"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Recent trends continue to support our forecast. As anticipated, the summer peak season created spot market volatility without much disruption to contractual service levels. The gap between spot and contract rates is still large and driving downward pressure on contract rates.

Rate pressures eased in the weeks following July Fourth as seasonal demand slowed and shifted; however, a few pockets are still experiencing challenging capacity conditions. This is particularly true for reefer equipment, which has seen rising rates in recent weeks.

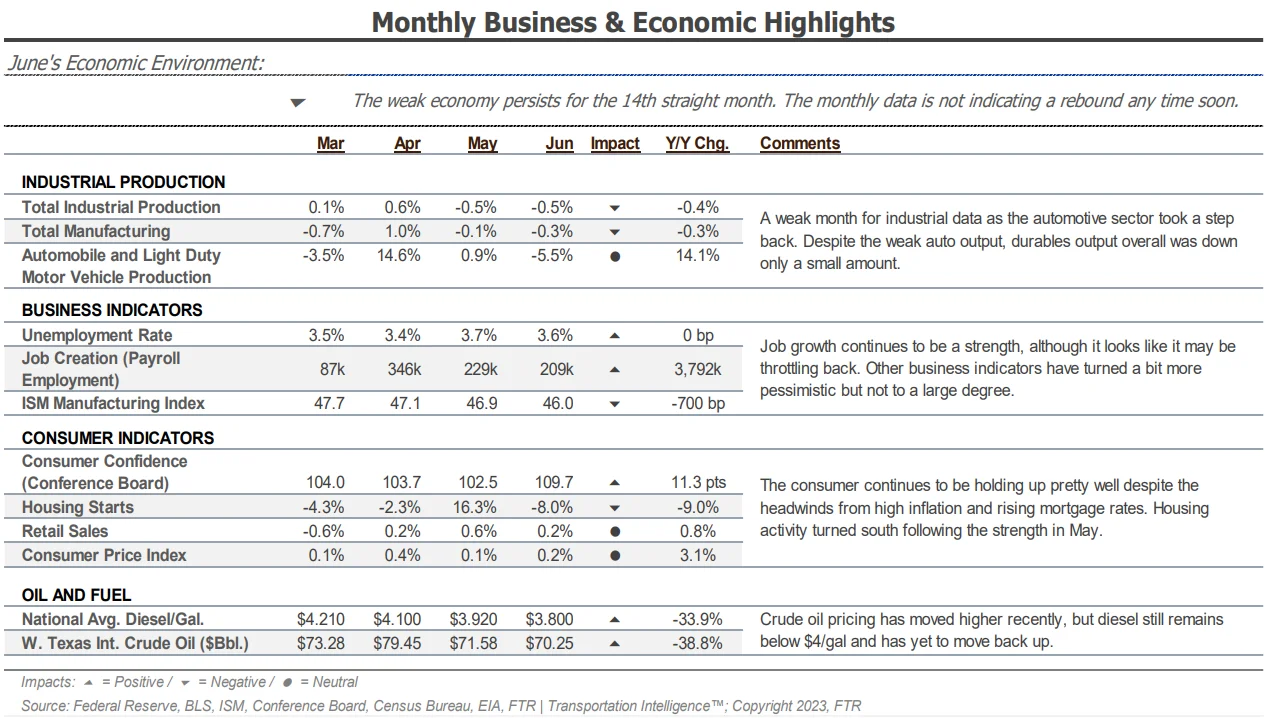

There are no meaningful changes to our outlook for freight demand. The economy shows signs of easing inflation, and consumer spending remains stable, an encouraging trend for future freight demand.

The capacity correction will likely pick back up due to poor trucking conditions. Spot rates will see more downward pressure on the heels of the summer peak season as rates fall and fuel costs have increased. This will increase the market’s vulnerability to disruption, especially after another RFP season drives contract rates down closer to spot levels.

"*" indicates required fields

Market conditions have continued to follow a more normal seasonal pattern in Q3.

Rates eased in the weeks following July Fourth but are beginning to tighten in certain regions as produce seasons shift and back-to-school shopping begins.

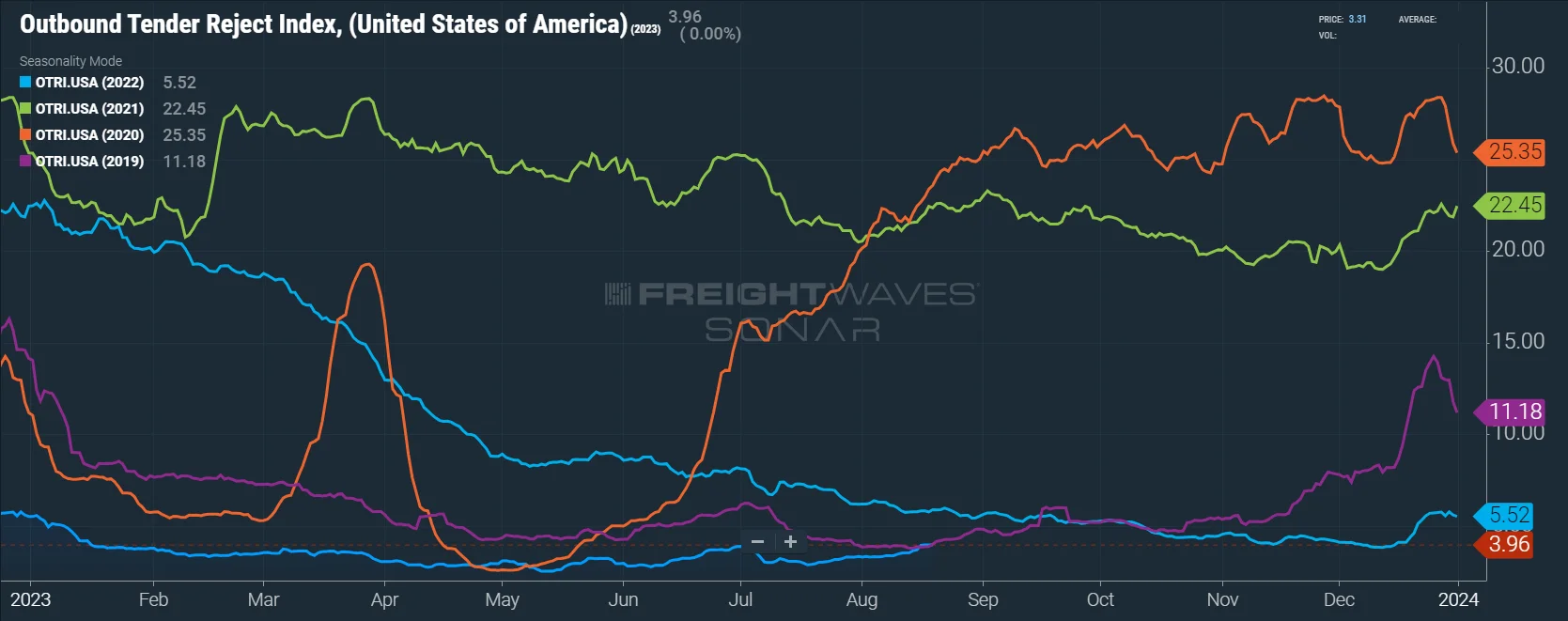

Tender rejection activity below 4% illustrates historically strong contract compliance and carriers’ continued appetite for accepting nearly all contract freight despite increased spot activity.

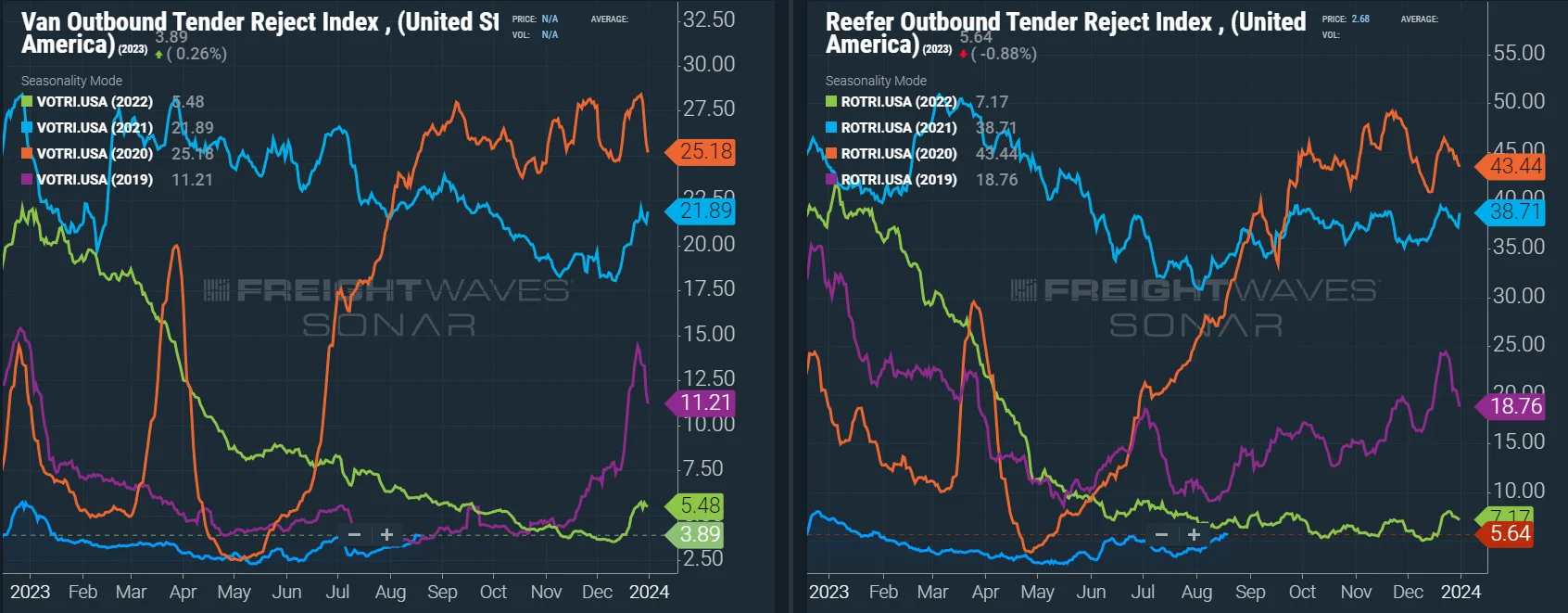

The gap between spot and contract rates for van and reefer equipment has closed to $0.48 and $0.46 per mile, respectively, meaning downward contract rate pressure should continue.

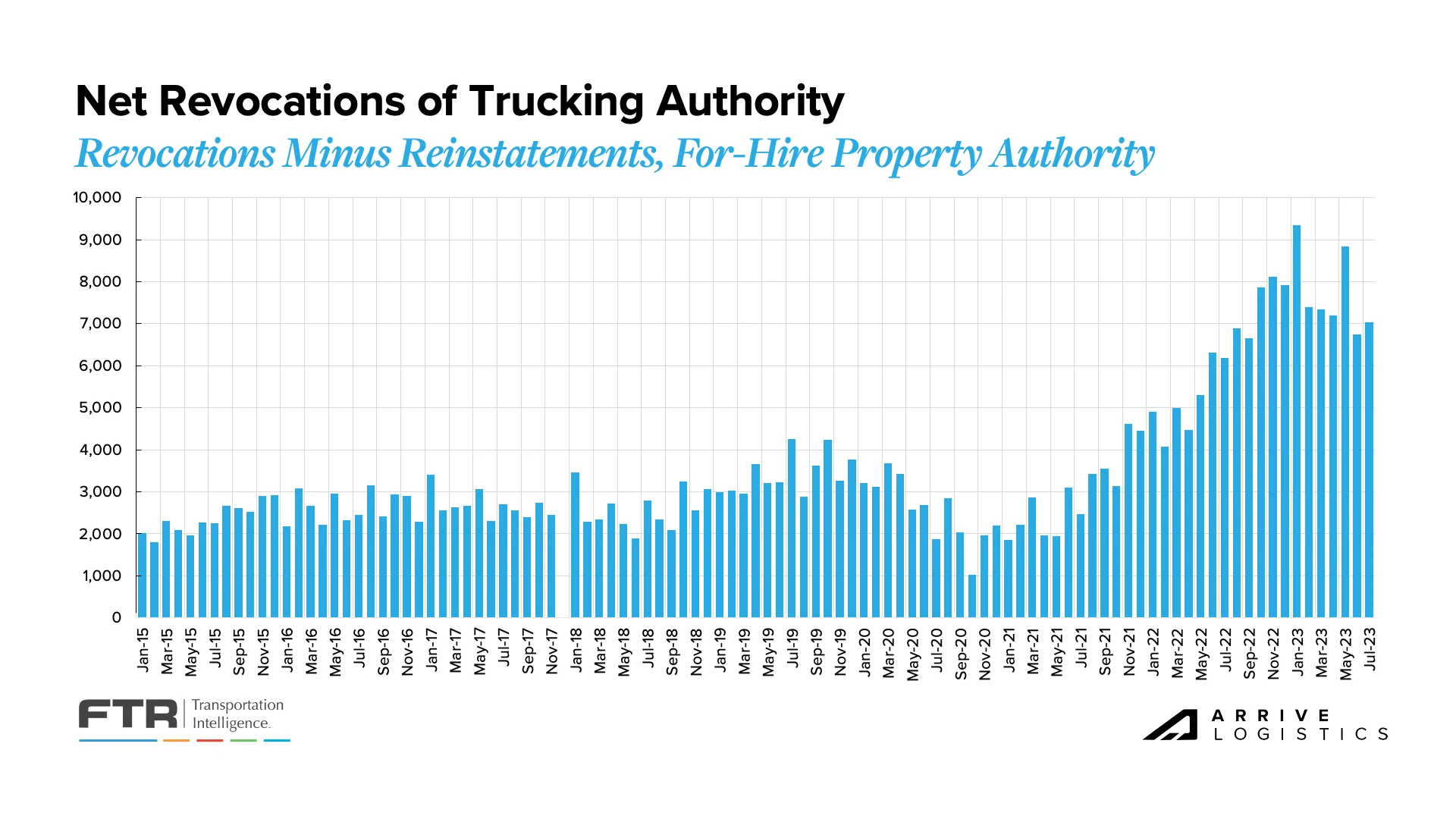

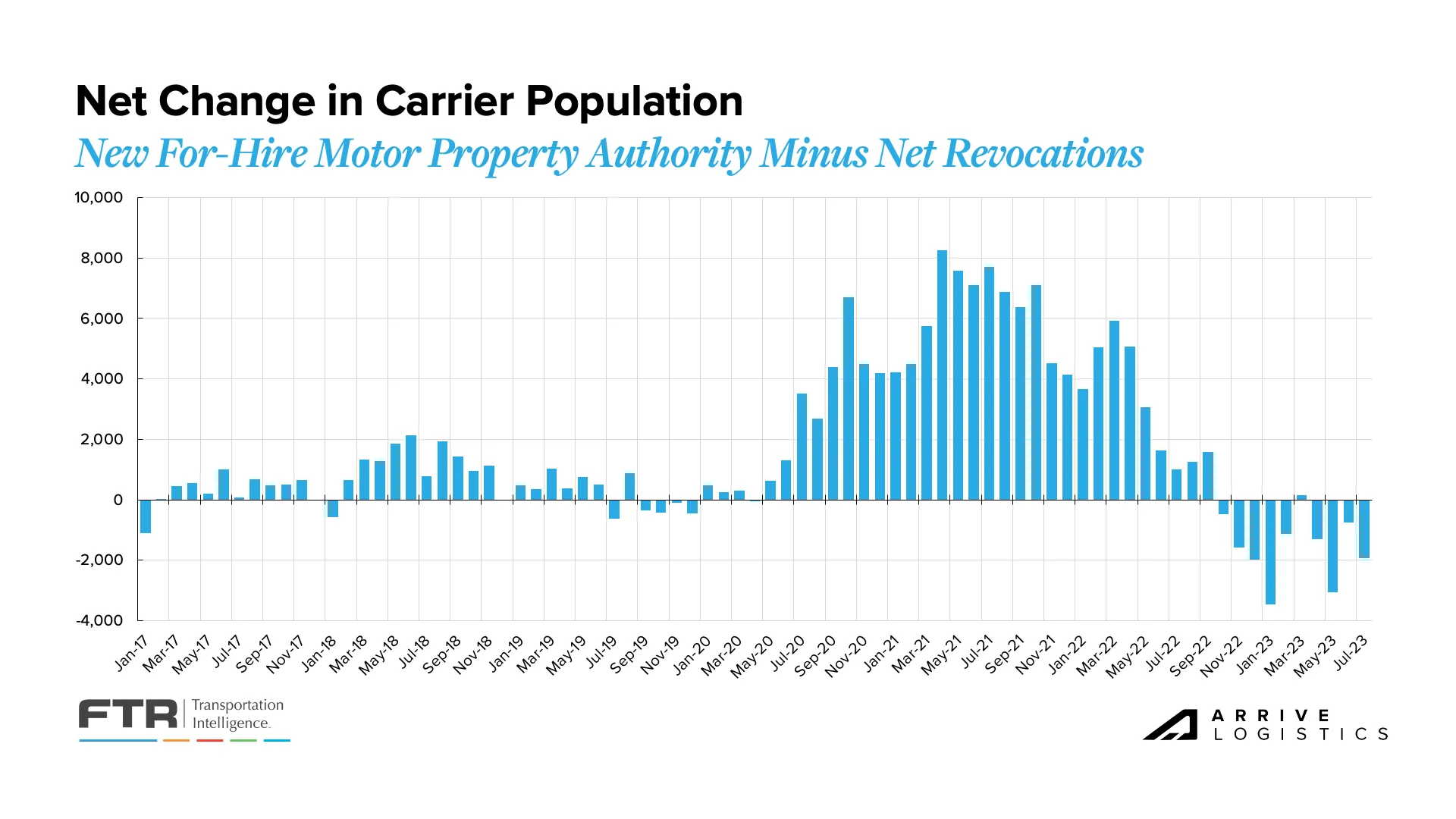

Large numbers of authority revocations continue; there has been a negative net change in the carrier population in nine of the last ten months as revocations outpace new entrants.

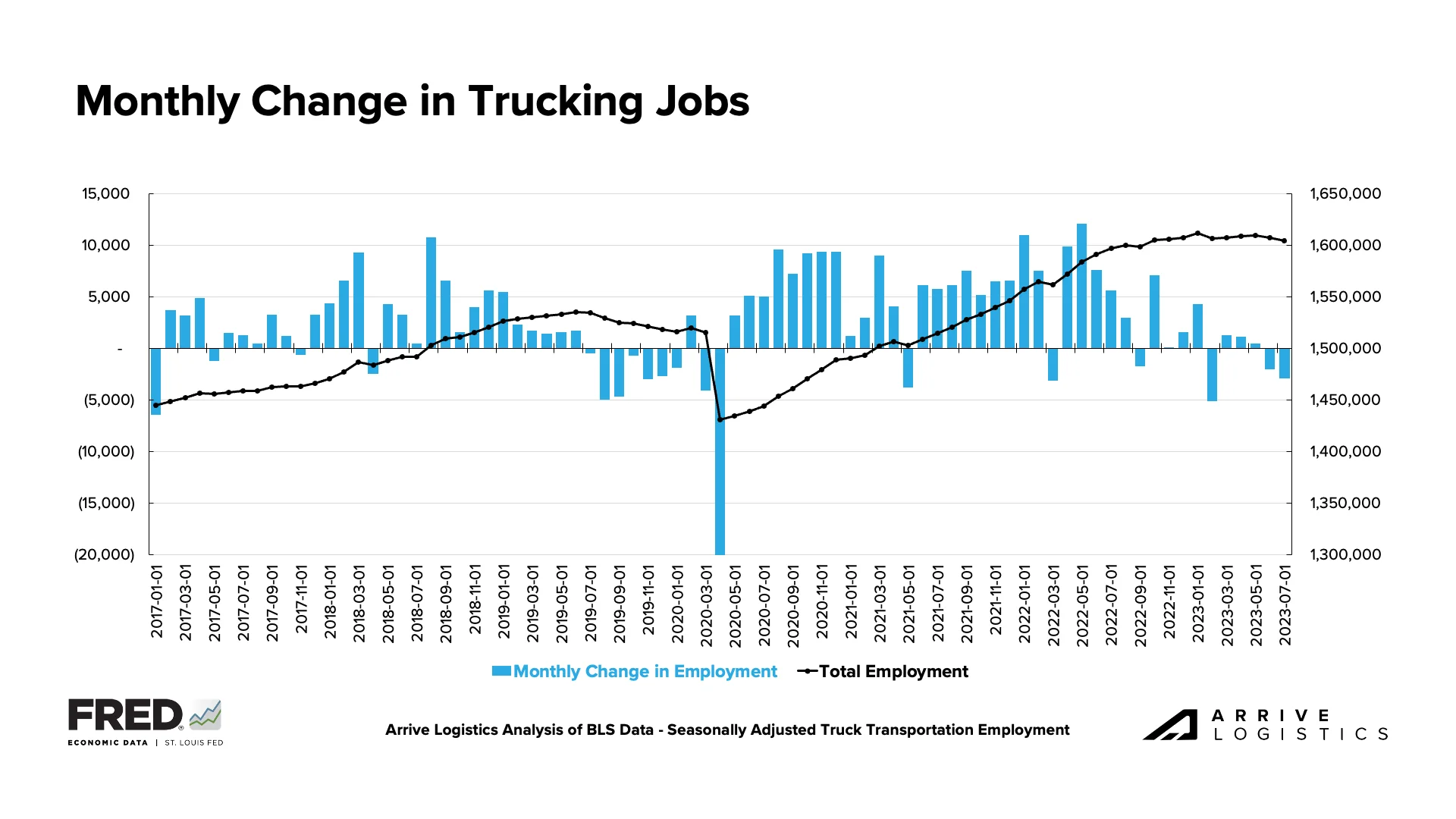

Trucking employment took a big step back over the past two months, falling by nearly 5,000 jobs to the lowest levels since last fall.

The manufacturing sector was expected to be a key demand driver in 2023, but new orders just contracted for the eleventh straight month, increasing potential downside demand risk.

The National Retail Federation reports that year-over-year retail imports are trending in the right direction and should be positive by year-end after peaking in August.

Consumer spending remains stable, supporting healthy freight demand. The risk for impact from student loan repayments is likely limited to younger, lower-income consumers.

What’s Happening: Demand slowed in line with seasonal expectations in July, but certain regions are experiencing tightness as produce harvests shift.

Why It Matters: Shippers can expect conditions to get tighter as we approach Labor Day.

Truckload demand slowed in July as the summer peak season wound down. DAT reported the second straight month-over-month spot load decrease as posts dropped by nearly 20% in July after falling by 6.1% in June. On a year-over-year basis, the annual comp’s decline is still an improvement as spot load posts moved from -54% in June to -50.3% in July.

Cass reported a 2.2% decrease in July shipments, translating to a 1.2% month-over-month decline on a seasonally adjusted basis. The index is down 8.9% year-over-year, a significant jump from 4.7% year-over-year in June. Cass noted that declining real retail sales and destocking remain the primary issues, but dynamics are shifting as real incomes improve and the worst destocking challenges end.

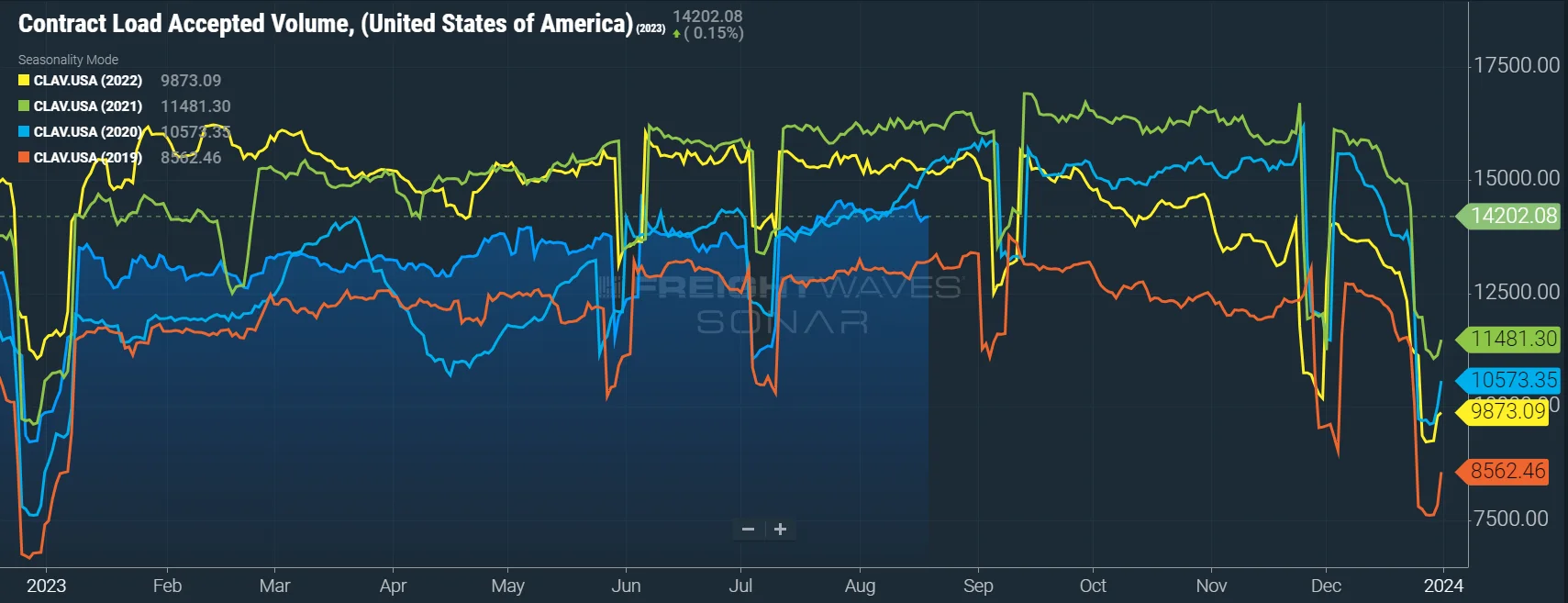

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 9.2% year-over-year, or 6.4% when measuring accepted volumes after the significant tender rejection rate decline.

Accepted volumes were up 5.7% month-over-month, driven by an 8.4% increase in accepted dry van tenders and a 6% decrease in accepted reefer tenders. Contrary to DAT’s spot data trends and the Cass Shipments Index, the data points to a month-over-month pickup in contractual volumes. However, the 6.4% year-over-year volume reduction is in line with Cass.

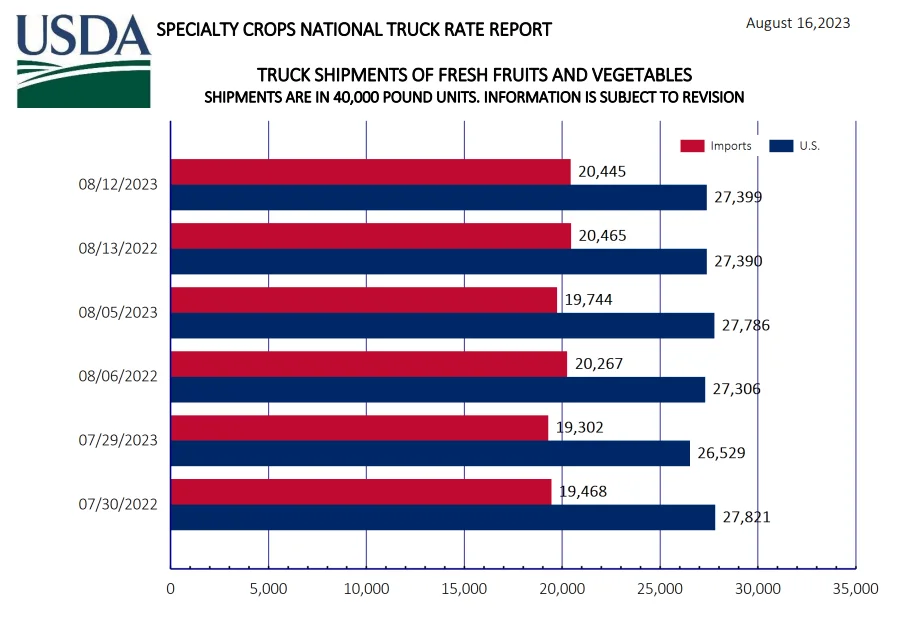

USDA truck shipment data for fresh fruits and vegetables also showed a pullback in total truck shipments and the year-over-year growth rate from a month ago. The three-week trend in early July showed total shipments were up 4% year-over-year, with U.S.-grown shipments down 1% and imported crop shipments up 12%. In August, the three-week trend shows total shipments are down just 1% year-over-year, with both U.S.-grown shipments and imports down 1%.

What’s Happening: Routing guide stability remains, but the market is becoming more sensitive to seasonal demand pressures.

Why It Matters: The next seasonal demand push is Labor Day, where we expect spot rate volatility and a pickup in tender rejections nationwide.

There are two important takeaways from the peak summer season capacity story: The return to normal seasonality and how strong routing guide compliance remained amid volatility.

As expected, certain pockets and regions experienced some spot rate volatility, but it had little impact on tender acceptance and service for shippers at the national level. This trend demonstrates where we stand in the capacity correction cycle — conditions remain oversupplied, and further correction is needed before the market becomes vulnerable to sustained disruption.

As expected, tenders rejections eased following The Fourth of July but have been steadily increasing in recent weeks, leaving them flat compared to 2019 levels.

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The numbers fluctuated between a mid-month low of 2.9% and 3.33% by month-end, indicating routing guide compliance on shippers’ contractual freight remained historically high.

Both van and reefer tender rejections followed similar trends in July, dipping to a mid-month low before increasing steadily. Both equipment types are seeing rejection rates in line with their summer peaks but overall remain low.

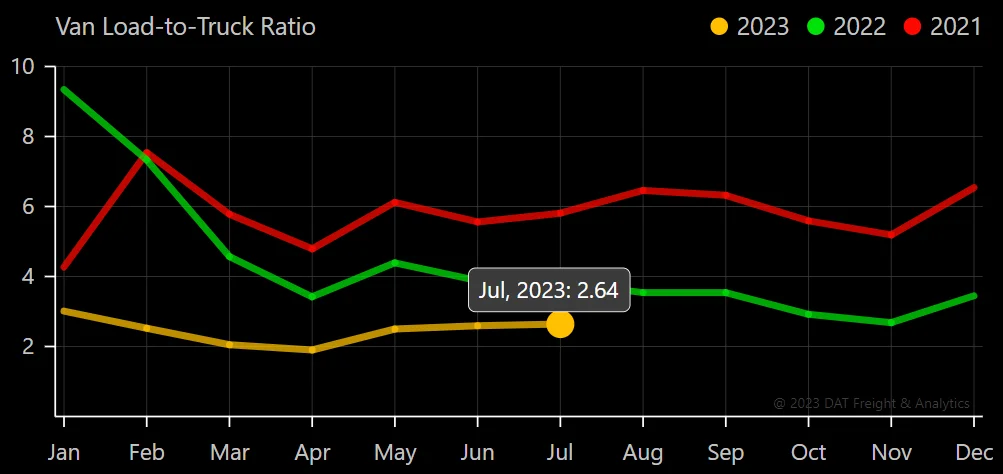

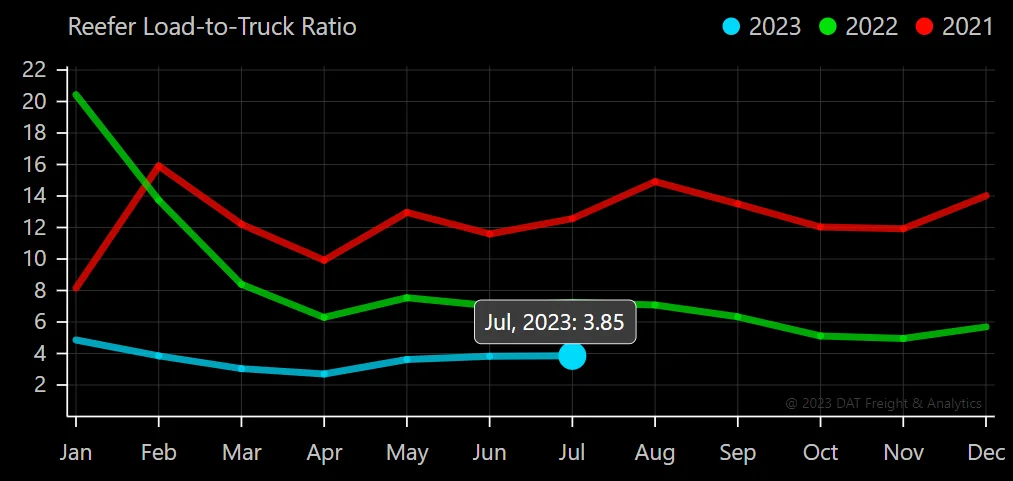

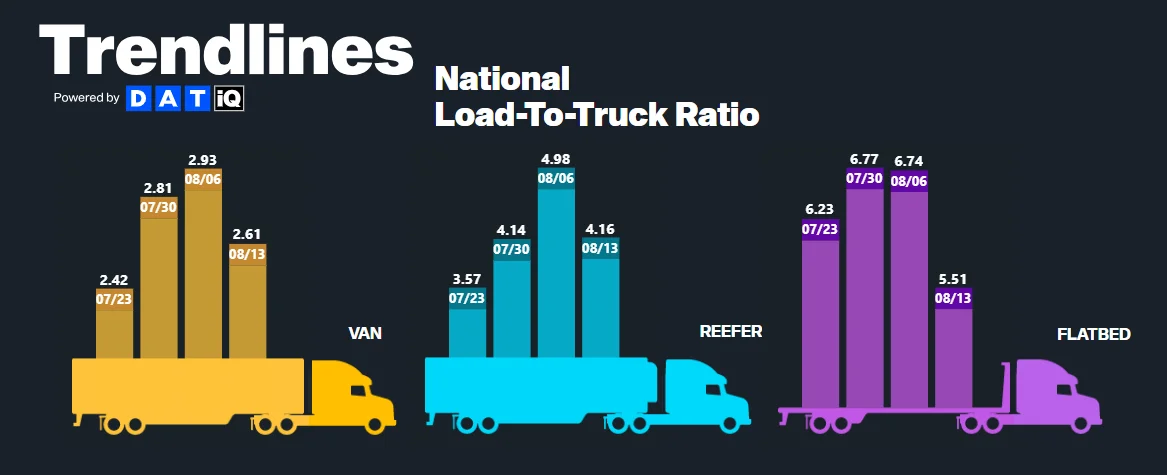

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. July data showed relatively flat conditions despite declining load posts, indicating truck posts were also down.

The Dry Van Load-to-Truck Ratio was up 2.2% month-over-month but remains down 31.2% year-over-year, whereas the Reefer Load-to-Truck Ratio was up 0.6% month-over-month but down 46.9% year-over-year.

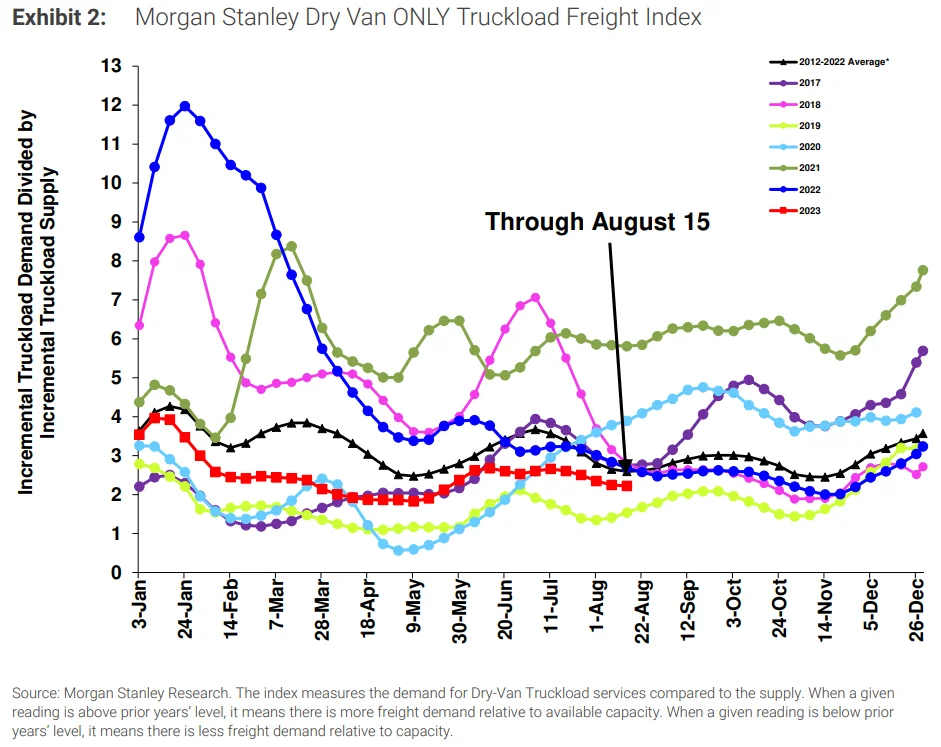

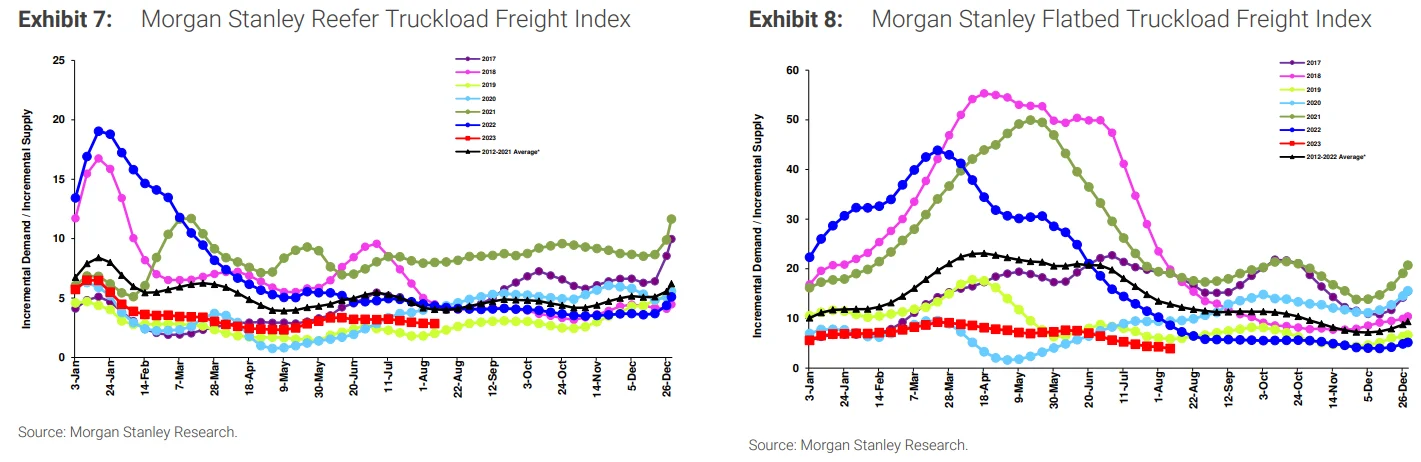

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

As expected, conditions have eased in line with normal seasonality following tightening conditions in line with the typical summer peak season. This aligns with the perspective that supply is still largely sufficient to support overall demand.

Historical data points to some potential tightening through the end of the third quarter, beginning around Labor Day. Given the trends seen in recent weeks with tender rejections, we anticipate some volatility in the spot market.

What’s Happening: Van and reefer rates have bottomed and are expected to track in line with normal seasonality.

Why it Matters: Recent data indicates we may be past the deflationary peak, so rates are unlikely to move lower from where they are today.

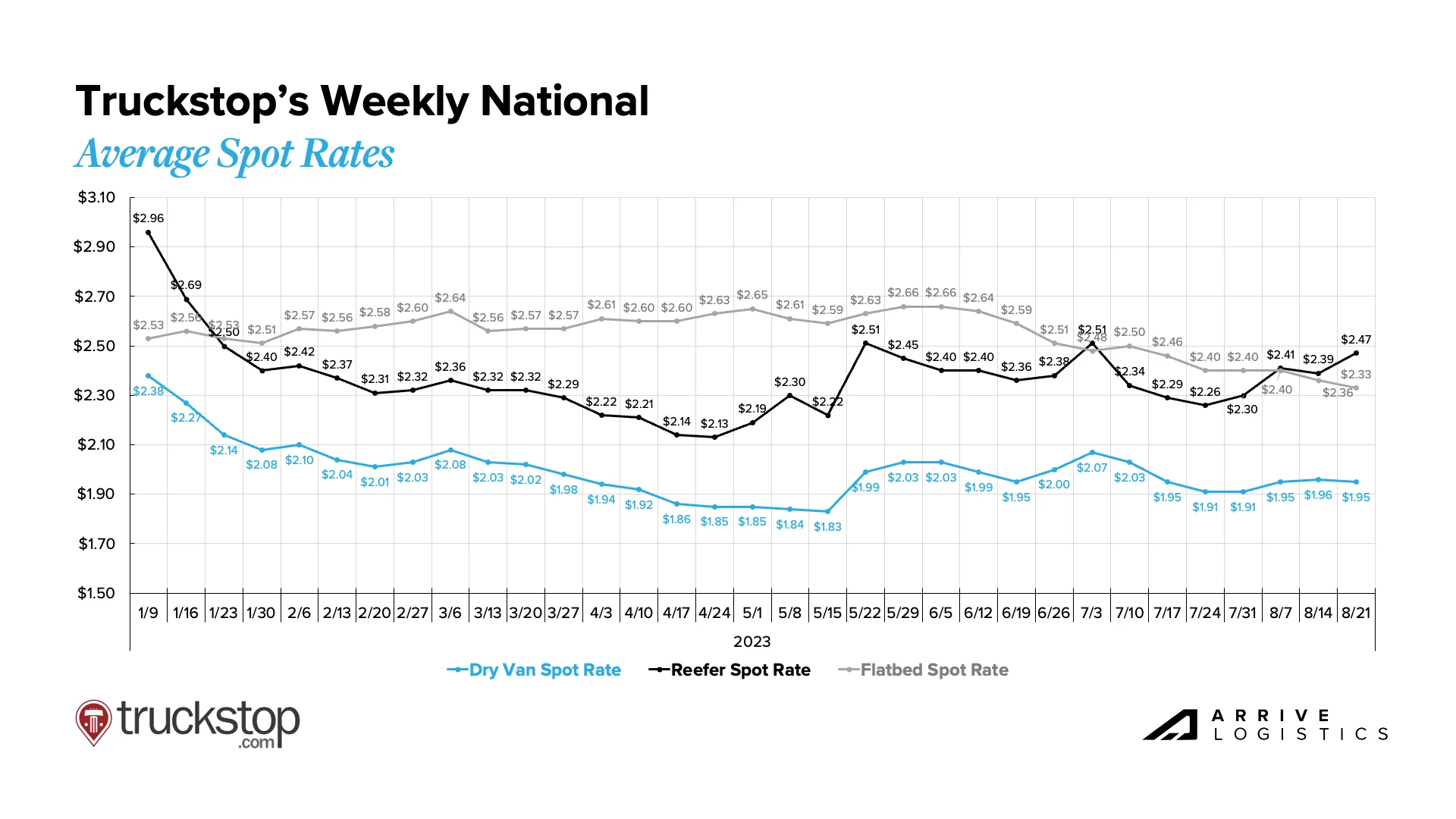

Truckstop’s Weekly National Average Spot Rates provide a detailed view of week-to-week rate movements, offering a more real-time look into the current rate environment.

As expected, rates across all modes dipped in early July as the summer peak season eased, but similar to tender rejection trends, van and reefer rates have risen since the middle of July. Flatbed rates, however, continue to trend down.

With an understanding that, historically, the market tightens between Labor Day and the end of the third quarter, it is unlikely that rates will return to the lows observed in late April and early May. Van and reefer rates have bottomed and are now more likely to experience seasonal upticks than further declines.

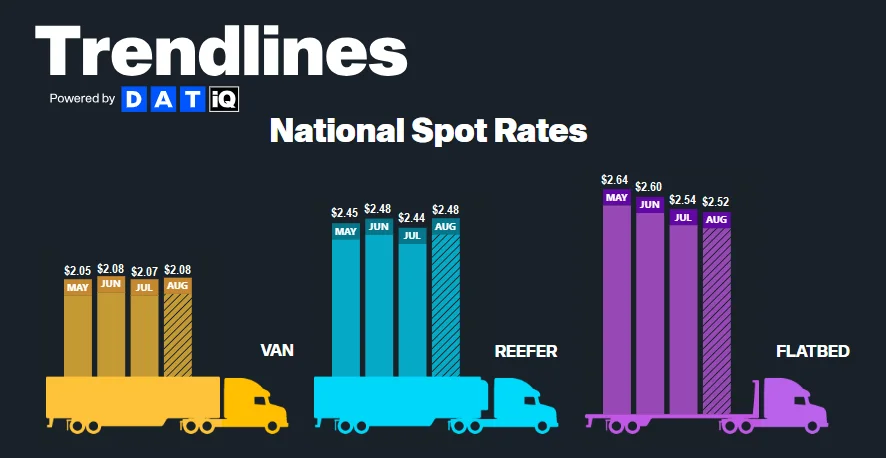

According to DAT, monthly all-in spot rates, including linehaul and fuel costs, are up slightly for van and reefer equipment and down for flatbed equipment. As of August 21st, van rates are up $0.01 per mile, reefer rates are up $0.04 per mile, and flatbed rates fell by $0.02 from July.

Rates are rising during a period in which they normally tend to ease due to significant hikes in fuel prices compared to a month ago. According to DAT, the dry van fuel surcharge increased $0.07 month-over-month from $0.44 to $0.51 per mile.

The month-over-month van rate spread bounced back to $0.50 in July after closing at $0.48 in June. This was expected as spot rates fell faster than contract rates following the holiday. However, the expectation is that the gap should continue to close now that spot rates have found a floor and contract rates face ongoing downward pressure.

All-in dry van spot rates are down 17.5% year-over-year in August, while linehaul spot rates are down 16.9%. All-in dry van contract rates are down 17.7% year-over-year, and linehaul contract rates are down 17.3%. We have now seen back-to-back improvements in year-over-year spot and contract rate growth trends, a sign that we are beyond peak deflationary pressures.

Figure 16: DAT Dry Van National Average RPM Spot vs. Contract

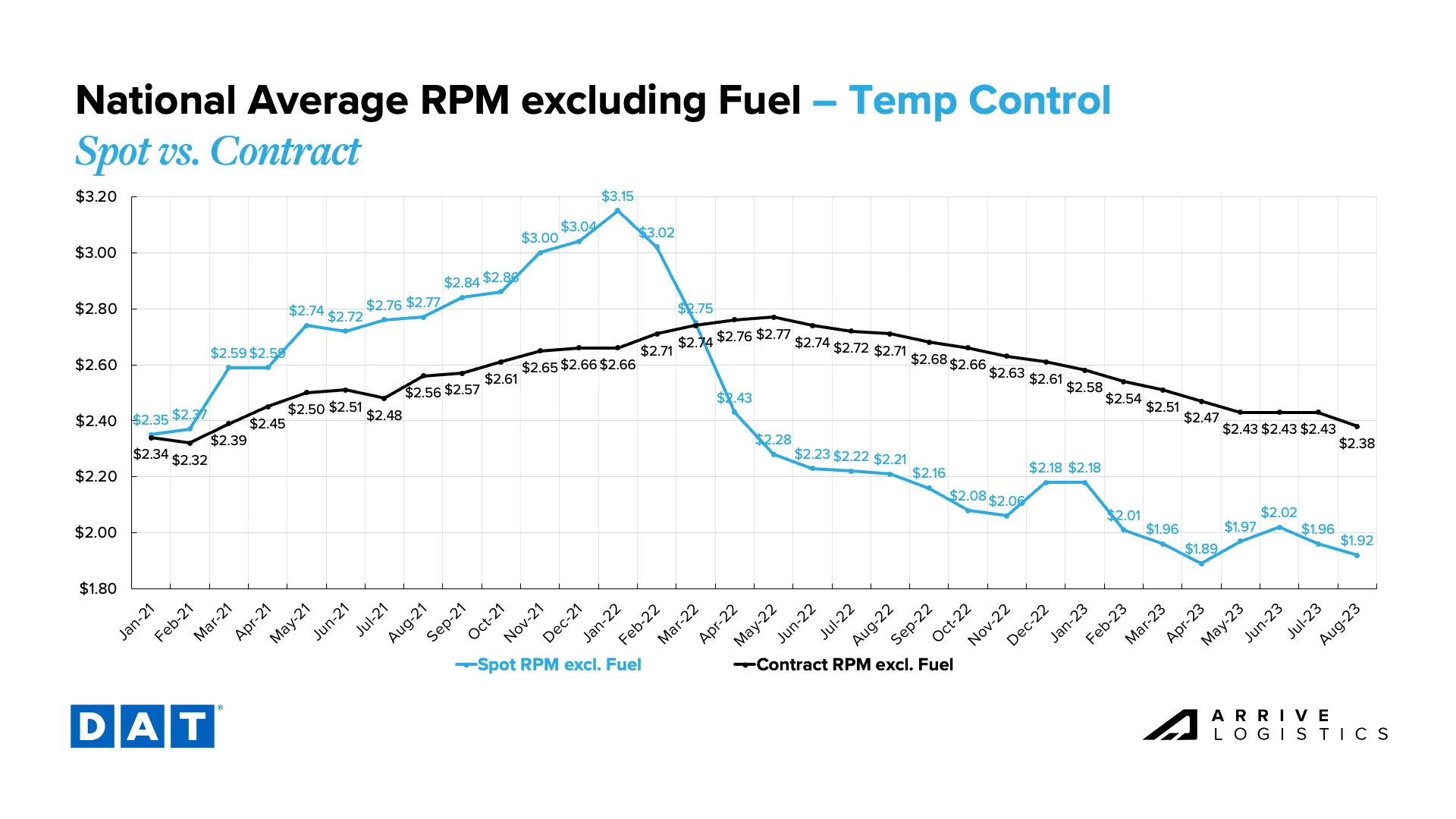

Monthly reefer rate trends followed van trends in July and early August, easing from a June high as the summer peak season faded. After reaching a high of $0.58 in April, the reefer equipment spot-contract rate spread dipped as low as $0.41 when spot rates peaked in June but is back up to $0.46 in early August. Like van trends, the gap should further close now that spot rates have found a floor and contract rates continue to undergo downward pressure.

Down 12.2% year-over-year, the current reefer contract rate is $2.38 per mile, excluding fuel, while the current reefer spot rate is down 13% year-over-year to $1.92 per mile, excluding fuel.

After stabilizing for the first half of 2023, Flatbed rates have rapidly declined recently. Despite contract rates falling, the spot-contract gap is still widening and is back to over $0.70 per mile after dipping to a low point of $0.58 in April. In August, spot rates are currently at $1.91 and contract at $2.62 per mile, excluding fuel.

What’s Happening: Yellow has officially closed its doors.

Why It Matters: Shippers are scrambling to find capacity.

On August 6th, Yellow announced it was filing for bankruptcy and closing after 99 years in business, leaving LTL shippers searching for alternative capacity solutions.

So far, LTL carriers that saw a sizable drop in tonnage in Q2 have absorbed a significant amount of Yellow’s former freight.

Certain carriers may negotiate higher rates to capitalize on increasing LTL demand, leading to capacity crunches.

Most LTL carriers outsource linehaul freight, but Yellow ran it using their fleet, meaning those loads could trickle into the truckload market.

The sudden LTL demand surge could negatively impact service, bringing it down to pre-pandemic levels.

Shippers with time-sensitive loads may want to avoid standard LTL service and instead utilize time-critical/guaranteed options.

What’s Happening: The BC port labor disputes have been resolved.

Why It Matters: Market conditions are soft enough that backlogged freight will not impact rates significantly.

The Port of Vancouver labor disputes that dominated Canadian freight market headlines last month have been resolved.

Though clearing rail and ocean terminals backlogs could take 4-8 weeks, the delays will have minimal impact on the Canadian freight market.

Though conditions are soft for now, some tightening is likely following Labor Day and as imports pick up through the holiday season.

Most maritime imports will come through the Port of Vancouver, but the Halifax and Montreal ports may also see volume upticks.

The demand increase at these ports could also drive up intermodal market rates.

Though seasonal tightness may lead to some rate volatility, it should be minimal as ample capacity still exists to support demand.

What’s Happening: The Peso is still stronger than the US dollar.

Why It Matters: Carriers continue to raise rates to cover the conversion gap.

The strength of the Peso is still impacting the cross-border Mexico market, as carriers that are paid in USD continue to raise rates to cover expenses they pay for in MXN.

Outbound rates from Guanajuato and Querato have dropped by as much as 10% as capacity softens in the wake of produce season; however, shippers’ savings are nominal due to the Peso’s value.

Demand is declining for construction materials like flooring, appliances, and furniture.

Shippers are starting to stock up for the holiday season ahead, driving retail and alcohol demand in turn.

As retail demand increases, so does the risk of theft — shippers should be aware of this and work closely with their transportation partners to ensure the security of their freight.

What’s Happening: Temp control market conditions are trending in line with typical seasonality.

Why It Matters: Certain regions are experiencing tightness — read on to see where.

East Coast

Upper Midwest

Central Plains

California

Pacific Northwest

What’s Happening: Demand is strong as peak season continues.

Why It Matters: Rates are stable for now, but contract could soon decline.

What’s Happening: Carrier margins are still getting squeezed.

Why It Matters: Current conditions are likely to continue aside from seasonal volatility, meaning carriers will continue to face challenges through year-end.

August has been a challenging month for carriers. Linehaul spot rates appear to be trending back to the cycle low and fuel costs have increased, pressuring margins even more than they already were. This news also comes after a revised jobs report showing back-to-back months of significant total trucking employment declines.

Carriers have largely been patient through the down cycle, but conditions are starting to take a toll, and it is clear that a capacity correction is underway. With only a modest upside to truckload demand on the horizon, carriers will likely see no sustained improvement in overall conditions through the year’s end beyond a few seasonal periods of opportunity. Thus, carrier exits will likely increase in the coming months.

This month we saw another high number of revocations lead to a negative net change in the carrier population, further indicating that the correction continues. There is a long way to go, as we see from strong contract service numbers, but this trend will inevitably lead to a capacity crunch, as it always does in the market cycle.

Increased operating expenses are the primary culprit causing carriers to close, as overall rates are still high compared to historical (pre-pandemic) levels. This trend continues to drive historically high revocations of authority, with July numbers reaching another top 10 all-time mark for the highest number of carrier exits.

When the July jobs report was released in early August, it showed that trucking jobs declined by 2,900. Further, the revised June figures revealed a job loss of 2,000, in contrast to the previous report, which indicated a decline of only 200 jobs.

Total employment is now at the lowest level since last fall after dropping by nearly 5,000 jobs over the summer. Given the worsening truckload rate environment, the trucking employment plateau observed throughout the first half of 2023 defied expectations. Carriers have been focused on retaining drivers, but the longer current conditions persist, the more likely we are to see overall employment fall further.

A key trend we’re still watching is revocations outpacing new carriers entering the market for nine of the last ten months, reducing the total number of carriers. A significant amount of capacity that entered the market over the last few years remains unutilized, so we expect this disparity to continue for at least the near term.

What’s Happening: August retail import volumes are on pace to be the highest since last fall.

Why It Matters: Though the outlook for retail import volumes is promising, ongoing contraction in the manufacturing sector remains a concern.

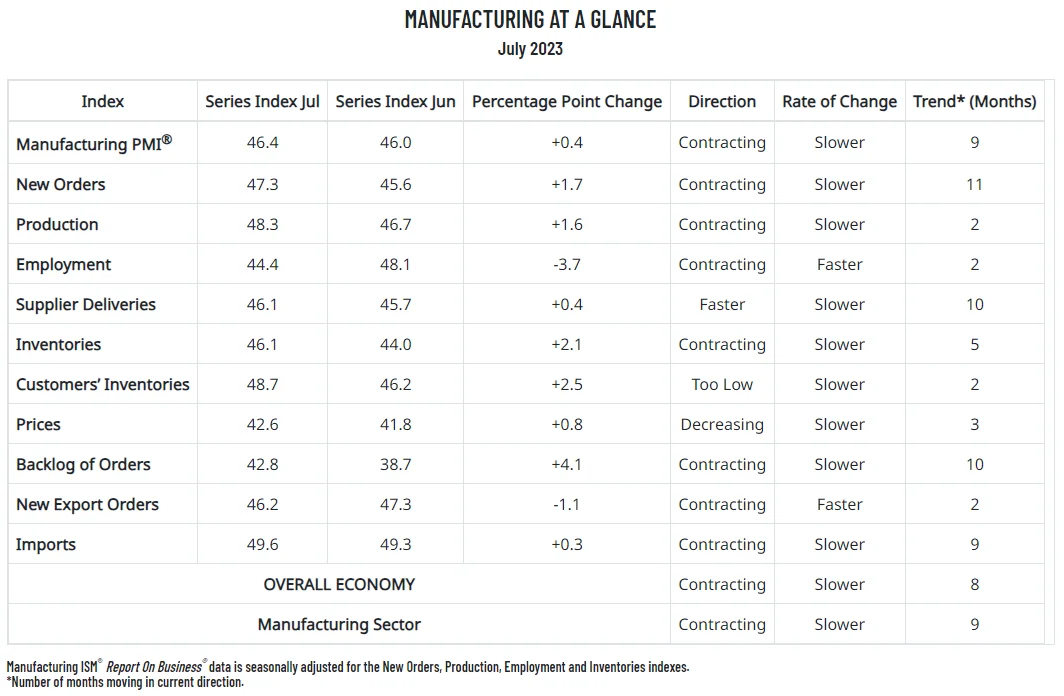

We continue to report on retail and manufacturing trends due to their significant impact on domestic freight demand. While manufacturing remains a concern after contracting for the ninth straight month in July, August import cargo volumes are on pace to be the highest since last fall.

The National Retail Federation (NRF) recently reported that import cargo volumes at the nation’s major container ports declined by 22% through the first half of 2023 compared to the previous year. August numbers, however, are projected to be the high water mark in 2023, down just 10% year-over-year and the first month since last October to crest 2 million TEU.

Imports are projected to decline steadily through the end of the year but turn positive year-over-year in November. Full-year import volumes are expected to drop 12.8% from 2022 once 2023 is said and done. As destocking continues, import volumes should normalize as retailers begin to place orders in line with stable consumer trends.

Figure 22: NRF Monthly Imports

The latest ISM manufacturing report indicated more easing backlogs as new orders contracted for the eleventh consecutive month amid slowing production. The new orders index contracting adds further uncertainty about future backlogs and, in turn, truckload demand. Manufacturing was expected to be one of the main volume drivers in 2023, and if contraction continues, demand will likely fall further than previously forecasted. However, there is still pent-up demand in the sector that should enable healthy volumes in the near term.

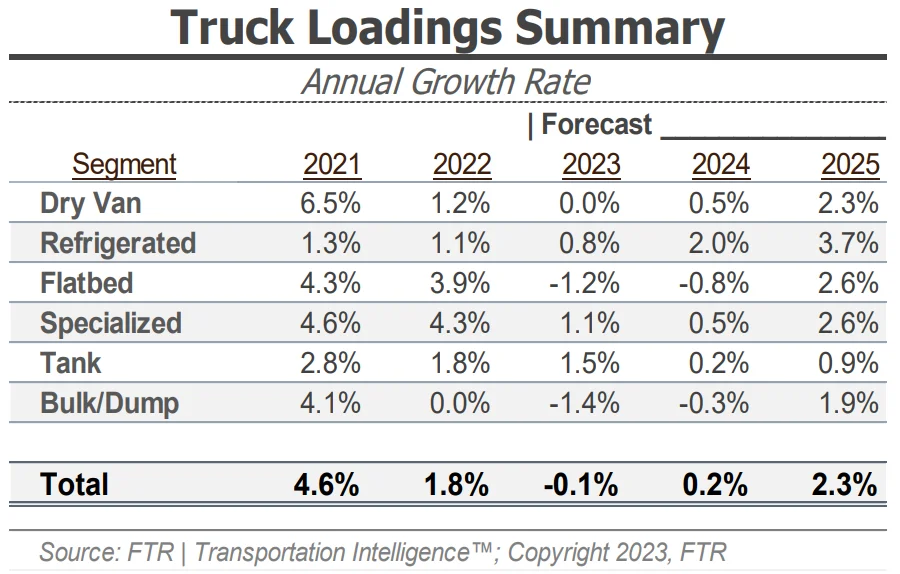

FTR’s latest truck loadings forecast for 2023 was unchanged this month, stable at -0.1% year-over-year growth. FTR noted that forecasts related to construction, chemicals, automotive, and food all had notable changes in the latest outlook but mostly balanced out. The 2024 outlook saw a slight downward revision, from 0.5% to 0.2% growth. The essentially flat outlook represents the lack of visible upside risk to demand growth.

What’s Happening: Recent data suggests that we might be at or at least very close to the interest rate peak.

Why It Matters: Slowing or reversing further interest rate hikes would positively impact freight demand.

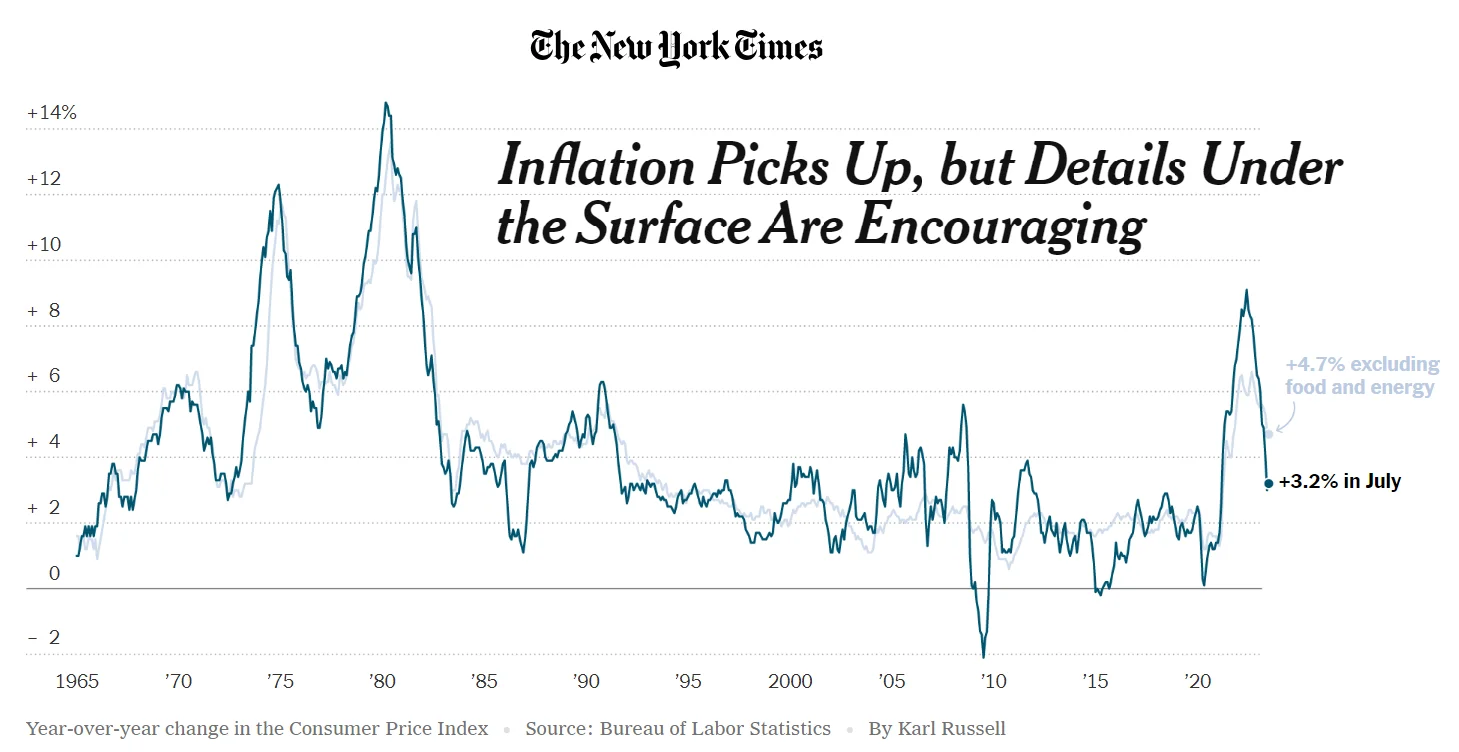

July CPI data showed that inflation picked back up slightly after slowing for twelve consecutive months, rising to 3.2% year-over-year growth. However, core inflation, which excludes food and energy, fell from 4.8% to 4.7% year-over-year. Some key components continue to see reductions month-to-month, including new and used vehicles and airline fares. The largest single increase was fuel.

When considering what this means for the next decision on interest rates, the data points to plenty of reasons to be optimistic that the Fed will hold off on another rate hike and potentially signals that we are at, or are very close to, the peak for interest rates.

Ultimately, slowing or reversing course on rate hikes positively affects future freight demand. Lower interest rates would almost certainly mean increased housing activity and capital investment in manufacturing, two sectors that contribute meaningfully to freight demand and are currently slumping.

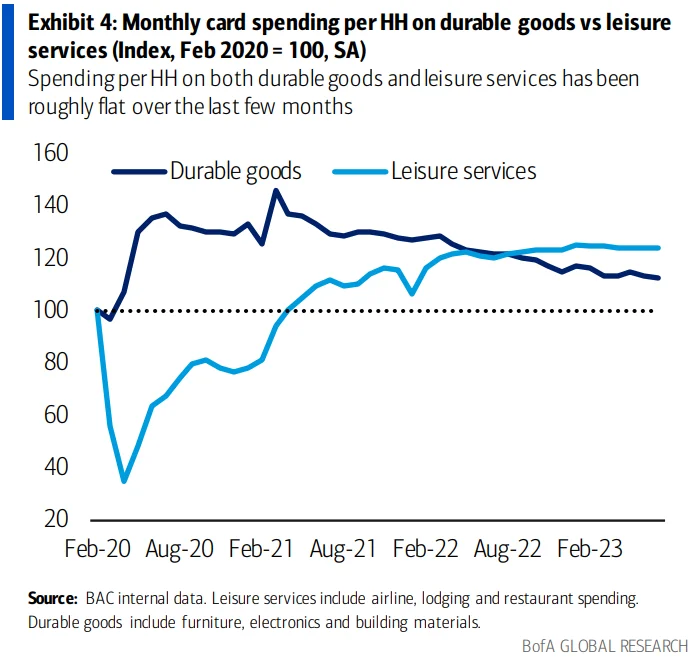

June Bank of America card data showed consumer spending per household increased by 0.1% year-over-year in July. Card spending also rose by 0.7% month-over-month on a seasonally adjusted basis in July. While the pickup in July due to Prime Day was consistent compared to 2022, spending around July 4th was larger than last year. On an individual category level, airlines, online retail, gas, and general merchandise saw the largest upticks, while furniture, lodging, and grocery spending declined in July.

Spending per household on durable goods and leisure services has been roughly flat over the last few months but remains elevated compared to pre-pandemic levels. The spending declines are minimal and represent the continued strength of the consumer; however, steady declines IN durable goods point to slight pullbacks in overall consumer demand for goods. Because durable goods tend to move on trucks, these spending declines can significantly impact truckload demand.

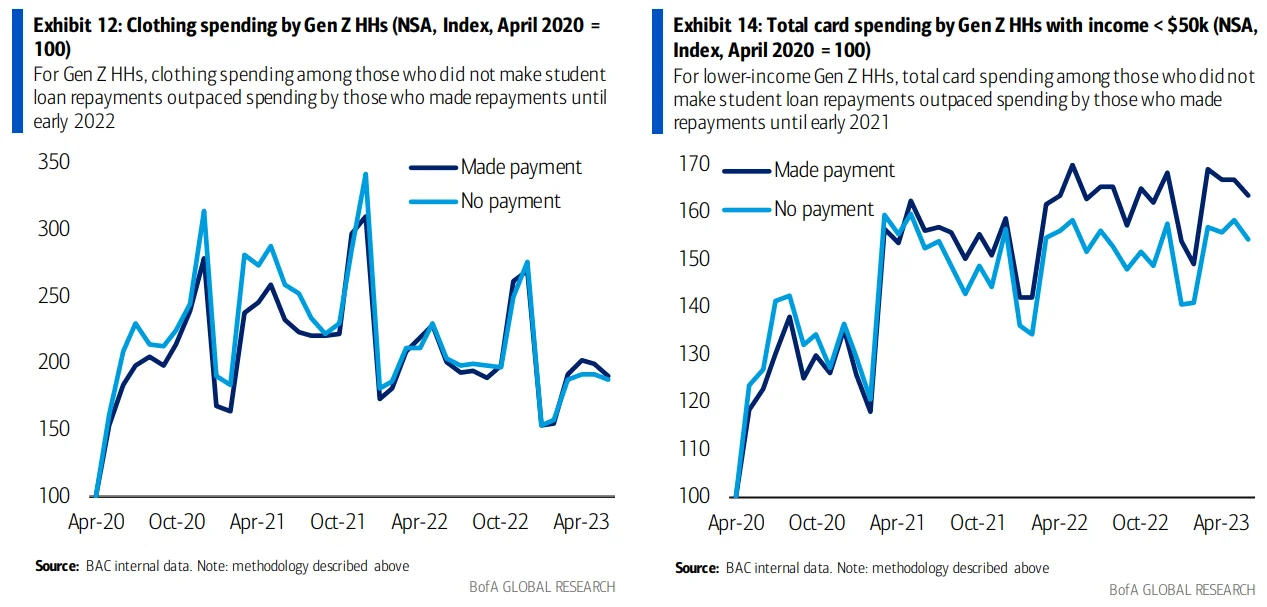

In recent months, there has been much speculation about the impact of the resumption of student loan repayments.

BofA just completed an analysis on the topic in their most recent consumer spending report. Their analysts indicate that to the extent that there is a meaningful impact from the resumption of student loan repayments, it is likely to be seen in spending by younger, lower-income consumers and in discretionary categories such as clothing.

The methodology assumes that if a household continued to repay its loans during the pandemic, it was probably in good financial health, and the data confirmed this. Those that continued to make payments spent more consistently. The only exception was that during the initial onset of the pandemic, there was a clear trend, particularly in lower-income Gen Z consumers, whose spending briefly outpaced those who had made payments. Overall, the concern for impacts on overall freight demand is still low. However, we will be monitoring this closely.

With the market currently in the lull between summer peak season and Labor Day, our stance on overall conditions remains largely unchanged. The market is behaving mostly as expected from a seasonal perspective. Recent seasonal volatility was not impactful enough to disrupt routing guides in any meaningful way, which means the market is still largely stable.

Our 2023 rate forecast and outlook for 2024 remains mostly unchanged. Overall, truckload demand outlook remains a concern, and capacity normalization is still in its early stages. Rates have come off the floor but are in line with seasonal demand. We expect this pattern of seasonal pressures to be the norm through at least early 2024.

The spot-contract gap remains elevated, which should result in deflationary pressure on contract rates. However, it is clear that current rate levels will not be sustainable for the long term, especially if fuel prices remain elevated and squeeze carrier profits. We expect at least one more RFP season before prices drop low enough to support market-wide exposure to prolonged routing guide disruption. In the meantime, shippers running contractual loads should see strong tender acceptance rates and service levels continue due to the oversupply of capacity.

The market will become increasingly vulnerable to disruptive events as capacity normalizes throughout the year. However, recent short-lived periods of volatility suggest that the market is still oversupplied with capacity and unlikely to experience any long-term disruptions through the remainder of 2023.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.