"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Port Strike: The East and Gulf Coast port strike is on hold. Both sides have returned to the negotiation table, and ports are again fully operational. The short-lived strike did not create any major disruptions. However, whether the two sides will reach a long-term agreement by January remains uncertain. As a result, shippers continue to make contingency plans like shifting operations to West Coast ports, which could strain infrastructure in the region until stakeholders reach an agreement.

Hurricane Helene: Hurricane Helene caused considerable damage, particularly in North Carolina, leading to long-term road closures that have disrupted regional routing and operations. Despite heavy damage, the storm’s short-term impact on the freight market appears to be limited and regional. However, recovery efforts may take several months and could drive future freight demand.

Hurricane Milton: Florida continues to navigate the fallout of Hurricane Milton. Regional inbound and outbound freight markets experienced significant disruption immediately following the storm but are normalizing as power is restored and repairs are made. The storm also did not meaningfully impact the long-term outlook for the national freight market.

Volatility hit the freight market in late September and early October due to the East and Gulf Coast port strikes and consecutive destructive hurricanes. However, the impact of these events was regionalized, and conditions normalized quickly as capacity easily absorbed the additional volume. Otherwise, demand remains stable, and capacity is abundant. As a result, the market continues to fluctuate in line with seasonal expectations, and major market movement is unlikely until mid-2025.

Key Takeaways:

Spot postings declined on a seasonal and annual basis in September.

Trucking employment numbers continue to decline, indicating capacity is undergoing attrition due to poor market conditions. However, overall levels remain elevated.

Tender rejections increased due to recent disruption, but rates remain relatively stable, indicating that capacity is sufficient to absorb demand.

National rates continue to follow seasonal expectations outside of regions impacted by Hurricanes Helene and Milton.

Clearinghouse regulations taking effect in November could impact over 100,000 drivers with “prohibited” status.

Inflation continues to fall, and more interest rate cuts are likely, but neither will impact the market until 2025.

What’s Happening: Aside from regional spikes, demand followed seasonal expectations.

Why It Matters: The market environment remains soft, with no change imminent.

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007. Despite recent disruptions, the latest reading shows no meaningful activity or demand increase as of mid-October, with trends returning to the 10-year average amid seasonal cooling.

Morgan Stanley Dry Van Truckload Freight Index

The most recent ACT For-Hire Trucking Supply-Demand Balance Index reading ticked up to 56.9 from 51.1 in July, reflecting increased import levels and demand movement in late summer. The market continues to balance out. Slowing tractor sales and private fleet growth will continue to prime conditions for an inflationary flip, though it may not occur for several months.

In recent weeks, hurricanes and the port strike disrupted routing guides and caused a seasonal deviation. However, abundant capacity and limited spot market demand mitigated the impact of these events.

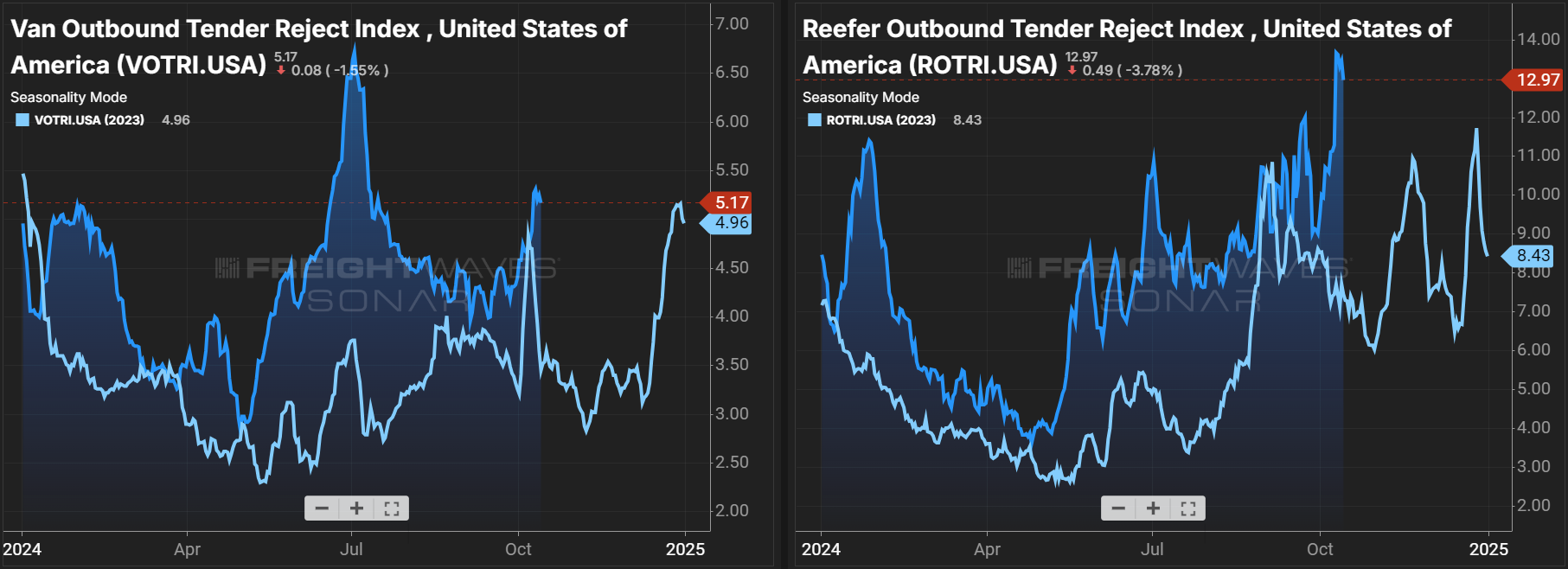

The Sonar Outbound Tender Reject Index (OTRI), which measures the rate at which carriers reject the freight they are contractually required to take, deviated slightly from 2023 trends. In October, demand typically eases, and capacity opens up. However, recent disruptive events caused regionalized volatility and a marginal increase in tender rejections at the national level. Conditions should continue to cool as November approaches, except for reefer markets, where tender rejections have reached the highest level in over two years.

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on its spot board. The most recent reading shows three consecutive months of declines, confirming the market is cooling in line with seasonal expectations. Interestingly, rising rejection rates did not impact recent load-to-truck data, indicating that the spot market is not experiencing the pressure that typically comes with routing guide disruption.

What’s Happening: Supply remains plentiful even amid increased demand.

Why It Matters: Strong capacity levels will limit any short-term spot rate increases.

FTR’s latest revocation data shows a carrier population decrease for the 21st time in the last 24 months. Revocations ticked up month-over-month, while new entrants declined sequentially, indicating carriers continue to struggle or exit the market amid persistently low revenues. However, many may be holding out for a market inflection in early 2025.

FTR’s Carrier Revocations, New Carriers & Net Change in Carrier Population

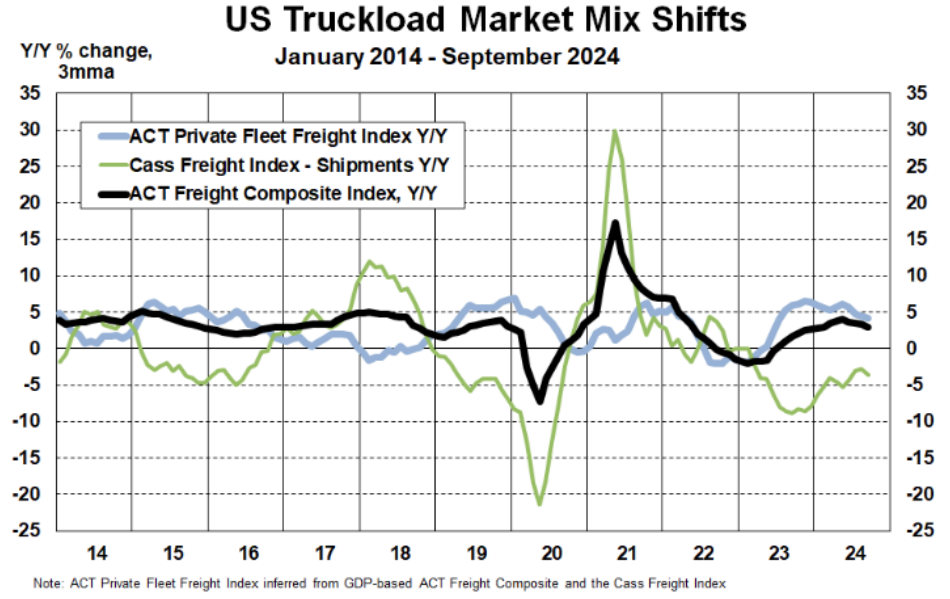

We continue to monitor the evolving role of private fleets as they increase their share of for-hire freight annually despite year-over-year shipment volume declines. With less freight available, for-hire carriers must negotiate aggressively on rates to maintain volume and revenue, which applies downward pressure on the market. If this trend continues and private fleet participation in the for-hire market grows, it could extend the current rate and supply environment.

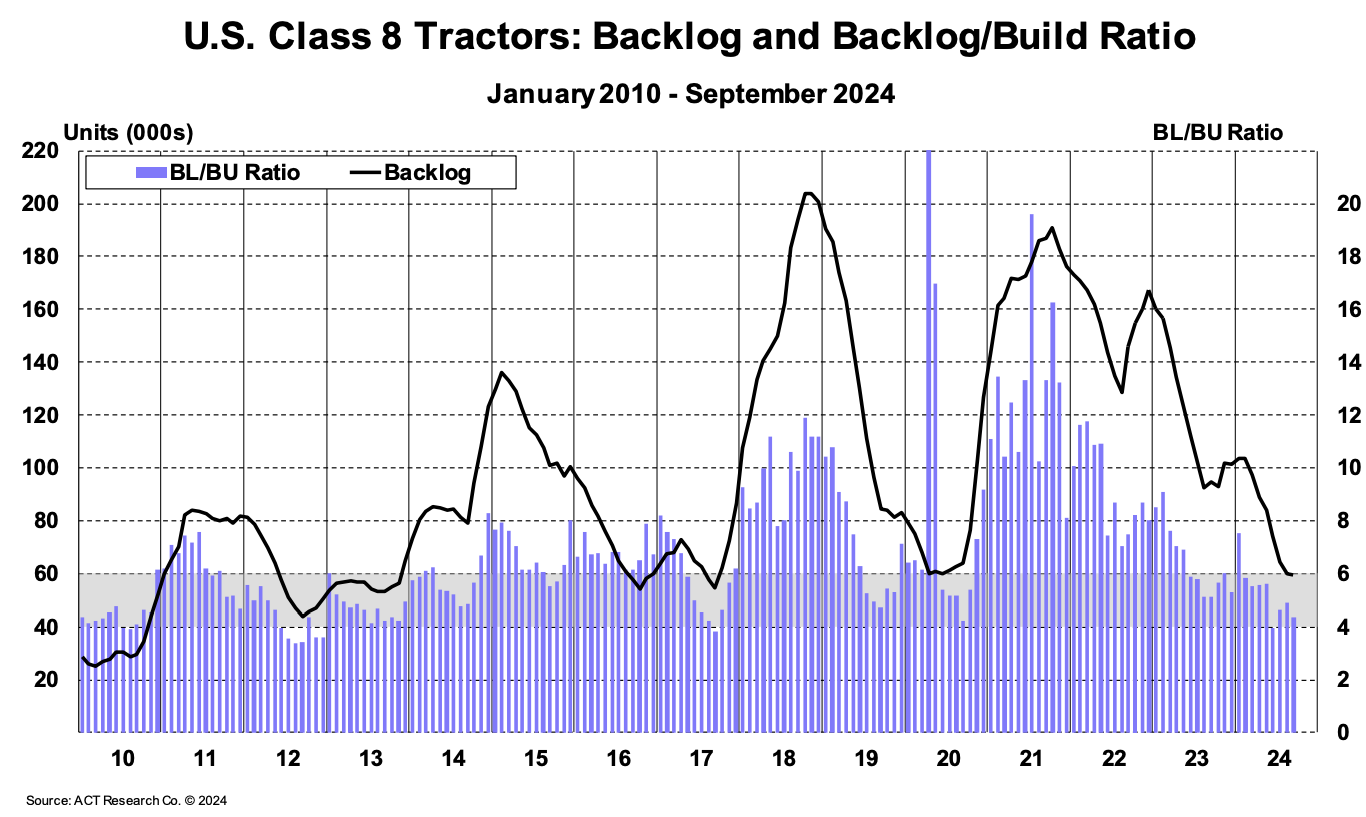

Based on the latest ACT Research data for U.S. Class 8 Tractors, the backlog-to-build (BL/BU) ratio fell from 4.9 months in August to 4.3 months in September, indicating that lower order rates continue to shrink the backlog. Despite experts forecasting a slow order season, backlogs may start to tick up as the season begins.

The most recent ACT For-Hire Driver Availability Index reading rose from 53.1 in July to 55.4 in August. This marks 27 consecutive months with a reading at or above 50 and indicates that there is no driver shortage. High driver availability likely correlates to older drivers staying active longer to cover higher living costs, as well increasing migration. Ultimately, the driver environment remains soft and is unlikely to change meaningfully in the near future.

One of the more notable impacts on the capacity environment could occur on November 18th, 2024, when drivers with prohibited status will become ineligible for employment by law. According to ACT Research, approximately 177,000 drivers currently have prohibited status. Though many are already unemployed, these drivers have all been eligible for employment until now. Removing this population from the workforce amid holiday peak season volatility could create significant disruption.

Trucking jobs fell by 700 on a seasonally adjusted basis in September, a symptom of poor spot rate conditions and increased contract rate competition. Nearly 12,800 trucking jobs have disappeared since April 2024, including 4,400 in the past four months. The decline will likely continue as private fleet investment decelerates and carriers struggle to operate in the current rate environment. However, recent spot volatility plus the upcoming retail peak season could mitigate further job losses until early next year.

What’s Happening: Demand should remain steady through year-end.

Why It Matters: Despite some up and downside risks, the market is still safe from demand-related disruption.

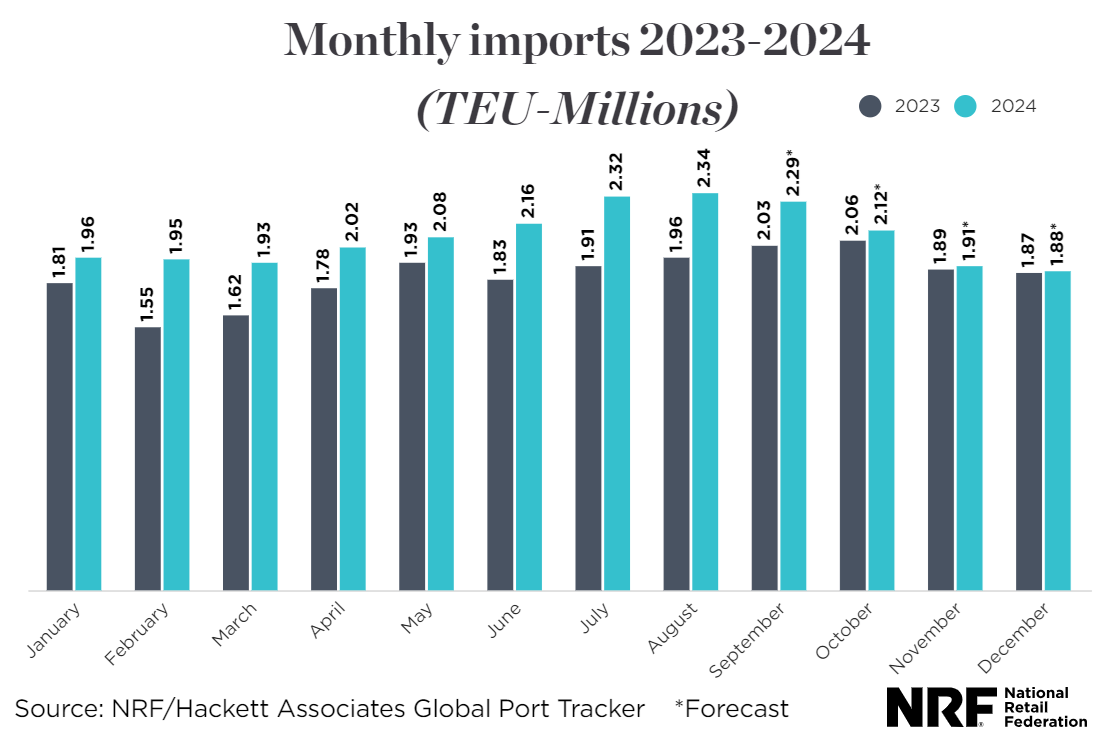

Forecasts continue to show stable freight volume. Both upside and downside risks are present, but there is no clear indication that demand shifts will impact the market in the near term. The latest National Retail Federation’s (NRF) forecast calls for year-over-year import volume increases for the remainder of 2024, with 25 million total TEUs expected by year-end.

While the East and Gulf Coast port strike is on hold until mid-January, shippers pushing freight forward during the summer months to avoid potential disruption led to a significant year-over-year increase in import volume. That surge has subsided, and imports for the rest of the year should be closer to 2023 levels than those from the first nine months of 2024. Despite the looming threat of the port strike resuming, major import forecast changes are unlikely for the remainder of the year as almost all holiday-related freight has arrived.

DAT reports that September spot load postings were down 1.8% month-over-month and nearly 13% year-over-year. The month-over-month decline mirrors August trends and indicates that the market may be cooling in line with seasonal expectations. The sequential freight reduction in September likely results from increased API utilization and fewer business days. Despite the pullback, this outcome is an improvement from the 12.3% month-over-month decline and 43.4% year-over-year decline in September 2023.

What’s Happening: Recent disruptions had a nominal market impact.

Why It Matters: Inbound demand and rates are down but outbound rates are rising.

What’s Happening: Cross-border Mexico markets remain quiet.

Why It Matters: Shippers are pricing aggressively to lock in low rates.

What’s Happening: Temp control supply was tested by recent volatility.

Why It Matters: Rates have settled, but it remains clear that market recovery is furthest along for temp controlled capacity.

East Coast

Winter weather will likely increase tightness through year-end.

Midwest

South

West

Pacific Northwest (PNW)

What’s Happening: The LTL market remains steady.

Why It Matters: No major fluctuations are expected in the near future.

What’s Happening: Demand continues to decline.

Why It Matters: Increases are unlikely until February.

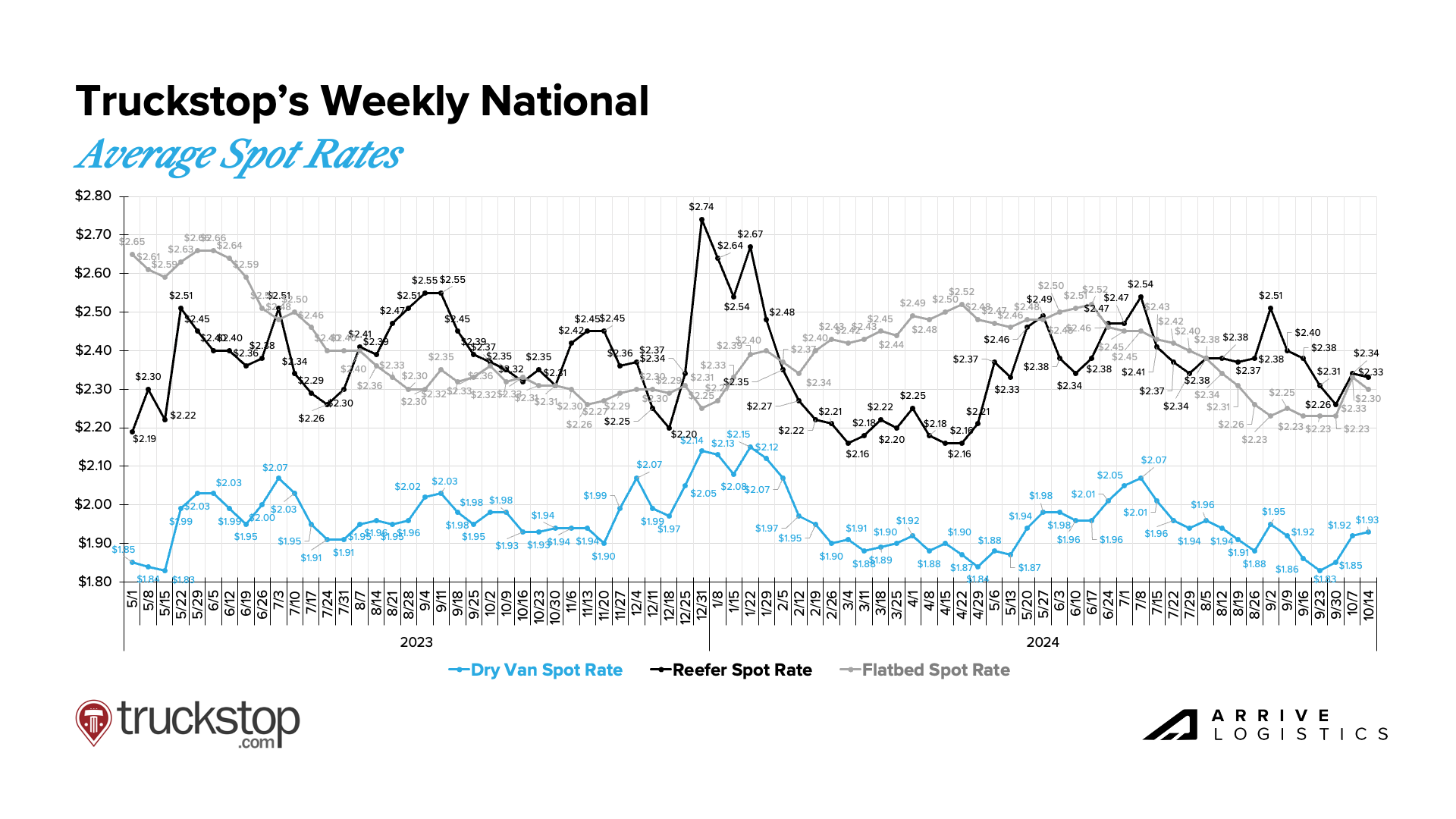

What’s Happening: Spot rates spiked in regions impacted by storms, but otherwise remained flat.

Why It Matters: Rate patterns should continue to follow normal seasonality.

Recent disruptive events caused spot rates to rise sharply in late September and early October. These spikes coincided with increased tender rejections triggered by travel delays and road closures in affected areas. Most of that volatility has subsided and rates are expected to normalize during the second half of October and rise again as the holidays approach.

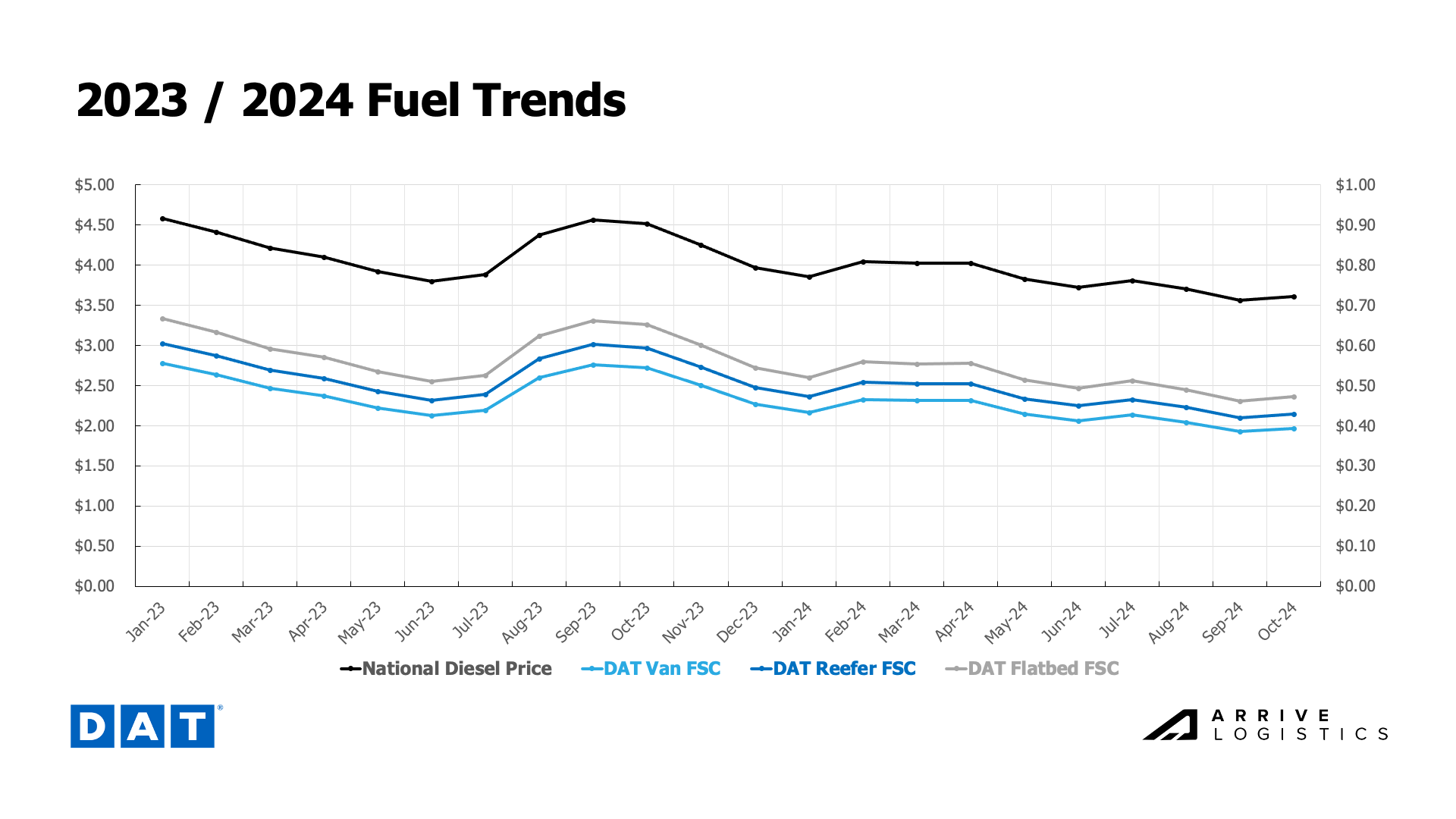

National diesel prices remain low but have ticked up in consecutive weeks, likely due to supply chain disruptions caused by Hurricanes Helene and Milton. Disruptions aside, fuel prices are steady, production remains strong and inventories are full. While current fuel prices should hold, winter weather and escalating conflicts in the Middle East remain risks.

DAT dry van data shows spot rates were flat in September and then increased in early October, especially in regions impacted by Hurricane Helene and Milton. As conditions in those areas normalize, rates will likely return to levels observed in October 2022 and 2023.

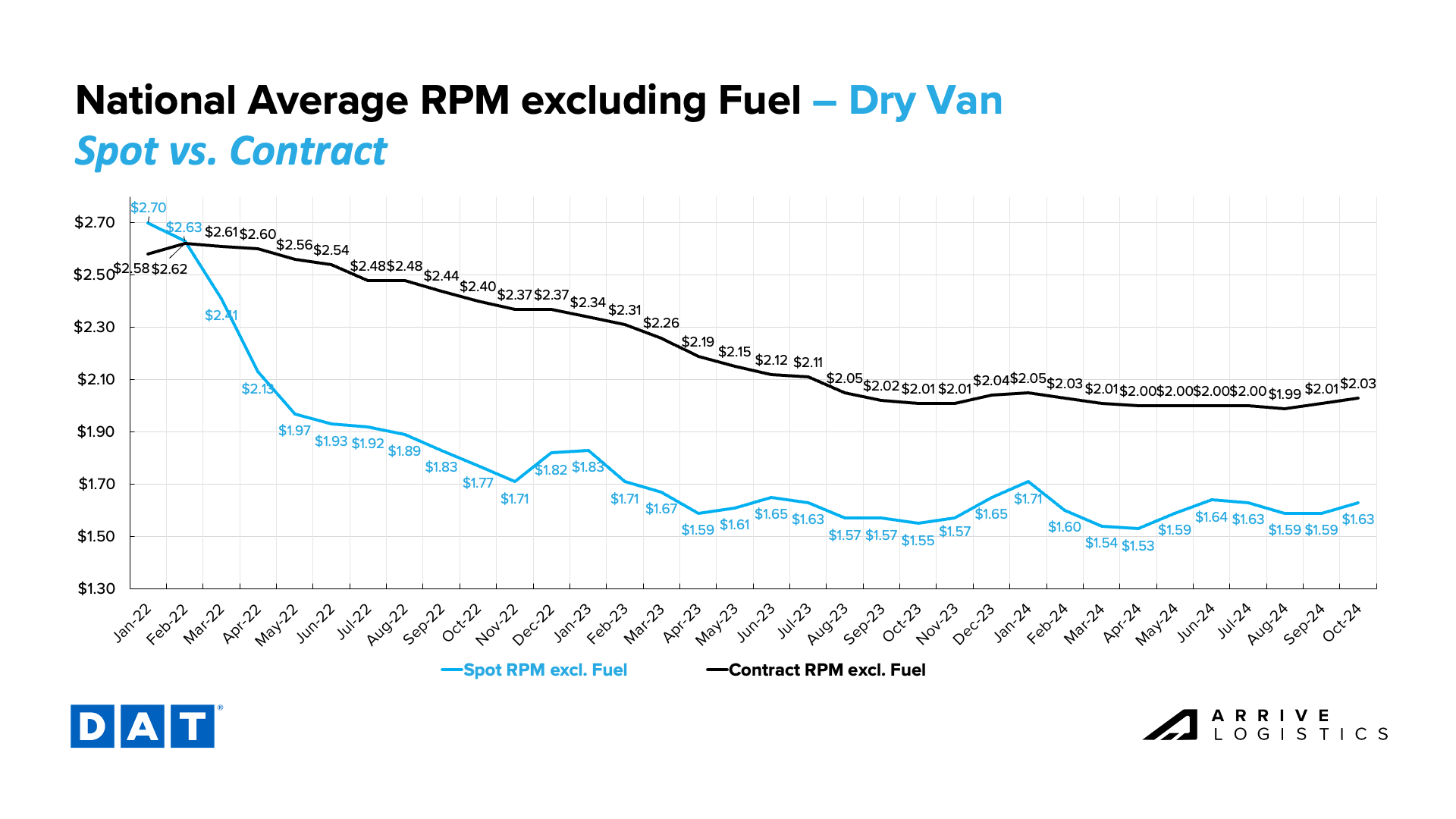

Contract rates remain relatively flat, with marginal increases in September and early October. As the RFP season begins, shippers may look to lock in long-term contracts to insulate themselves against expected rate increases in 2025.

The spot-contract rate gap remains relatively wide at $0.40 per mile, excluding fuel, indicating the market is still safe from disruption.

Early October reefer trends differed slightly from dry van trends. Spot rates remain at $1.95 per mile, excluding fuel, and contract rates fell by $0.01 to $2.31 per mile.

This year’s spot rate trend is noticeably stronger than October 2022 and 2023, which had drops of $0.08 per mile and $0.06 per mile, respectively. Reefer market disruption should continue through year-end, causing rates to increase sharply.

Flatbed rates remain relatively steady but rose slightly in early October, likely due to increased recovery-related demand in regions impacted by Hurricanes Helene and Milton. Contract rates are still well above spot rates at $2.56 per mile.

What’s Happening: Consumers remain frugal yet cautiously optimistic.

Why It Matters: This trend will likely continue until interest rates and inflation fall further.

Inflation continues to decline and move closer to the historical 2% target. The reading of 2.4% in September was the lowest since 2020. As a result, we expect more rate cuts in the near future, which would be inflationary and an upside risk to demand. As interest rates decline, consumer spending and housing activity should pick up and positively impact freight demand in 2025.

Recent Bank of America credit card data shows spending declined 0.9% year-over-year in September after rising 0.9% year-over-year in August. However, spending increased just 0.6% month-over-month on a seasonally adjusted basis as consumers remained cautious. Services sector spending increased on a quarterly basis, but retail spending continued to shrink slowly. Ultimately, consumer spending is expected to stay relatively stable until interest rates fall further and wages continue to grow.

In recent weeks, the freight market was tested by three potentially disruptive events. Each time, capacity absorbed the additional volatility without any major impact on a national scale. Regional impacts were more significant, but even those markets normalized quickly as urgent recovery efforts slowed.

Outside of these events, there have been no meaningful demand spikes or capacity declines this year. As a result, the market continues to follow normal seasonality and remains relatively stable ahead of the holiday season.

Moving forward, rates should mostly hold steady, with some increased movement as the holidays approach, especially in areas impacted by hurricanes and regions where winter weather could create disruptions.

The Arrive Carrier Market Outlook, created by Arrive Insights™, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, ACT Research, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.