"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Recent trends continue to support our forecast. However, the freight market recovery is further along for reefer equipment than for van, increasing near-term reefer rate volatility exposure as seasonal demand picks up around the holidays.

Recent disruptions had little impact on van contractual service levels, indicating the van market remains unlikely to experience disruption in the short term. Although we anticipate a muted peak season for van equipment, a few pockets will likely experience challenging capacity conditions. The gap between spot and contract rates is still large and should drive further downward pressure on contract rates into 2024.

All major demand indices showed sequential growth in August, adding confidence to our base case forecast of a freight market recovery in 2024. There is downside risk, however, as uncertainty around the impact of student loan repayments and how future interest rate trends will impact manufacturing and the housing and construction markets.

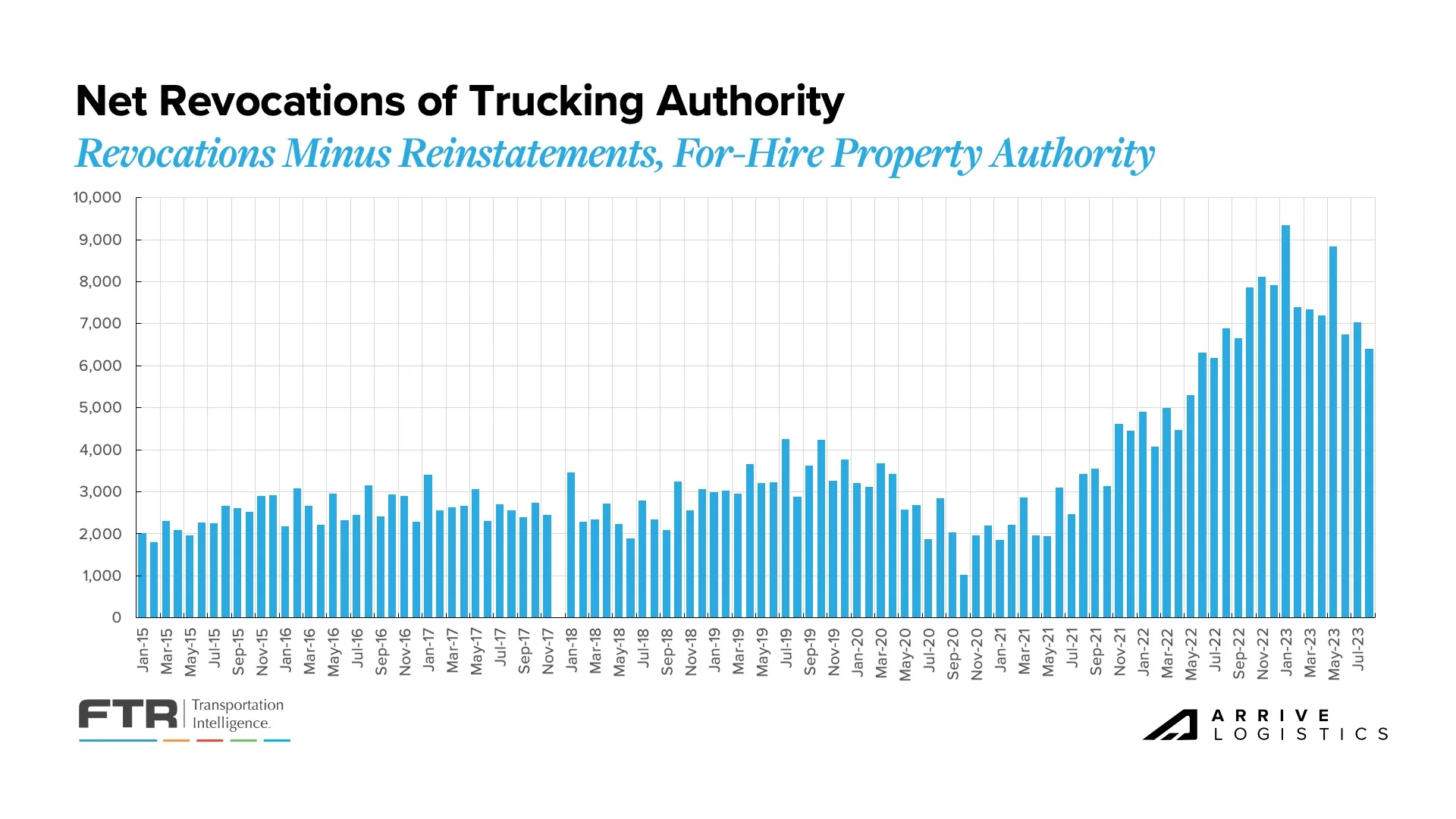

The capacity correction has picked up amid worsening trucking conditions, mostly due to elevated fuel costs impacting carrier profitability. This ongoing trend will increase the market’s vulnerability to disruption, especially after another RFP season drives contract rates down closer to spot levels.

"*" indicates required fields

Recent demand trends provide support for a freight market recovery in 2024.

Hurricane Idalia compounded the impact of Labor Day on the spot market, particularly in the Southeast.

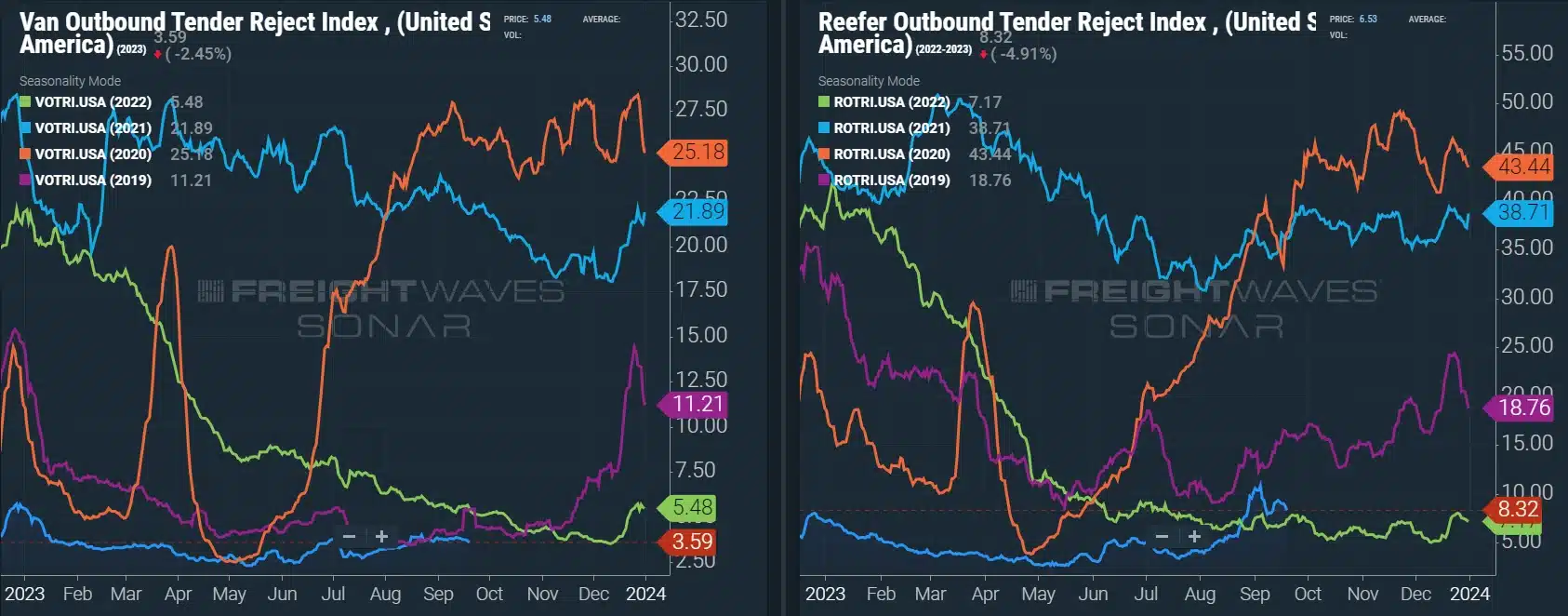

Seasonal demand surges for reefer equipment are causing significant routing guide challenges for shippers, a sign that the reefer market’s recovery is further along than the van market.

Rates jumped early in the month due to elevated spot market activity but have eased in the weeks following, indicating a return to normal seasonality.

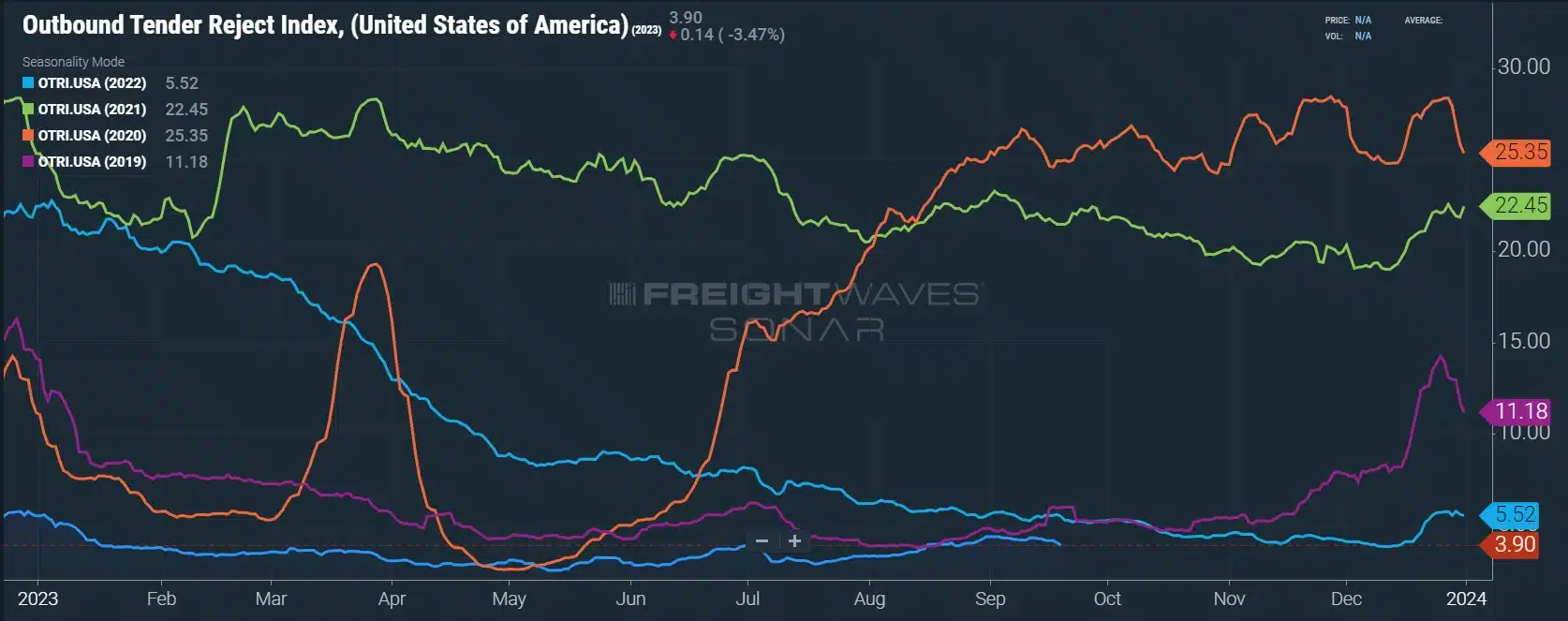

Tender rejection activity below 4% illustrates historically strong contract compliance and carriers’ continued appetite for accepting nearly all contract freight despite increased spot activity.

The gap between spot and contract rates for van and reefer equipment is mostly flat at $0.49 and $0.45 per mile, respectively, meaning downward contract rate pressure should continue.

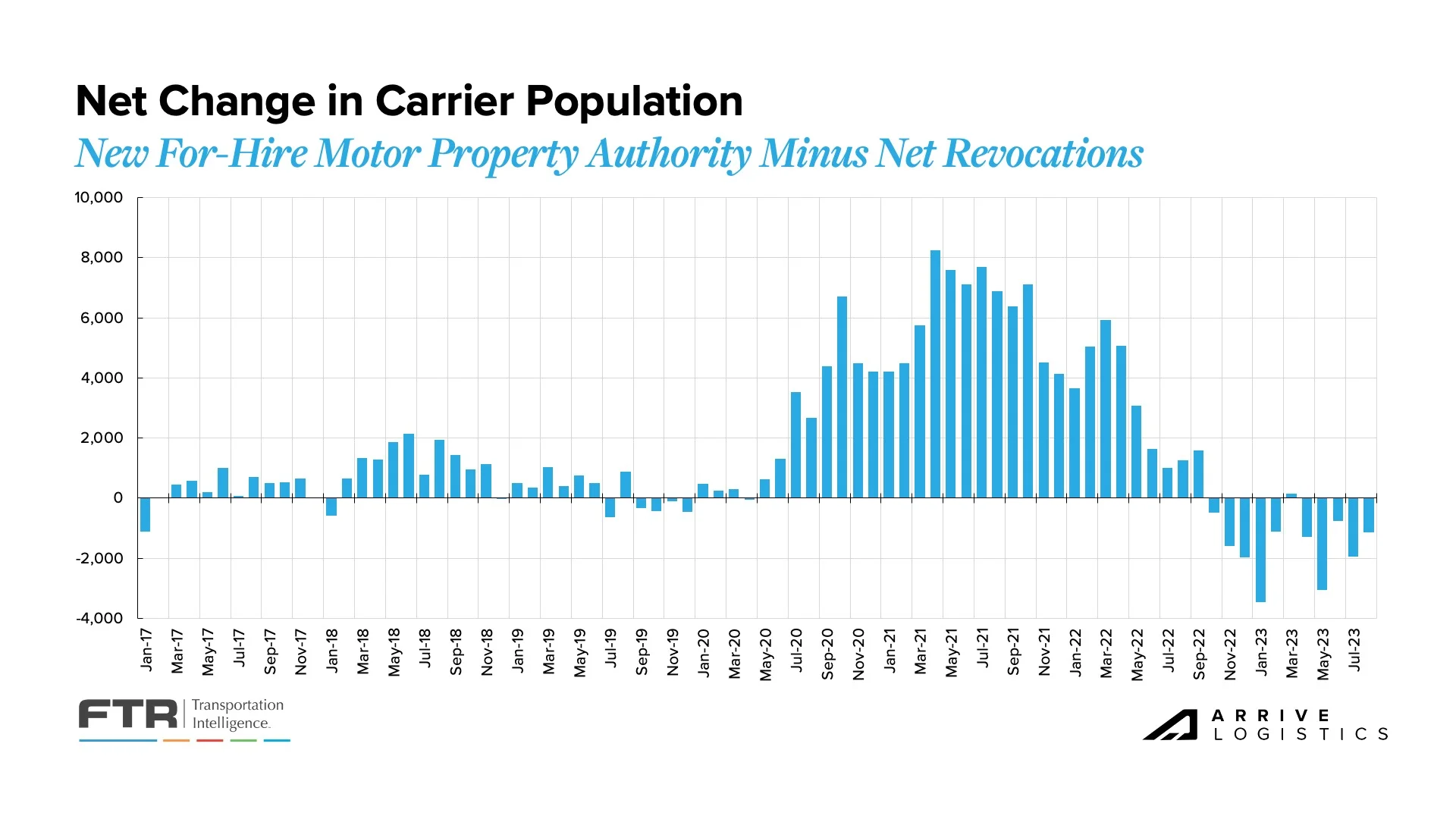

Large numbers of authority revocations continue; there has been a negative net change in the carrier population in 10 of the last 11 months as exits outpace new entrants.

Trucking employment took a significant step back over the past three months, falling by more than 41,000 jobs to the lowest levels since Q1 of 2022.

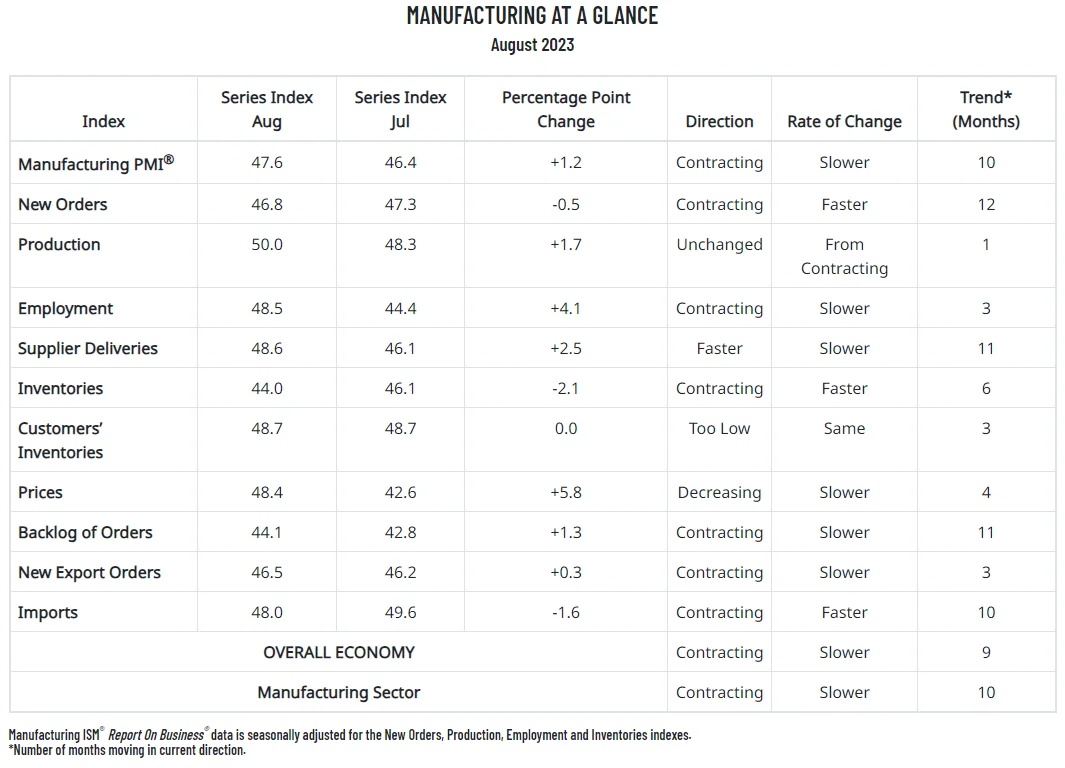

The manufacturing sector was expected to be a key demand driver in 2023, but new orders just contracted for the twelfth straight month, increasing potential downside demand risk.

The National Retail Federation reports strength in the forecast for retail imports through the end of the year, a sign that retailers are optimistic about consumers and that the inventory cycle is being reset as destocking moderates.

Consumer spending remains stable, supporting healthy freight demand. The risk for impact from student loan repayments is likely limited to younger, lower-income consumers.

Sticky inflation could lead to lasting rate elevation, limiting freight volume growth in the short to mid-term.

What’s Happening: The demand environment appears to be improving.

Why It Matters: If demand continues to stabilize and eventually grows, we will stay on track to a freight market recovery in 2024.

Freight volumes remained healthy in August, increasing nominally on a seasonally adjusted basis across major indices.

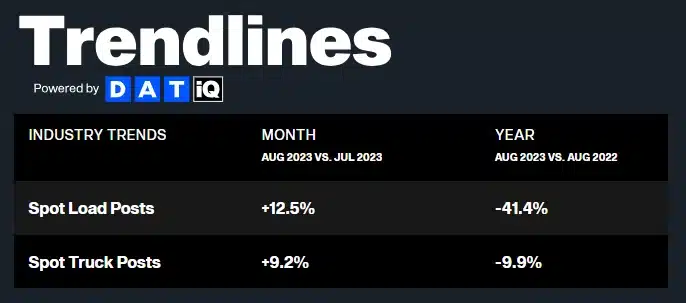

DAT reports exclusively on spot trends and noted that August spot load posts were up 12.5% compared to July after falling in each of the previous two months. The annual comps still showed a year-over-year decline, but spot load posts improved from -54% in June and -50.3% in July to -41.4% in August.

Cass reported a 1.9% decrease in August shipments, translating to a 0.8% month-over-month increase on a seasonally adjusted basis. However, the index is down 10.6% year-over-year, which is a step in the wrong direction from 8.9% in July and a significant jump from the 4.7% year-over-year decline in June. Cass noted this trend appears especially significant given the extraordinary destocking last summer, which created freight demand as retailers shipped out stale inventory.

Interestingly, Cass also believes meaningful private fleet capacity growth accounts for a substantial decline in volume because these fleets insource freight from the for-hire market. This trend appears significant and could have far-reaching implications for future market conditions.

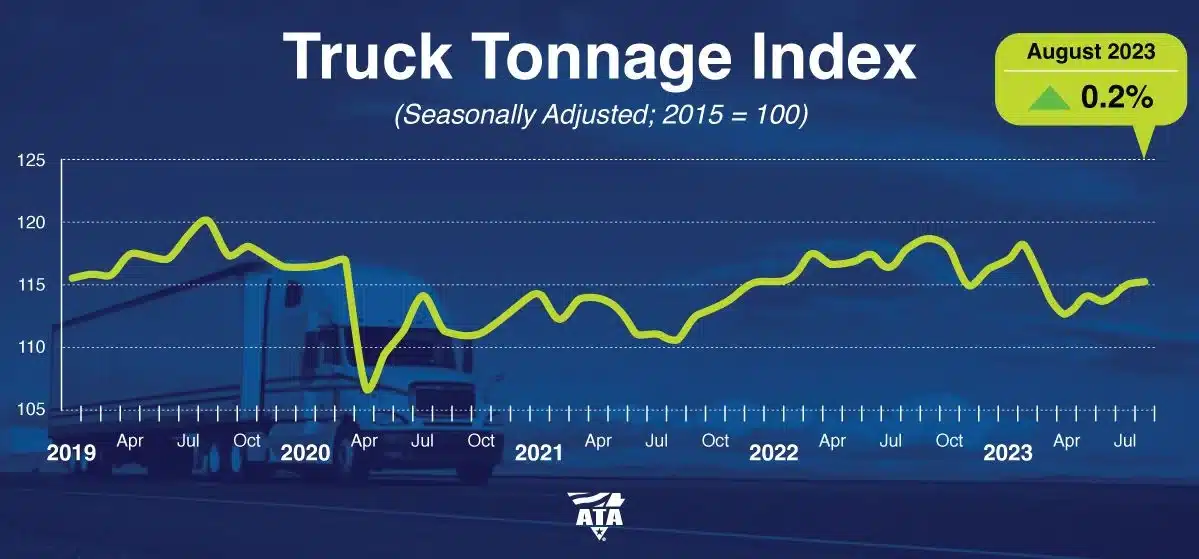

Like Cass, the ATA reported August volumes increased 0.2% on a seasonally adjusted basis and 6.3% on a non-seasonally adjusted basis from July. On a year-over-year basis, the index showed a negative growth increase from July, similar to Cass. The seasonally adjusted index was down 2.3% in August, compared to just 1.2% in July.

It’s safe to assume the same factors influenced the ATA report as the Cass report. ATA Chief Economist Bob Costello noted, “The evidence is growing that tonnage hit bottom in April and continues its slow climb upwards… Year-over-year comparisons remain difficult as tonnage peaked in September of last year, and as a result, it is unlikely that tonnage turns positive for at least a month or two longer.”

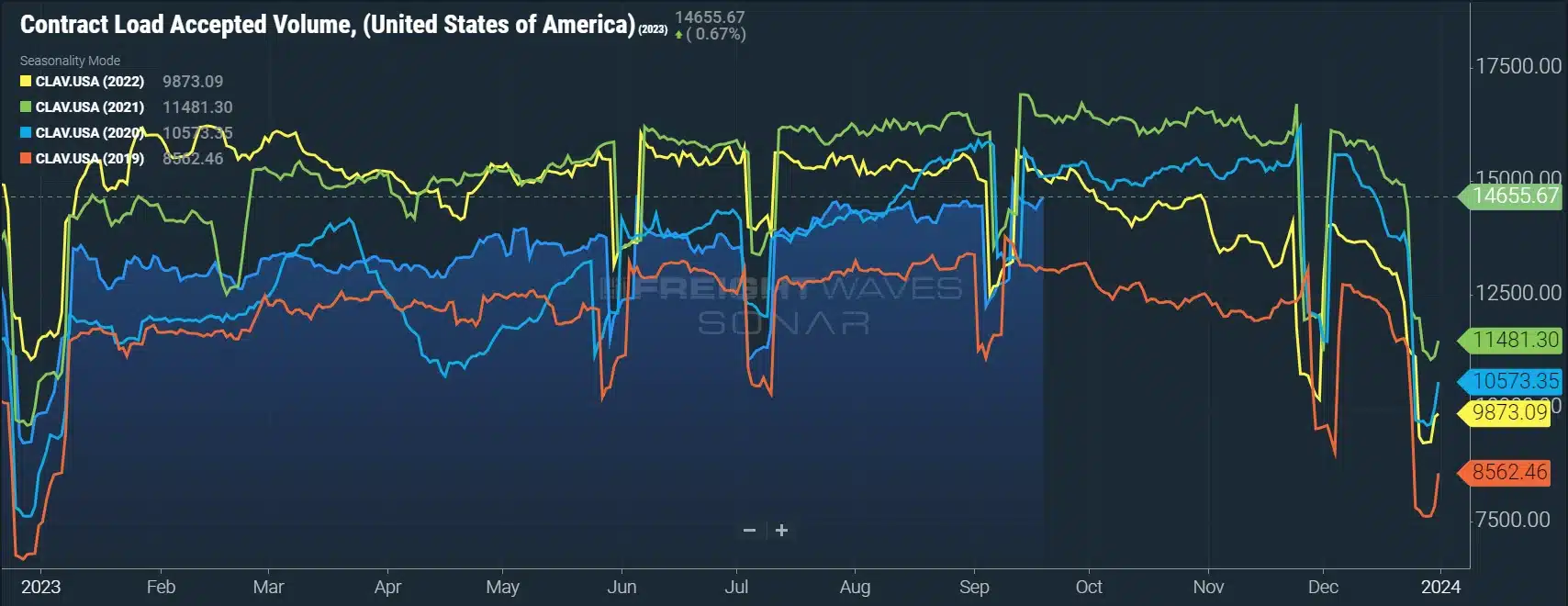

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 6.7% year-over-year, or 5.5% when measuring accepted volumes after the significant tender rejection rate decline.

Accepted volumes were up 0.8% month-over-month, driven by a 0.2% increase in accepted dry van tenders and a 9.7% increase in accepted reefer tenders. The overall increase is largely in line with the Cass and ATA reports and directionally with DAT spot trends. Consistency across all indices enables greater confidence that the data shows an improving demand environment.

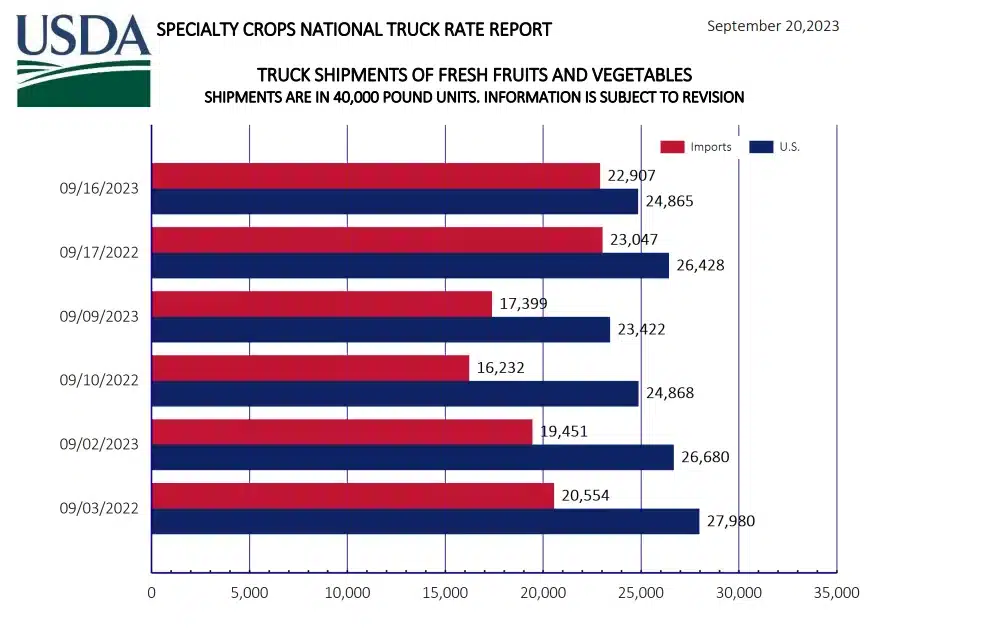

Contrary to the reefer tender volume trends reported by FreightWaves, USDA truck shipment data for fresh fruits and vegetables showed pullbacks in total truck shipments and the year-over-year growth rate from a month ago. In mid-August, the three-week trend showed total shipments were down 1% year-over-year, with both U.S.-grown and imported crop shipments down 1%. In mid-September, the three-week trend shows total shipments are down 3% year-over-year, with U.S.-grown shipments down 5% and imports flat.

What’s Happening: The capacity correction continues.

Why It Matters: Even hurricane Idalia wasn’t disruptive enough to drive a sustained capacity crunch, meaning we still have a ways to go.

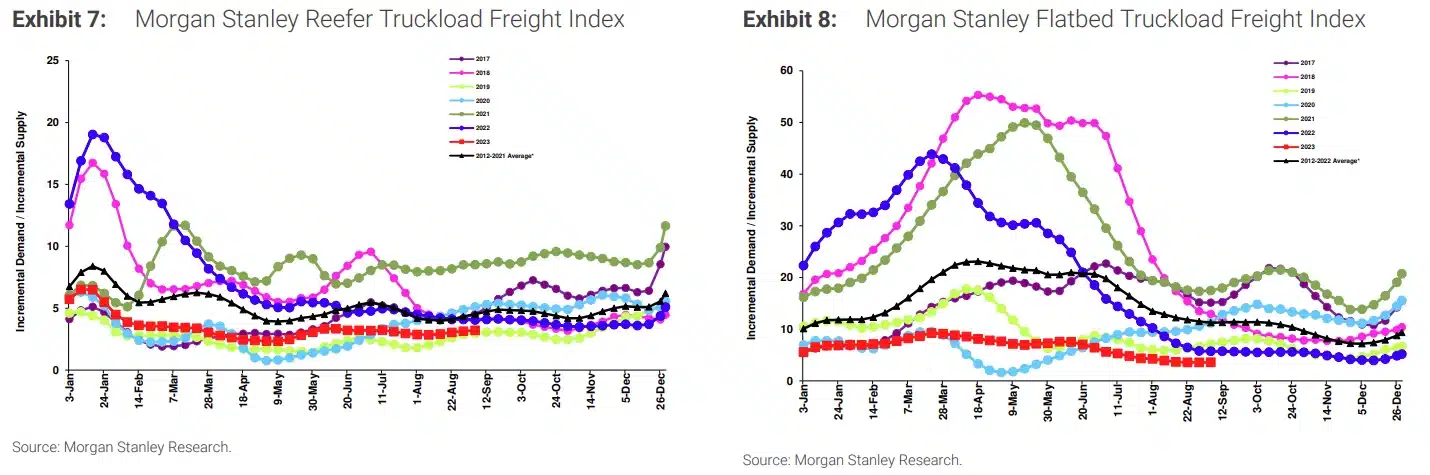

Summer peak season illustrated normal historical market tightness. Demand surges caused regional pockets of rate volatility, signaling that the market was generally becoming more balanced, so volatility associated with seasonal demand surges and disruptive events should continue. The supply and demand rebalancing seems to be further along for refrigerated equipment than for van, so reefer rate swings have been and may continue to be more volatile.

As expected, August van rates were volatile in certain pockets and regions, but it had little impact on tender acceptance and service for shippers at the national level. This trend demonstrates where we stand in the capacity correction cycle — conditions remain oversupplied, and further correction is needed before the market becomes vulnerable to sustained disruption.

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The numbers fluctuated between an early-month low of 3.3% and 4.39% by month-end, indicating routing guide compliance on shippers’ contractual freight remained historically high.

The year’s most significant disruptive event was Hurricane Idalia hitting Florida’s Gulf Coast the week before Labor Day. Although it affected conditions in the Southeast for a few weeks, the nationwide rejection rates for van rates only increased slightly.

For reefer equipment, however, it was a different story. Tender rejections jumped to nearly 11% for the first time in almost 18 months, a sign that the market is much more balanced and susceptible to disruption. However, despite the significant national average increase, localized rejection rates as high as 30%-40% in certain regions were driving the impact.

Regional tightness is moving from the Southeast and Northern Midwest as the produce season shifts to the Pacific Northwest. We agree with those forecasting a muted peak season as Q4 begins; however, the reefer environment could become challenging as we approach Thanksgiving and Christmas.

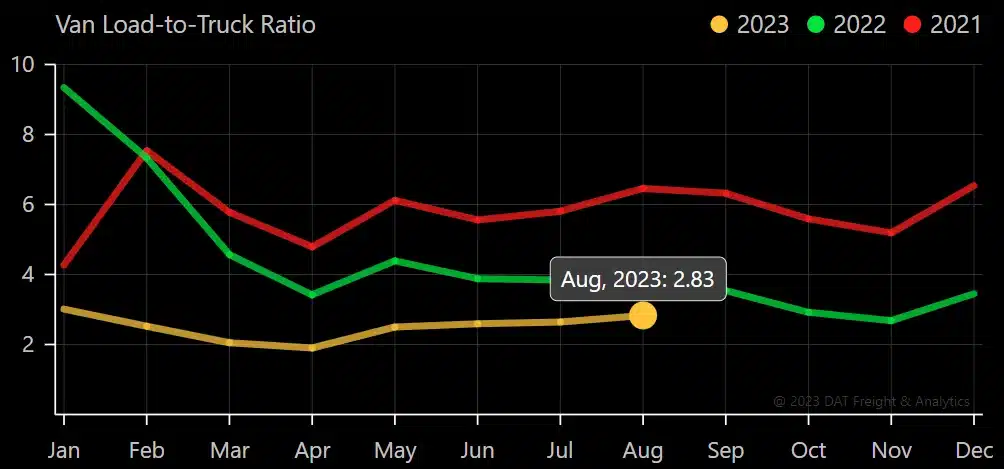

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. August data showed relatively flat conditions despite a meaningful spot load increase, indicating truck posts were also up.

The Dry Van Load-to-Truck Ratio was up 7.2% month-over-month but remains down 20% year-over-year, whereas the Reefer Load-to-Truck Ratio was up 14.5% month-over-month but down 37.8% year-over-year.

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

As expected, conditions tightened slightly before Labor Day. Hurricane Idalia also drove tightness, but all things considered, the index barely increased, indicating supply is still largely sufficient to support demand. Historical data points to potential tightening through the end of Q3 before easing early in Q4.

What’s Happening: Spot rates remain well below contract rates.

Why it Matters: Even though spot rates have found a floor, contract rates should continue to see downward pressure until the gap closes further.

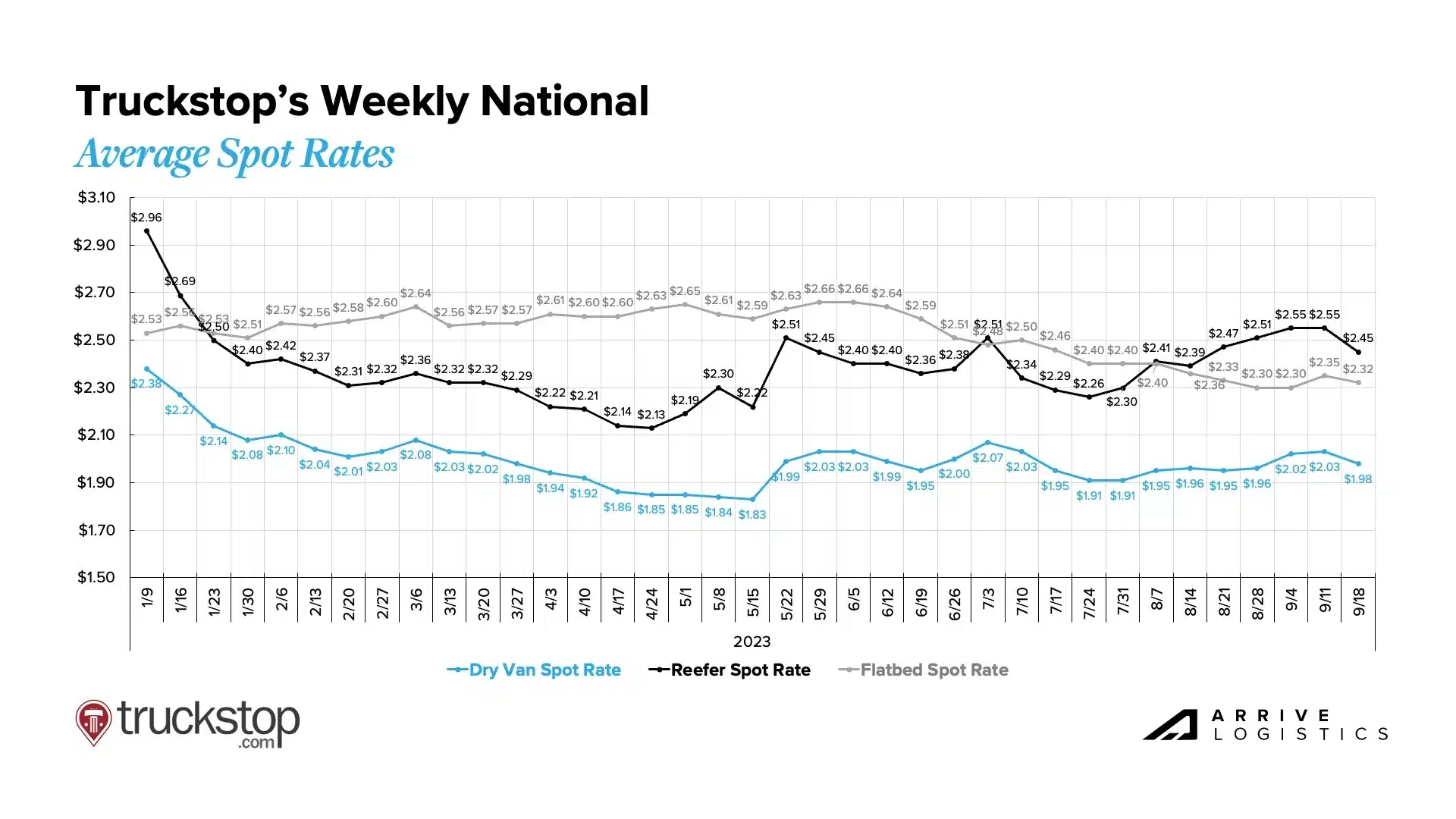

Truckstop’s Weekly National Average Spot Rates provide a detailed view of week-to-week rate movements and a real-time look into the current rate environment.

Following tender rejection trends, Hurricane Idalia caused rates to pick up in late August and early September. The impact was more pronounced for reefer equipment due to concurrent produce seasons in the Upper Midwest and Pacific Northwest. Flatbed rates, however, continue to trend down.

After picking up at the onset of the summer peak season, van and reefer rates have fluctuated with seasonal pressures but have not regressed to April lows. Steady demand improvements and the ongoing capacity correction are helping to solidify the spot rate floor. Van and reefer rates have bottomed out and are more likely to experience seasonal upticks than further declines.

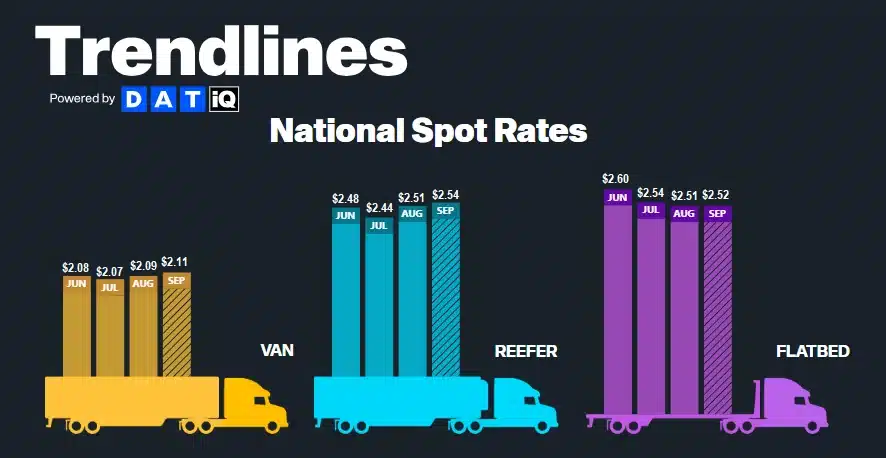

According to DAT, all-in spot rates, including linehaul and fuel costs, are up slightly for all three equipment types month-over-month. Since August, van rates are up $0.02 per mile, reefer rates are up $0.03 per mile, and flatbed rates are up $0.01.

All-in rates are rising as linehaul rates fall due to significant fuel price hikes in the last month. According to DAT, the dry van fuel surcharge increased from $0.44 to $0.55 per mile over the last two months.

The month-over-month van rate spread held steady at $0.49 in August and month-to-date in September after closing at $0.48 in July. Fuel volatility is also contributing to this trend, but the gap should continue to close now that spot rates have found a floor and contract rates face ongoing downward pressure.

All-in dry van spot rates are down 13.9% year-over-year in September, while linehaul spot rates are down 14.8%. All-in dry van contract rates are down 15.0% year-over-year, and linehaul contract rates are down 16.0%. These improvements illustrate that peak deflationary pressures are behind us.

Figure 16: DAT Dry Van National Average RPM Spot vs. Contract

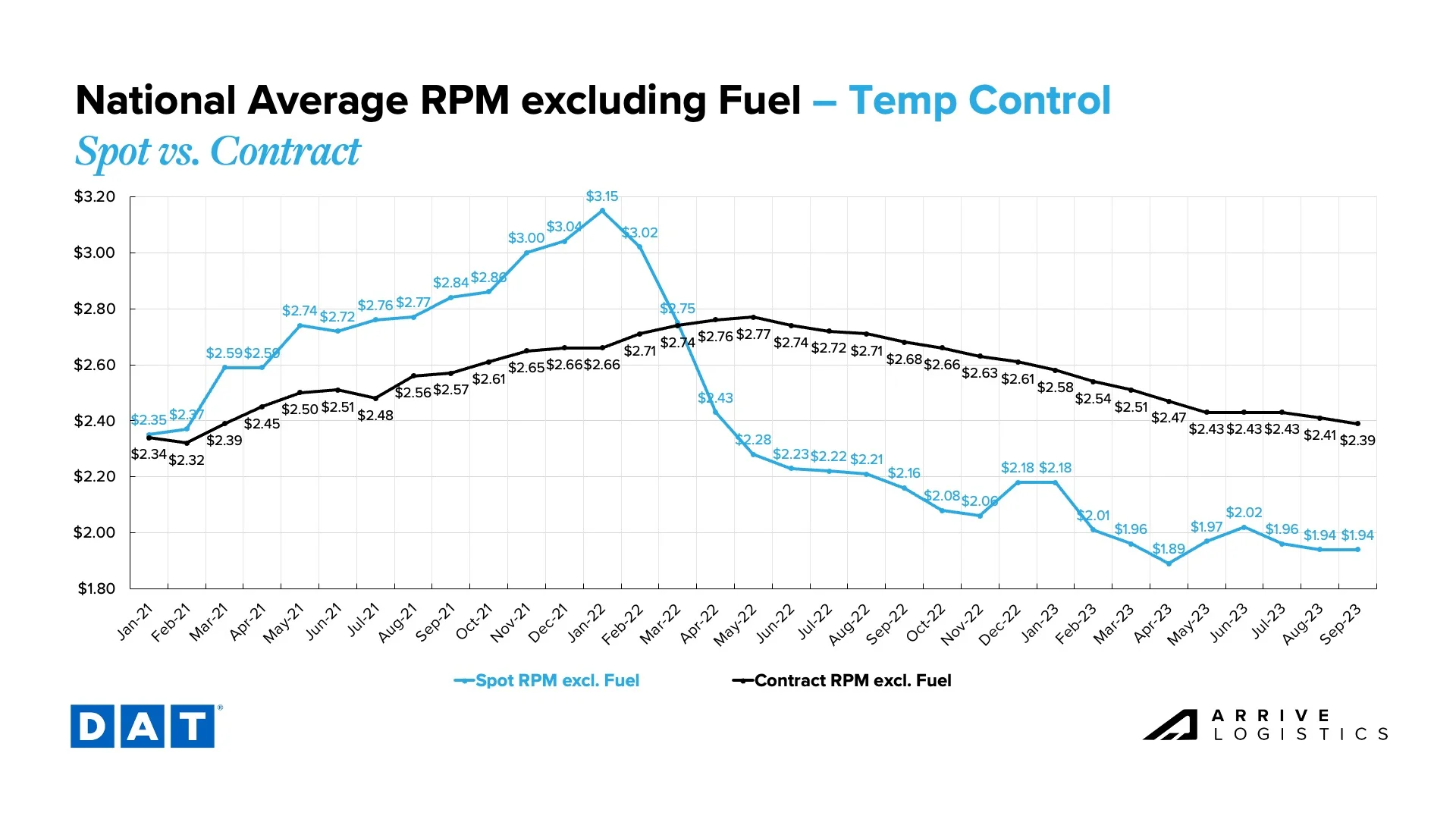

Monthly reefer rate trends followed van trends throughout Q3, easing from a June high as the summer peak season faded. After reaching an April high of $0.58, the reefer equipment spot-contract rate spread dipped as low as $0.41 when spot rates peaked in June but is back up to $0.45 in early September. Like van trends, the gap should further close now that spot rates have found a floor and contract rates continue to undergo downward pressure.

Down 10.8% year-over-year, the current reefer contract rate is $2.39 per mile, excluding fuel, while the current reefer spot rate is down 10.2% year-over-year to $1.94 per mile, excluding fuel.

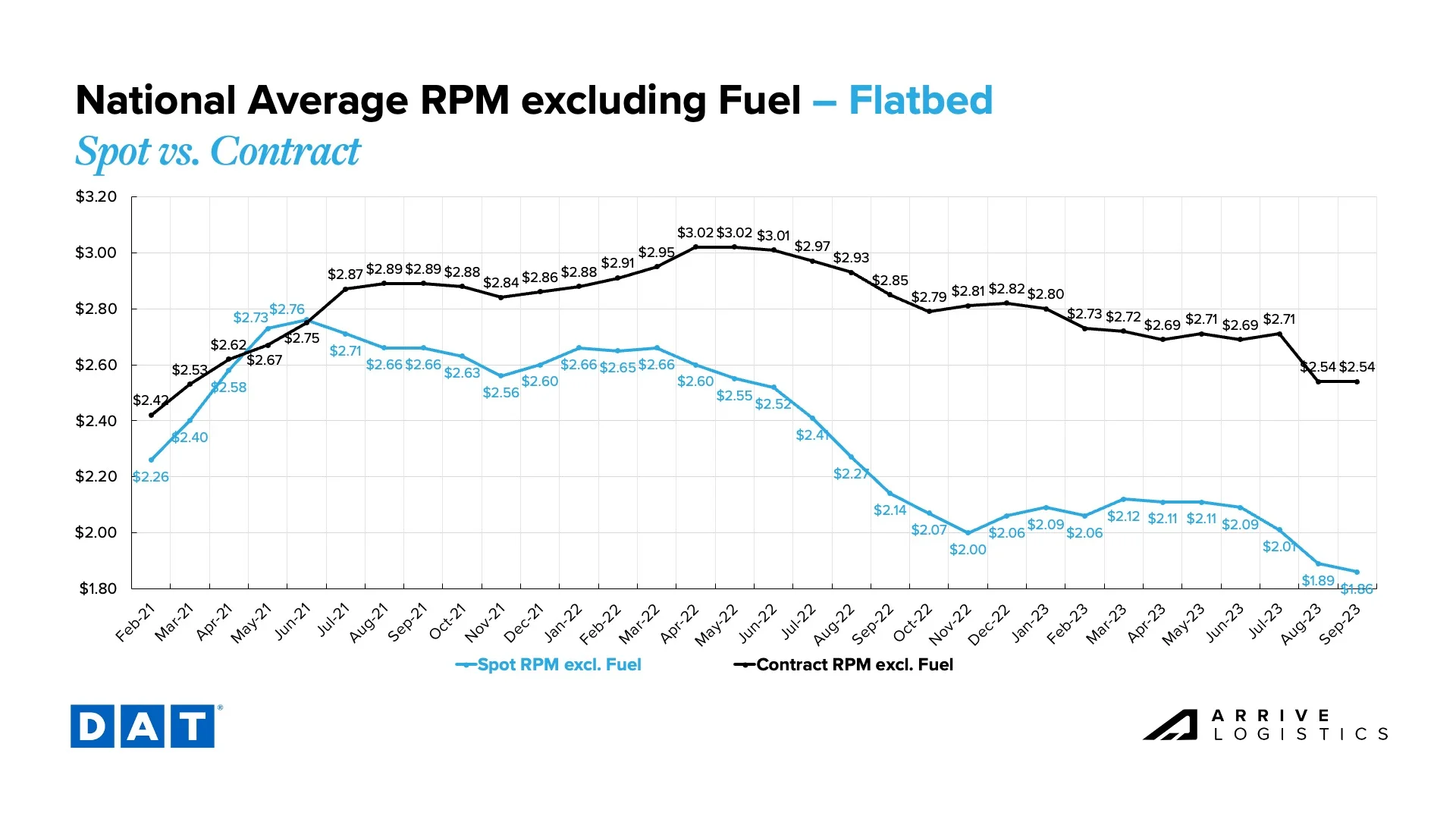

After stabilizing for the first half of 2023, Flatbed rates have rapidly declined recently. Despite contract rates falling quickly, the spot-contract gap is still near an all-time high at $0.68 per mile after dipping to a low of $0.58 in April. In September, spot rates are currently at $1.86 and contract at $2.54 per mile, excluding fuel.

What’s Happening: The United Auto Workers (UAW) strike could significantly impact Ontario, Michigan, and Ohio freight markets. Carriers will likely need to source volume from other areas for the strike’s duration.

Why It Matters: Carriers will likely need to source volume from other areas for the strike’s duration.

The United Auto Workers (UAW) strike will likely impact the transportation of automotive freight between Ontario, Michigan, and Ohio. Carriers will likely need to source volume from other areas for the strike’s duration.

Much of the auto freight that moves in the affected areas is contractual; this means carriers are unlikely to go far from the market to find freight, so there could be an influx of moving to the Midwest.

Truckload backlogs from the Port of Vancouver strikes have been cleared, and backlogs of intermodal freight in the region have been reduced.

Rates remain relatively flat across the country, as the market has yet to experience any capacity tightness. A shift in market conditions is more likely to come from a supply reduction than a demand shock.

The Bank of Canada continues to hold rates as their Federal Bank continues its attempts to reduce inflation.

What’s Happening: Auto theft is still a significant issue for cross-border shipping.

Why It Matters: We recommend shipping with CTPAT or OEA-certified carriers.

The summer peak season is now in the rearview mirror, with overall volumes tapering off over the past month.

As construction season slows down, so do production lines.

Retail freight, such as toys and gifts, is seeing an uptick in volumes as retailers prep for the 2023 holiday season.

Load-to-truck ratios in the Laredo market have dropped to around two after sitting around five earlier this year. The ratio will likely rise again around the holiday season.

Although the UAW Auto strike will impact certain carriers, it is unlikely to have a large-scale impact as there is still excess capacity in the market.

Produce such as peppers and onions will soon begin moving out of Northwest Mexico into El Paso, Nogales, Tijuana, and Mexicali.

Auto theft continues to be a significant issue, with sources saying there were 58 auto thefts per day during Q2 in Central Mexico. To protect your freight, we recommend shipping with CTPAT or OEA-certified carriers.

The Mexican Peso is still going strong as the nearshoring trend continues. Smaller fleets may ask for increased rates to offset the financial impact, while larger fleets are likely to keep rates as is.

What’s Happening: The LTL market is still seeing increased shipments with lower weightage and size.

Why It Matters: If this continues, it could increase operating costs and inefficiencies throughout the industry.

What’s Happening: Temp control market conditions are trending in line with typical seasonality.

Why It Matters: Certain regions are experiencing tightness as the produce season shifts — read on to see where.

East Coast

Upper Midwest

Central Plains

West Coast

Pacific Northwest

What’s Happening: Rates typically increase during this time of year.

Why It Matters: Rates remaining flat reflect a softer market than usual.

The open-deck market remains relatively quiet as the soft period between November and February approaches.

Areas such as Mississippi, Alabama, Georgia, Arkansas, and Tennessee continue to see some tightness, with load-to-truck ratios in the double digits.

Intra-Texas is still experiencing elevated demand, but ample capacity continues to support the market.

The oil and gas industry continues to drive demand, with steel pipes being one of the most common commodities.

Rates typically increase during this time of year but are still flat for now, indicating softer than normal market conditions. We usually see a decrease in truck costs during Q4, but they will likely remain steady due to the influx in port volumes.

What’s Happening: Tough conditions drive more carriers out of the market.

Why It Matters: This trend will continue as capacity moves closer to equilibrium with demand.

Conditions continue to worsen for carriers in September. Not only have spot rates fallen considerably over the past 18 months, but if the recent rise in fuel costs persists, it could cause many more operating authorities to shut down.

Carriers have largely been patient through the down cycle, but conditions are starting to take a toll as the capacity correction continues. With only a modest upside to truckload demand on the horizon, carriers are unlikely to see conditions improve meaningfully through the year’s end beyond a few seasonal periods of opportunity. Thus, carrier exits will likely increase in the coming months.

This month, high revocations again led to a negative net change in the carrier population. Strong contract service numbers indicate the correction is far from over, but this trend will inevitably lead to a capacity crunch, as it always does in the market cycle.

Increased operating expenses are the primary culprit causing carriers to close, as overall rates are still high compared to historical (pre-pandemic) levels. This trend continues to drive record-high revocations of authority, although August totals were the lowest in more than a year at just over 6,400 carriers.

Total employment has reached the lowest level since March of 2022 after dropping by more than 41,000 jobs over the past three months. Though this is largely due to Yellow closing in August, some of those job losses may show up in September.

Given the worsening truckload rate environment, the trucking employment plateau observed in the first half of 2023 defied expectations. Carriers have focused on retaining drivers, but the longer current conditions persist, the more likely overall employment will fall further.

Figure 20: FTR’s Monthly Change in Trucking Jobs

A key trend we’re still watching is revocations outpacing new carriers entering the market for 10 of the last 11 months, reducing the total number of carriers. A significant amount of capacity that entered the market over the last few years remains unutilized, so we expect this disparity to continue for at least the near term.

What’s Happening: Rising retail volumes are a bright spot heading into Q4.

Why It Matters: Though promising, manufacturing sector contraction and uncertainty around continued consumer spending strength are concerning.

Recent truckload demand data is encouraging. With tonnage rising, it is easy to point to slowing destocking efforts as an ongoing and future demand driver. Volumes should also get a boost from normalizing retail ordering patterns as the inventory cycle resets.

On the flip side, there are still concerns about manufacturing trends, consumer spending, and 2024 housing and construction trends amid the pending resumption of student loan payments and the potential for an extended period of elevated interest rates.

The National Retail Federation (NRF) recently reported that import cargo volumes at the nation’s major container ports may hit the 2 million TEU mark for the second consecutive month in September and remain there in October. NRF Vice President Jonathan Gold says, “These are strong numbers, and a sign retailers are optimistic about the holiday season since they don’t import merchandise unless they think they can sell it.” This means we could see a good finish to peak season, especially if consumers show strength early on.

If consistent import volumes continue through Q4, year-over-year declines of 11.4% in August could flip to 12% increases in year-over-year import growth by December. This gives some context to how the inventory cycle’s reset could impact demand and just how large a step back retailers took a year ago to correct their overstocked inventories.

Figure 22: NRF Monthly Imports

The latest ISM manufacturing report indicated more easing backlogs as new orders contracted for the twelfth consecutive month amid slowing production. The new orders index contracting adds further uncertainty about future backlogs and, in turn, truckload demand. Manufacturing was expected to be one of the main volume drivers in 2023, and if contraction continues, demand will likely fall further than previously forecasted. However, stable production levels indicate the sector still has pent-up demand, which should enable healthy volumes in the near term.

FTR’s latest truck loadings forecast for 2023 improved slightly and turned positive this month, increasing from -0.1% year-over-year growth a month ago to 0.2% as of this month. FTR noted that the latest outlook indicates stronger activity for loadings related to the automotive and construction sectors but weaker activity for food and chemicals. The 2024 outlook saw a meaningful positive growth revision, from 0.2% to 0.9%, but slow growth will likely continue into next year.

What’s Happening: Sticky inflation is increases chances of higher for longer interest rates.

Why It Matters: Higher interest rates are stifling for the growth potential for freight demand.

August CPI data showed that inflation will likely remain sticky even though price increases have cooled notably. While there is no direct relationship to truckload demand, it is easy to make a connection between elevated interest rates and slowing freight volumes — this is the concern as we look towards 2024.

If inflation remains above the target, it is unlikely that the Fed will lower interest rates, leaving questions about whether the inventory cycle reset will be enough to stabilize freight volumes. If inflation were to ease, however, it would open the option for the Fed to lower interest rates, which would almost certainly mean increased housing activity and capital investment in manufacturing, two sectors that contribute meaningfully to freight demand and are currently slumping.

Bank of America card data showed consumer spending per household increased by 0.4% year-over-year in August. However, card spending per household dropped by 0.2% month-over-month on a seasonally adjusted basis.

Spending was weak across most categories except gas, where price increases were mostly to blame. Bank of America noted that the monthly spending decline was not related to Hurricane Idalia or pending student loan payment resumptions; it was simply a return to trend-like spending. Therefore, the August cooldown need not disrupt the broader narrative of consumer resilience. As long as the labor market remains healthy, BofA remains positive on the consumer outlook.

The past month solidified our outlook for supply and demand driving the freight market’s recovery in 2024. A resilient consumer and slowing retail destocking support flat to stable demand growth, and supply reductions driven by high revocations of operating authority amid poor trucking conditions will leave the market more vulnerable to disruption.

While the recovery may be further along for refrigerated equipment, the market is behaving mostly as expected from a seasonal perspective. Recent volatility was not impactful enough to disrupt routing guides in any meaningful way for van freight, which means the van market is still largely stable. We expect greater challenges for reefer equipment in line with seasonal demand increases around the holidays.

Our 2024 outlook is mostly unchanged. The spot-contract gap remains elevated, which should result in deflationary pressure on contract rates. However, current spot rate levels will not be sustainable for the long term, especially if fuel prices stay elevated and squeeze carrier profits.

We expect at least one more RFP season before contract rates drop low enough to drive market-wide exposure to prolonged routing guide disruption. In the meantime, shippers running contractual loads should see strong tender acceptance rates and service levels continue due to the oversupply of capacity, particularly on van equipment.

The market will become increasingly vulnerable to disruptive events as capacity normalizes throughout the remainder of the year, but we do not anticipate any significant disruptions ahead of 2024.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.