"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Recent trends continue to support our forecast. There are indications that we have reached the floor for spot rates as we head into the 100 days of summer. The gap between spot and contract rates continues to remain large and drive downward pressure on contract rates.

Additionally, we have started to see some pockets of tightness in the southeast as produce season gets underway. This has led to a slight increase in reefer spot rates in those areas.

Finally, overall freight demand continues to falter with spot postings remaining significantly lower than this time last year. Meanwhile, capacity continues to normalize to new levels and will ultimately lead to longer-term equilibrium conditions.

"*" indicates required fields

What’s Happening: Small crop yields are impacting reefer volumes.

Why It Matters: Produce season is known for driving volume heading into the 100 days of summer, but low yields are furthering already soft conditions.

There were no major surprises in the April volume trends. Softening demand persisted, but signs of seasonal pickups appeared in the back half of the month. Cass reported a 1.3% month-over-month decline in shipments from March, on a seasonally adjusted basis, with the index remaining down 2.4% year-over-year. The report noted declining retail sales and ongoing inventory destocking as the primary headwinds facing freight volumes, though the worst destocking woes are likely behind us.

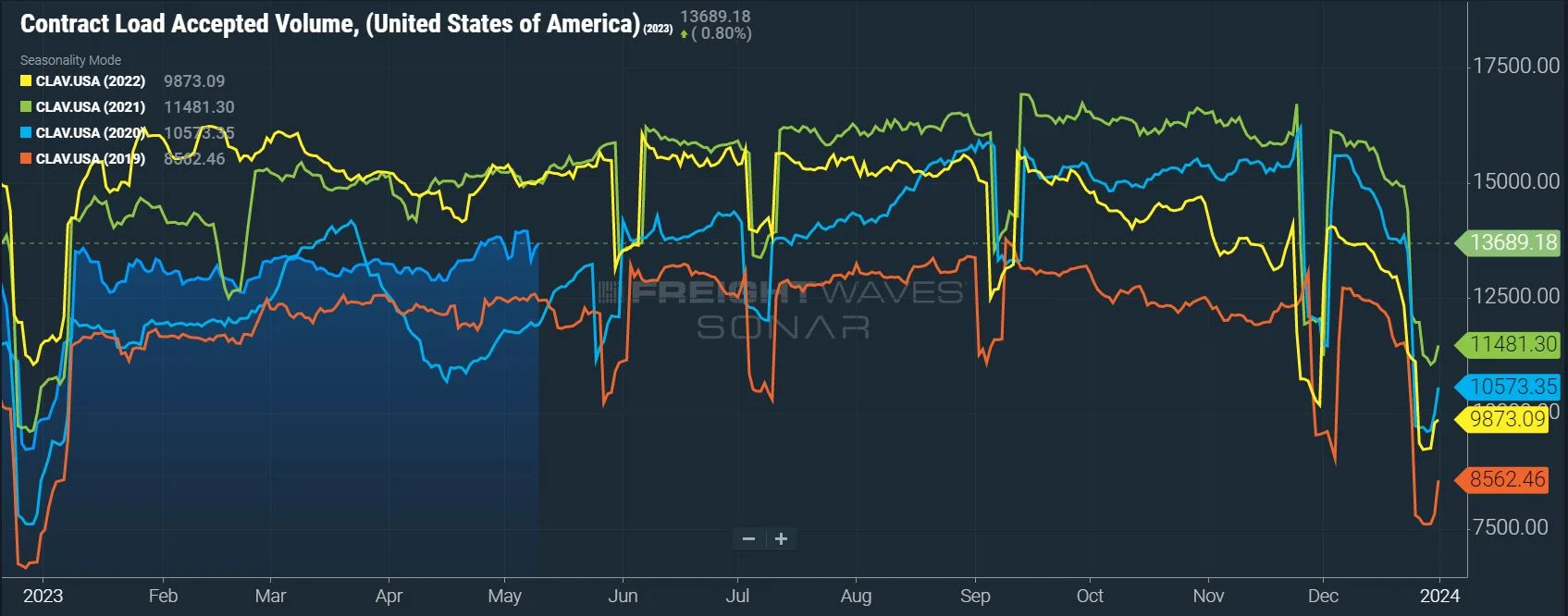

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 18% year-over-year, or 13% when measuring accepted volumes after the significant tender rejection rate decline. Accepted volumes were up 2.5% month-over-month, driven by a 2.9% increase in accepted dry van tenders, while reefer equipment accepted tenders declined by 3.3%.

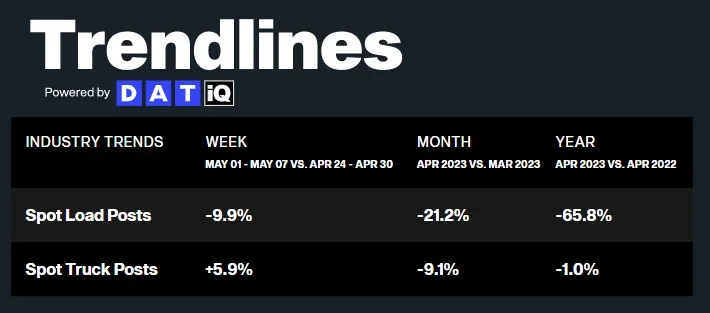

The strong bias towards contractual freight continued in April as spot load postings dropped 21.2% month-over-month. April spot postings were also down by over 65% from a year ago. We expect to see more of the same in May, as spot load postings were already down 10% from the last week of April.

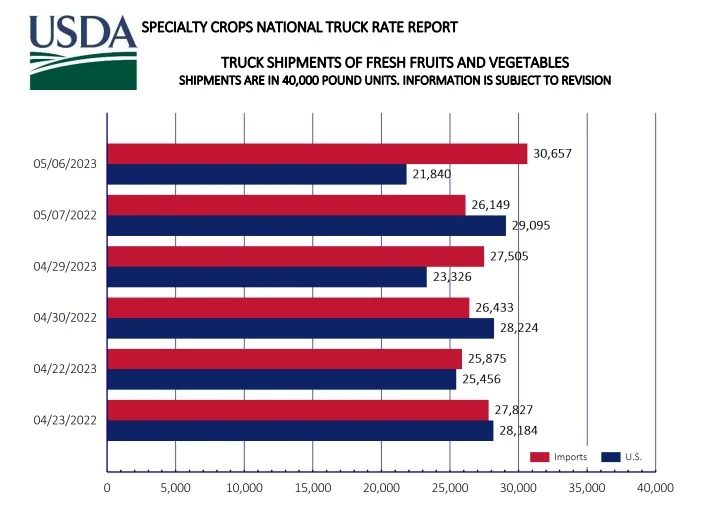

As expected, the peak season for reefer equipment has been muted thus far, largely due to low crop yields. Freightwaves data shows that volumes are down, and the USDA is also reporting notable year-over-year declines in April, particularly for U.S.-grown crops.

U.S.-grown and imported fruit and vegetable shipments were down 10% year-over-year. U.S.-grown shipments were down 18% for the past three weeks, while imported crop shipments were down just 2%. This trend isn’t solely responsible for the unseasonably low reefer demand but is making a significant impact, particularly in produce markets.

What’s Happening: Tender Rejections remain at all-time lows for this time of year despite increased produce activity.

Why It Matters: Besides some possible volatility as the summer peak season gets underway, shippers can expect strong routing guide compliance on contractual freight to continue.

Softening demand in April exacerbated the already-oversupplied market. While certain pockets or regions could experience some seasonal spot rate volatility, it is unlikely to impact tender acceptance and service for shippers, as carriers continue to show a strong interest in and ability to support current contractual freight demand.

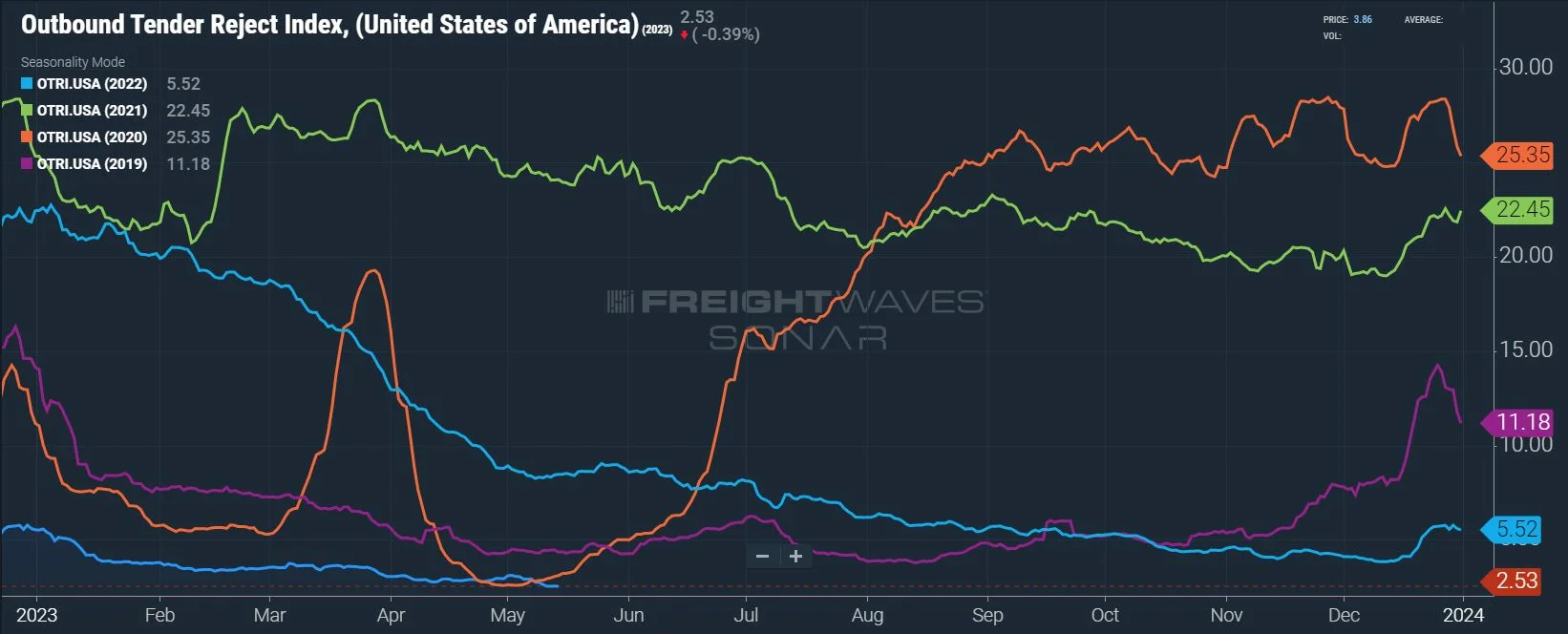

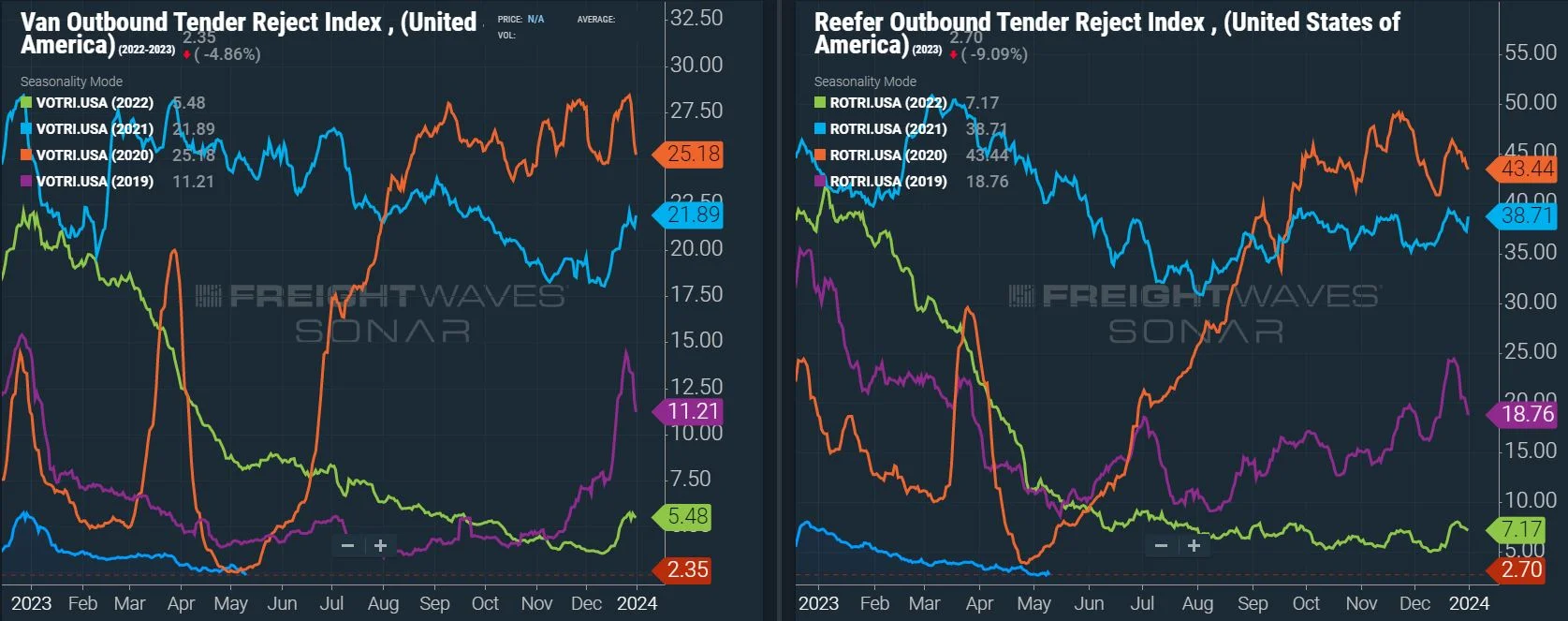

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The rate remained relatively flat month-over-month, decreasing from a 3.1% high in April to a 2.53% low in May, indicating routing guide compliance on contractual freight continued to improve for shippers. Meanwhile, reefer tender rejections aligned with van rejections, easing throughout the month.

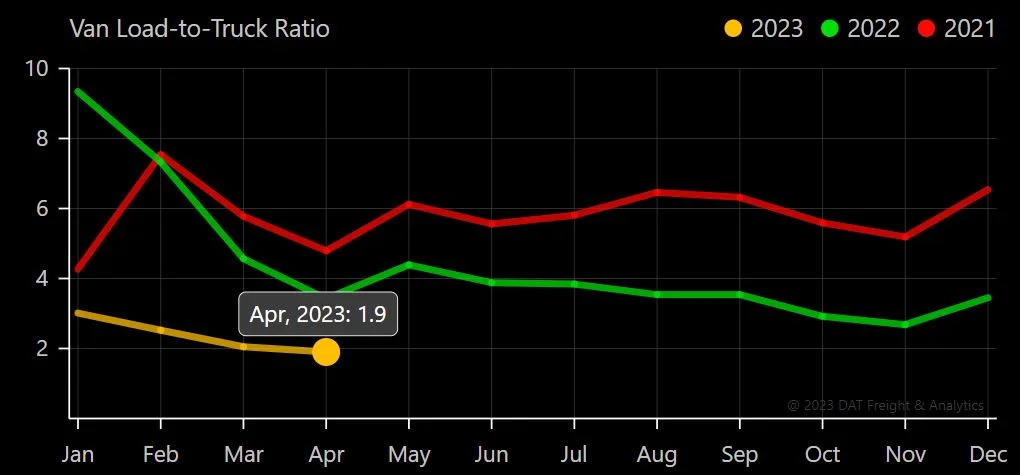

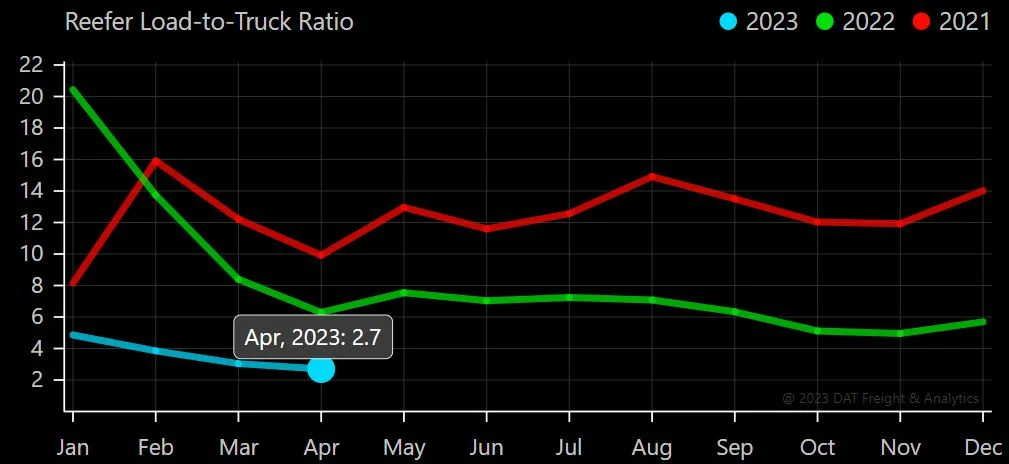

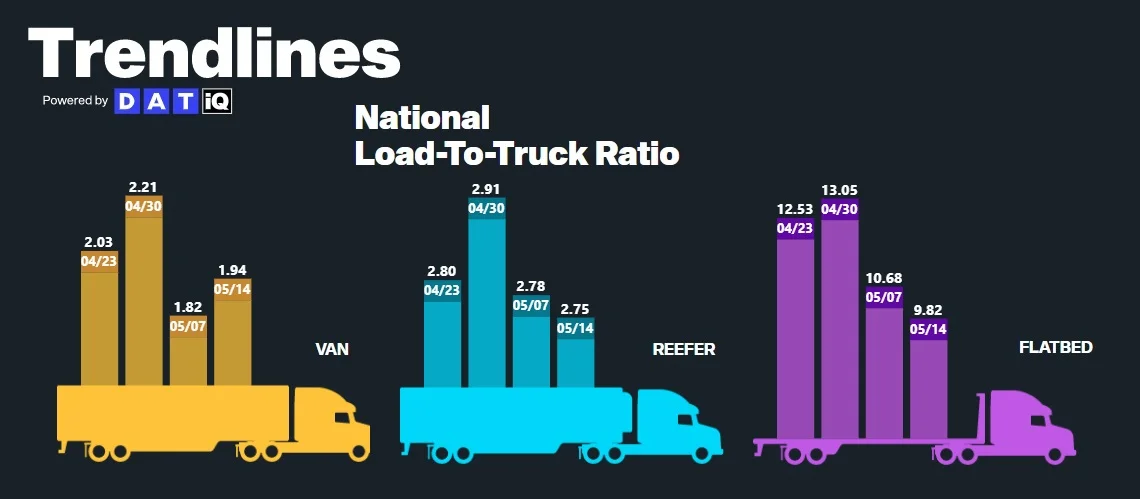

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. April data was inconsistent with typical seasonal pressures: The Dry Van Load-to-Truck Ratio was down 7.4% month-over-month and 45% year-over-year, and the Reefer Load-to-Truck Ratio was down 11.2% month-over-month and 57% year-over-year.

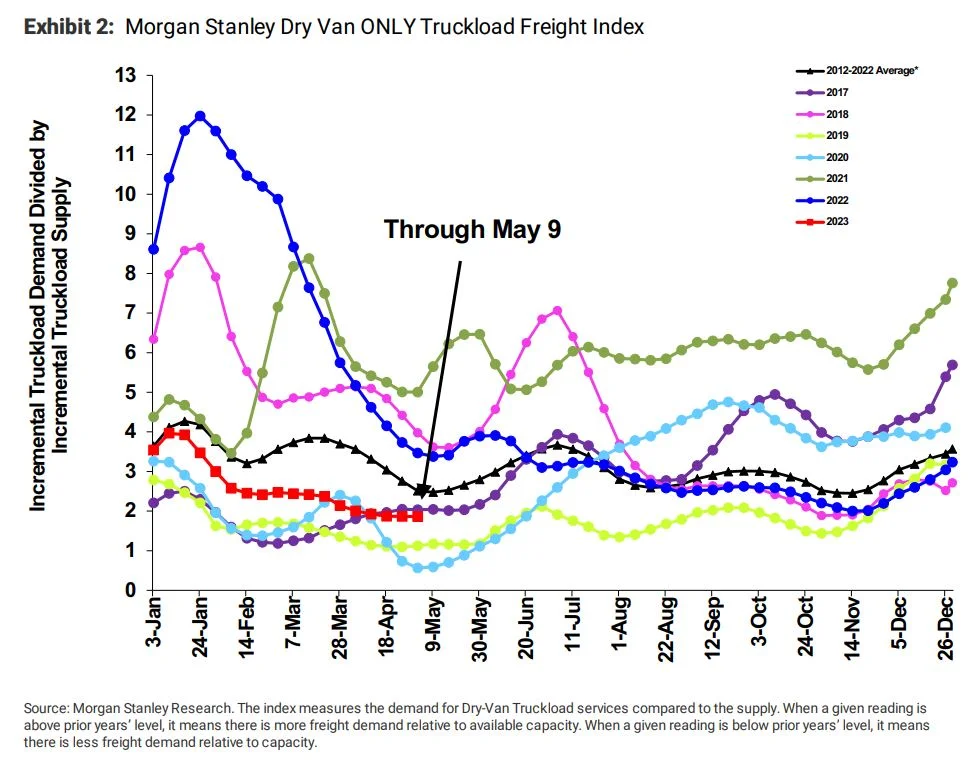

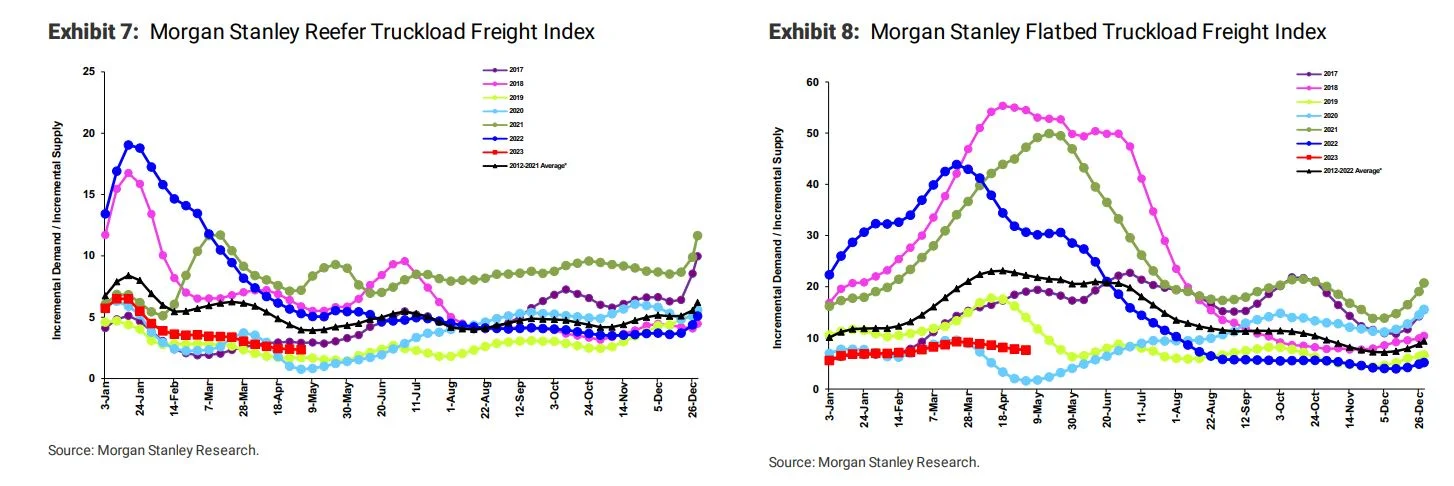

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

Like other truckload supply measures, normal seasonal trends typically indicate softening throughout April before tightening begins in mid-May. This year’s data illustrated flat to decreasing tightness as the month progressed, which mirrors tender rejection and load-to-truck data and provides further evidence that capacity is abundant relative to demand. Normal seasonality would lead us to believe that conditions could begin to tighten as we approach the start of summer peak season in the coming weeks.

What’s Happening: Rates followed the same trajectory they did last month — flat.

Why it Matters: This trend will likely continue unless supply and demand experience a meaningful shift during the summer peak season.

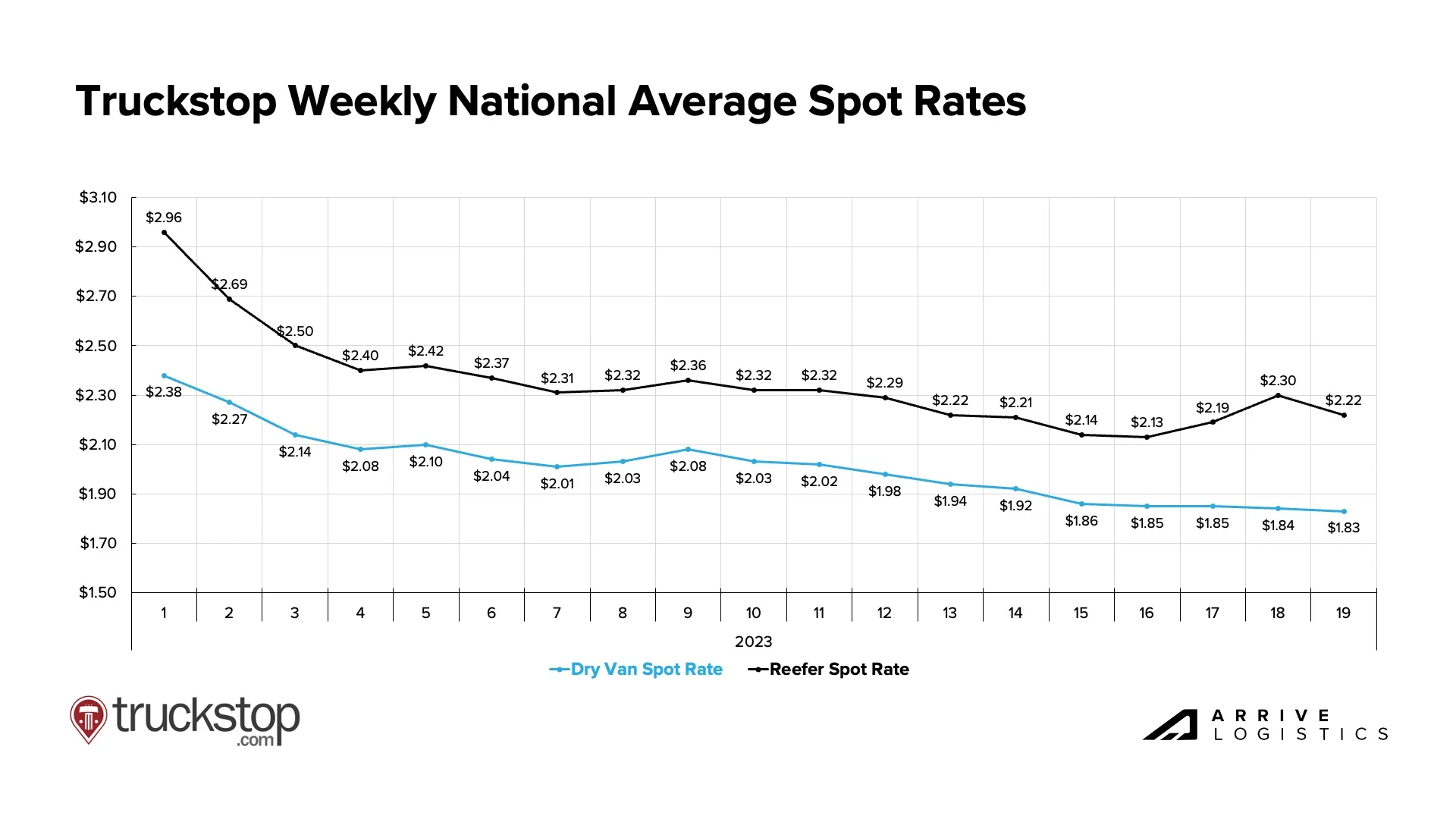

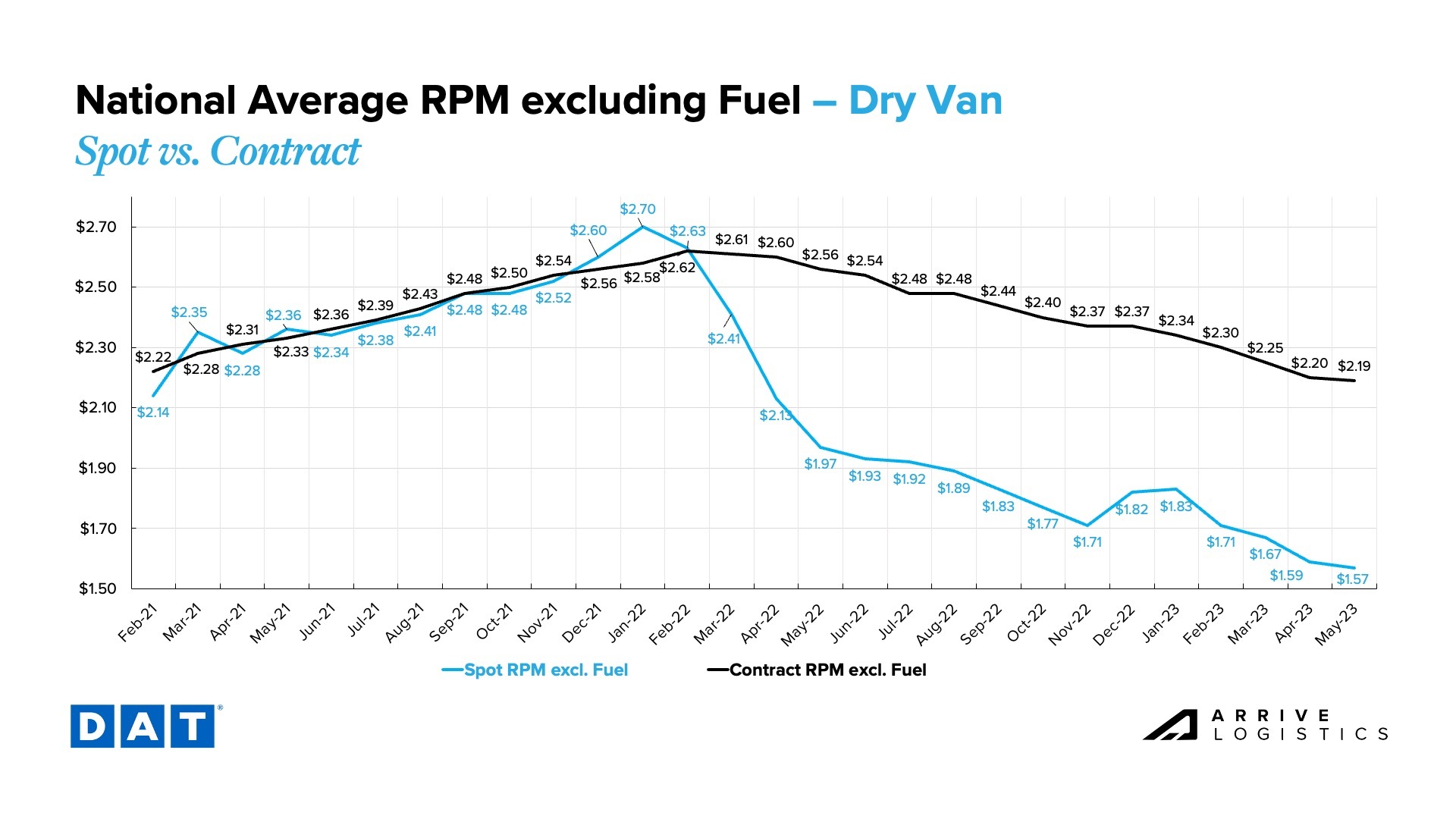

Little change in April supply and demand trends meant more of the same for spot and contract rates. Truckstop and FTR reported weekly dry van spot rates have stayed flat or decreased for ten straight and 15 of the last 18 weeks. However, dry van rates are only down $0.03 over the last four weeks, indicating that conditions may have stabilized. Considering the summer peak season starts in mid-May, it is likely that overall spot rates have found the floor. Reefer equipment spot rates have started rising as the produce season gets underway.

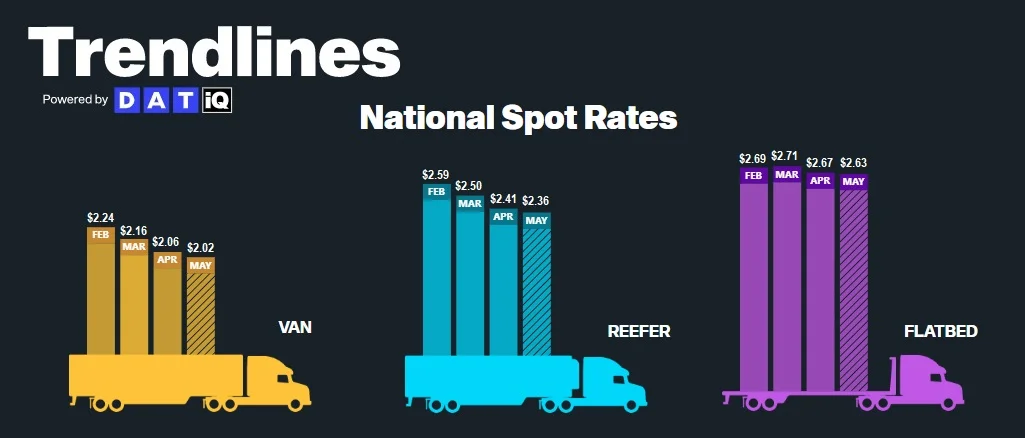

According to DAT, monthly all-in spot rates, including linehaul and fuel costs, are down across all three equipment types. As of May 10th, van and flatbed rates are down $0.04 per mile, while reefer rates have dropped by $0.05. The declining reefer rates seem contrary to what Truckstop reported, illustrating the importance of more granular data. Weekly and even regional data may begin to trend differently than national averages, so it is important to be aware of market conditions at the level that matters most to you.

The month-over-month van rate spread is flat at $0.61 between spot and contract. As a result, downward pressure on contract rates should continue for the foreseeable future, even as the market experiences some seasonal pressures in the back half of the second quarter.

All-in dry van spot rates are down 24.9% year-over-year, while linehaul spot rates are down 20.3%. All-in dry van contract rates are down 19.8% year-over-year, and linehaul contract rates are down 14.8%.

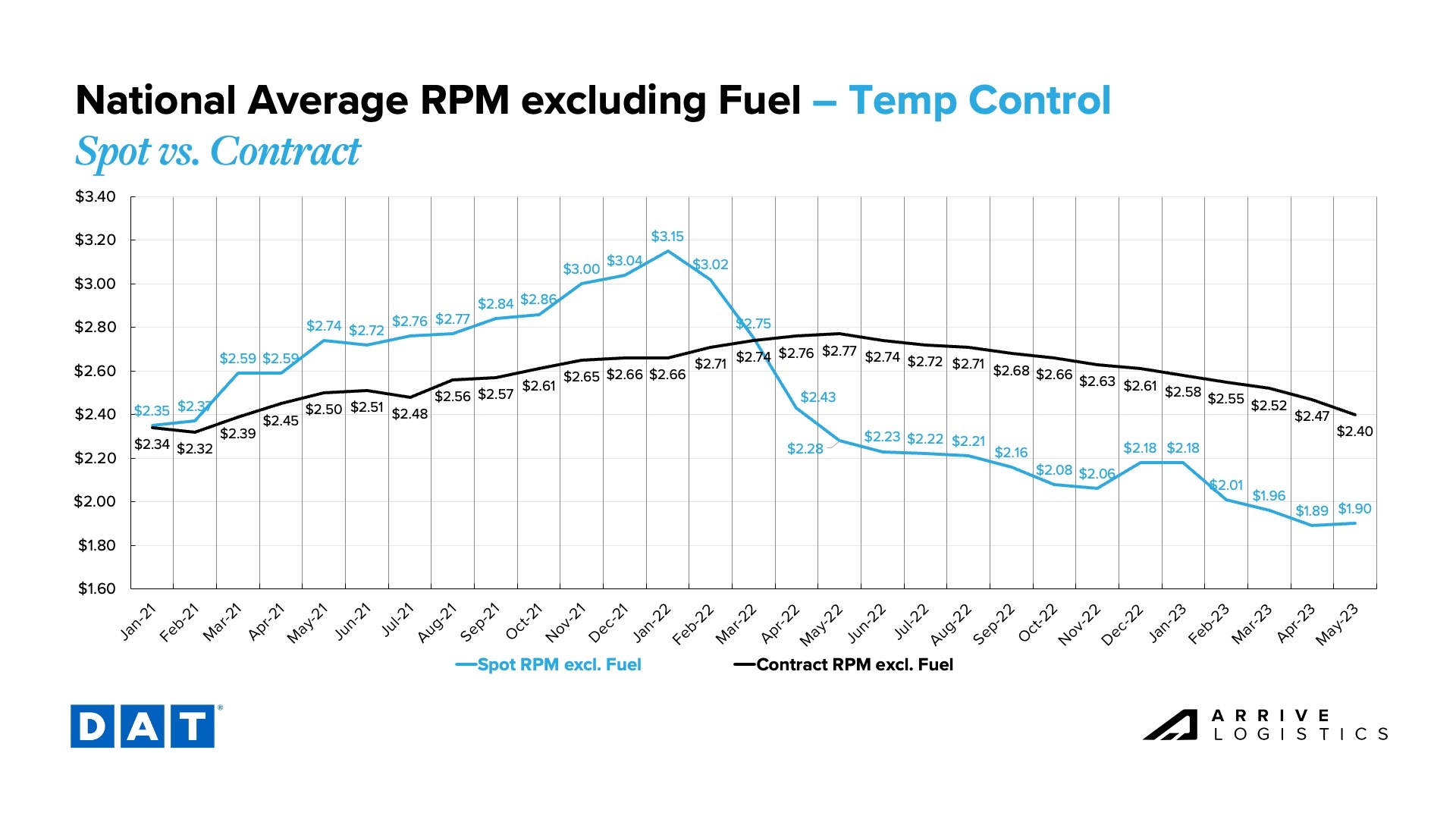

Reefer spot linehaul rates are beginning to deviate from the van rate pattern early in the month, while contract rates show a sizable decline from April. If this holds, it will result in a meaningful decline in the reefer spot-to-contract rate spread, which moved from $0.58 in April to $0.51 per mile in May. The most likely scenario as the month continues is increasing reefer spot rates as the produce season ramps up; weekly data from Truckstop provides good insight into what is to come with the monthly national average.

Down 14.1% year-over-year, the current reefer contract rate is $2.40 per mile, excluding fuel, while the current reefer spot rate is down nearly 18% year-over-year to $1.90 per mile, excluding fuel. Though the year-over-year trend is significant, we have likely passed peak year-over-year deflationary pressures.

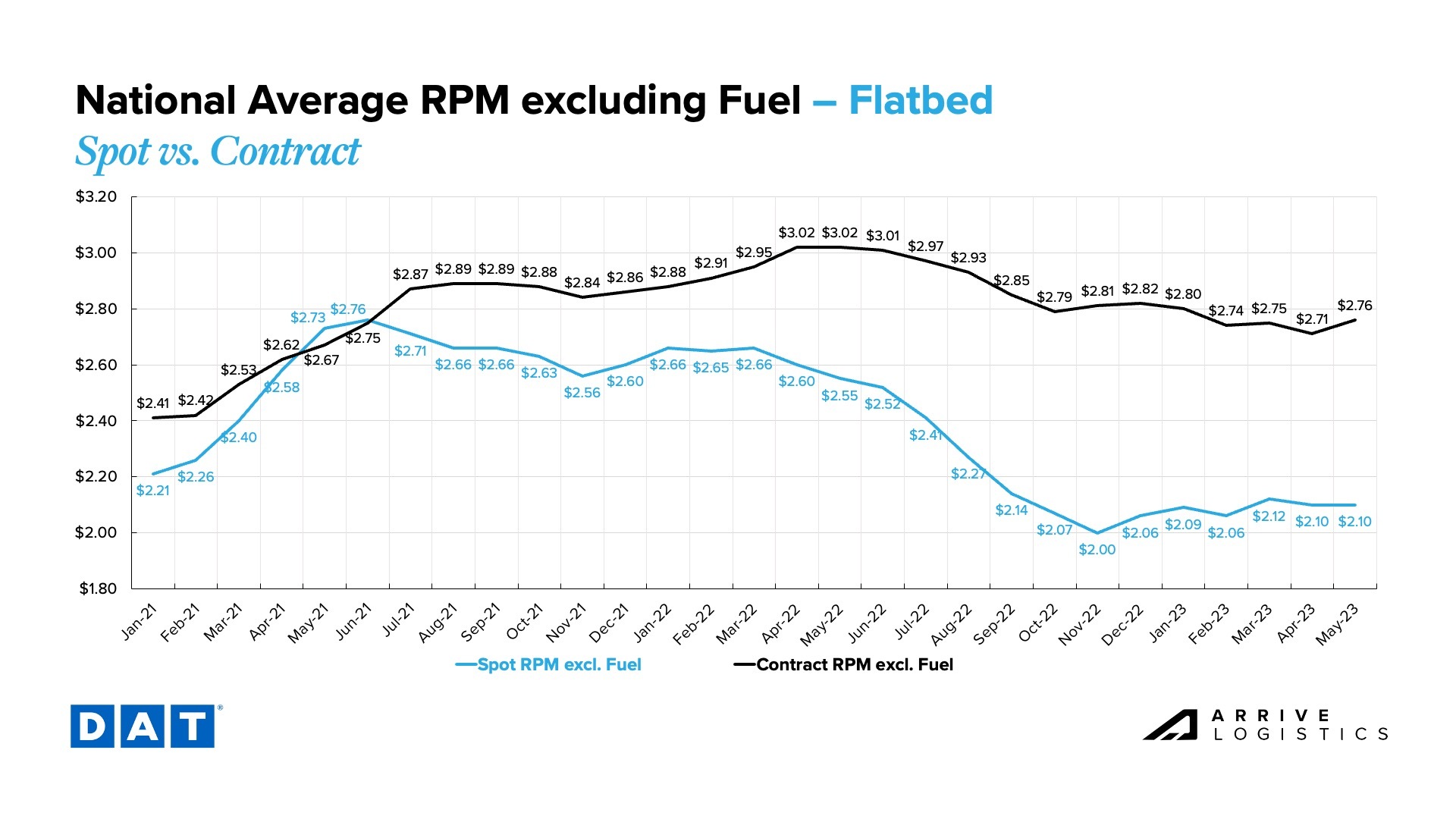

Thanks partly to the return of warm weather and the onset of construction season, spot flatbed rates increased by $0.01 in April, while contract rates appear to have returned to March levels. Spot rates landed at $2.10 and contract at $2.76, excluding fuel.

What’s Happening: Year-over-year LTL sector contract renewals in early Q2 were in the positive low to mid-single digits.

Why It Matters: Though perhaps a short-term improvement, the rate of year-over-year yield improvement still decelerated in Q1 and will likely continue to do so in Q2.

What’s Happening: Temp control is heating up.

Why It Matters: Elevated pricing is expected through the remainder of the produce season.

General Cross-Border Mexico Market Update: Now that we’re in the midst of produce season, temperature-controlled capacity is at a premium. Pricing requests continue to flow in for fresh and frozen produce capacity, which impacts overall cross-border capacity downstream. We expect to see elevated pricing and limited capacity into July.

Market Specific Updates:

Canada Update:

What’s Happening: Summer peak season may soon cause lane- and equipment-specific volatility in certain areas.

Why It Matters: Though the trend may not be apparent in the national market, these areas and equipment types will likely experience capacity constraints and rising rates.

Though it may not be reflected in the national market, we expect certain regions and specific equipment types to experience increased volatility as the summer peak season begins. Capacity constraints and increased rate pressure could impact lanes that have been recently easy to cover, and typical seasonal volatility between mid-May and Independence Day will be variable based on lane and equipment type.

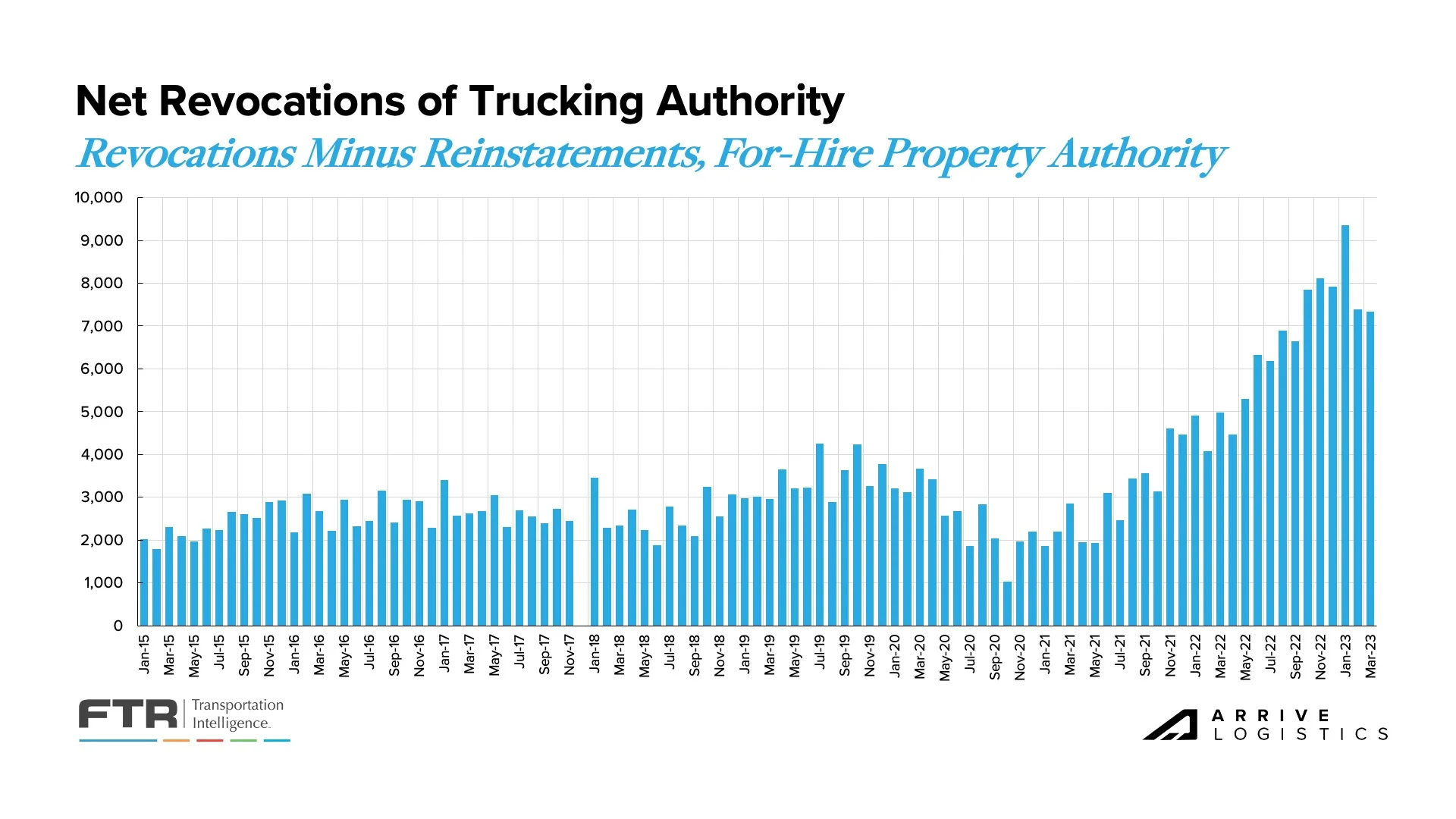

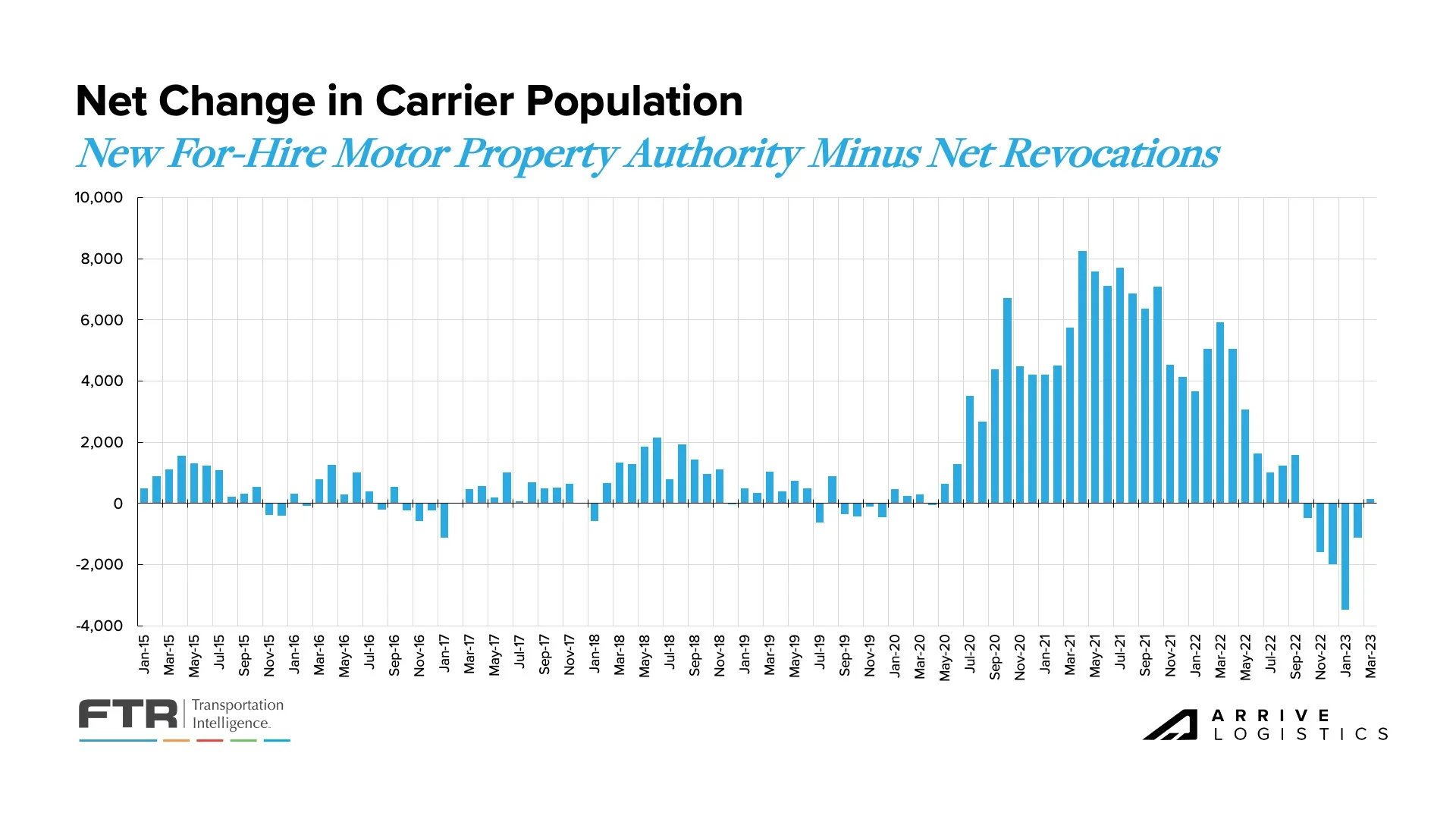

At the national level, however, weak demand is expected to drive a persistent oversupply of capacity in the market, resulting in ongoing normalization. Carriers in the spot market are still facing poor conditions, and revocations of trucking authority remain at historically high levels, despite a slight pullback from March to April. Some revocations may be owner-operators taking company jobs with larger asset carriers, while others are carriers opting out of the market altogether.

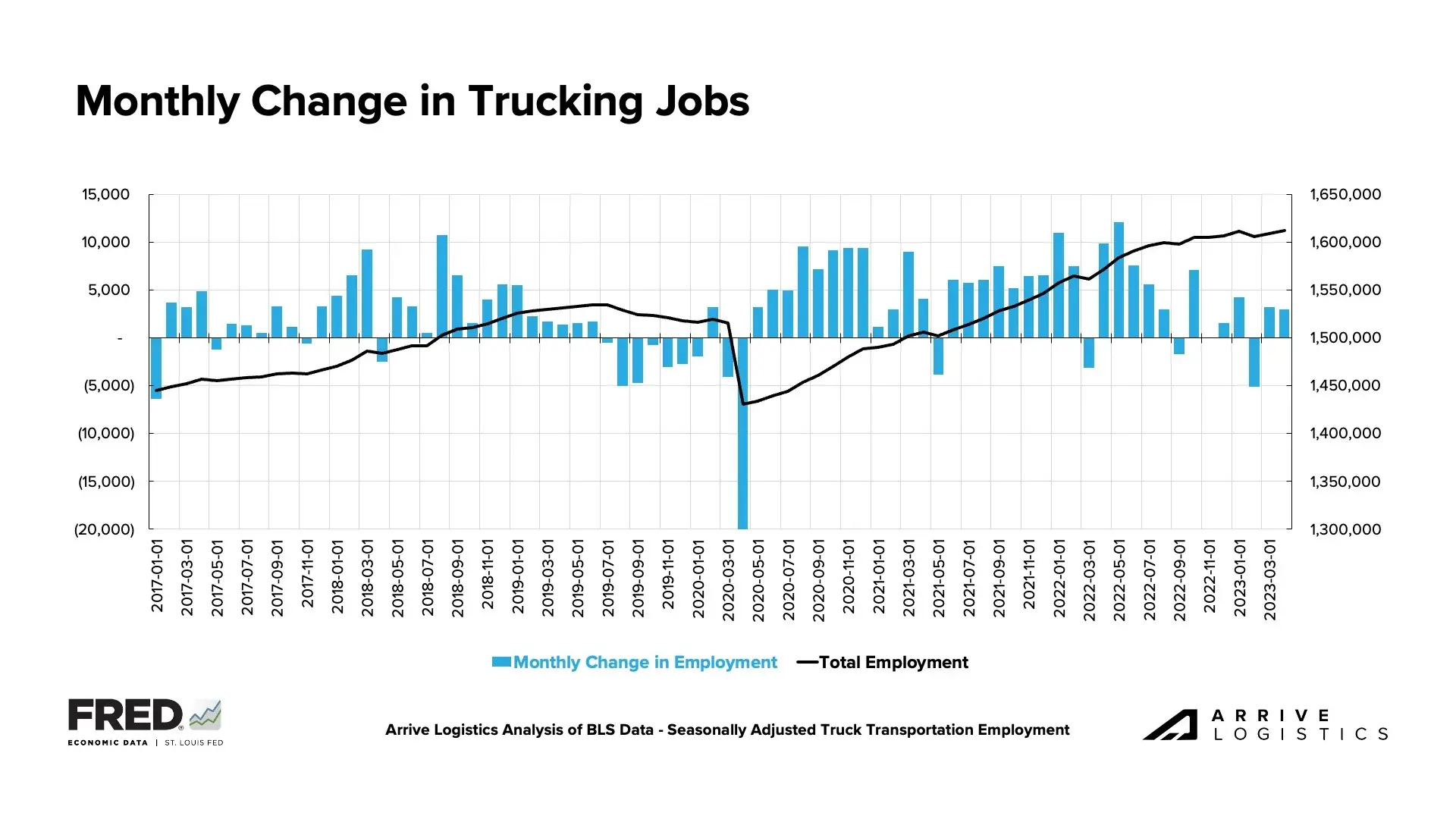

Ongoing trucking sector job growth continues to defy expectations amid the declining rate environment. The trend is likely driven by a combination of owner-operators who are finally taking company jobs and a need to support growing demand in certain areas such as non-single-family housing construction and oil and gas drilling.

A key trend we’re watching is revocations outpacing new carriers entering the market for six of the last seven months, reducing the total number of carriers. A significant amount of capacity that entered the market over the last few years remains unutilized, so we expect this disparity to continue for some time.

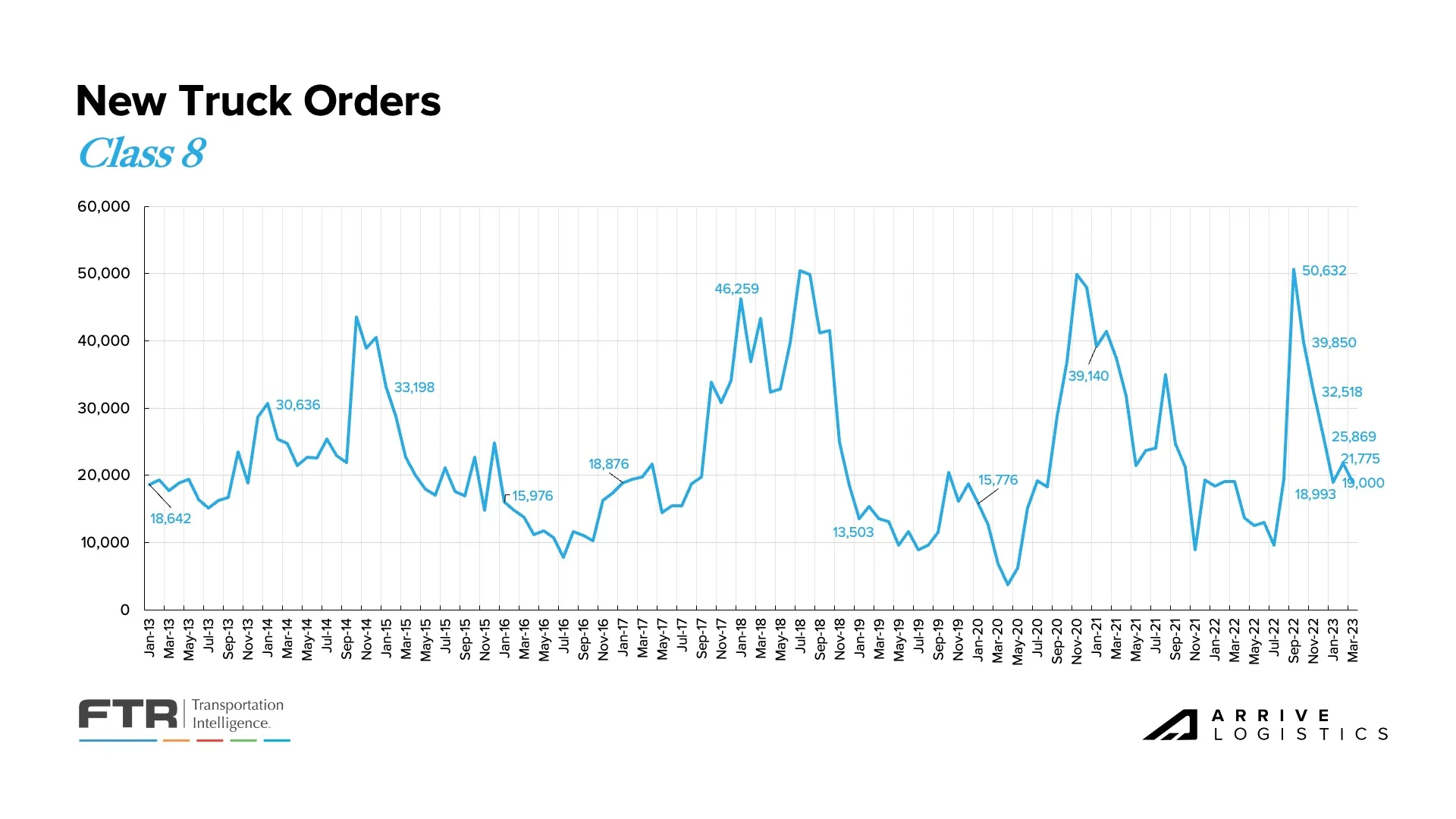

In April, FTR reported that new Class 8 truck orders fell for the sixth time in the last seven months to 12,050 units. They noted the slowdown is not a direct indication of declining demand but rather build slots for the year being filled. Low order numbers are expected to continue until 2024 build slots open, at which point we should better understand new equipment demand.

What’s Happening: Persistently low retail and manufacturing volumes remain a downside risk.

Why It Matters: These sectors comprise a significant amount of overall volume, meaning the ripple effects could be felt for some time.

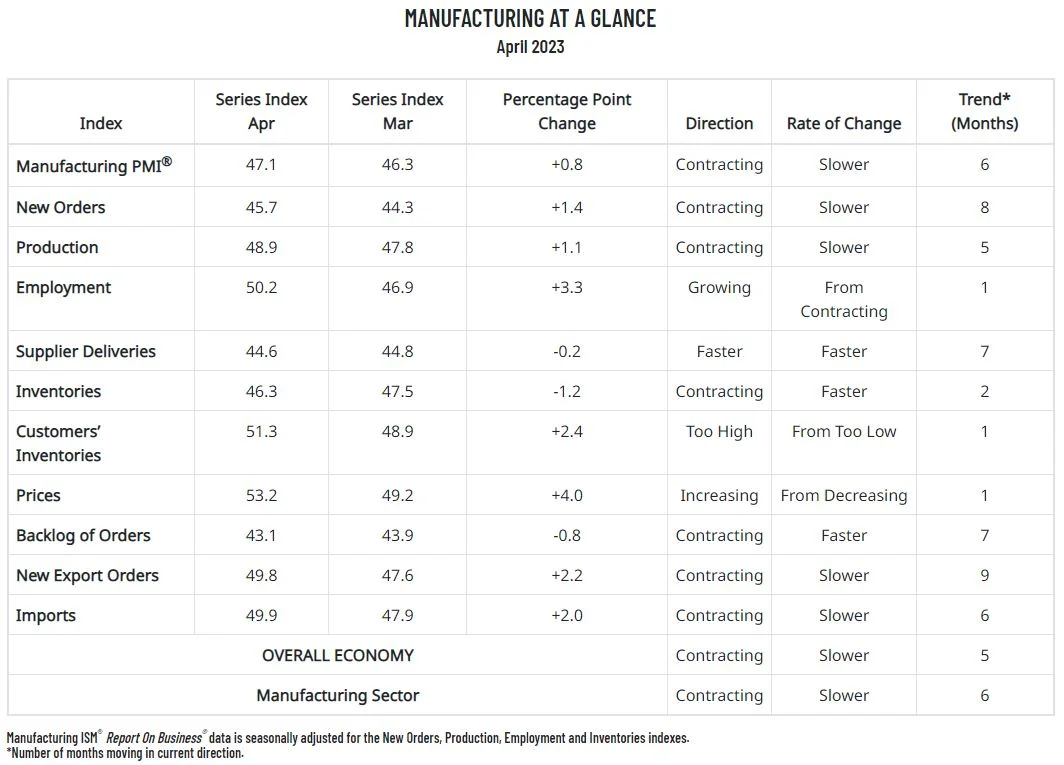

We continue to report on retail and manufacturing trends due to their significant impact on domestic freight demand. Recent data indicated a concerning outlook for both sectors. Manufacturing contracted for the sixth consecutive month, while imports have significantly declined from the record-setting levels observed a year ago.

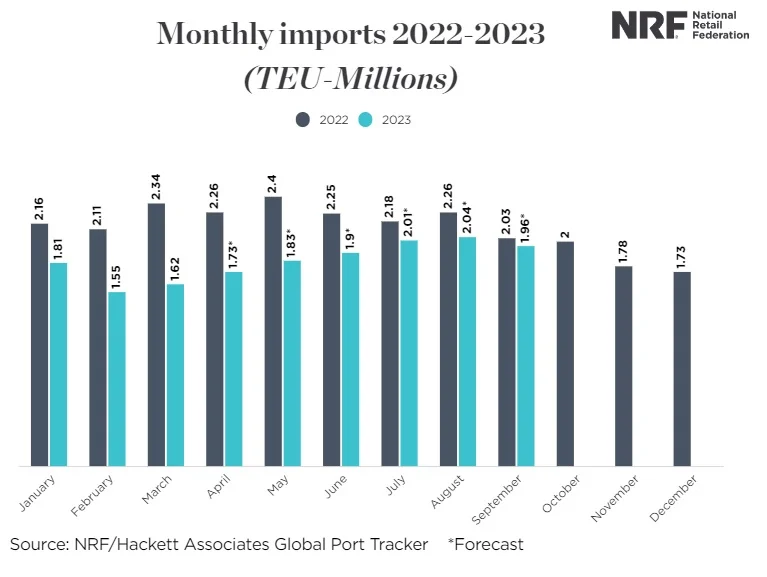

The National Retail Federation (NRF) is beginning to alter its stance on the retail imports outlook. According to the latest update from its Global Port Tracker, imports are expected to remain below recent levels until inflation rates and inventory surpluses are reduced. Further, the revised forecast now predicts a more substantial import volumes decline in the first half of the year compared to a month ago. However, the NRF also acknowledged that recent positive developments in West Coast port labor negotiations are encouraging.

The ISM manufacturing report indicated more easing backlogs as new orders contracted for the sixth consecutive month amid slowing production. The new orders index continued to contract, raising even more uncertainty about future backlogs and, in turn, truckload demand. Manufacturing was expected to be one of the main volume drivers in 2023, and if contraction persists, demand will likely fall further than previously forecasted. However, there is still significant pent-up demand in the sector that should enable healthy volumes in the near term.

Construction-related demand continues to support struggling truckload volumes. The Wall Street Journal recently reported that construction equipment, trucks, and building supplies manufacturers are still ringing up sales despite slowdowns in other economic areas. They also noted that order backlogs from supply-chain bottlenecks during the pandemic and higher demand from new factories under construction have boosted manufacturing companies. This positive outlook provides at least some assurance that freight volumes are unlikely to fall off a cliff.

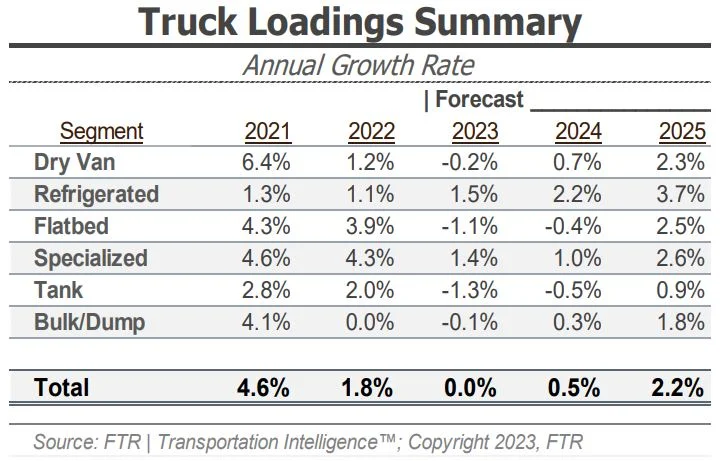

FTR’s latest truck loadings forecast is significantly stronger this month, improving from a 1.6% decrease to end up flat year-over-year following meaningful revisions to bulk/dump and flatbed loadings. A stronger demand outlook for building materials was the key driver behind that increase. The dry van and reefer loadings forecasts were slightly better but essentially flat.

What’s Happening: Inflation continues to slow down while consumer spending also sees a year-over-year decline.

Why It Matters: Persistent inflation along with high prices limits the spending power of consumers, leading to overall demand remaining down.

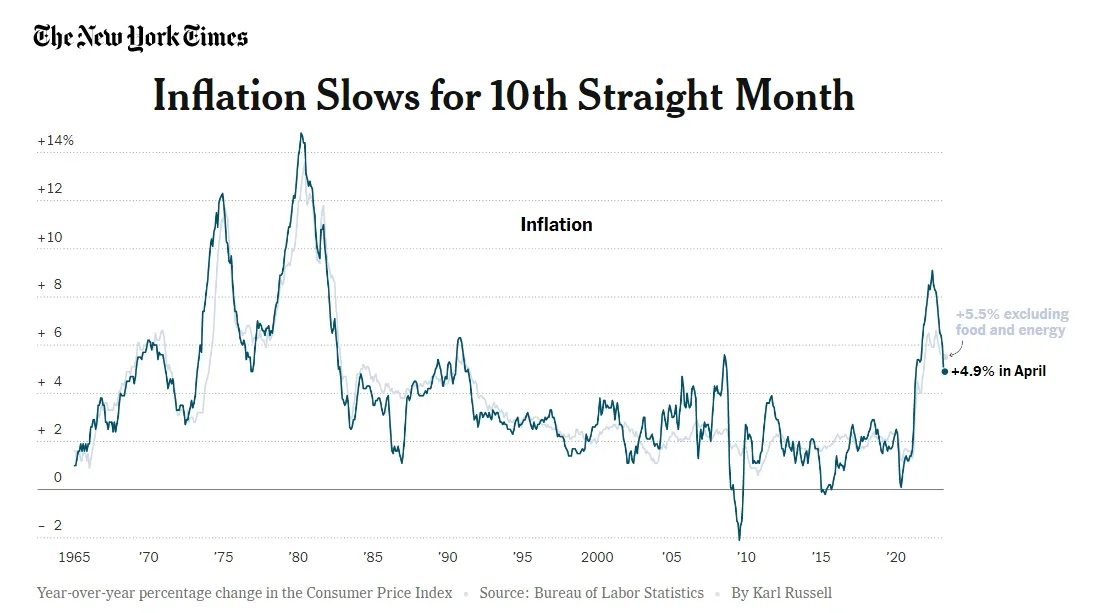

May CPI data showed that inflation slowed for the tenth consecutive month in April, falling to 4.9% year-over-year growth (5.5% excluding food and energy). Rising shelter costs remained a key driver, accounting for about a third of the index. This month, the shelter index increased 8.1% year-over-year, accounting for >60% of the total core inflation increase.

Overall, inflation has declined meaningfully in some areas while continuing to rise in others. A few notable increases include rent and automotive-related costs such as used vehicle prices, gas, and insurance. With the Fed still intent on driving down inflation to the 2% range, we expect to see continued action with the next opportunity to raise rates. Speculators indicate another rate hike of 25 basis points is the most likely scenario.

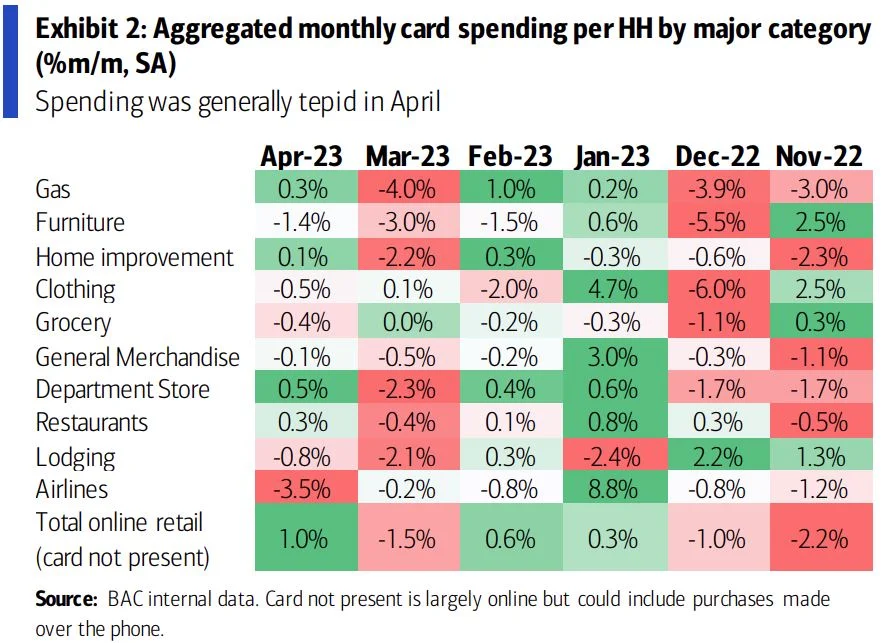

Bank of America card data revealed consumer spending per household decreased by 1.2% year-over-year in April, the first year-over-year decline since February 2021 when ice storms shut down large portions of Texas and the South. The seasonally adjusted 0.3% month-over-month increase in April was driven by online retail and department store spending. Airlines, lodging, and furniture were the weakest categories.

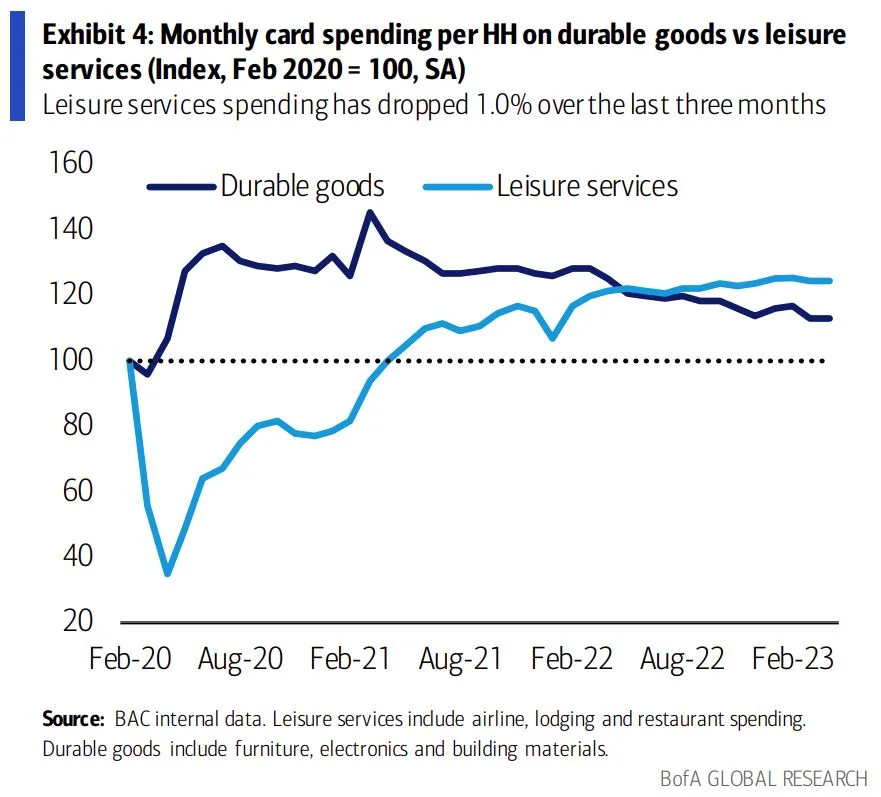

Services spending has slowed, possibly indicating that the tailwinds associated with reopening have run their course. However, the durable goods spending story remains the same, with the data showing a steady decline after peaking more than two years ago. Because durable goods tend to move on trucks, these spending declines have a larger impact on truckload demand.

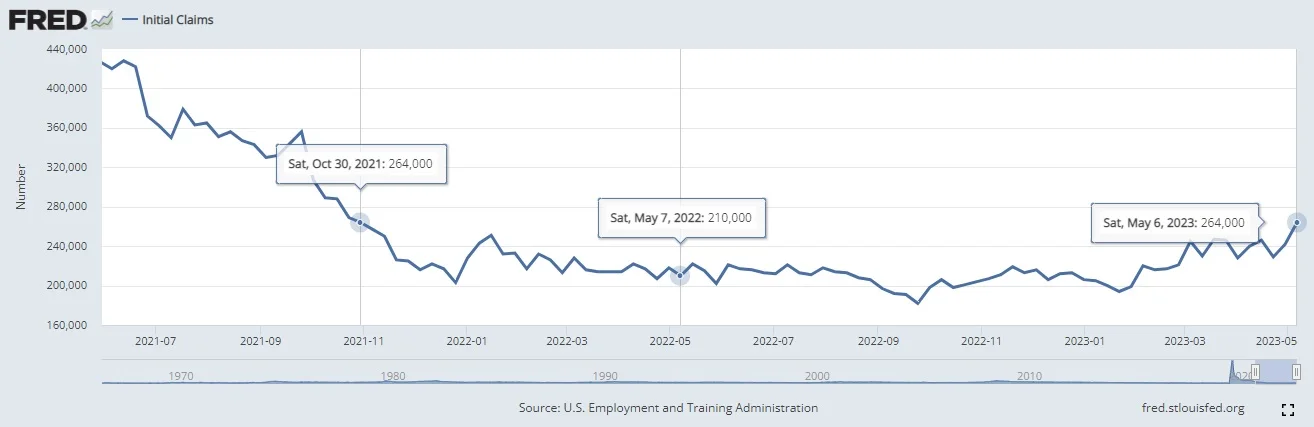

Initial jobless claims have increased slightly in recent months, and current levels are at their highest since October 2021. Overall claims remain low, but recent increases indicate the labor market may be showing some cracks. The unemployment rate, however, remains extremely low and is a sign that the market is still relatively strong despite the recent uptick in layoffs. The robust labor market signals confidence in consumers’ ability to sustain current spending levels and avoid a sudden drop in truckload demand.

Though signs of seasonal pickups appeared late in the month, April freight market conditions were largely consistent with March. The spot market remained competitive among carriers looking for freight, while shippers running loads contractually continued to experience historically high tender acceptance rates and improved service levels due to the oversupply of capacity.

Overall, the truckload demand outlook remains a concern, and capacity normalization is still just beginning to materialize. Rate conditions continue to worsen for dry van carriers and may be below profitable levels for those with high spot exposure. Reefer carriers in the right regions are seeing upward rate pressures as seasonal demand picks up.

Our 2023 rate forecast remains mostly unchanged, with some increased downside risk due to demand uncertainty. We expect spot rates will find their floor relatively quickly — likely by Memorial Day Weekend — and remain stable throughout the year with seasonal fluctuations. The unprecedented spot-contract gap will also continue to put deflationary pressure on contract rates.

As this all unfolds throughout the year, the market will become increasingly vulnerable to disruptive events as capacity continues to normalize. However, recent short-lived periods of volatility suggest that the market is still oversupplied with capacity and unlikely to experience any long-term disruptions through the remainder of 2023.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.