"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

Recent trends continue to support our forecast. As anticipated, the summer peak season created spot market volatility without much disruption to contractual service levels. The gap between spot and contract rates is still large and driving downward pressure on contract rates.

Rate pressures eased in the weeks following July Fourth as seasonal demand slowed and shifted; however, a few pockets are still experiencing challenging capacity conditions.

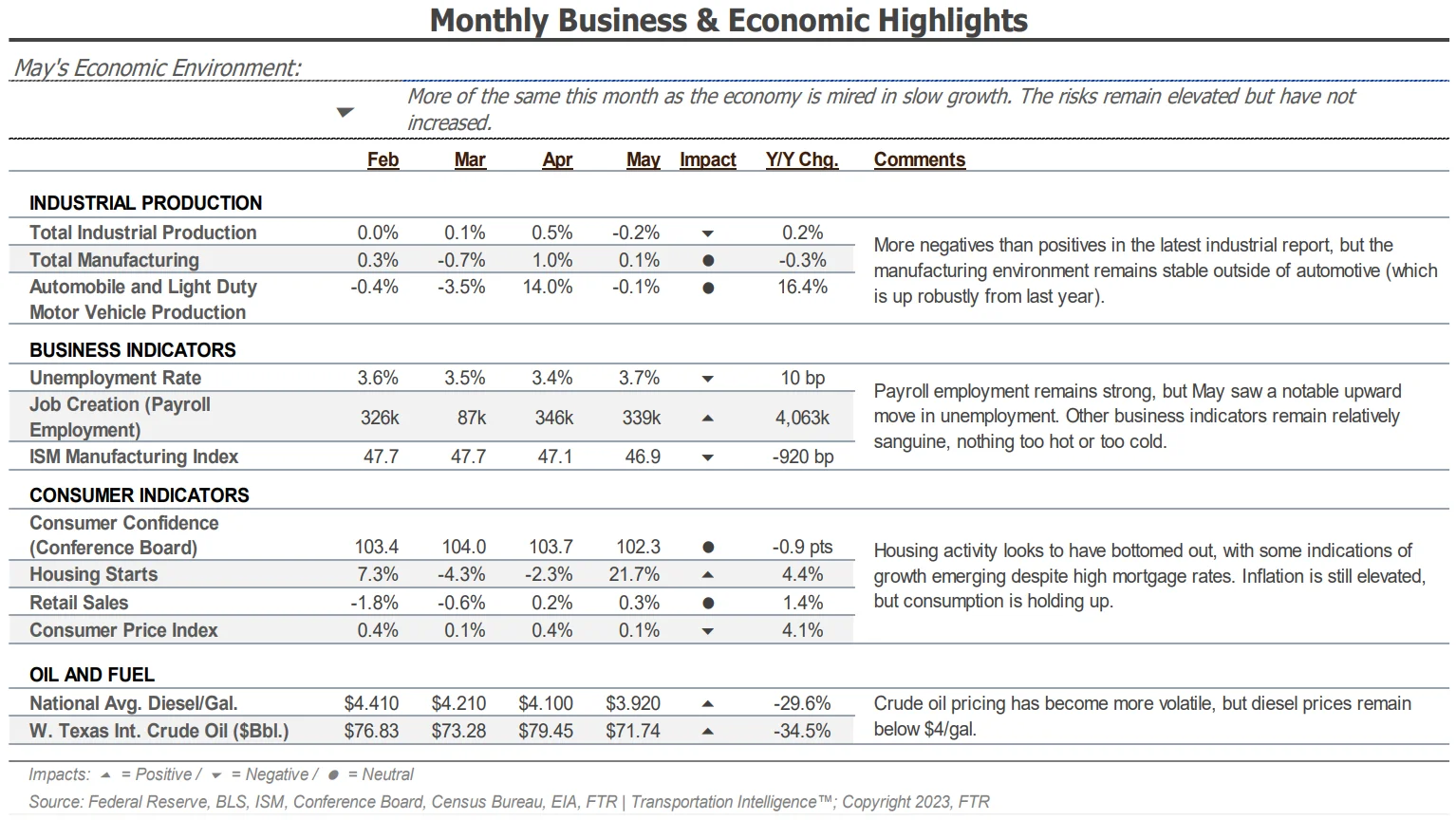

There are no meaningful changes to our outlook for freight demand. The economy is showing signs of easing inflation and slight pullbacks in consumer spending due to FED rate hikes, but the strong labor market is encouraging.

Driven by poor trucking conditions, the capacity correction will likely pick back up as spot rates see more downward pressure on the heels of the summer peak season. This will increase the market’s vulnerability to disruption, especially after another RFP season drives contract rates down closer to spot levels.

"*" indicates required fields

What’s Happening: Demand has contracted toward normal seasonality following the peak season surge.

Why It Matters: Shippers can expect conditions to return to what they were in May and early June until the fall surge gets underway in late August.

Summer peak season proved to be more muted than usual after coming in like a lion with CVSA Roadcheck in mid-May. DAT reported a month-over-month spot load post increase of nearly 30% in May but then regressed in June, falling by 6.1%. On a year-over-year basis, the annual comp’s decline is still an improvement as spot load posts moved from -61% year-over-year in May to -54% year-over-year in June.

Cass reported a 1.6% decrease in June shipments, translating to a 1.9% month-over-month decline on a seasonally adjusted basis. The index is down 4.7% year-over-year, an improvement from 5.6% in May. Declining real retail sales and ongoing inventory destocking remain the primary headwinds facing freight volumes, but the worst destocking woes are likely over now.

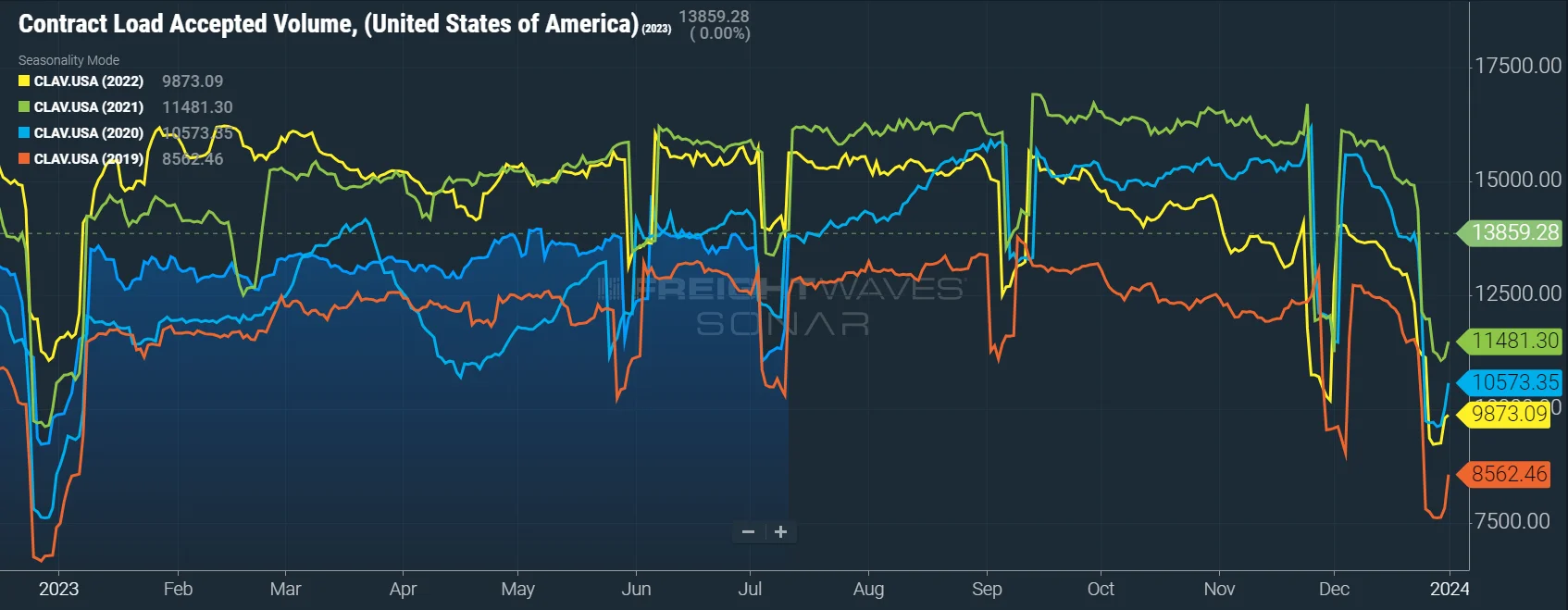

The FreightWaves SONAR Outbound Tender Volume Index (OTVI), which measures contract tender volumes across all modes, was down 17.4% year-over-year, or 13.6% when measuring accepted volumes after the significant tender rejection rate decline. Accepted volumes were down 4.0% month-over-month, driven by a 6.8% increase in accepted reefer tenders and a 14% decrease in accepted dry van tenders. The accepted contract volumes pullback from May is closely in line with the pullback in spot demand according to DAT and directionally aligned with the pullback in shipments, per Cass.

After low crop yields led to muted peak season conditions in early May, recent data indicate a recovery for reefer volumes in June and early July, with Freightwaves reporting that year-over-year accepted reefer volumes were up 6% in early July after being flat a month ago and down two months ago.

USDA truck shipment data for fresh fruits and vegetables also showed improvement from a month ago. The three-week trend in early May showed total shipments were down 10% year-over-year, with U.S.-grown shipments down 18% and imported crop shipments down 2%. In June, the three-week trend showed total shipments were down just 6% year-over-year, with U.S.-grown shipments down 15% but imported crop shipments up by 6%. Those improvements continued in early July; total shipments are up 4% year-over-year, with U.S.-grown shipments down 1% but imported crop shipments now up by 12%.

What’s Happening: Capacity reached peak tightness during the final week of June but has eased in the weeks following July Fourth.

Why It Matters: Most lanes should see easing capacity, but a few pockets may see continued challenges.

This year’s summer peak season demonstrated where we stand in the capacity correction cycle. As expected, certain pockets and regions experienced some spot rate volatility, but it had little impact on tender acceptance and service for shippers at the national level.

Carriers had good reason to show strong interest in and ability to support current contractual freight demand — rejections are already declining following July Fourth, a sign that conditions should remain soft, barring any unforeseen events.

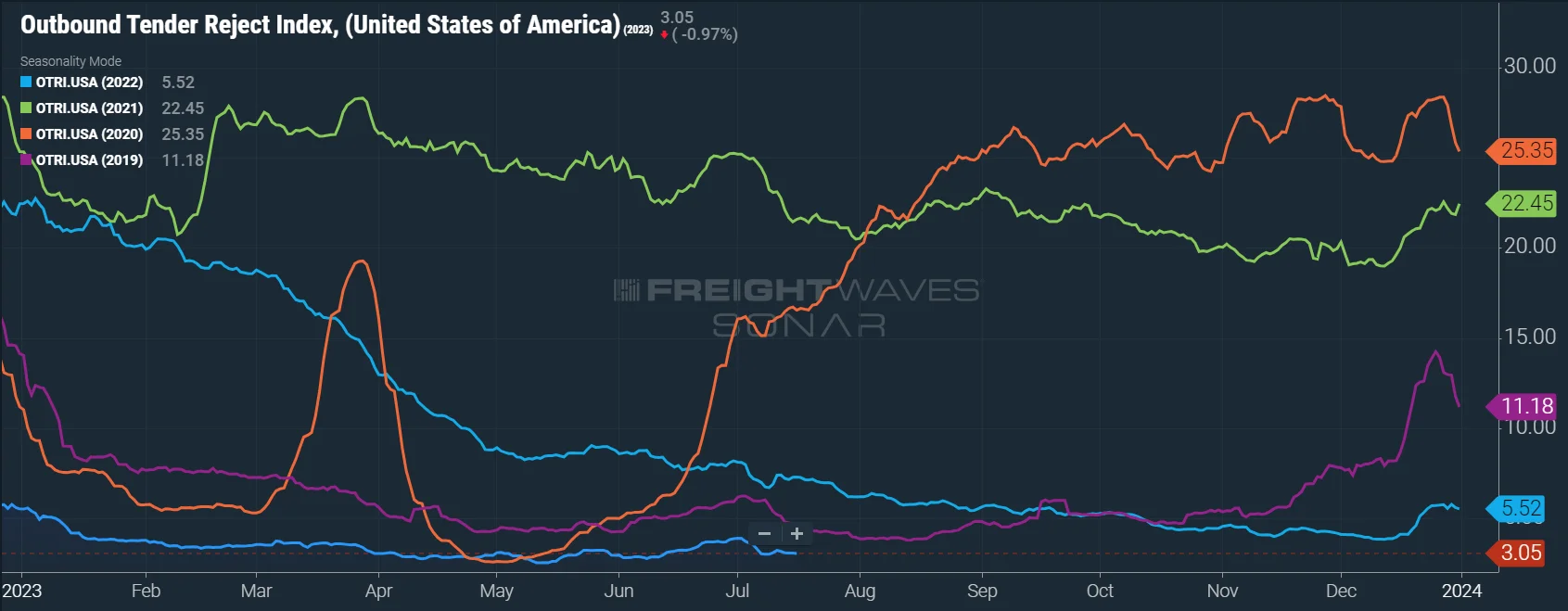

The Sonar Outbound Tender Reject Index (OTRI) measures the rate at which carriers reject the freight they are contractually required to take. The numbers fluctuated between a low of 2.7% and a high of 3.9% in June, indicating routing guide compliance on shippers’ contractual freight remained historically high.

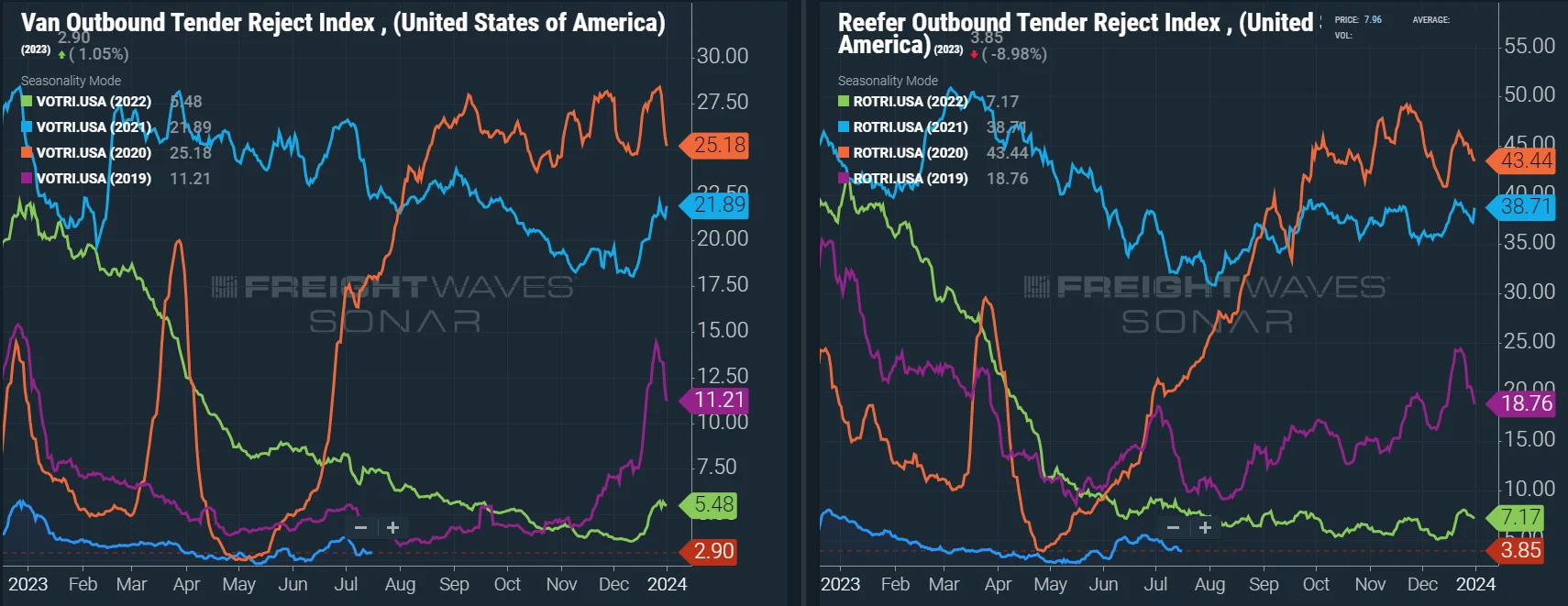

Both van and reefer tender rejections increased throughout June, reaching highs in the last week of the month and quarter. Since then, both equipment types have declined, indicating the volatility was primarily associated with the typical pre-July Fourth surge and the softening that follows.

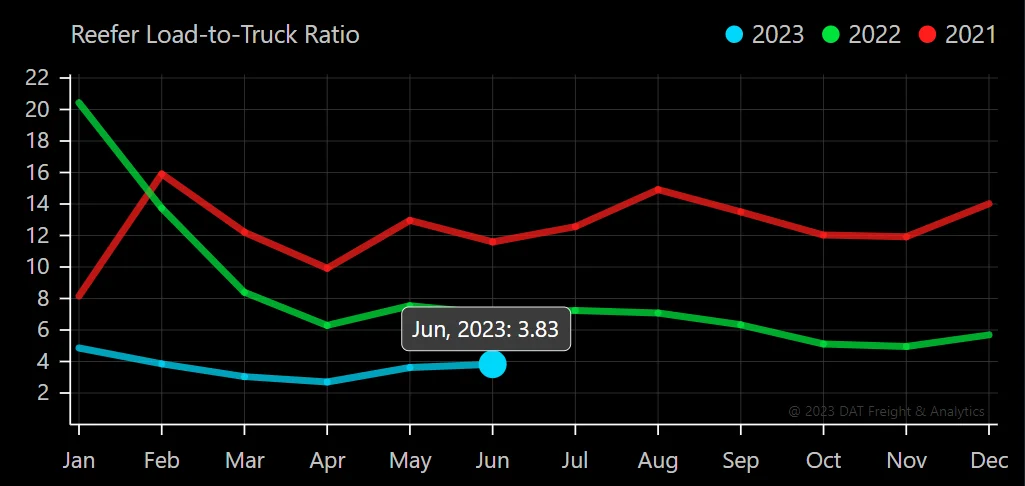

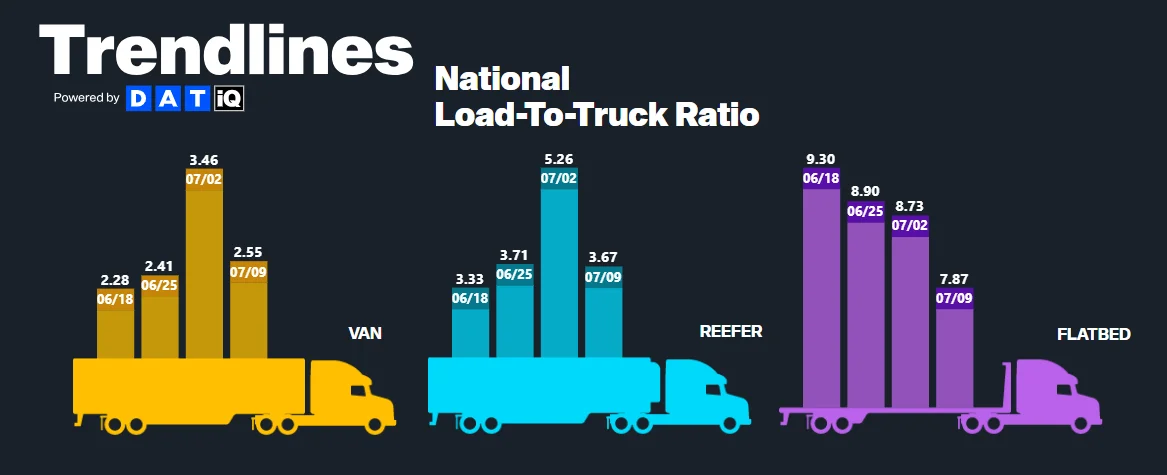

The DAT Load-to-Truck Ratio measures the total number of loads relative to the total number of trucks posted on their spot board. June data showed tightening despite declining load posts, indicating truck posts were also down. The Dry Van Load-to-Truck Ratio was up 3.4% month-over-month but remains down 33.3% year-over-year, whereas the Reefer Load-to-Truck Ratio was up 5.7% month-over-month but down 45.6% year-over-year.

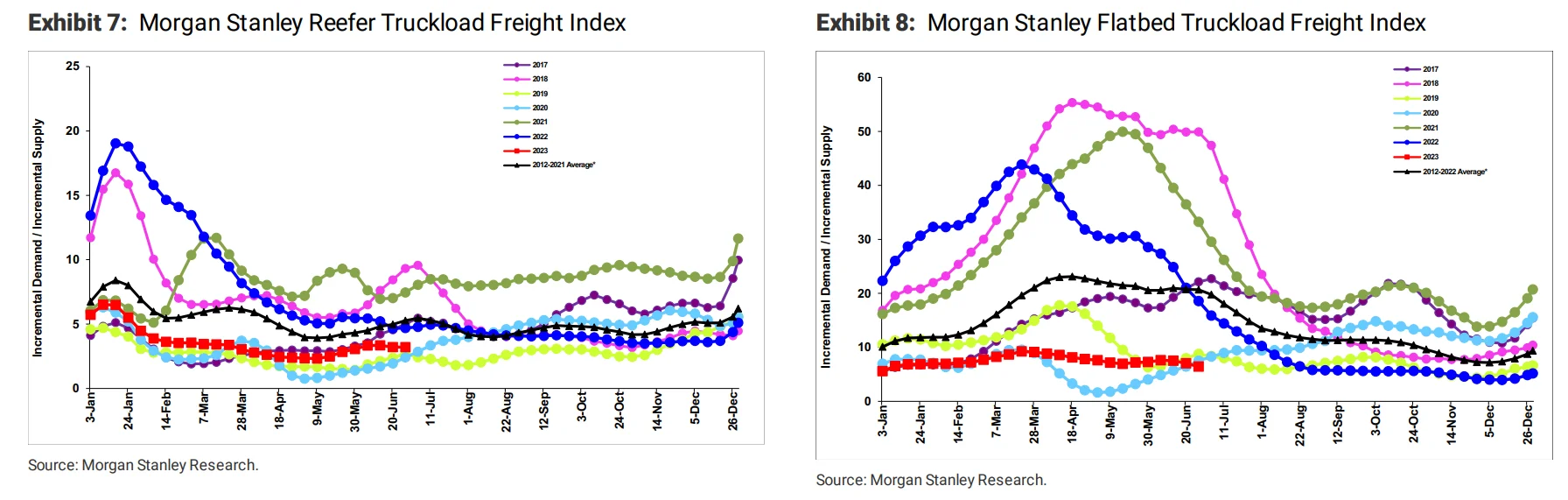

The Morgan Stanley Dry Van Freight Index is another measure of relative supply; the higher the index, the tighter the market conditions. The black line with triangle markers on the chart provides a great view of what directional trends would be in line with normal seasonality based on historical data dating back to 2007.

As expected, conditions tightened in line with normal seasonality beginning in mid-May but remained below historical levels. This largely aligns with the trends seen in contract tender rejections and indicates that while the market has seen more volatility recently, supply is still largely sufficient to support overall demand. Although the data is only updated through the Fourth, we expect further softening based on our observations since the holiday.

What’s Happening: As with demand, rates are easing as July progresses.

Why it Matters: Shippers can expect a return to pre-peak season conditions ahead of the Fall surge.

According to Truckstop’s Weekly National Average Spot Rates, elevated van and reefer rates persisted throughout June following May increases due to the CVSA Roadcheck week and an uptick in seasonal produce activity. With seasonality being the main reason for the rate increase, rather than a fundamental shift in market conditions, we expect rates to ease again through the back half of July.

According to DAT, monthly all-in spot rates, including linehaul and fuel costs, are flat for van equipment and down for reefer and flatbed equipment. As of July 15th, reefer rates were down $0.03 per mile, while flatbed rates fell by $0.04 from June. These trends represent the relative tightness at the beginning of the month, particularly for van and reefer. National average spot rates will likely ease as the month progresses as seasonal pressures wind down.

The month-over-month van rate spread closed meaningfully in June, falling to $0.49 from $0.55 in May. While surely an improvement, this is still a large gap, so downward pressure on contract rates should continue for the foreseeable future even though early July results show contract rate increases for van freight. As July progresses, the month-over-month trend will likely turn negative as it has with reefer contract rates.

All-in dry van spot rates are down 20.9% year-over-year, while linehaul spot rates are down 13.5%. All-in dry van contract rates are down 19.1% year-over-year, and linehaul contract rates are down 12.9%. While contract rates continue to experience negative year-over-year growth, four consecutive months of year-over-year spot rate growth demonstrate that they are well past peak deflationary pressures.

June reefer spot linehaul rates increased at a pace similar to van equipment but showed earlier signs of easing post-peak season. From April through early June, the national average reefer spot rate jumped by $0.13 per mile, which likely played into reefer contract rate declines stalling out in June. It was also a key reason why the reefer spot-to-contract rate spread fell from $0.58 in April to just $0.41 per mile in early July. While this may increase as spot rates ease in July, the declining rate spread is an early sign that market conditions are normalizing.

Down 11.8% year-over-year, the current reefer contract rate is $2.40 per mile, excluding fuel, while the current reefer spot rate is down nearly 12% year-over-year to $1.99 per mile, excluding fuel. Despite the significant trend, we have likely passed peak year-over-year deflationary pressures.

Flatbed rates have been significantly more stable this year. Rising contract rates and falling spot rates are currently widening the spot-contract gap, which moved from $0.58 in April to $0.72 in early July. Spot and contract flatbed linehaul rates both decreased by $0.02 in June. Spot rates landed at $2.09 and contract at $2.70, excluding fuel.

What’s Happening: Ongoing UPS negotiations are driving some small parcel shippers to lean on LTL services.

Why It Matters: The LTL network is not built to manage freight of this nature, so the trend could cause disruptions if negotiations are not resolved soon.

What’s Happening: Market conditions remain soft and rates have yet to find a floor.

Why It Matters: Shippers should anticipate good rates and excellent service on all freight to continue in the near term.

What’s Happening: The Peso (MXN) recently reached a seven-year high as nearshoring drives more manufacturing and capital investment to Mexico.

Why It Matters: Mexican carriers are paid in USD, but most of their operating expenses are in MXN, resulting in less revenue locally.

What’s Happening: Tightness and rate increases are following typical seasonal trends.

Why It Matters: Northwest, Midwest and East Coast shippers should anticipate tight conditions to begin shortly and last through September.

Conditions in Florida, South Texas and Arizona are beginning to soften as the produce season rolls on.

Capacity is easy to find and rates are stable in these areas, but conditions are tightening on the East Coast.

Conditions are tight in Georgia and the Carolinas; this trend will soon reach the Midwest and Northeast regions.

Arizona and Southern California are softening; however, Salinas, California, is still experiencing tightness.

Conditions are tightening in Washington as the cherry season gets underway; this typically lasts through the first week of August and is followed by the apple, pear, and potato seasons, which will drive tight conditions starting around Labor Day.

Capacity in Idaho and Utah will get tight around the same time, along with Wisconsin, Minnesota, New York and Pennsylvania.

A note on Agricultural Exemptions: The US government put Agricultural Exemptions in place to help get unpackaged and unprocessed agricultural commodities to market with fewer delays during the produce season. “Agricultural commodities” are defined as fruits and vegetables that retain their original form (i.e., they have not been significantly changed by processing or packing after harvest).

During harvest season, the exemption allows drivers to remain off duty to refuel, washout, drive, load/unload, scale and even multi-stop when within a 150-air-mile radius (172.6 statute miles) of the source when hauling agricultural commodities that have not been significantly changed. “Source” is defined as any intermediate storage or handling location away from the source at the farm or field (e.g., ports, cross-docks, etc.).

These exemptions benefit carriers by helping them pick up more driveable hours and work around common bottlenecks like long wait times. They also benefit shippers by offering more loading and pick-up flexibility since carriers aren’t as time-bound.

What’s Happening: Carriers are looking for additional revenue streams to stay afloat as the slow season winds down.

Why It Matters: Mid-size and large carriers will likely begin pursuing contract freight opportunities to generate more consistent revenue.

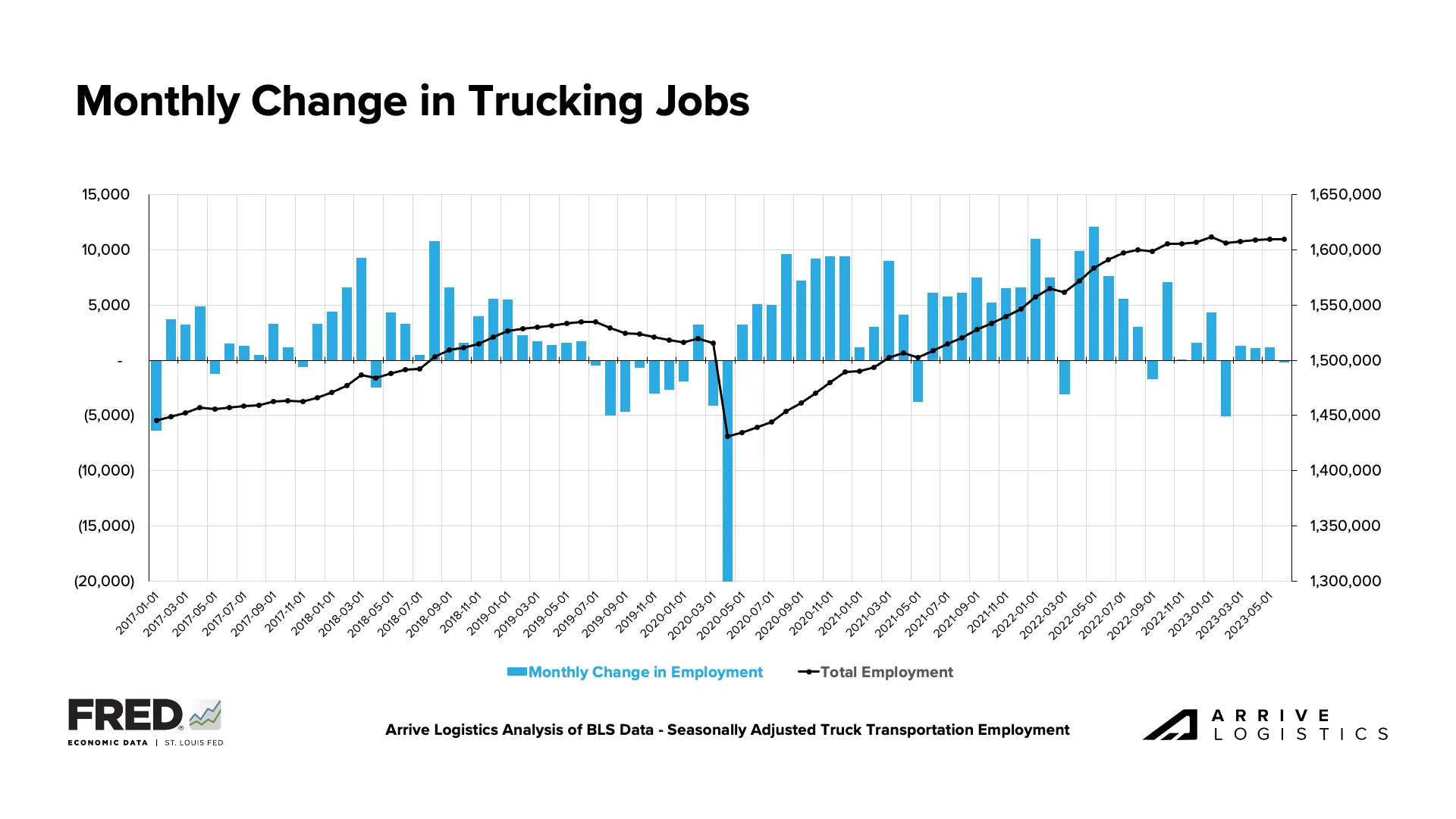

What’s Happening: Considering the declining truckload rate environment, the trucking employment plateau observed throughout the first half of 2023 defied expectations.

Why It Matters: Carriers remain focused on driver retention, but the longer current conditions persist, the more likely it is that overall employment begins to fail.

Carriers saw the spot rate environment improve throughout the summer peak season but are likely starting to see many of those opportunities subside. This rate ebb and flow through normal seasonal cycles reflects what we expect the spot market to look like through at least early 2024 as the rebalancing of supply and demand continues in the freight market.

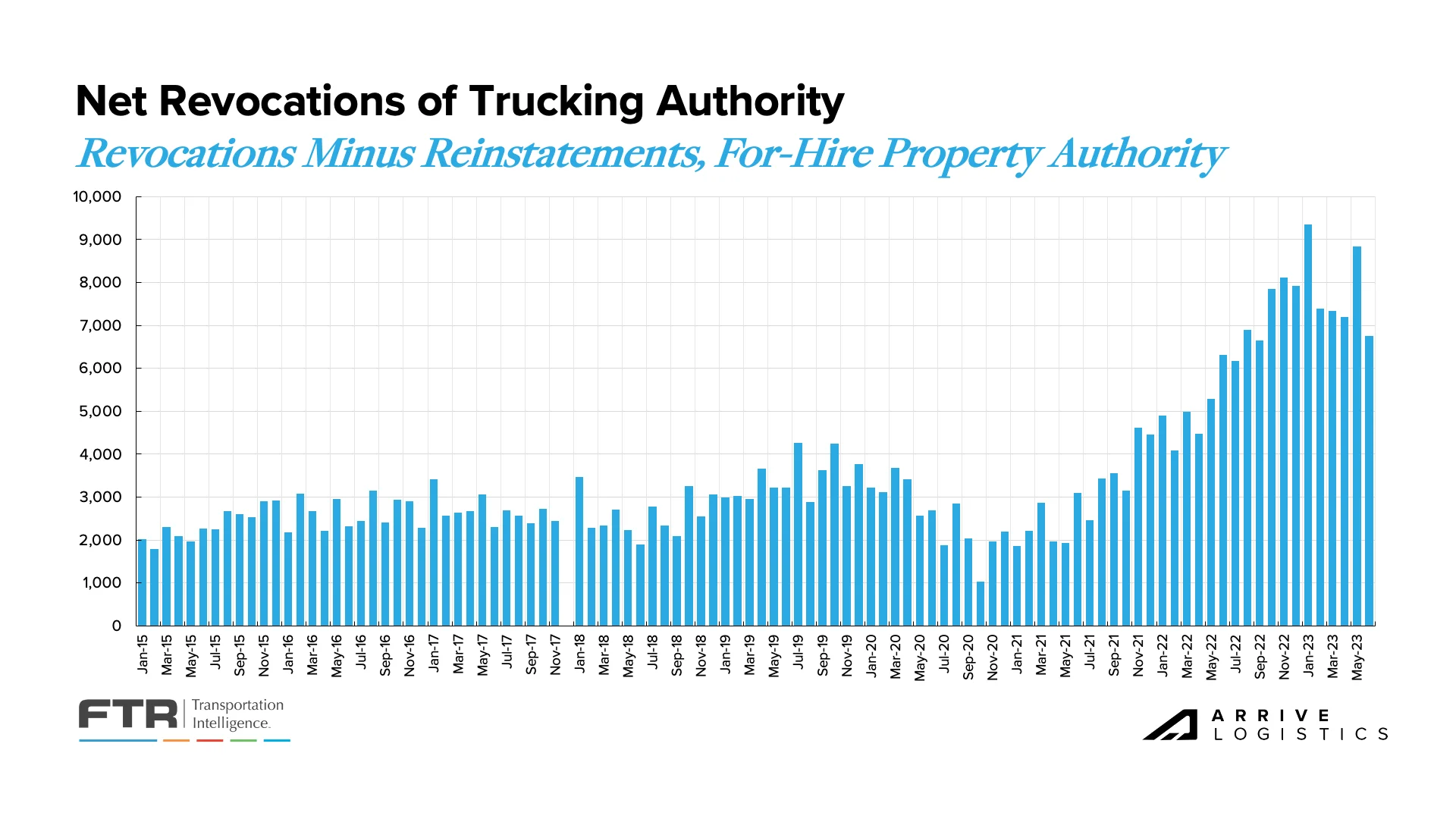

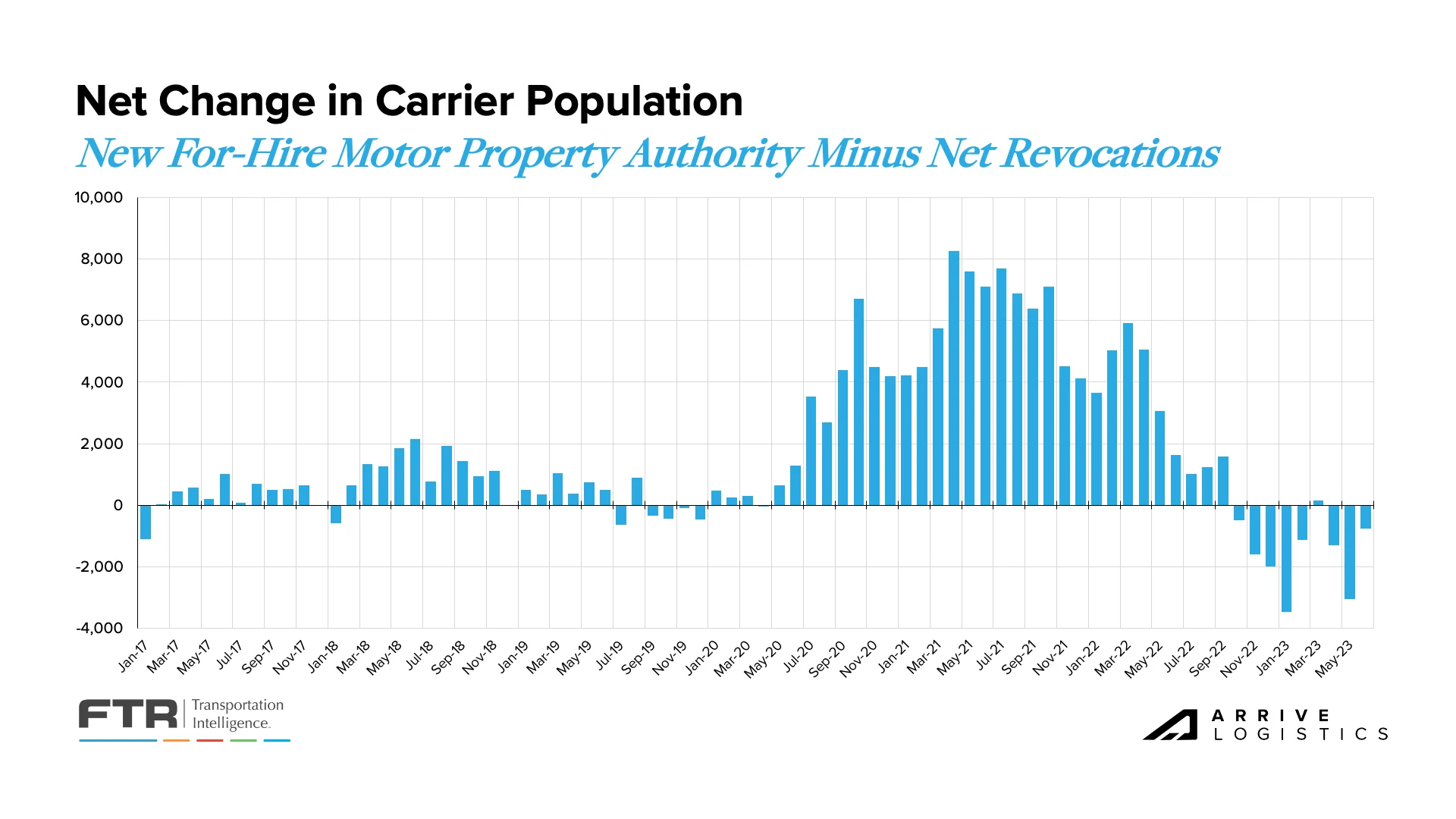

As more capacity exits the market, it will become increasingly vulnerable to disruptions. Last month we noted FTR’s Avery Vise’s comments that “During the first five months of 2022, 10 for-hire trucking firms with 100 or more trucks lost authority. During the same period in 2023, 31 carriers with 100 or more trucks lost authority.” While one or two truck operations going under is bad, it is safe to assume their capacity will mostly stay in the market and eventually be absorbed by other firms. However, when a 100-truck operation folds, the impact is much more significant and points to how tough this landscape is for carriers.

This month we saw another high number of revocations lead to a negative net change in the carrier population, indicating that the correction is underway. There is a long way to go, as we see from strong contract service numbers, but this trend will inevitably lead to a capacity crunch, as it always does in the market cycle.

Increased operating expenses are the primary culprit causing carriers to close, as overall rates are still high compared with historical (pre-pandemic) levels. This trend continues to drive historically high revocations of authority, with June numbers reaching another top 10 all-time mark for the highest number of carrier exits.

The resilient trucking sector job market showed a slight decline of just 200 jobs month-over-month in June. However, it’s important to note that although total employment is down 1,700 jobs from the high mark in January, we are still above any level recorded in 2022. Given the declining truckload rate environment, the trucking employment plateau observed throughout the first half of 2023 defied expectations. Carriers are clearly focused on retaining drivers, but the longer current conditions persist, the more likely it is that overall employment begins to fall.

A key trend we’re still watching is revocations outpacing new carriers entering the market for eight of the last nine months, reducing the total number of carriers. A significant amount of capacity that entered the market over the last few years remains unutilized, so we expect this disparity to continue for at least the near term.

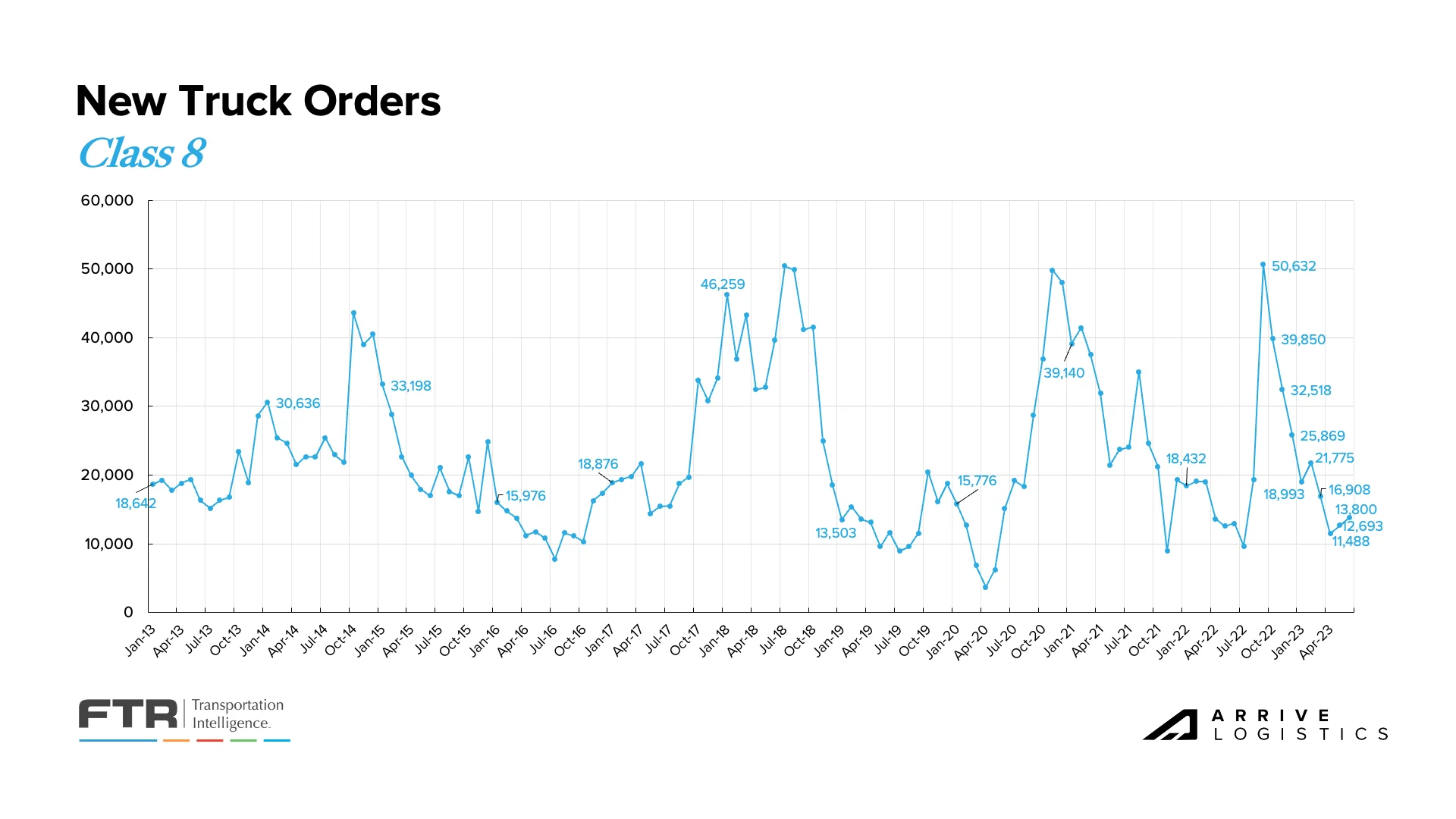

June truck orders have come in above expectations but remain below replacement levels for the third straight month. Historically, orders falling below replacement point to a soft market, but there is some indication the reduced order levels are a result of build slots being full. Regardless, lower orders and high production rates are expected to ease backlogs and wait times for future orders.

What’s Happening: Demand remains healthy overall, but manufacturing contraction remains a concern.

Why It Matters: There is a greater risk to the downside for demand based on the outlook for retail imports and manufacturing.

We continue to report on retail and manufacturing trends due to their significant impact on domestic freight demand. Recent data indicated some encouraging signs for the retail sector, but manufacturing remains a concern after contracting for the eighth consecutive month in June. Although imports have declined significantly from the record-setting levels observed a year ago, forecasts show that year-over-year imports may turn positive by November.

The National Retail Federation (NRF) recently reported that once June numbers are finalized, import cargo volumes at the nation’s major container ports could potentially show a decline of 17.5% through the first half of 2023 compared to the previous year. The Q3 forecast shows a year-over-year decline of just 8.5%, highlighting the steady improvement in year-over-year comps. The NRF pointed to the continued strength of the consumer and progress with inventory destocking as reasons for the optimism around future growth.

Figure 23: NRF Monthly Imports

The latest ISM manufacturing report indicated more easing backlogs as new orders contracted for the tenth consecutive month amid slowing production. The new orders index contracting further adds uncertainty about future backlogs and, in turn, truckload demand. Manufacturing was expected to be one of the main volume drivers in 2023, and if contraction continues, demand will likely fall further than previously forecasted. However, there is still significant pent-up demand in the sector that should enable healthy volumes in the near term.

FTR’s latest truck loadings forecast for 2023 turned slightly negative this month, decreasing from 0.5% to -0.1% year-over-year growth following a weaker outlook mostly due to food, packaged goods and building materials. However, loadings for automotive strengthened. The 2024 outlook was also marginally weaker but remains positive.

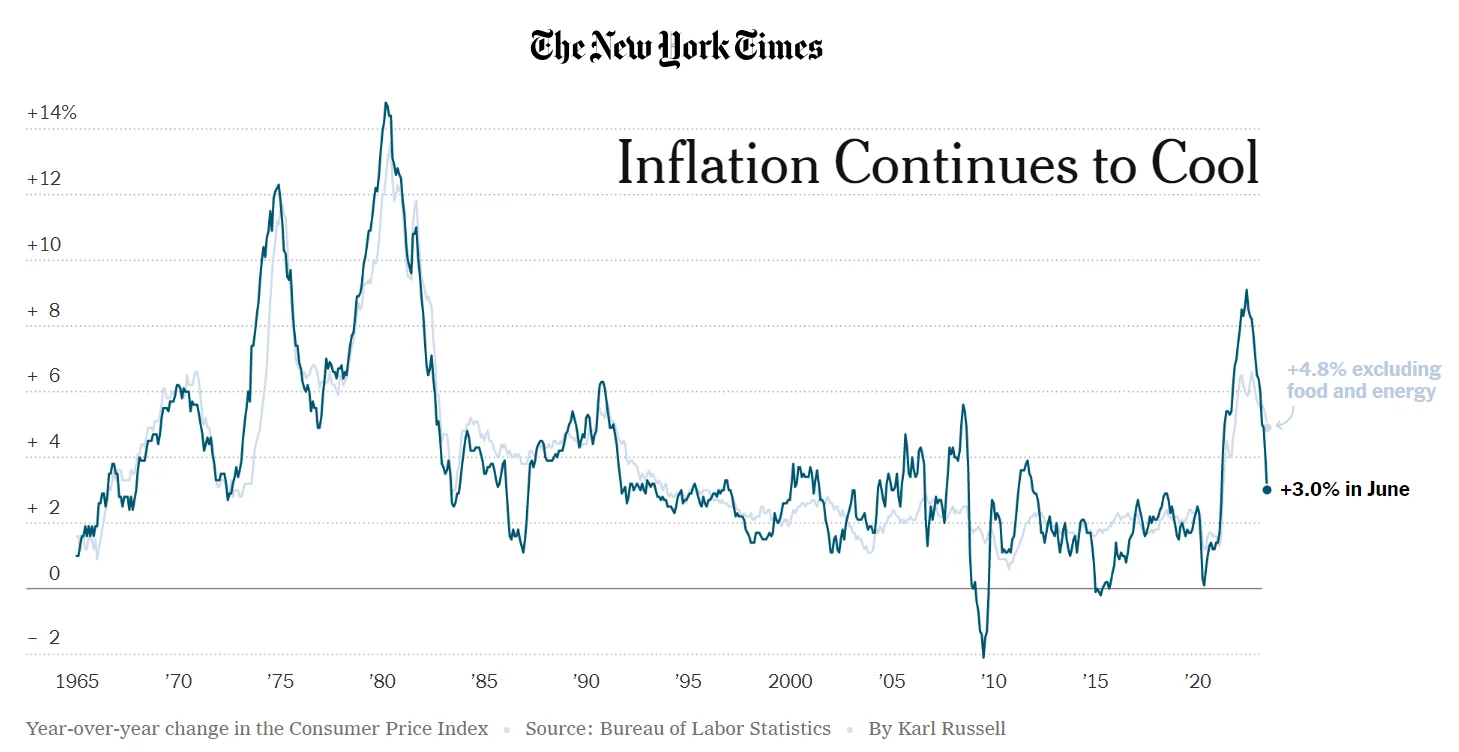

What’s Happening: Inflation fell more sharply than expected to 3.0%.

Why It Matters: Some believe the slowdown could lead the FED to hold off on further rate hikes, which would be welcome news for freight demand.

June CPI data showed inflation slowed for the twelfth consecutive month, falling to 3.0% year-over-year growth (4.8% excluding food and energy). Both of these figures came in below expectation, which is certainly good news for the consumer as it means the Fed will have more to think about ahead of their meetings in late July. The consensus ahead of the data release was that they would raise interest rates, but now we are seeing some indication that the pause in rate hikes could be extended. Ultimately, slowing or reversing course on rate hikes positively affects future freight demand.

June Bank of America card data showed consumer spending per household decreased by 0.2% year-over-year, consistent with May results. This is the third consecutive year-over-year decrease and provides evidence against the notion that the economy re-accelerated in the second quarter. BofA noted that the economic and consumer spending growth is below-trend but not recessionary.

On an individual category level, department store and grocery spending maintained strength, while most other categories saw spending decelerate in June.

Spending per household on durable goods and leisure services has shown soft growth over the past three months, another indication that the tailwinds associated with reopening may have run their course. The spending declines are minimal and represent the continued strength of the consumer; however, consistent declines point to sustained pullbacks in overall consumer demand. Because durable goods tend to move on trucks, these spending declines can significantly impact truckload demand.

Initial jobless claims have increased slightly in recent months, and current levels are the highest since mid-2021. Overall claims remain low, but recent increases indicate the labor market may be showing some cracks. The unemployment rate, however, remains extremely low and is a sign that the job market is still relatively strong despite the recent rise in layoffs. The robust labor market signals confidence in consumers’ ability to sustain current spending levels and avoid a sudden drop in truckload demand.

The summer peak season came and went. While it brought about some long overdue spot rate increases, the market still underperformed relative to normal historical seasonality.

As expected, demand has eased following July Fourth, and downward pressure on rates across all modes has already begun. Some areas of tightness remain as produce-related demand shifts to new regions, but at a national level, we anticipate soft conditions will last until at least Labor Day.

Our 2023 rate forecast remains mostly unchanged. Overall, truckload demand outlook remains a concern, and capacity normalization is still in its early stages. Rates have come off the floor but are in line with seasonal demand. We expect this pattern of seasonal pressures to be the norm through at least early 2024.

The spot-contract gap remains elevated, which should result in deflationary pressure on contract rates. However, some carriers who priced freight cheaply to win volume appear to be struggling with profitability, resulting in the first signs of carriers beginning to fail shippers. We expect at least one more RFP season before prices drop low enough to support market-wide exposure to sustained routing guide disruption. In the meantime, shippers running contractual loads should see strong tender acceptance rates and service levels continue due to the oversupply of capacity.

The market will become increasingly vulnerable to disruptive events as capacity normalizes throughout the year. However, recent short-lived periods of volatility suggest that the market is still oversupplied with capacity and unlikely to experience any long-term disruptions through the remainder of 2023.

The Arrive Monthly Market Update, created by Arrive Insights, is a report that analyzes data from multiple sources, including but not limited to FreightWaves SONAR, DAT, FTR Transportation Intelligence, Morgan Stanley Research, Bank of America Internal Data, Journal of Commerce, Stephens Research, National Retail Federation and FRED Economic Data from the past month as well as year-over-year. We know market data is vital in making real-time business decisions. At Arrive Logistics, we are committed to giving you the data and insights you need to better manage your freight.