowing to the for-hire market despite the existing cost advantages. They tend to have higher costs than for-hire fleets, so it is fair to say that freight shifting in their direction continues to limit overall demand in the for-hire market, extending the current downcycle.

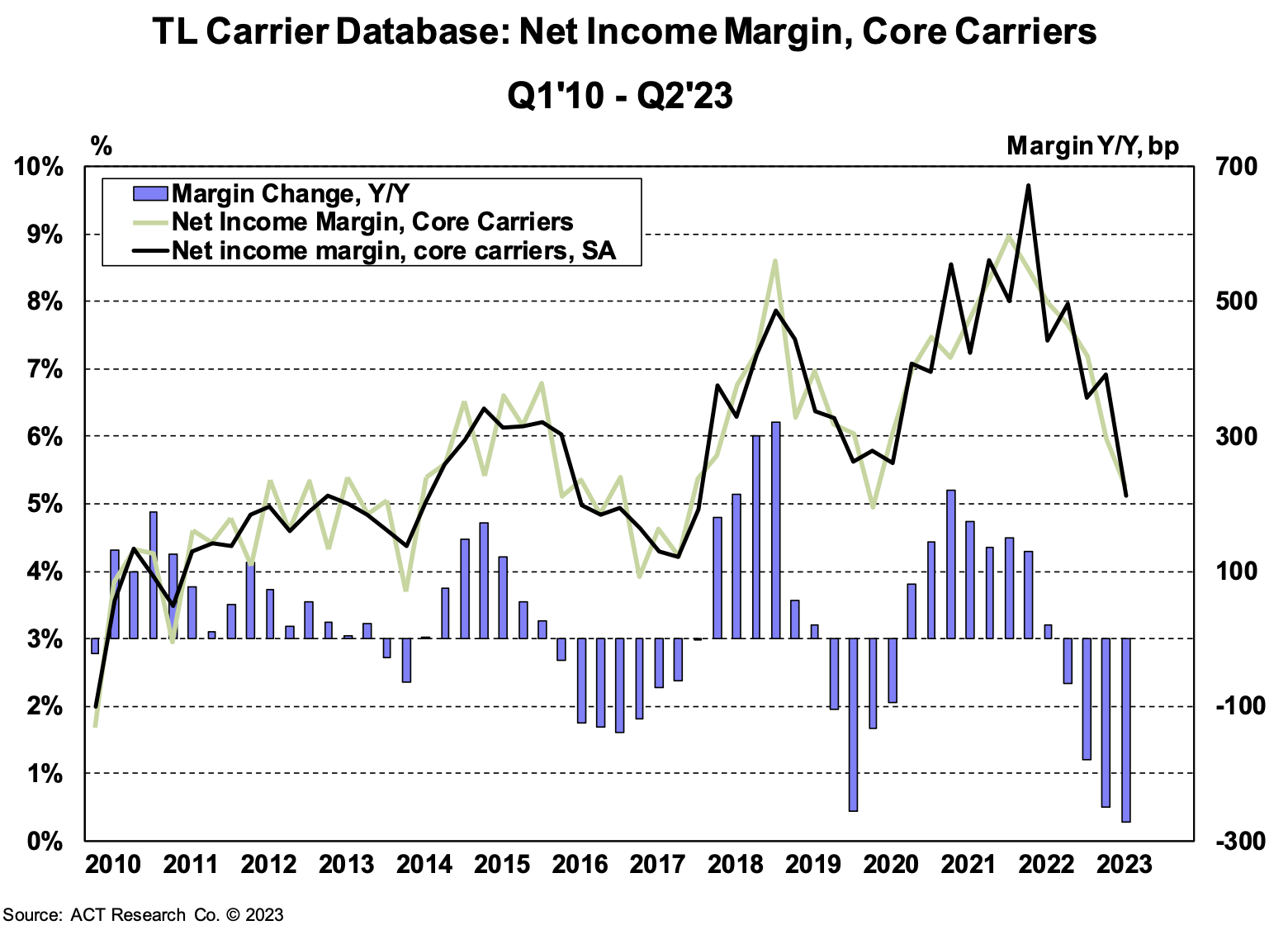

Spot rates continue to stabilize but remain well below operating costs, leading to the third quarter in which public carriers earned negative margins on spot loads. This trend will likely affect owner-operators and carriers with high spot exposure, potentially leading them to close their businesses or join larger fleets. Historically, there would be a quick rise in spot rates when this occurs. However, capacity is plentiful despite this trend, indicating that conditions could remain challenging in the near future.

Figure 17: ACT Illustrative Spot Operating Margin

Carriers’ net income margins in Q2 2023 dipped below 5% for the first time since the onset of the pandemic. Q2 was also the fifth straight quarter in which carriers saw a year-over-year margin decline. This earning environment will likely persist into 2024 as we move through this oversupplied market.

When looking at the full scope of public carrier businesses, 2022 margins were strong but notably down from the last two years. As rates fall further in 2023, the revenue per mile and cost per mile gap will continue to shrink, meaning margins for large carriers could do the same. However, if fuel prices continue to decline, it will lower costs and support better margins for all carriers.

What’s Happening: The United Auto Workers (UAW) strike could significantly impact Ontario, Michigan, and Ohio freight markets. Carriers will likely need to source volume from other areas for the strike’s duration.

Why It Matters: Carriers will likely need to source volume from other areas for the strike’s duration.

What’s Happening: Auto theft is still a significant issue for cross-border shipping.

Why It Matters: We recommend shipping with CTPAT or OEA-certified carriers.

What’s Happening: The LTL market is still seeing increased shipments with lower weightage and size.

Why It Matters: If this continues, it could increase operating costs and inefficiencies throughout the industry.

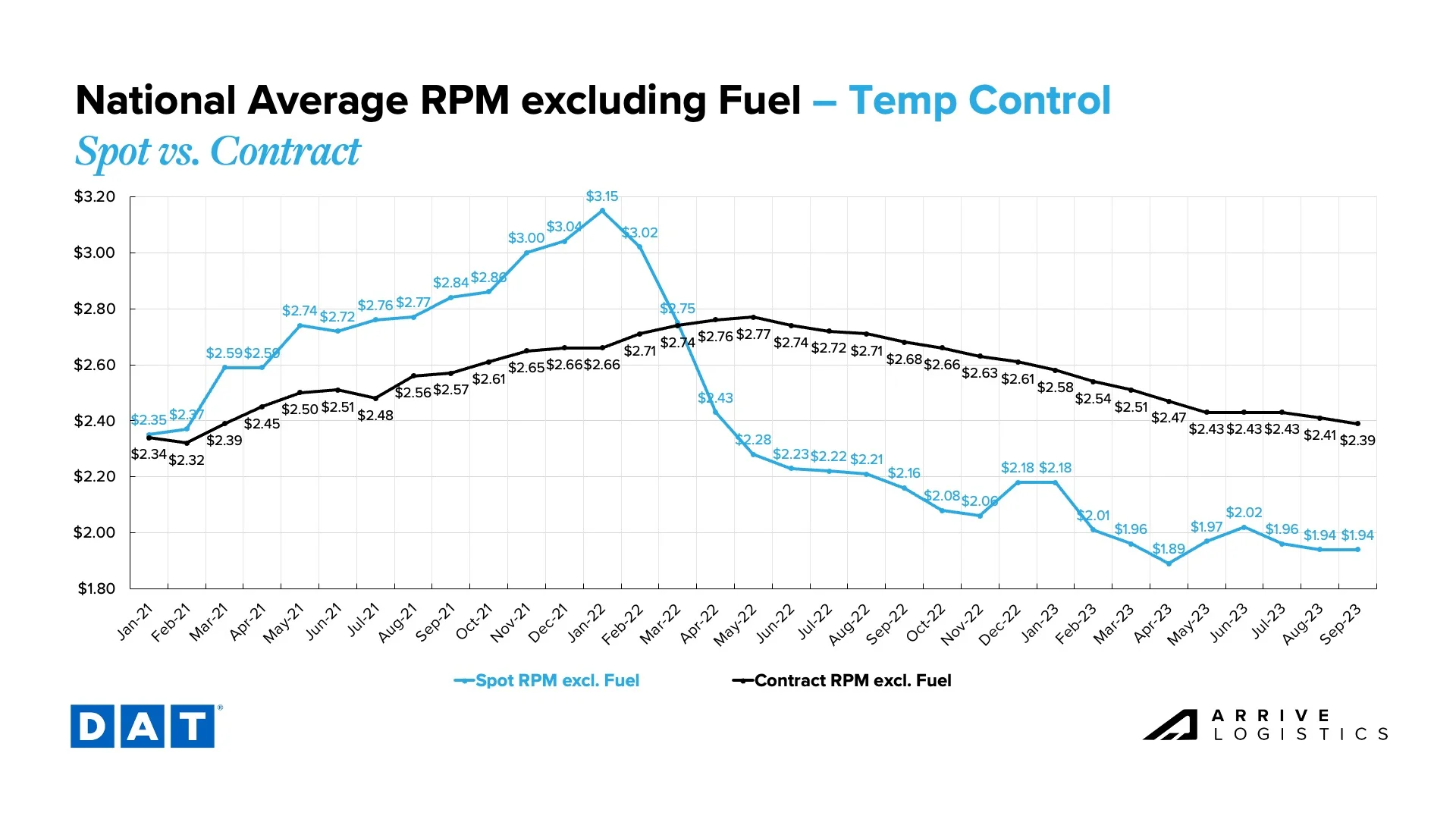

What’s Happening:Temp control market conditions are trending in line with typical seasonality.

Why It Matters:Certain regions are experiencing tightness as the produce season shifts — read on to see where.

East Coast

Upper Midwest

Central Plains

West Coast

Pacific Northwest

What’s Happening:Rates typically increase during this time of year.

Why It Matters:Rates remaining flat reflect a softer market than usual.

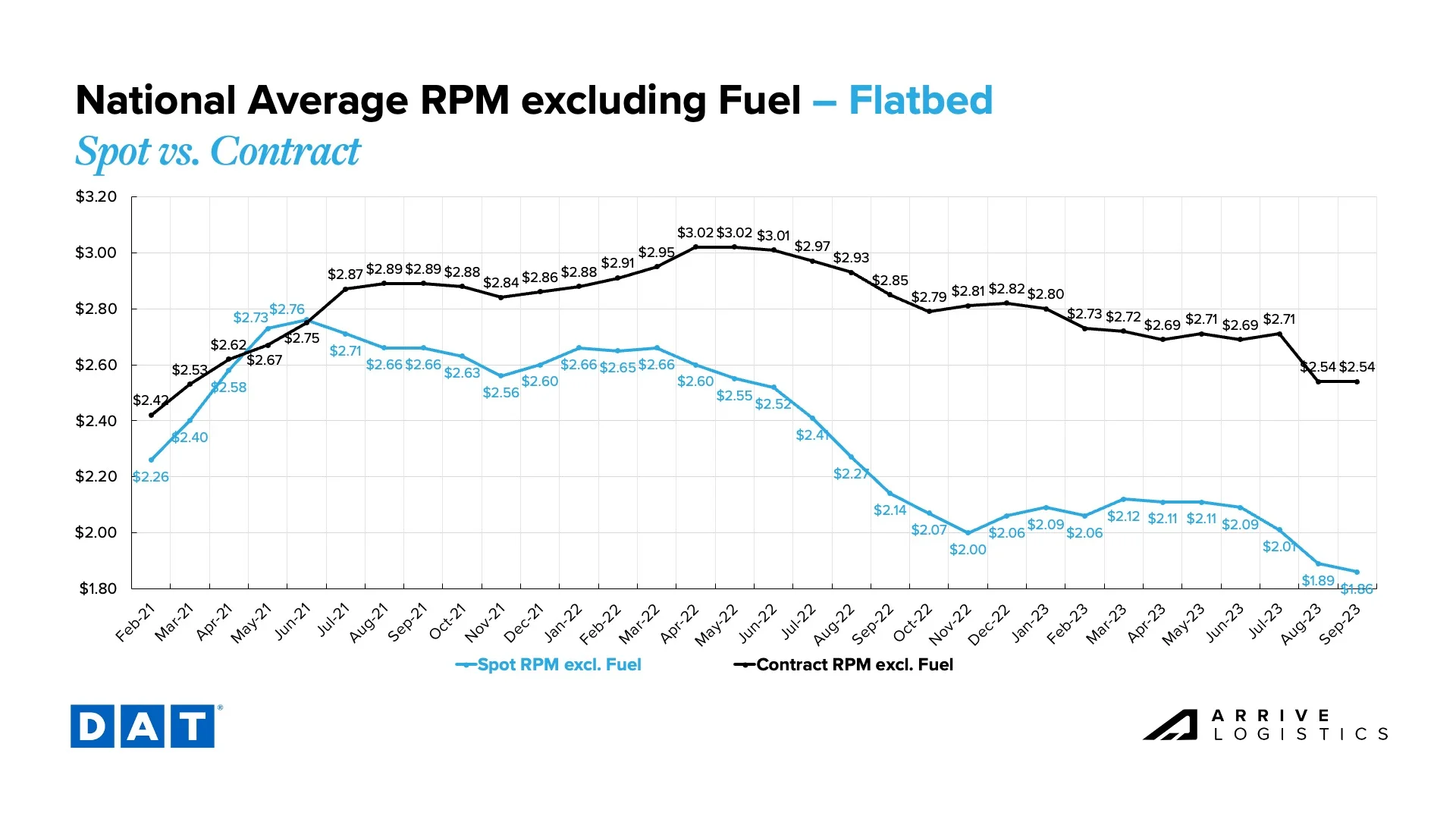

What’s Happening: Spot rates remain well below contract rates.

Why It Matters: Even though spot rates have found a floor, contract rates should continue to see downward pressure until the gap closes further.

The month-over-month van rate spread held steady at $0.49 in August and month-to-date in September after closing at $0.48 in July. Fuel volatility also contributes to this trend, but the gap should continue to close now that spot rates have found a floor and contract rates face ongoing downward pressure.

All-in dry van spot rates are down 13.9% year-over-year in September, while linehaul spot rates are down 14.8%. All-in dry van contract rates are down 15.0% year-over-year, and linehaul contract rates are down 16.0%. These improvements illustrate that peak deflationary pressures are behind us.

Figure 20: DAT Dry Van National Average RPM Spot vs. Contract

Monthly reefer rate trends followed van trends throughout Q3, easing from a June high as the summer peak season faded. After reaching an April high of $0.58, the reefer equipment spot-contract rate spread dipped as low as $0.41 when spot rates peaked in June but is back up to $0.45 in early September. Like van trends, the gap should further close now that spot rates have found a floor and contract rates continue to undergo downward pressure.

Down 10.8% year-over-year, the current reefer contract rate is $2.39 per mile, excluding fuel, while the current reefer spot rate is down 10.2% year-over-year to $1.94 per mile, excluding fuel.

After stabilizing for the first half of 2023, Flatbed rates have rapidly declined recently. Despite contract rates falling quickly, the spot-contract gap is still near an all-time high at $0.68 per mile after dipping to a low of $0.58 in April. In September, spot rates are currently at $1.86 and contract at $2.54 per mile, excluding fuel.

What’s Happening: Sticky inflation is increasing the chance of interest rates staying higher for longer.

Why It Matters: Higher interest rates are stifling the growth potential for freight demand.

August CPI data showed that inflation will likely remain sticky even though price increases have cooled notably. While there is no direct relationship to truckload demand, it is easy to make a connection between elevated interest rates and slowing freight volumes — this is the concern as we look towards 2024.

If inflation remains above the target, it is unlikely that the Fed will lower interest rates, leaving questions about whether the inventory cycle reset will be enough to stabilize freight volumes. If inflation were to ease, however, it would open the option for the Fed to lower interest rates, which would almost certainly mean increased housing activity and capital investment in manufacturing, two sectors that contribute meaningfully to freight demand and are currently slumping.

After several months of steady declines, low production and record demand caused August diesel prices to increase. Production cuts in Saudi Arabia and other OPEC countries significantly decreased overall supply, and extreme heat in the Southern U.S. prevented local refineries from operating at maximum efficiency. National diesel prices will likely remain elevated as Saudi Arabia announced they will extend production cuts into 2024.

Figure 24: National Average Diesel Rates & DAT Fuel Surcharge RPM

The story of 2023 remains the same, with abundant capacity driving persistently loose market conditions. While a holiday season demand increase is likely, we anticipate a relatively muted Q4 compared to previous years, given the available capacity.

Class 8 Tractor backlogs continue to shrink as production outpaces new orders, another indication that fleets continue to feel the pressure of reduced margins.

A recent trend worth watching is shippers with private fleets avoiding the for-hire market despite the cost benefits, which, in turn, limits freight opportunities for for-hire carriers and could potentially extend the current down cycle.

Our 2024 outlook is mostly unchanged. The spot-contract gap remains elevated, which should result in deflationary pressure on contract rates. However, current spot rate levels will not be sustainable for the long term, especially if fuel prices stay elevated and squeeze carrier profits.

The market will become increasingly vulnerable to disruption as capacity normalizes throughout the remainder of the year, but we do not anticipate any significant events ahead of 2024.

The Arrive Carrier Market Outlook, created by Arrive Insights™, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, ACT Research, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.